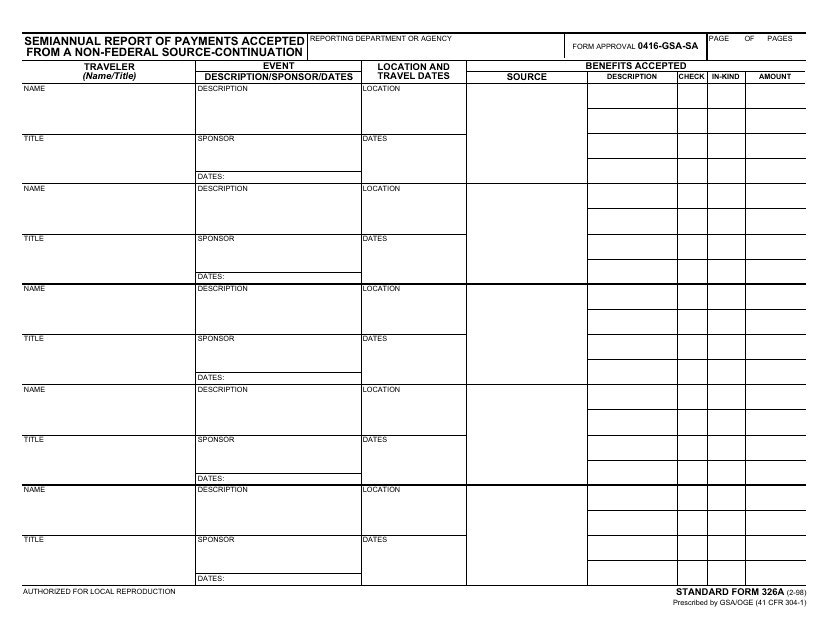

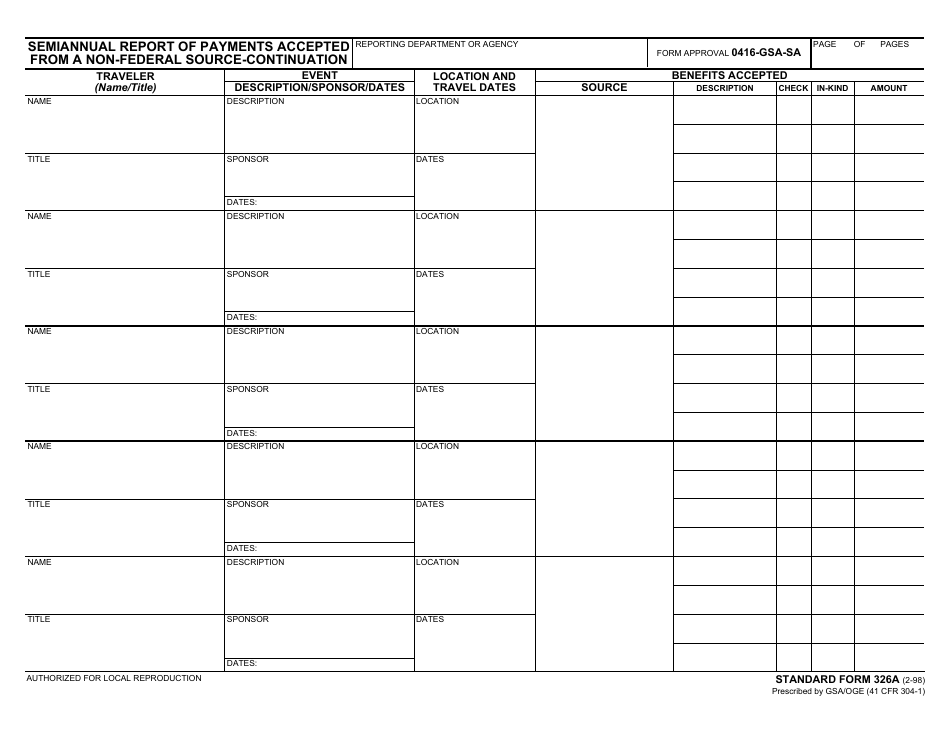

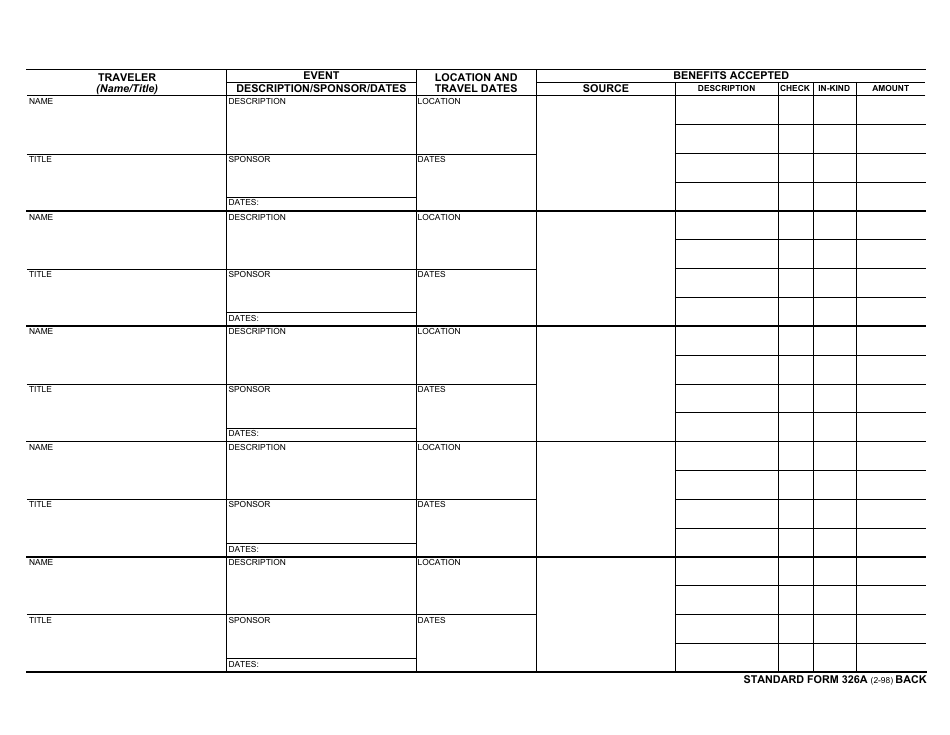

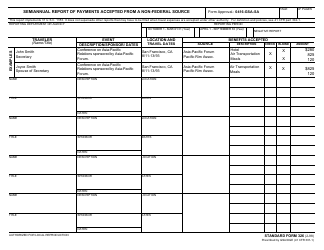

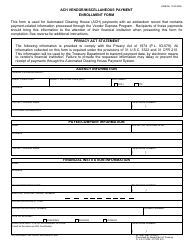

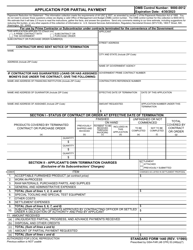

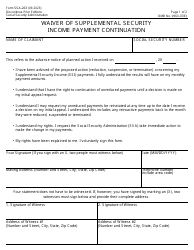

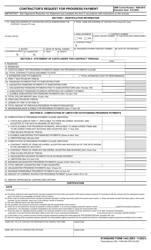

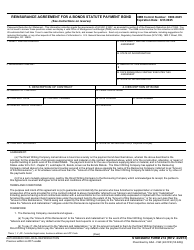

Form SF-326A Semiannual Report of Payments Accepted From a Non-federal Source - Continuation

What Is Form SF-326A?

This is a legal form that was released by the U.S. General Services Administration on February 1, 1998 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SF-326A?

A: Form SF-326A is the Semiannual Report of Payments Accepted From a Non-federal Source - Continuation.

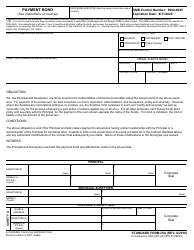

Q: What is the purpose of Form SF-326A?

A: The purpose of Form SF-326A is to report payments received from non-federal sources.

Q: Who is required to file Form SF-326A?

A: Anyone who has accepted payments from non-federal sources is required to file Form SF-326A.

Q: How often should Form SF-326A be filed?

A: Form SF-326A should be filed semiannually.

Q: What information is required on Form SF-326A?

A: Form SF-326A requires the reporting of detailed information about the payments received from non-federal sources.

Form Details:

- Released on February 1, 1998;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SF-326A by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.