This version of the form is not currently in use and is provided for reference only. Download this version of

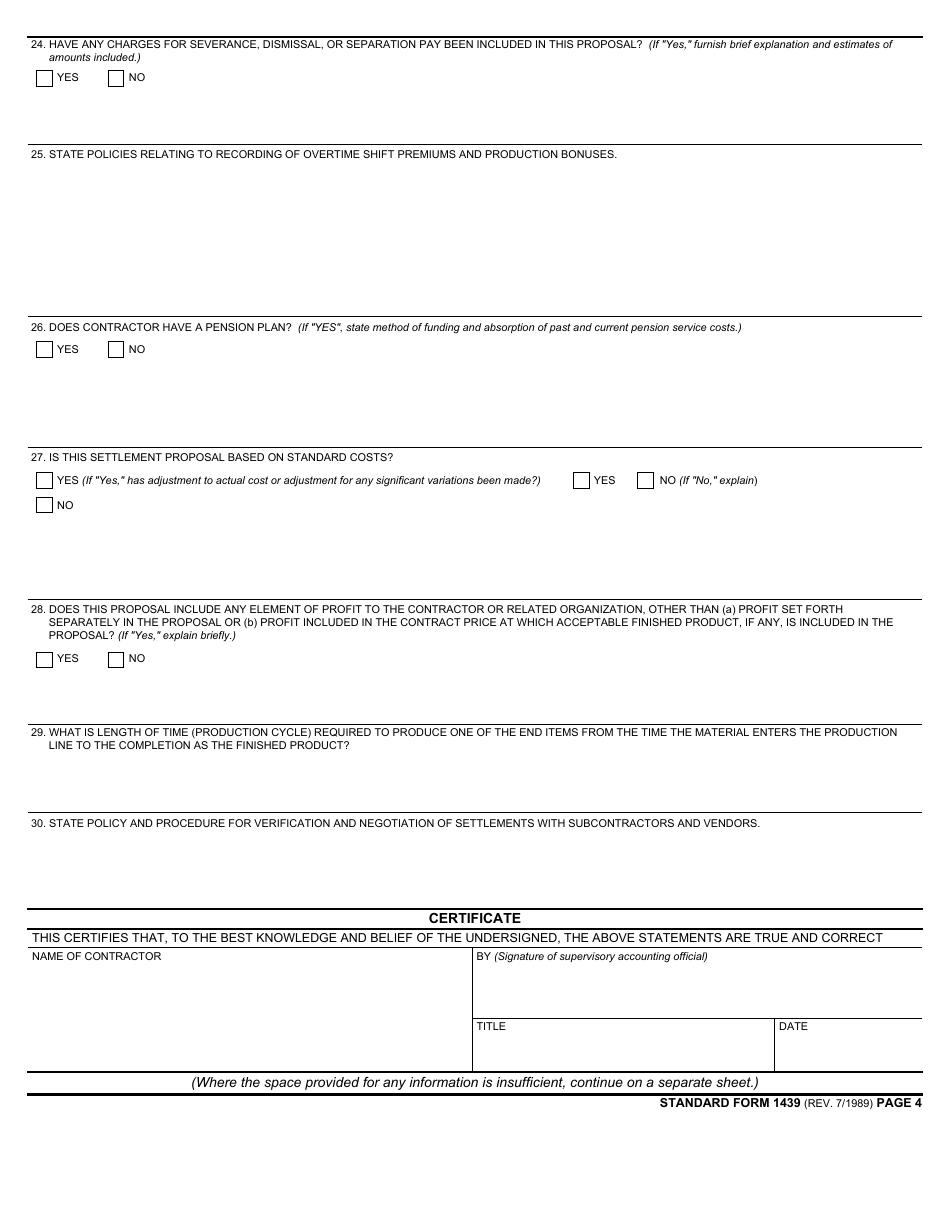

Form SF-1439

for the current year.

