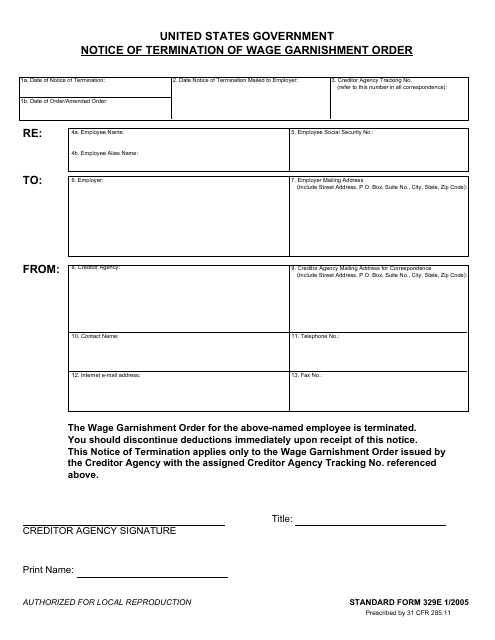

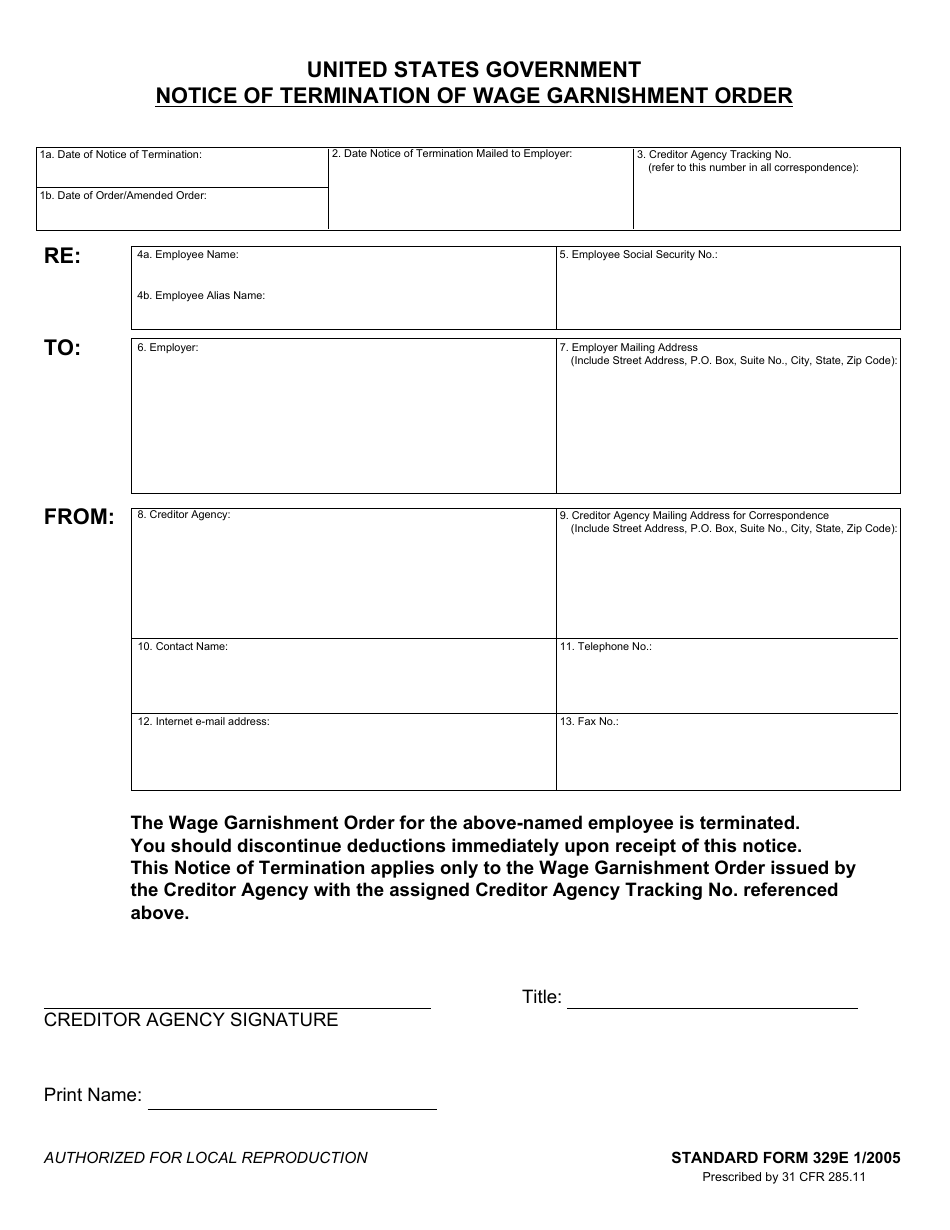

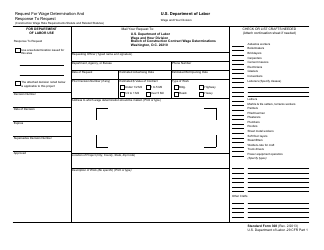

Form SF-329E Notice of Termination of Wage Garnishment Order

What Is Form SF-329E?

This is a legal form that was released by the U.S. General Services Administration on January 1, 2005 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SF-329E?

A: Form SF-329E is the Notice of Termination of Wage Garnishment Order.

Q: When should I use Form SF-329E?

A: You should use Form SF-329E when you want to terminate a wage garnishment order.

Q: What is a wage garnishment order?

A: A wage garnishment order is a legal process that allows a creditor to take a portion of your wages to satisfy a debt.

Q: Do I need to provide any supporting documents with Form SF-329E?

A: You may need to provide supporting documents, such as proof of payment or evidence that the debt has been satisfied, depending on the requirements of the agency.

Q: Is there a fee to file Form SF-329E?

A: There is typically no fee to file Form SF-329E.

Q: What happens after I file Form SF-329E?

A: After you file Form SF-329E, the agency will review your request and take the necessary actions to terminate the wage garnishment order.

Q: How long does it take for the wage garnishment to be terminated after filing Form SF-329E?

A: The time it takes to terminate the wage garnishment order can vary depending on the agency and their processing times.

Q: Can I appeal if my request to terminate the wage garnishment order is denied?

A: Yes, you may have the option to appeal the decision if your request to terminate the wage garnishment order is denied.

Form Details:

- Released on January 1, 2005;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SF-329E by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.