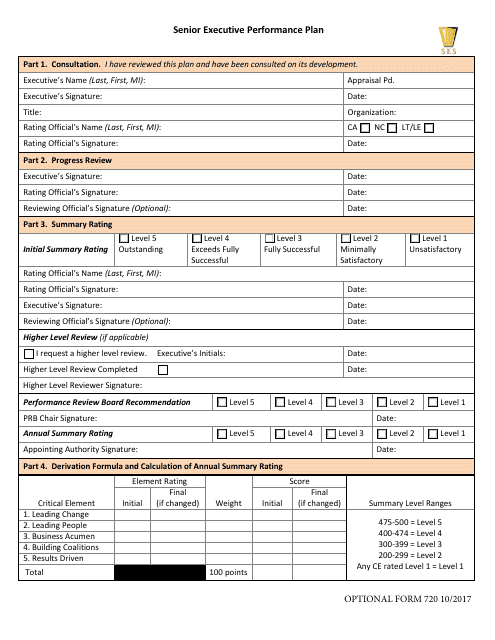

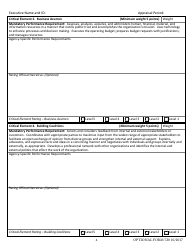

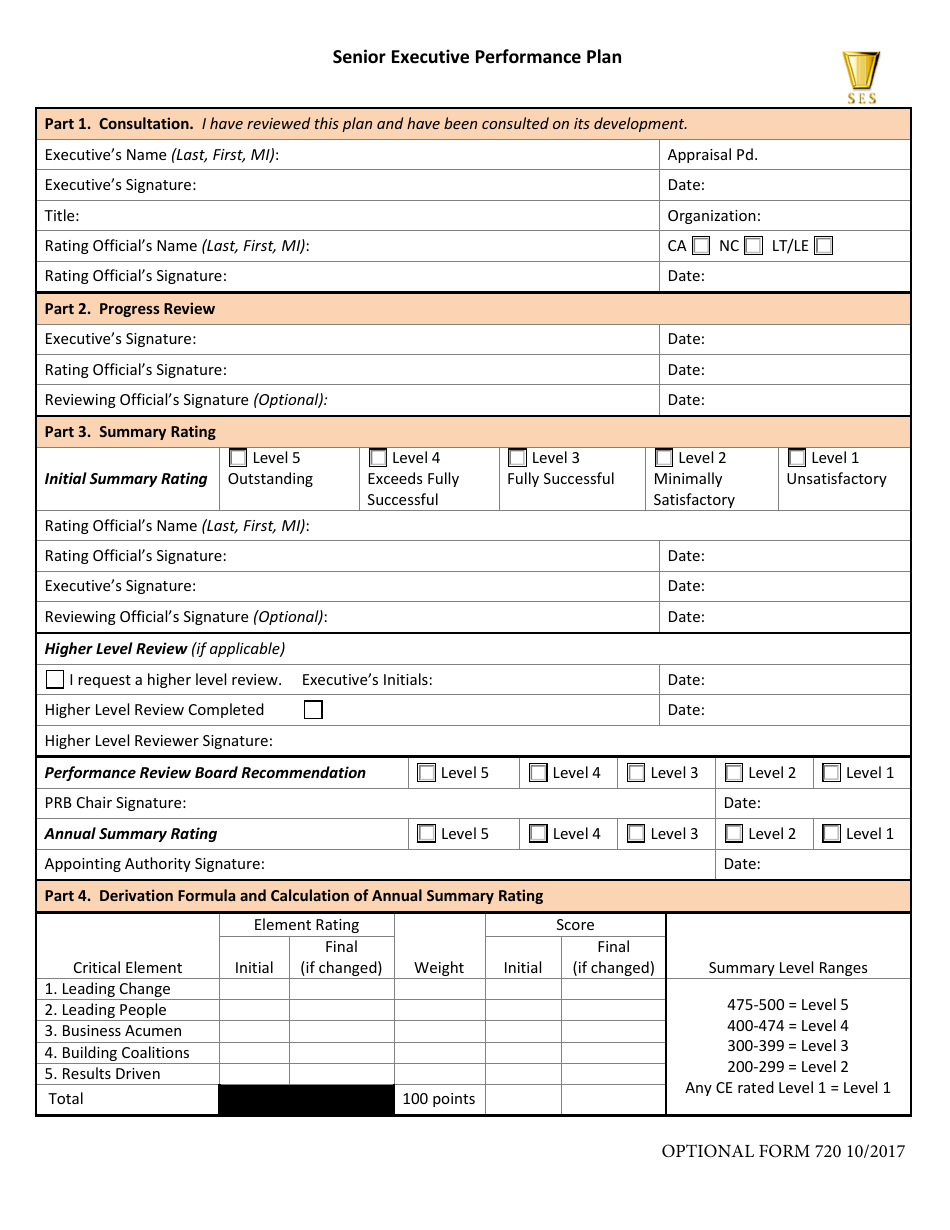

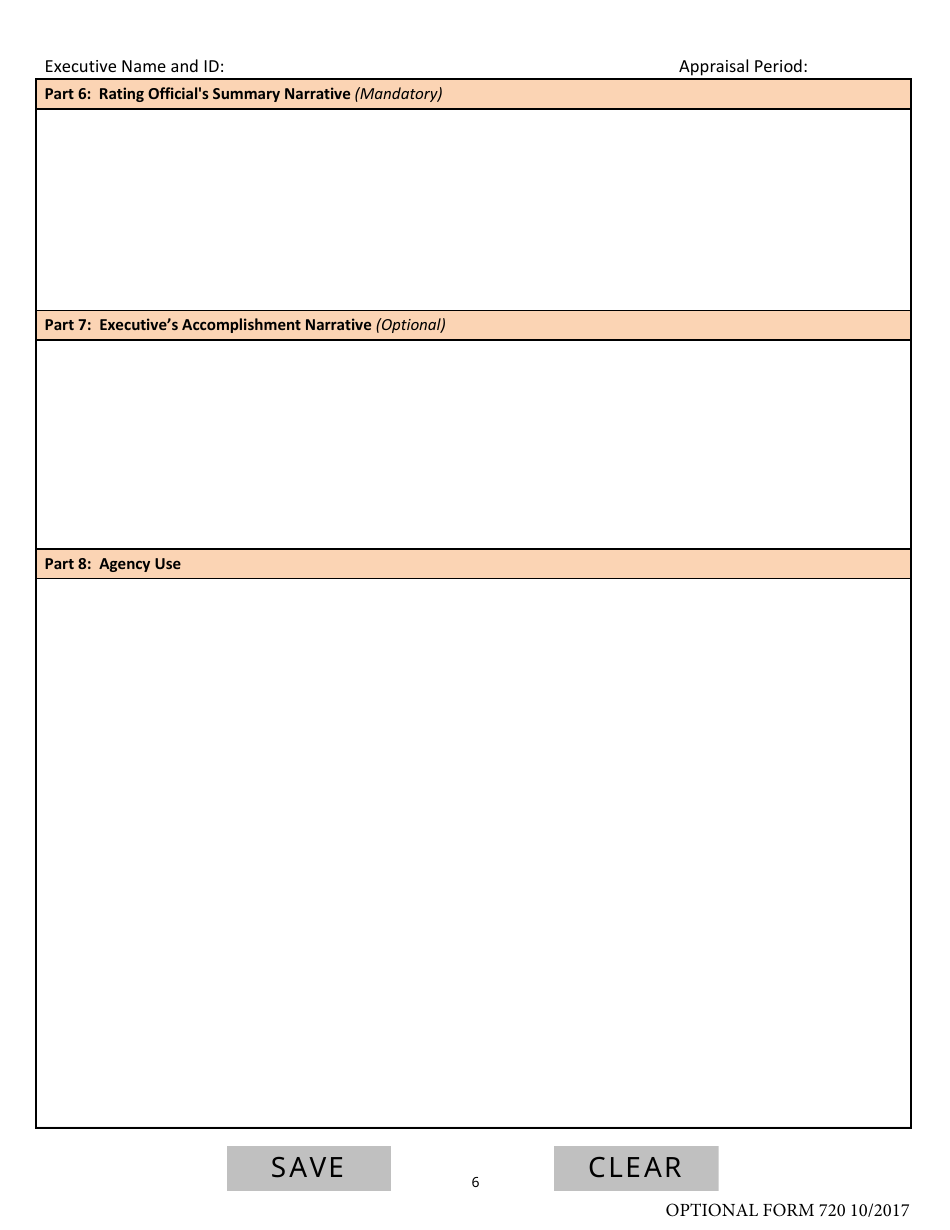

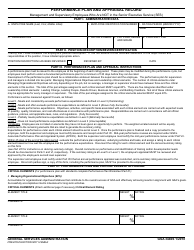

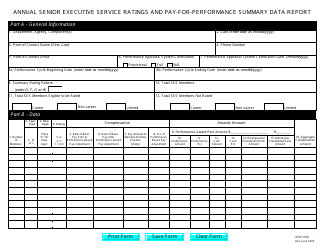

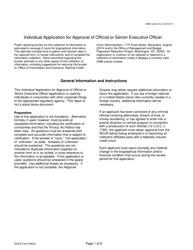

Optional Form 720 Senior Executive Performance Plan

What Is Optional Form 720?

