This version of the form is not currently in use and is provided for reference only. Download this version of

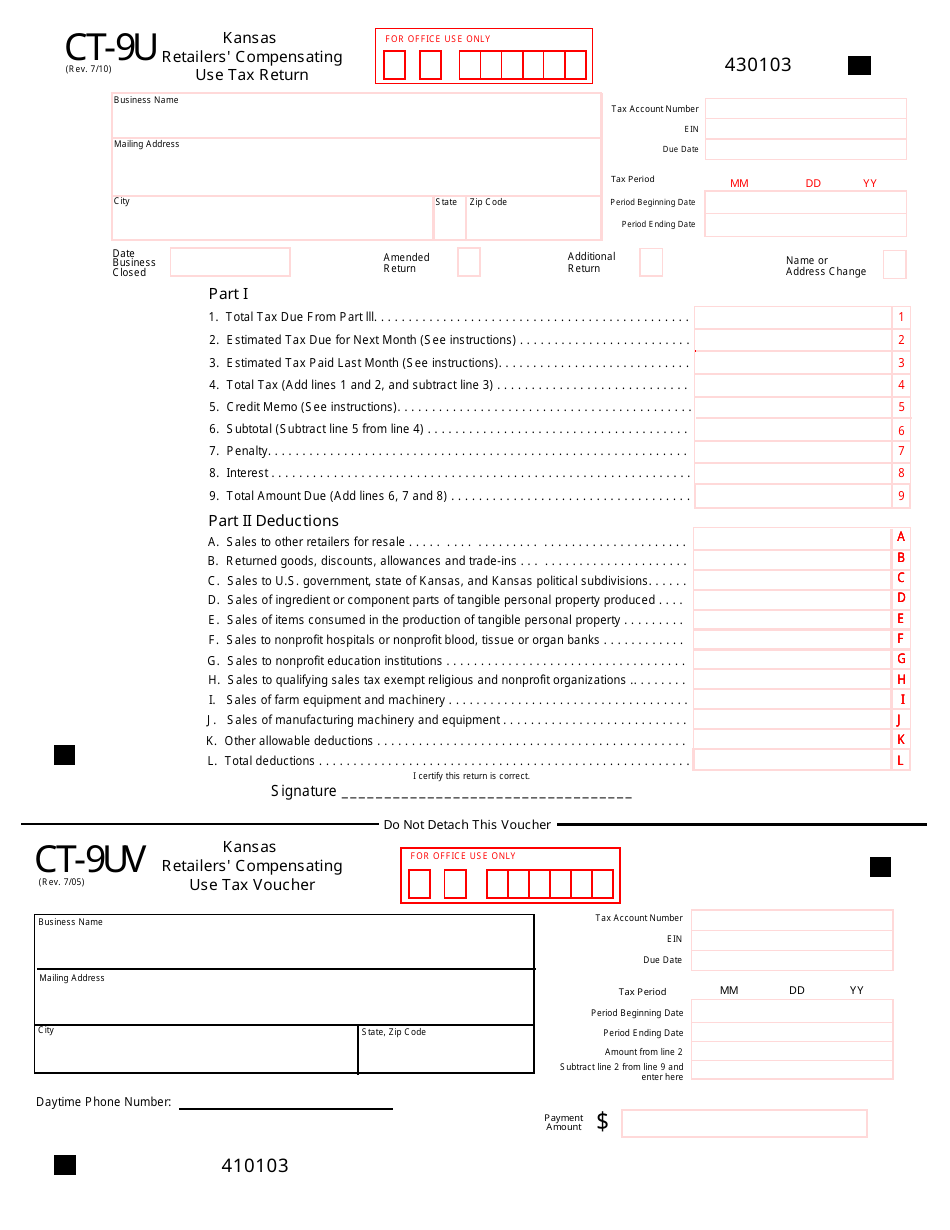

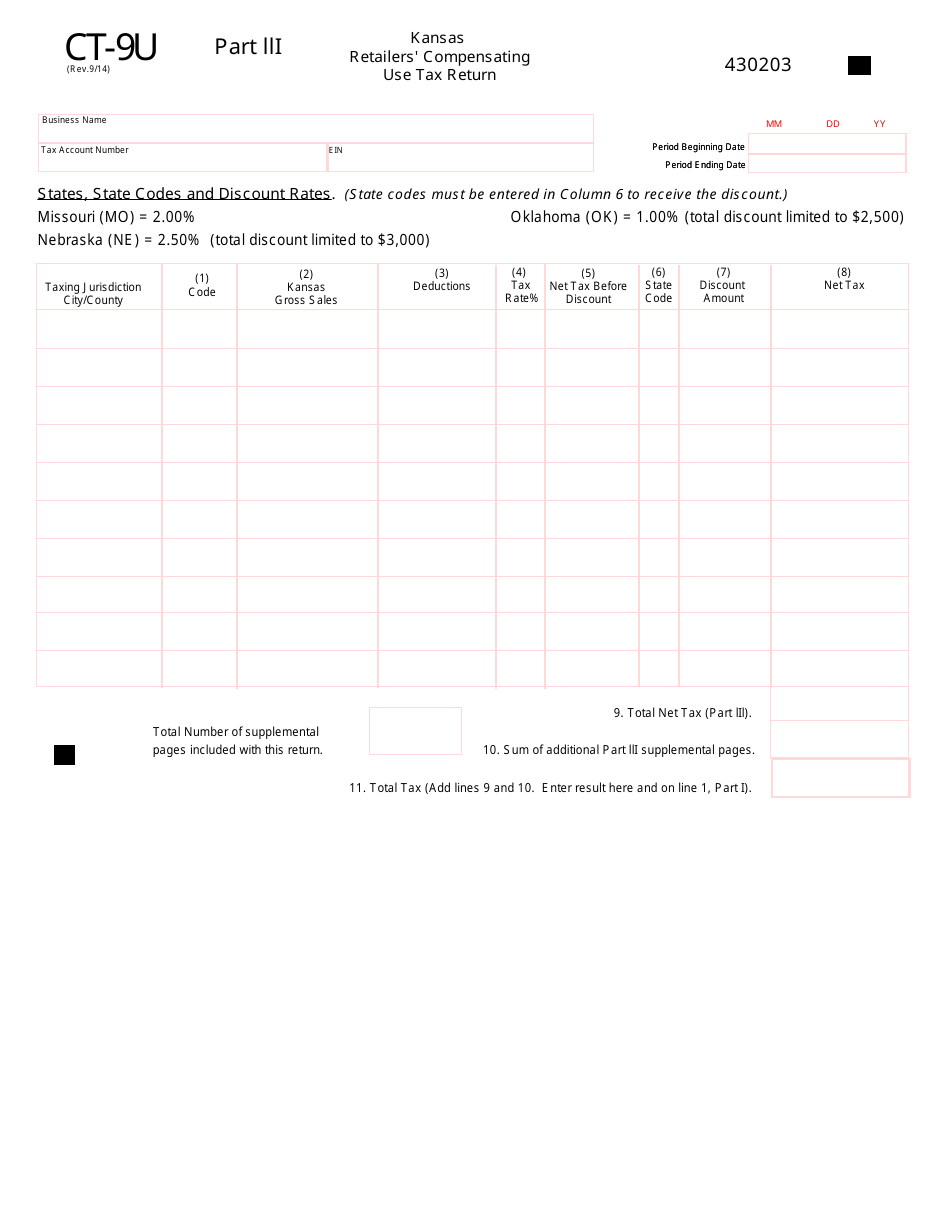

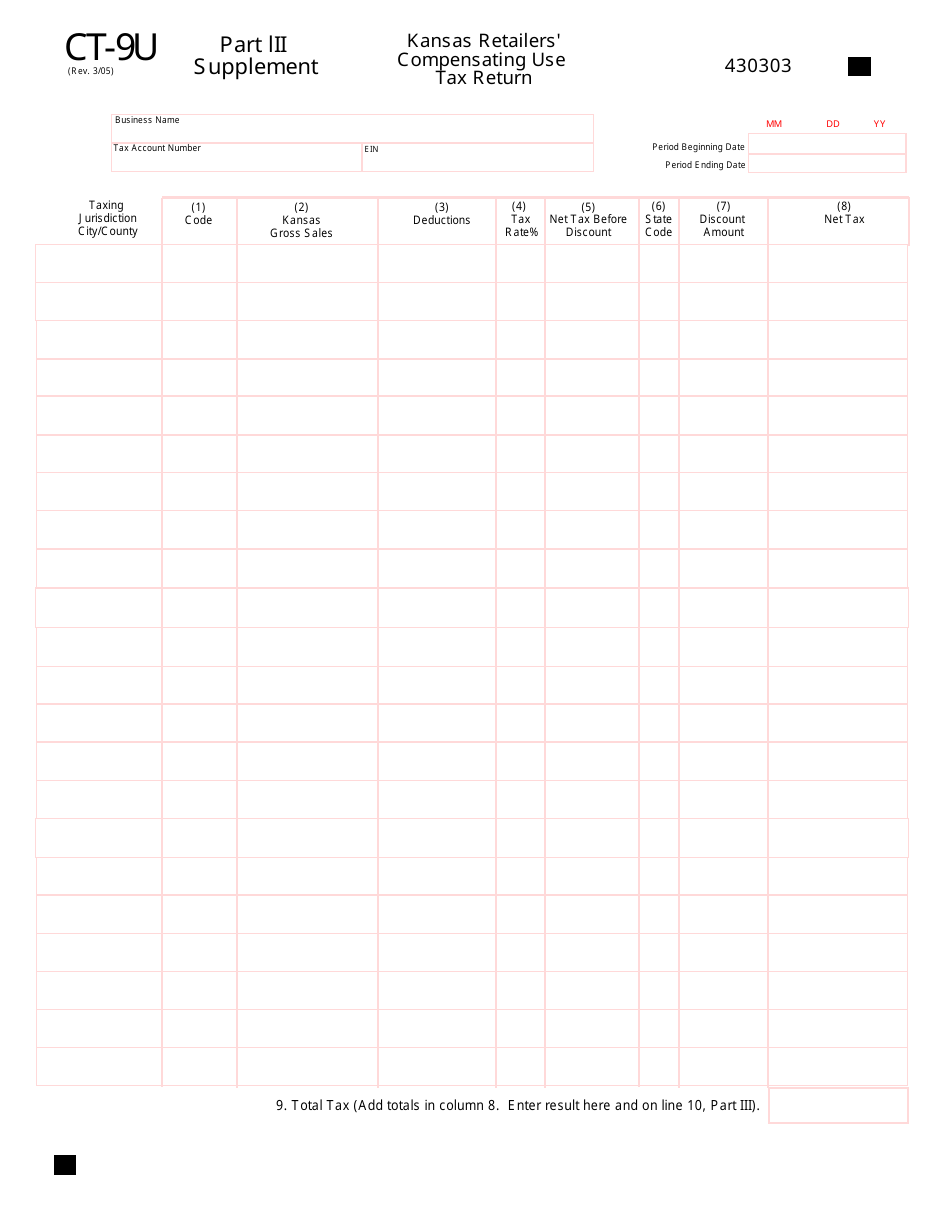

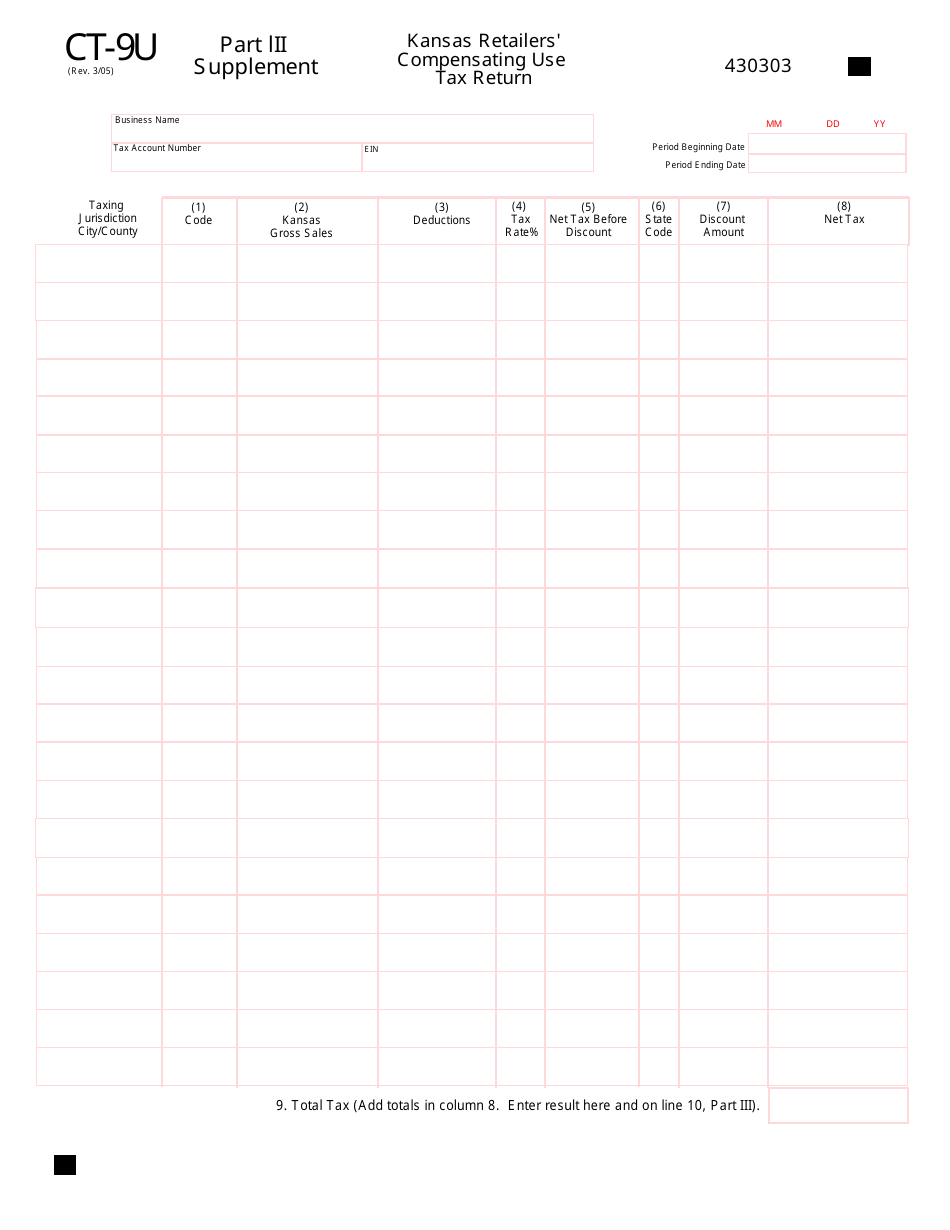

Form CT-9U

for the current year.

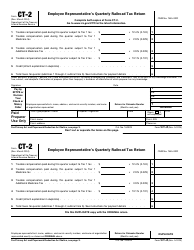

Form CT-9U Kansas Retailers' Compensating Use Tax Return - Kansas

What Is Form CT-9U?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-9U?

A: Form CT-9U is the Kansas Retailers' Compensating Use Tax Return.

Q: Who needs to file Form CT-9U?

A: Kansas retailers who have collected sales tax from customers and remitted it to the state.

Q: What is compensating use tax?

A: Compensating use tax is a tax on goods purchased out-of-state and used in Kansas, when no sales tax was paid at the time of purchase.

Q: When is Form CT-9U due?

A: Form CT-9U is due on or before the 25th day of the month following the end of the reporting period.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing, including interest charges and potential legal action.

Form Details:

- Released on March 1, 2005;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-9U by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.