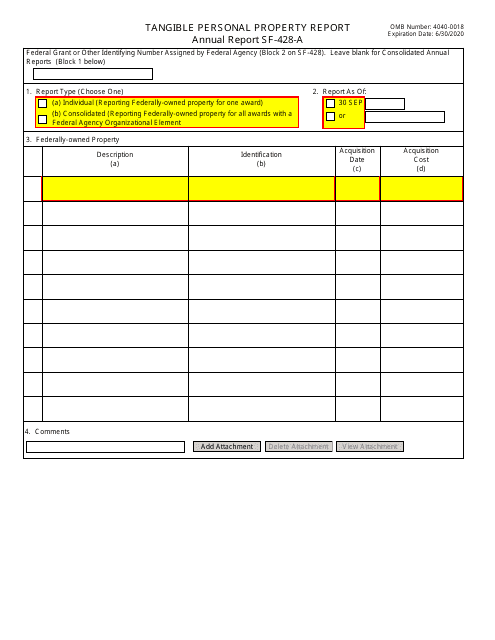

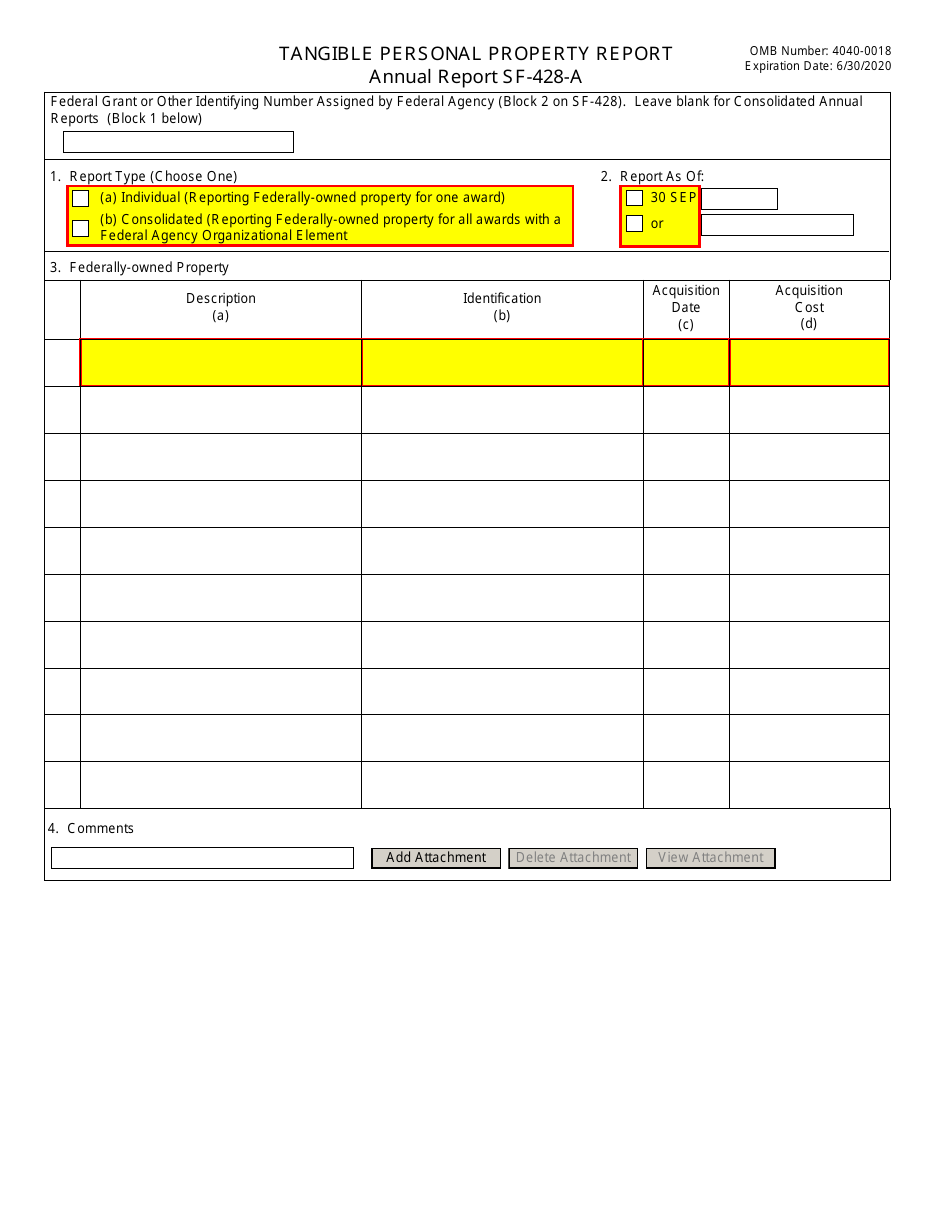

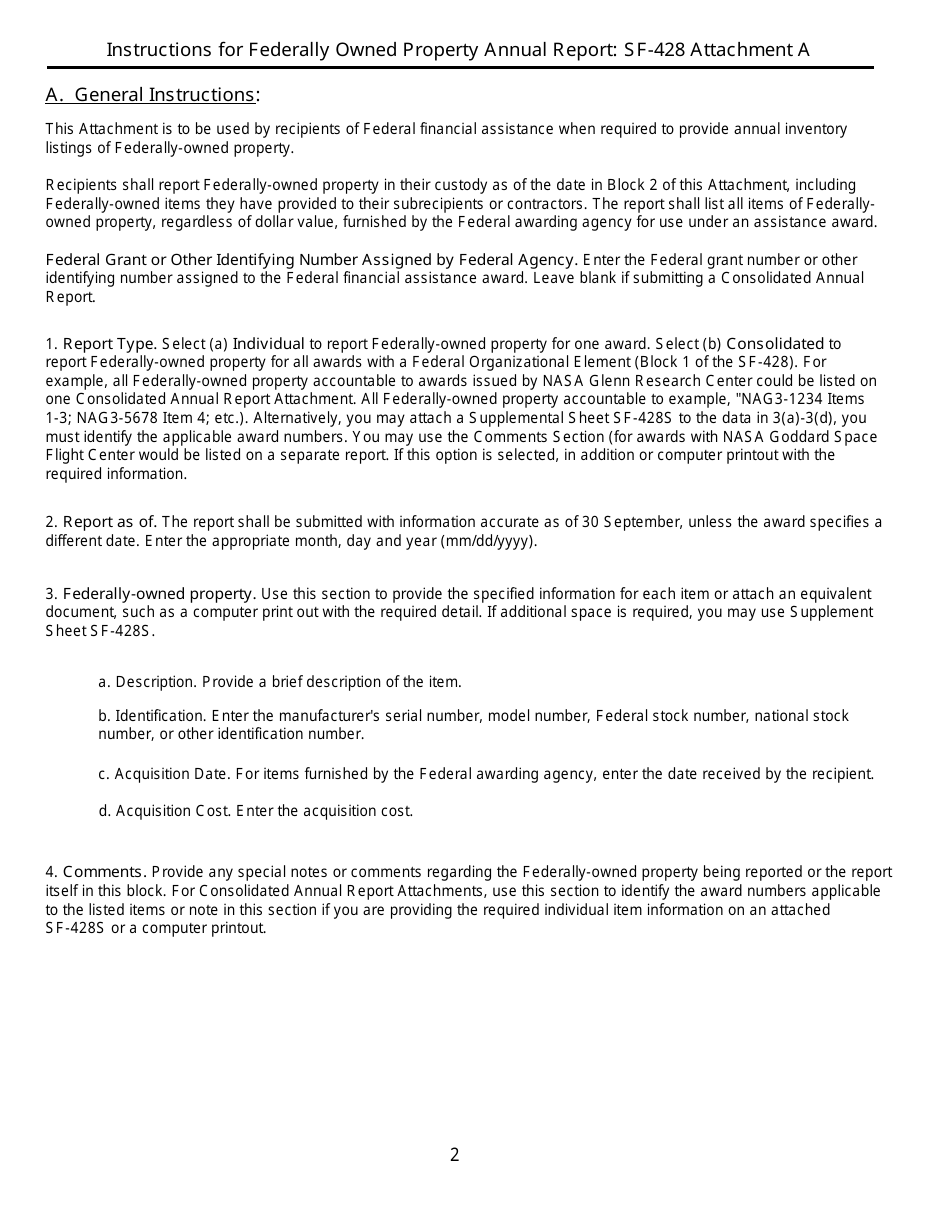

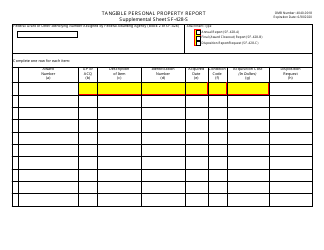

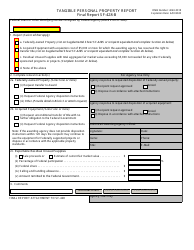

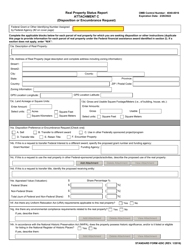

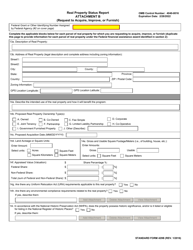

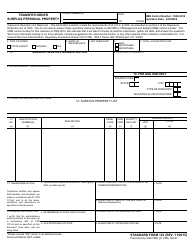

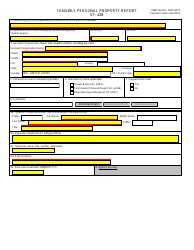

Form SF-428-A Tangible Personal Property Report - Annual Report

What Is Form SF-428-A?

This is a legal form that was released by the U.S. General Services Administration on June 1, 2017 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SF-428-A?

A: Form SF-428-A is the Tangible Personal Property Report - Annual Report.

Q: What is the purpose of Form SF-428-A?

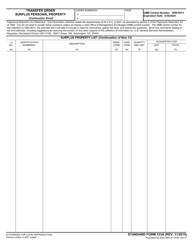

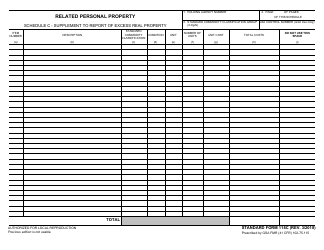

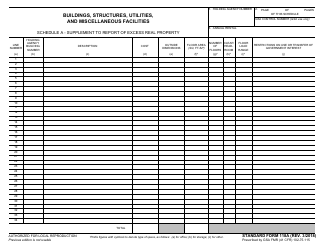

A: The purpose of Form SF-428-A is to report the annual status of tangible personal property (equipment, supplies, etc.) acquired by grantees with federal funds.

Q: Who needs to file Form SF-428-A?

A: Grantees receiving federal funds and who have acquired tangible personal property need to file Form SF-428-A.

Q: When is Form SF-428-A filed?

A: Form SF-428-A is filed annually, typically at the end of the fiscal year.

Q: Are there any penalties for not filing Form SF-428-A?

A: Failure to file Form SF-428-A or provide false information may result in penalties, including withholding of funds and legal actions.

Form Details:

- Released on June 1, 2017;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SF-428-A by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.