This is a legal form that was released by the U.S. General Services Administration on October 1, 2017 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 720?

A: Form 720 is a tax form used to report certain types of federal excise taxes.

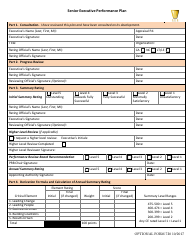

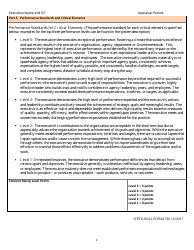

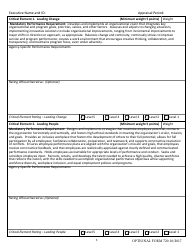

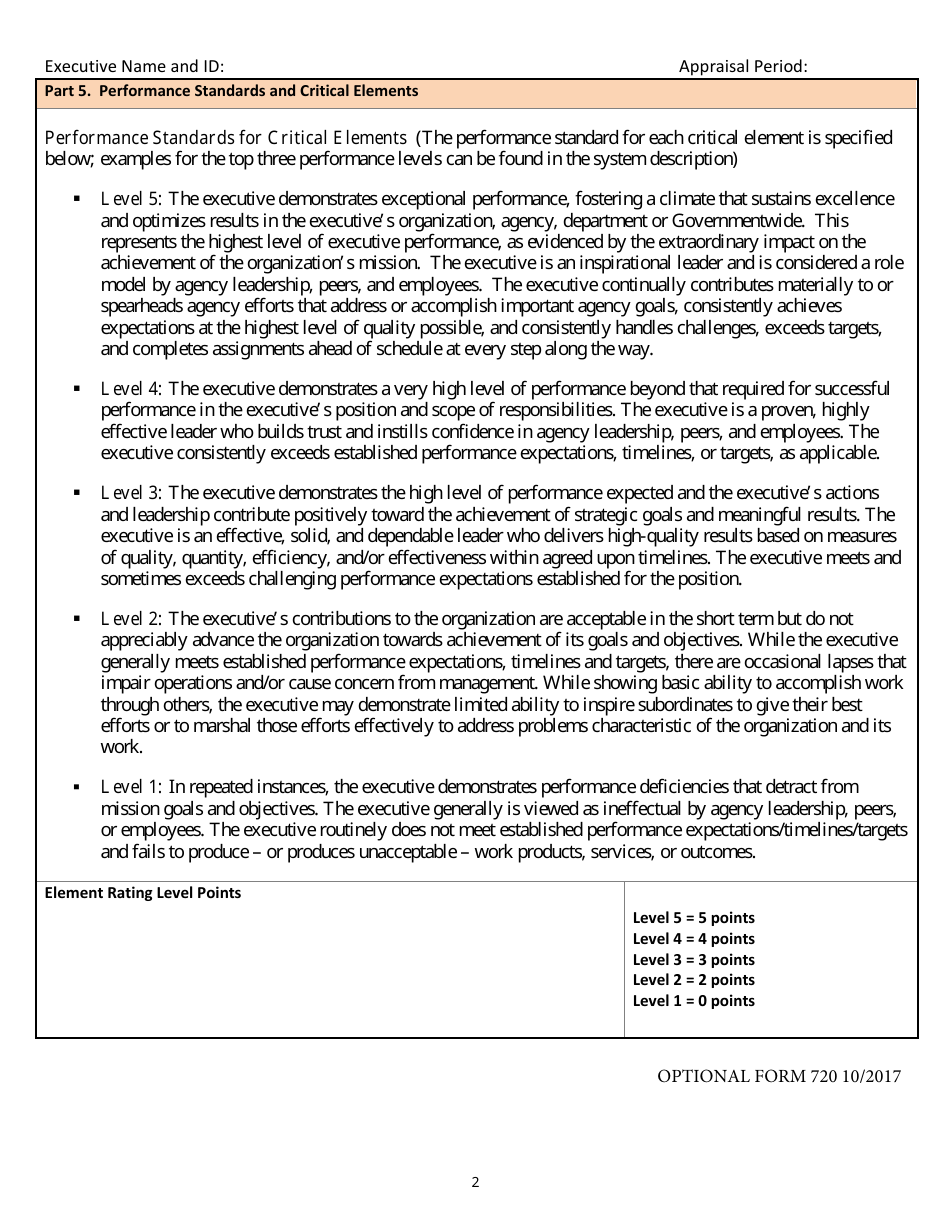

