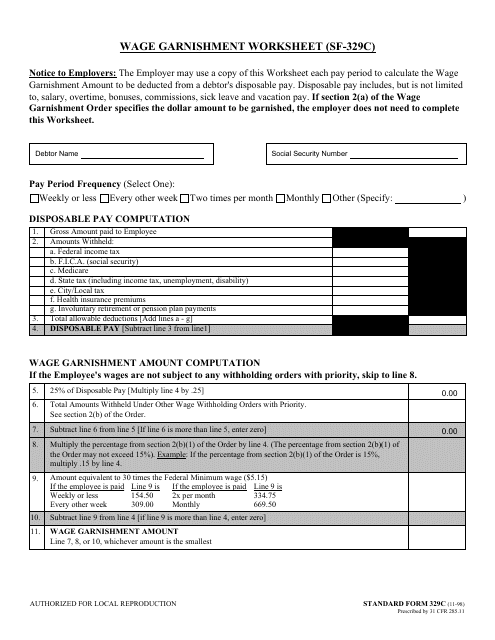

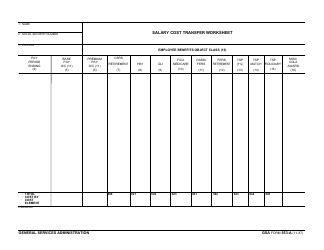

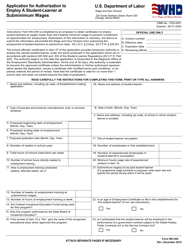

Form SF-329C Wage Garnishment Worksheet

What Is Form SF-329C?

This is a legal form that was released by the U.S. General Services Administration on November 1, 1998 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SF-329C?

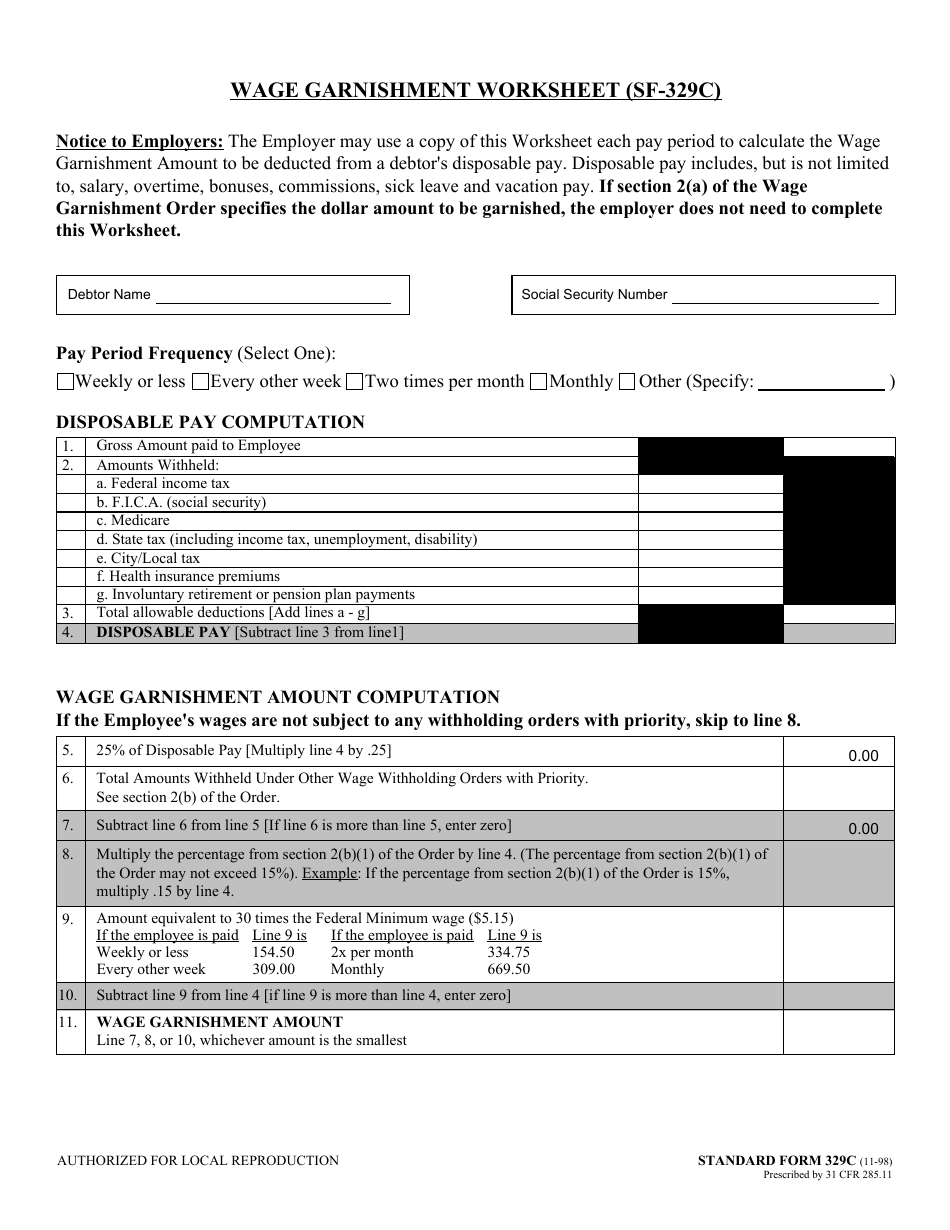

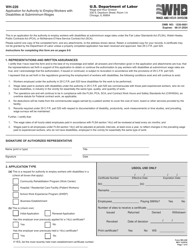

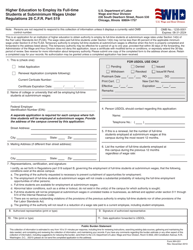

A: Form SF-329C is a Wage Garnishment Worksheet that is used by federal agencies to calculate the amount of money that can be withheld from an employee's wages to satisfy a debt.

Q: When is Form SF-329C used?

A: Form SF-329C is used when a federal agency needs to initiate wage garnishment to collect a debt from an employee.

Q: How is Form SF-329C filled out?

A: Form SF-329C requires information such as the employee's name, Social Security Number, and the amount of the debt. It also requires calculations to determine how much can be withheld from the employee's wages.

Q: Who is responsible for completing Form SF-329C?

A: Generally, the federal agency that is initiating the wage garnishment is responsible for completing Form SF-329C.

Q: Can an employee dispute the calculations on Form SF-329C?

A: Yes, an employee has the right to dispute the calculations on Form SF-329C if they believe there is an error or if they are facing a financial hardship.

Form Details:

- Released on November 1, 1998;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SF-329C by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.