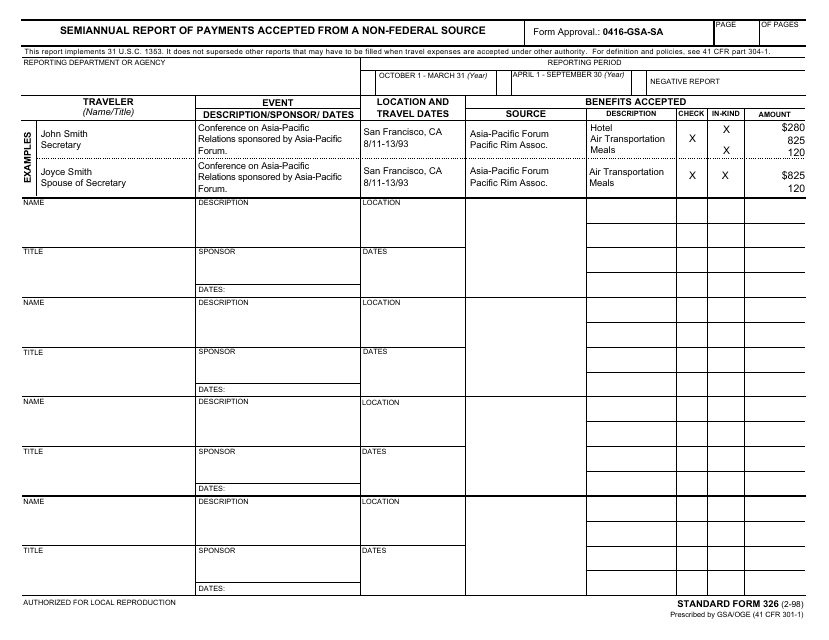

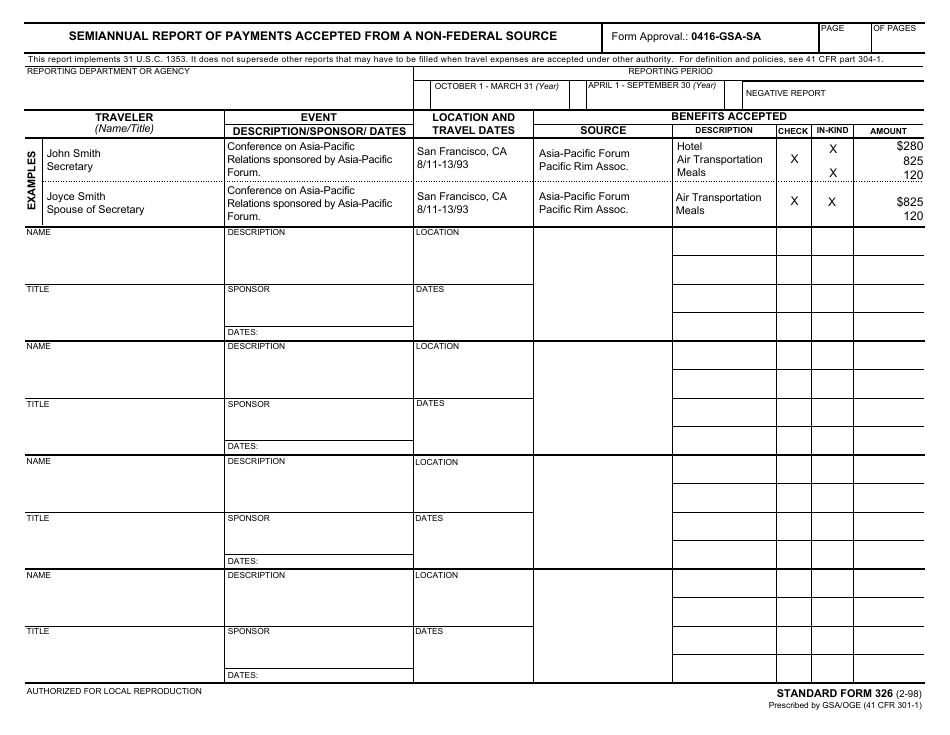

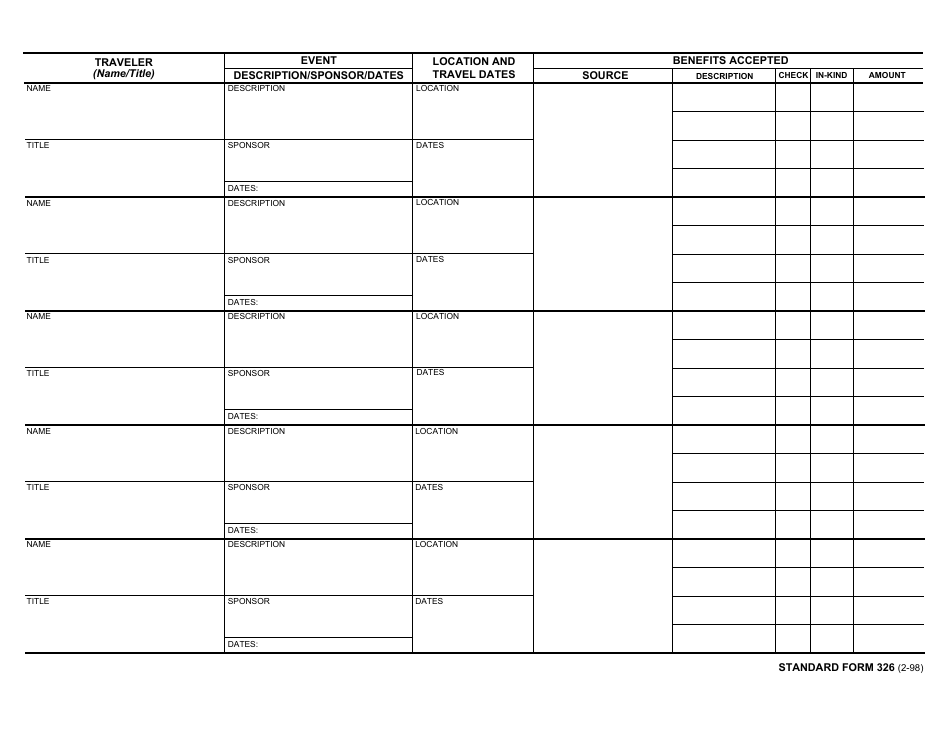

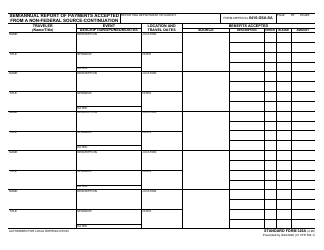

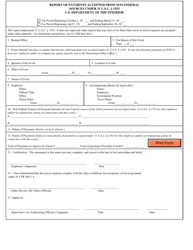

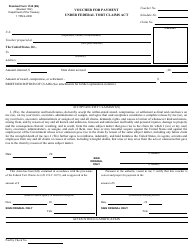

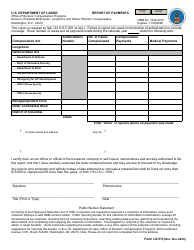

Form SF-326 Semiannual Report of Payments Accepted From a Non-federal Source

What Is Form SF-326?

This is a legal form that was released by the U.S. General Services Administration on February 1, 1998 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SF-326?

A: Form SF-326 is a semiannual report used to disclose all payments accepted from a non-federal source.

Q: Why is Form SF-326 required?

A: Form SF-326 is required to ensure transparency and accountability in financial transactions by federal entities.

Q: Who needs to file Form SF-326?

A: Federal entities that have accepted payments from non-federal sources are required to file Form SF-326.

Q: When is Form SF-326 filed?

A: Form SF-326 is filed semiannually, with reports due on April 30th and October 31st each year.

Q: What information is included in Form SF-326?

A: Form SF-326 includes details of the payments accepted, such as the source of the payment, amount received, and purpose of the payment.

Form Details:

- Released on February 1, 1998;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SF-326 by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.