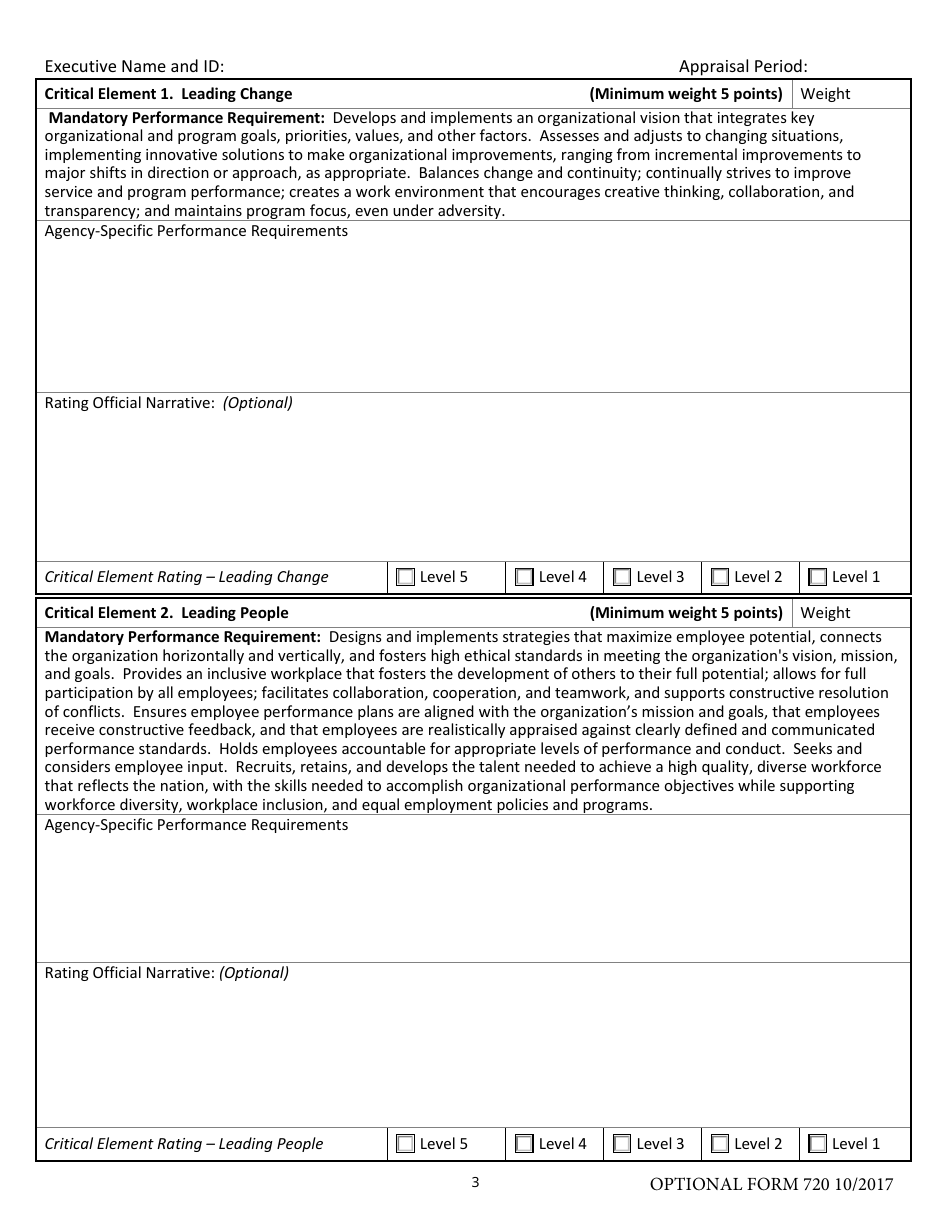

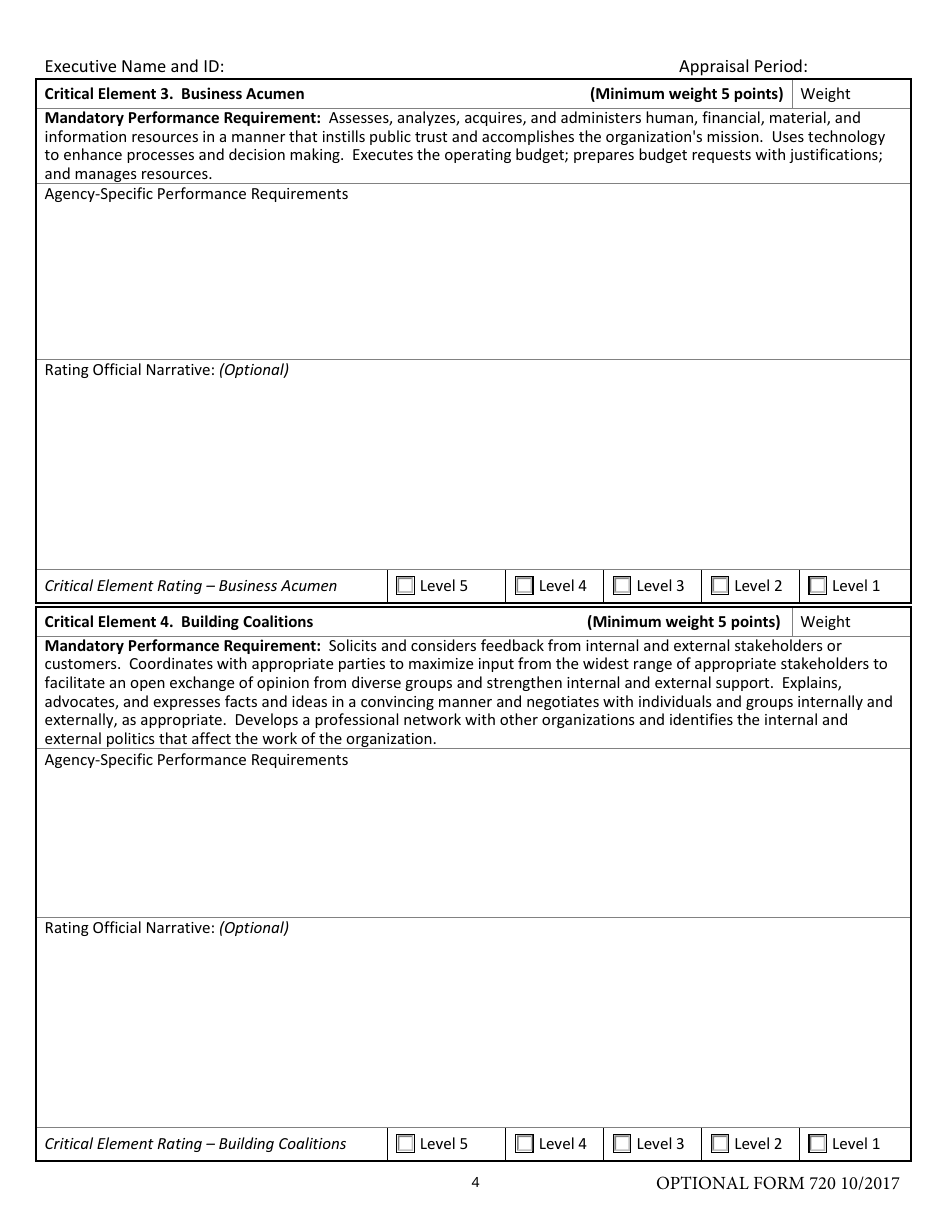

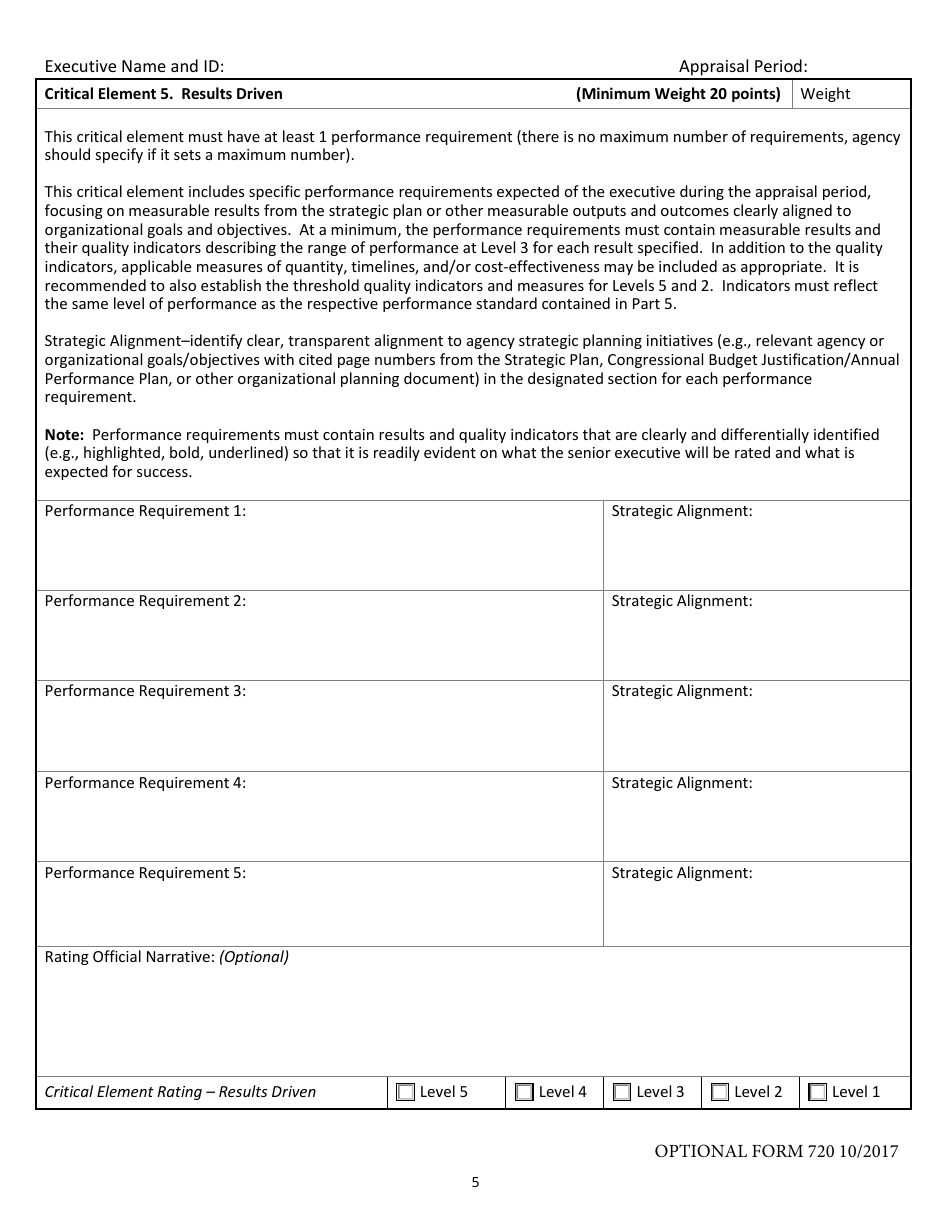

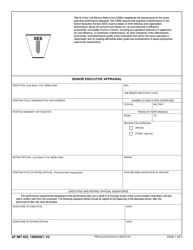

Q: What is the Senior Executive Performance Plan (SEPP)?

A: The Senior Executive Performance Plan (SEPP) is a program that provides performance-based incentives for senior executives in federal agencies.

Q: Who is eligible for the SEPP?

A: Senior executives in federal agencies who meet certain criteria may be eligible for the SEPP.

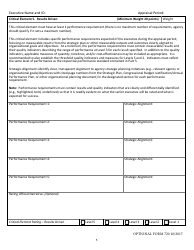

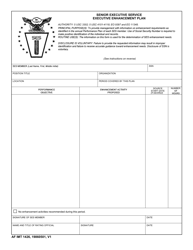

Q: What are the requirements for participation in the SEPP?

A: The specific requirements for participation in the SEPP can vary depending on the agency and position, but generally involve meeting performance goals and criteria.

Q: How are incentives determined under the SEPP?

A: Incentives under the SEPP are typically based on the achievement of predetermined performance goals and may be calculated as a percentage of base salary.

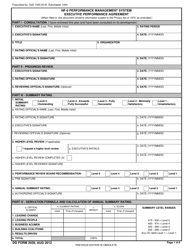

Form Details:

- Released on October 1, 2017;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Optional Form 720 by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.