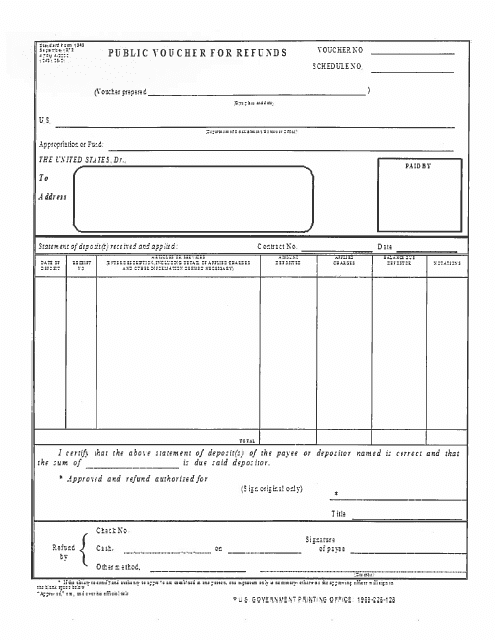

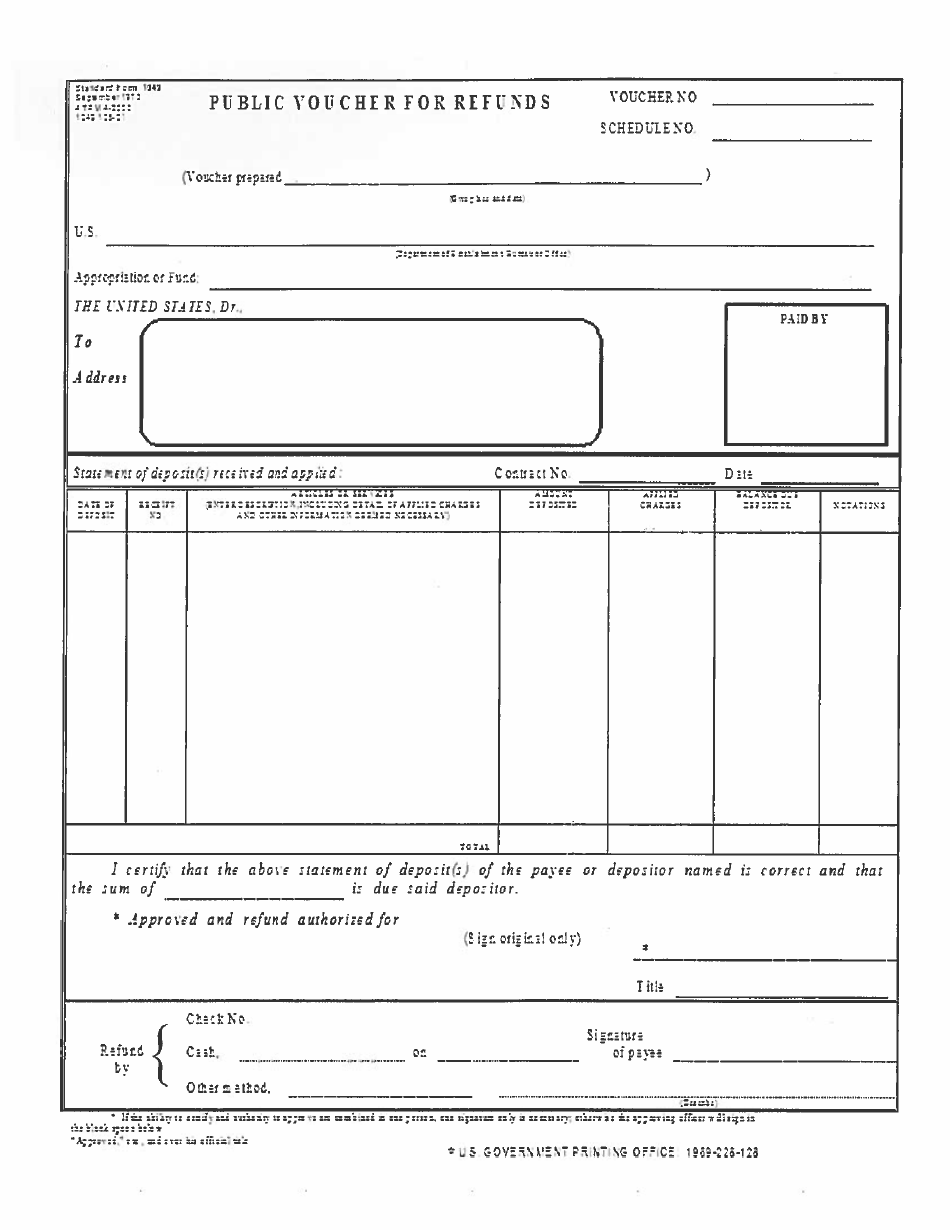

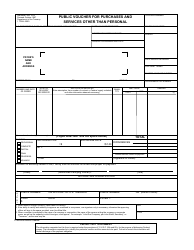

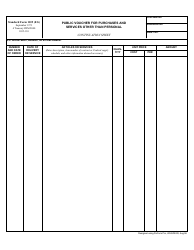

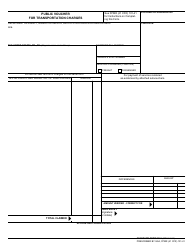

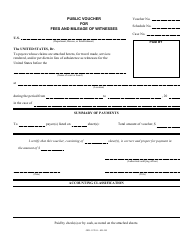

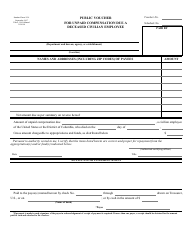

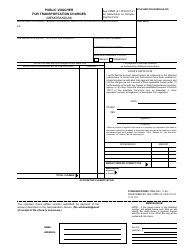

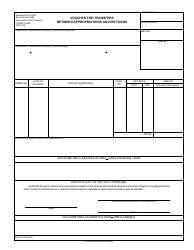

Form SF-1049 Public Voucher for Refunds - Table Format

What Is Form SF-1049?

This is a legal form that was released by the U.S. General Services Administration on September 1, 1973 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SF-1049?

A: Form SF-1049 is a public voucher used for refunds.

Q: What is the purpose of Form SF-1049?

A: The purpose of Form SF-1049 is to request a refund of money owed to an individual or organization.

Q: Who can use Form SF-1049?

A: Form SF-1049 can be used by individuals or organizations who are entitled to a refund from a government agency or department.

Q: How do I fill out Form SF-1049?

A: You need to provide your personal information, including your name, address, and taxpayer identification number, as well as details about the refund you are requesting.

Q: Are there any fees associated with filing Form SF-1049?

A: No, there are no fees associated with filing Form SF-1049.

Q: Can I submit Form SF-1049 electronically?

A: It depends on the agency or department. Some may allow electronic submissions, while others may require a physical copy to be mailed.

Q: How long does it take to receive a refund after submitting Form SF-1049?

A: The processing time for a refund can vary depending on the agency or department. It is best to contact them directly for an estimated timeline.

Q: Can I track the status of my refund after submitting Form SF-1049?

A: Yes, you can typically track the status of your refund by contacting the agency or department responsible for processing it.

Q: What should I do if there is a mistake on my Form SF-1049?

A: If you realize there is a mistake on your form after it has been submitted, you should contact the agency or department as soon as possible to rectify the error.

Form Details:

- Released on September 1, 1973;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SF-1049 by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.