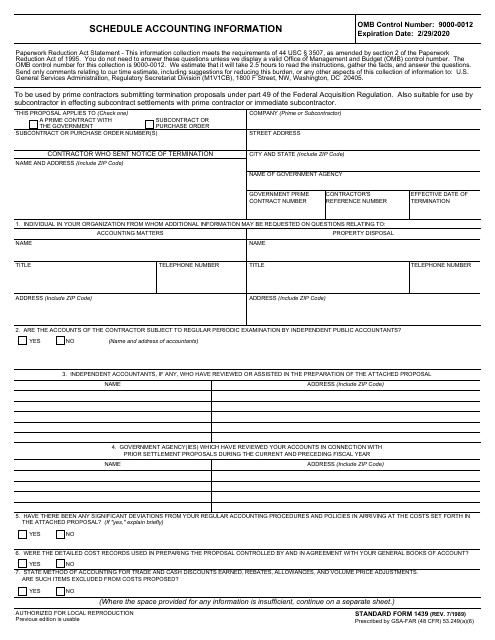

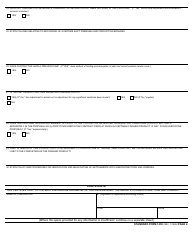

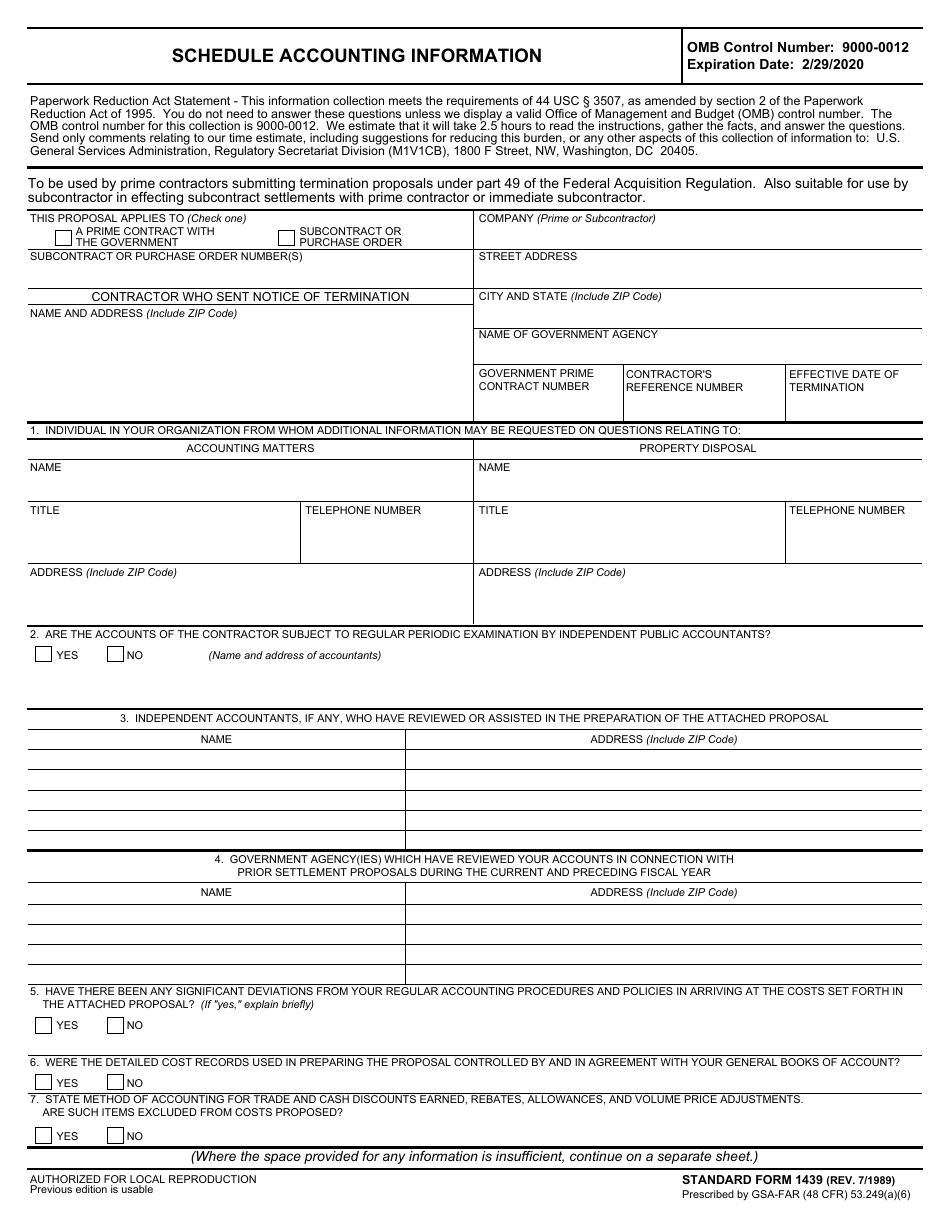

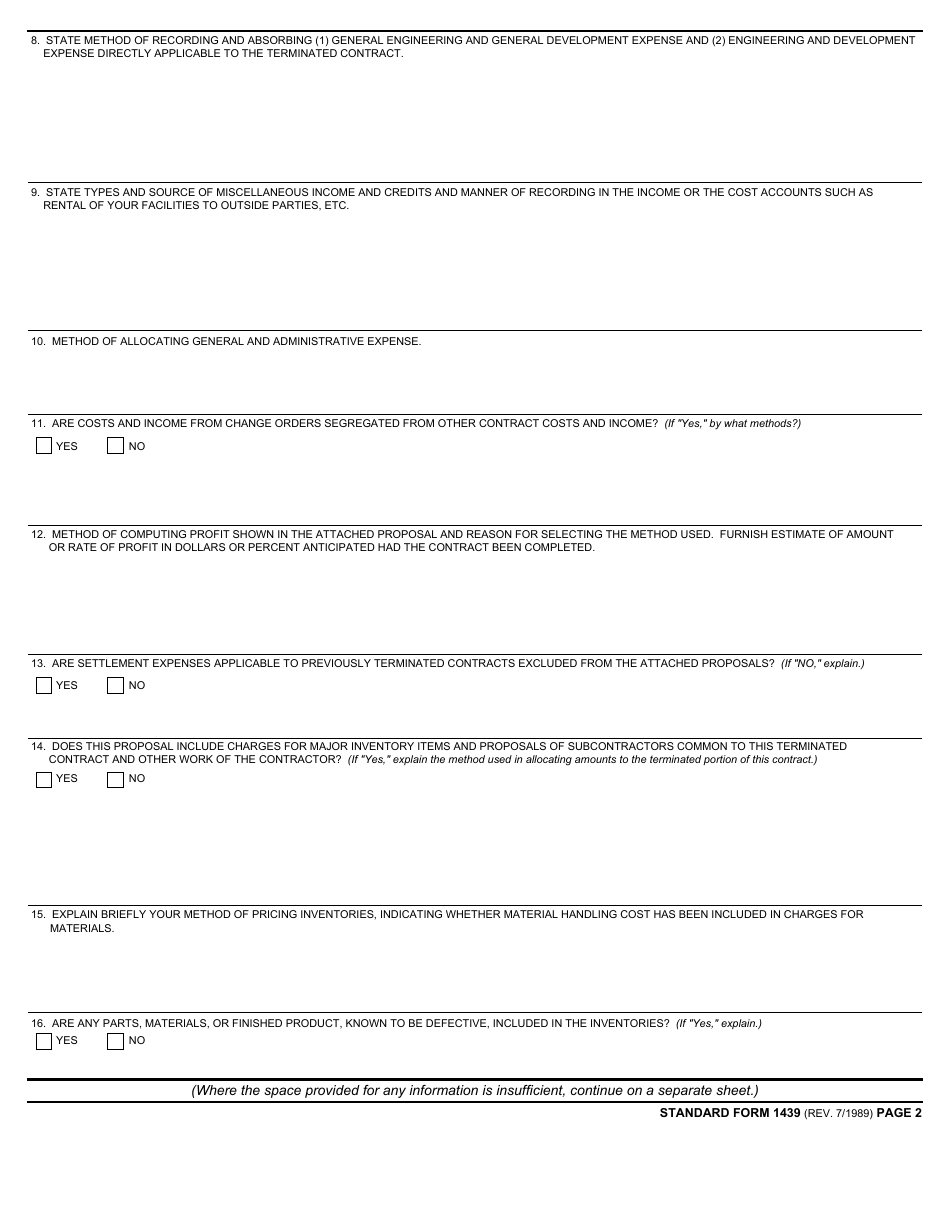

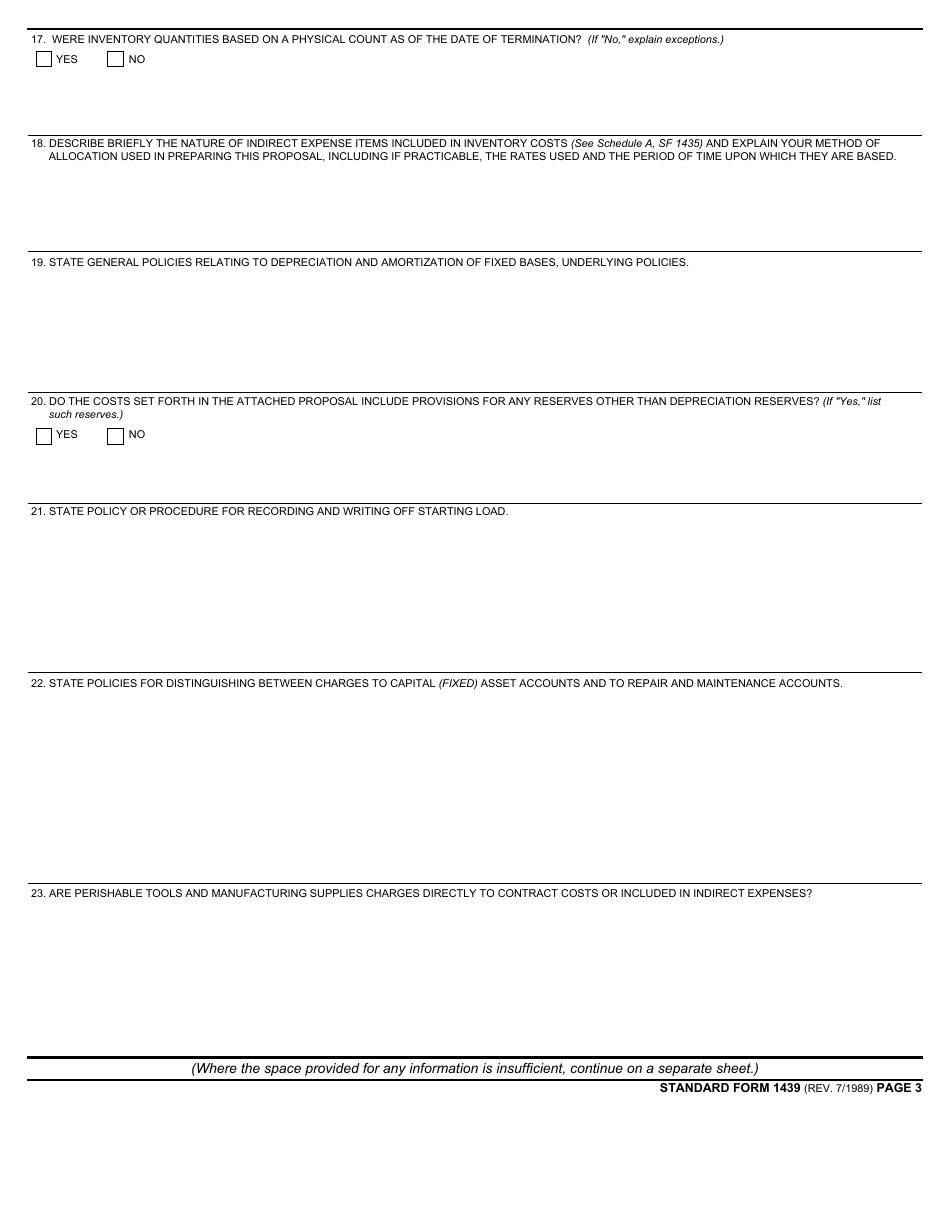

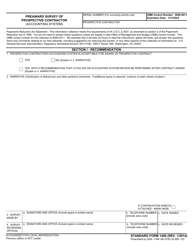

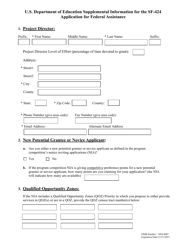

Form SF-1439 Schedule Accounting Information

What Is Form SF-1439?

This is a legal form that was released by the U.S. General Services Administration on July 1, 1989 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SF-1439 Schedule Accounting Information?

A: Form SF-1439 Schedule Accounting Information is a document used to provide detailed accounting information on contracts and subcontracts.

Q: Who needs to fill out Form SF-1439 Schedule Accounting Information?

A: Contractors and subcontractors who have contracts with the government need to fill out Form SF-1439 Schedule Accounting Information.

Q: What information is required on Form SF-1439 Schedule Accounting Information?

A: Form SF-1439 requires information such as the contractor's name, contract number, indirect cost pool information, and applicable Federal Acquisition Regulation (FAR) clauses.

Q: Is Form SF-1439 Schedule Accounting Information mandatory?

A: Yes, for contractors and subcontractors with government contracts, filling out Form SF-1439 Schedule Accounting Information is mandatory.

Form Details:

- Released on July 1, 1989;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SF-1439 by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.