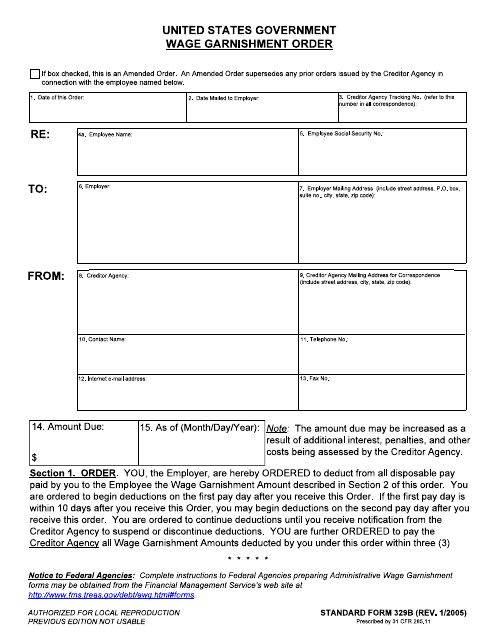

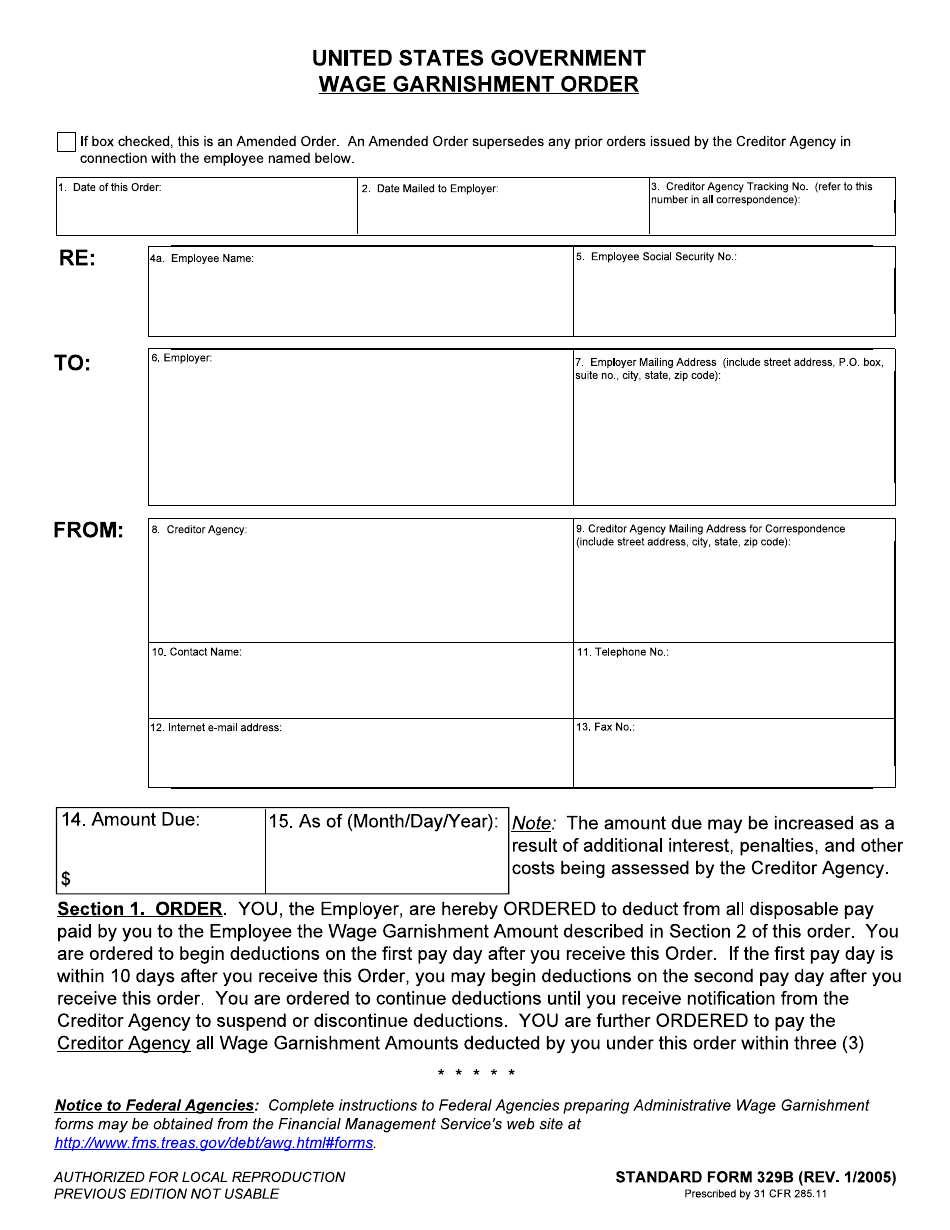

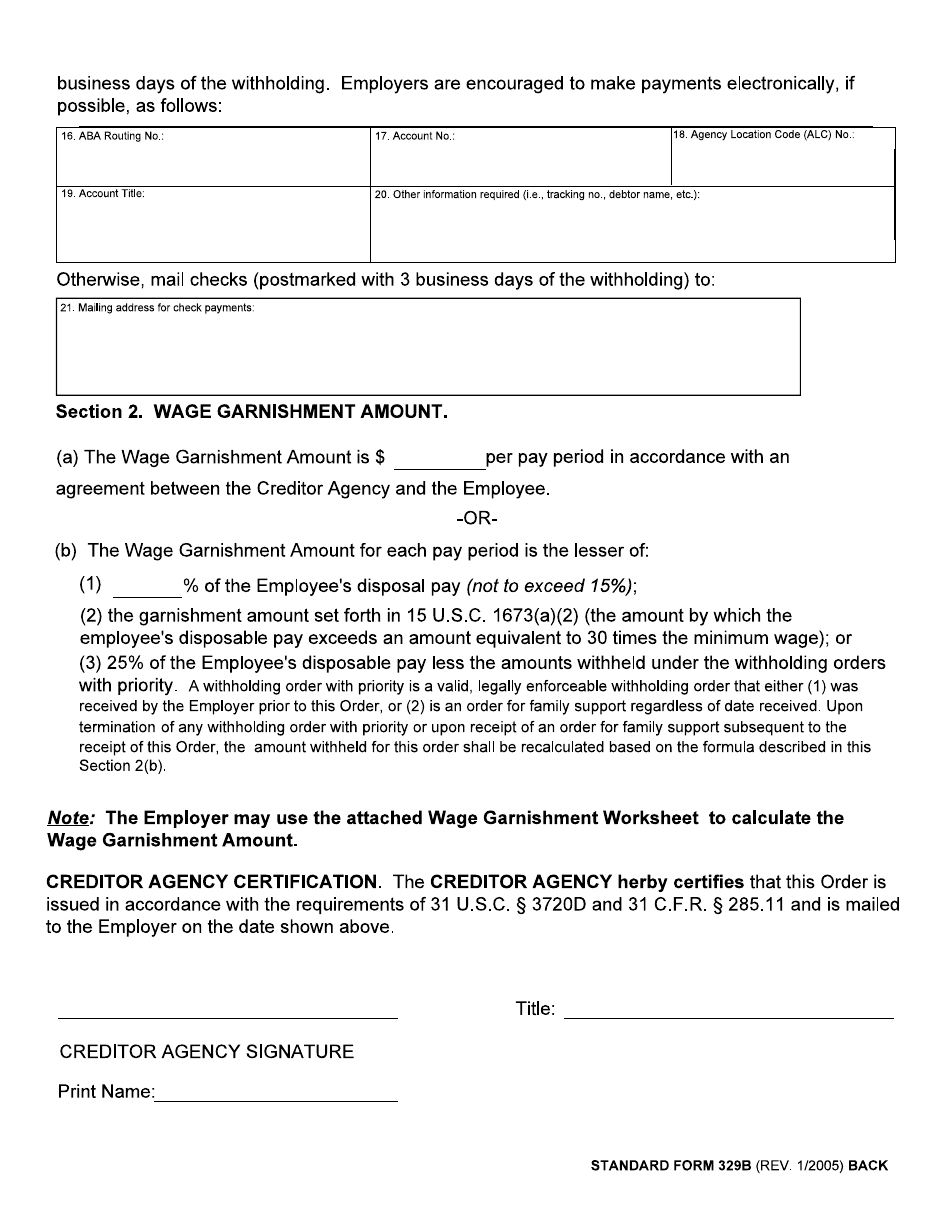

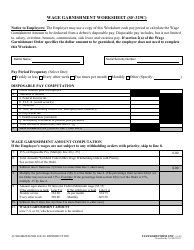

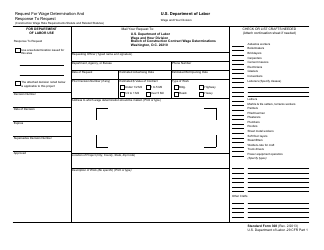

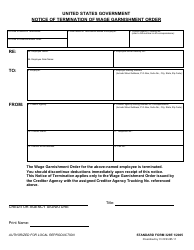

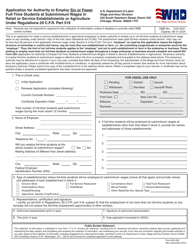

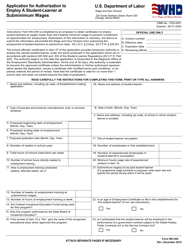

Form SF-329B Wage Garnishment Order

What Is Form SF-329B?

This is a legal form that was released by the U.S. General Services Administration on January 1, 2005 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SF-329B?

A: Form SF-329B is a Wage Garnishment Order.

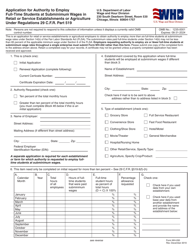

Q: Who uses Form SF-329B?

A: Form SF-329B is used by federal agencies to initiate wage garnishment for federal employees.

Q: What is wage garnishment?

A: Wage garnishment is a legal process where a portion of an employee's wages are withheld to repay a debt.

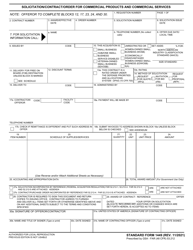

Q: What information is included in Form SF-329B?

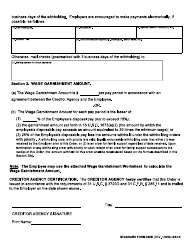

A: Form SF-329B includes information about the employee, the creditor, the debt being garnished, and the amount to be withheld from the employee's wages.

Q: How is Form SF-329B submitted?

A: Form SF-329B is submitted by the federal agency to the employee's payroll office for implementation.

Q: Is Form SF-329B specific to a particular state?

A: No, Form SF-329B is a federal form and is used for wage garnishment of federal employees regardless of the state they work in.

Form Details:

- Released on January 1, 2005;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SF-329B by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.