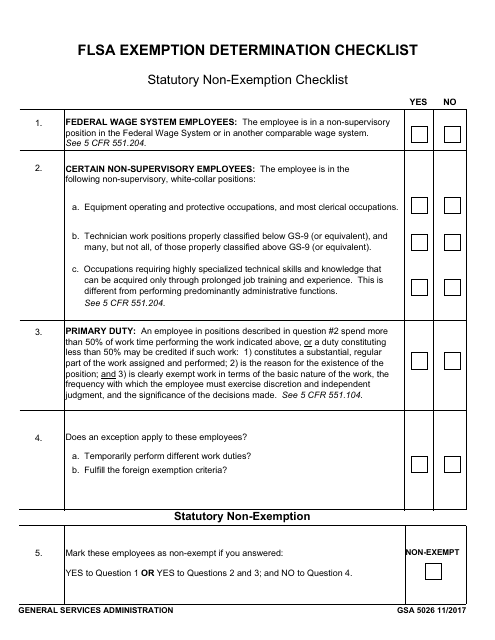

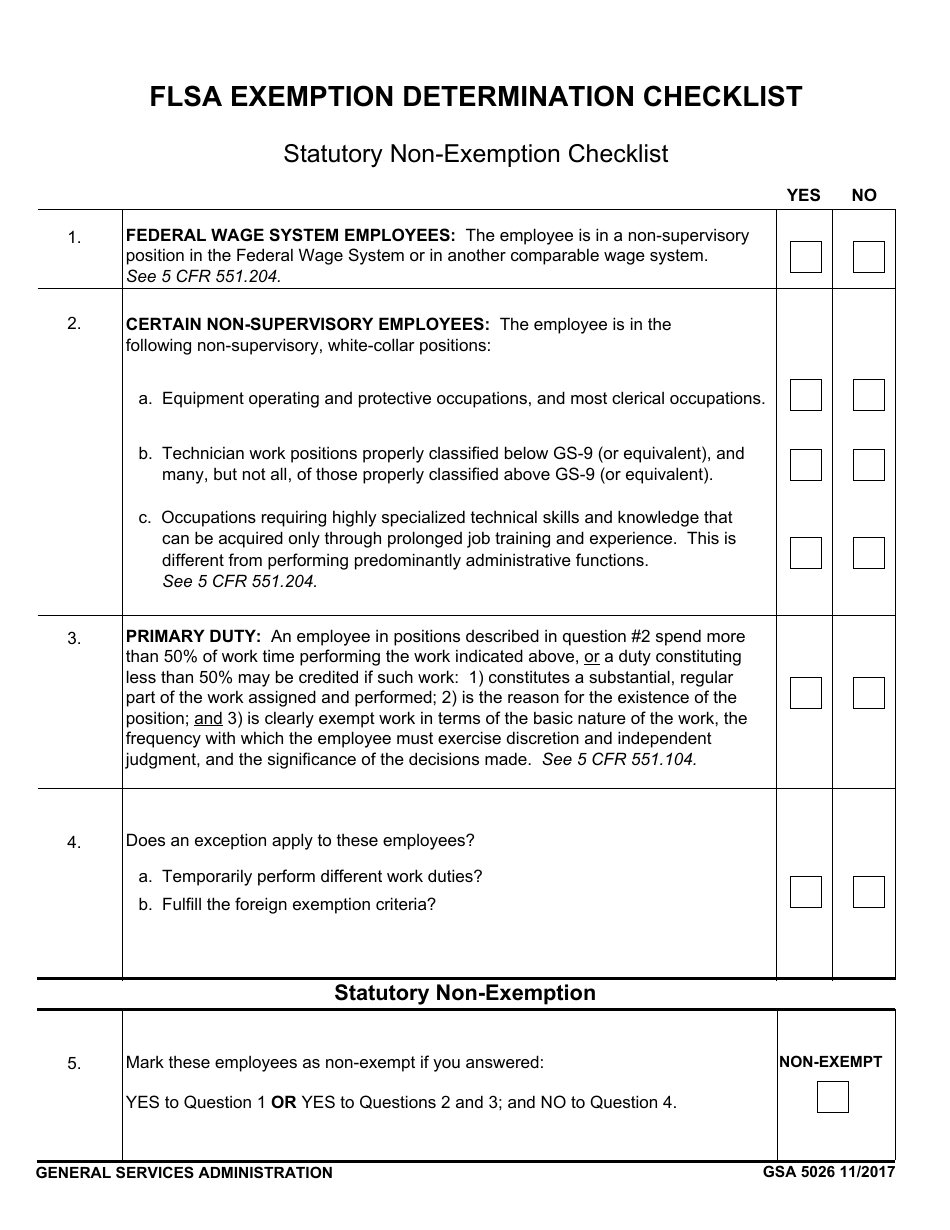

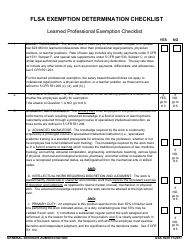

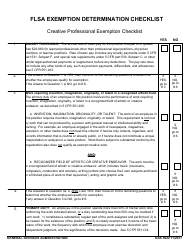

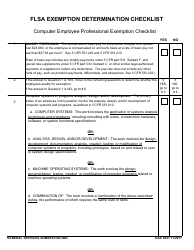

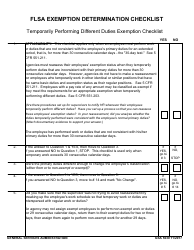

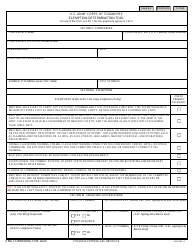

GSA Form 5026 Flsa Exemption Determination Checklist - Statutory Non-exemption

What Is GSA Form 5026?

This is a legal form that was released by the U.S. General Services Administration on November 1, 2017 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GSA Form 5026?

A: GSA Form 5026 is a form used to determine the exemption status under the Fair Labor Standards Act (FLSA).

Q: What is the purpose of the Flsa Exemption Determination Checklist?

A: The purpose of the checklist is to help determine if an employee is eligible for a statutory exemption under the Fair Labor Standards Act (FLSA).

Q: What does 'statutory non-exemption' mean?

A: 'Statutory non-exemption' means that an employee does not meet the criteria for any of the statutory exemptions under the FLSA and therefore must be paid overtime for hours worked beyond 40 in a workweek.

Q: Who uses GSA Form 5026?

A: GSA Form 5026 is typically used by employers to evaluate and determine the exemption status of their employees under the FLSA.

Q: What happens if an employee is determined to be 'statutory non-exempt'?

A: If an employee is determined to be 'statutory non-exempt', they must be paid overtime for any hours worked beyond 40 in a workweek, as required by the Fair Labor Standards Act (FLSA).

Form Details:

- Released on November 1, 2017;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of GSA Form 5026 by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.