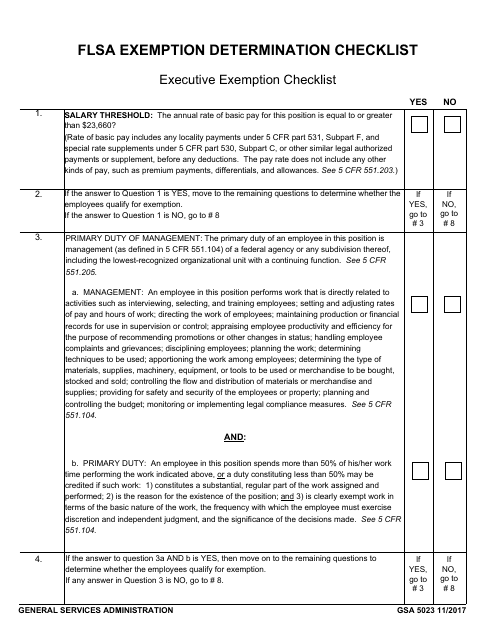

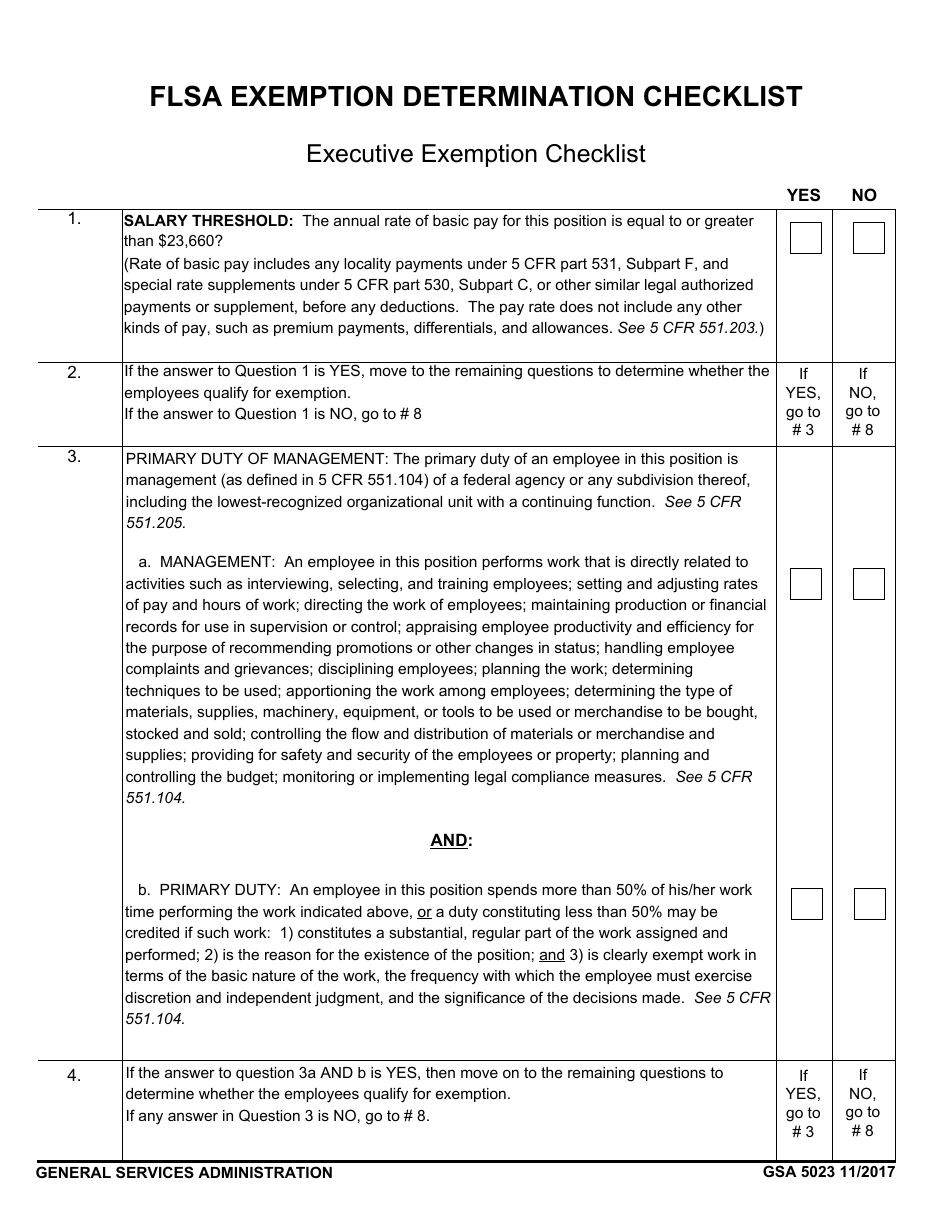

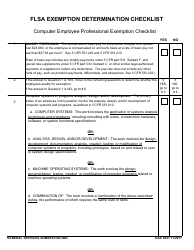

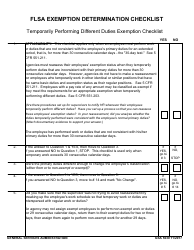

GSA Form 5023 Flsa Exemption Determination Checklist - Executive Exemption

What Is GSA Form 5023?

This is a legal form that was released by the U.S. General Services Administration on November 1, 2017 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GSA Form 5023?

A: GSA Form 5023 is a form used to determine if an employee is exempt from the Fair Labor Standards Act (FLSA) under the Executive Exemption.

Q: What is the Fair Labor Standards Act (FLSA)?

A: The Fair Labor Standards Act (FLSA) is a federal law that establishes minimum wage, overtime pay, recordkeeping, and child labor standards for employees in the private sector and in federal, state, and local governments.

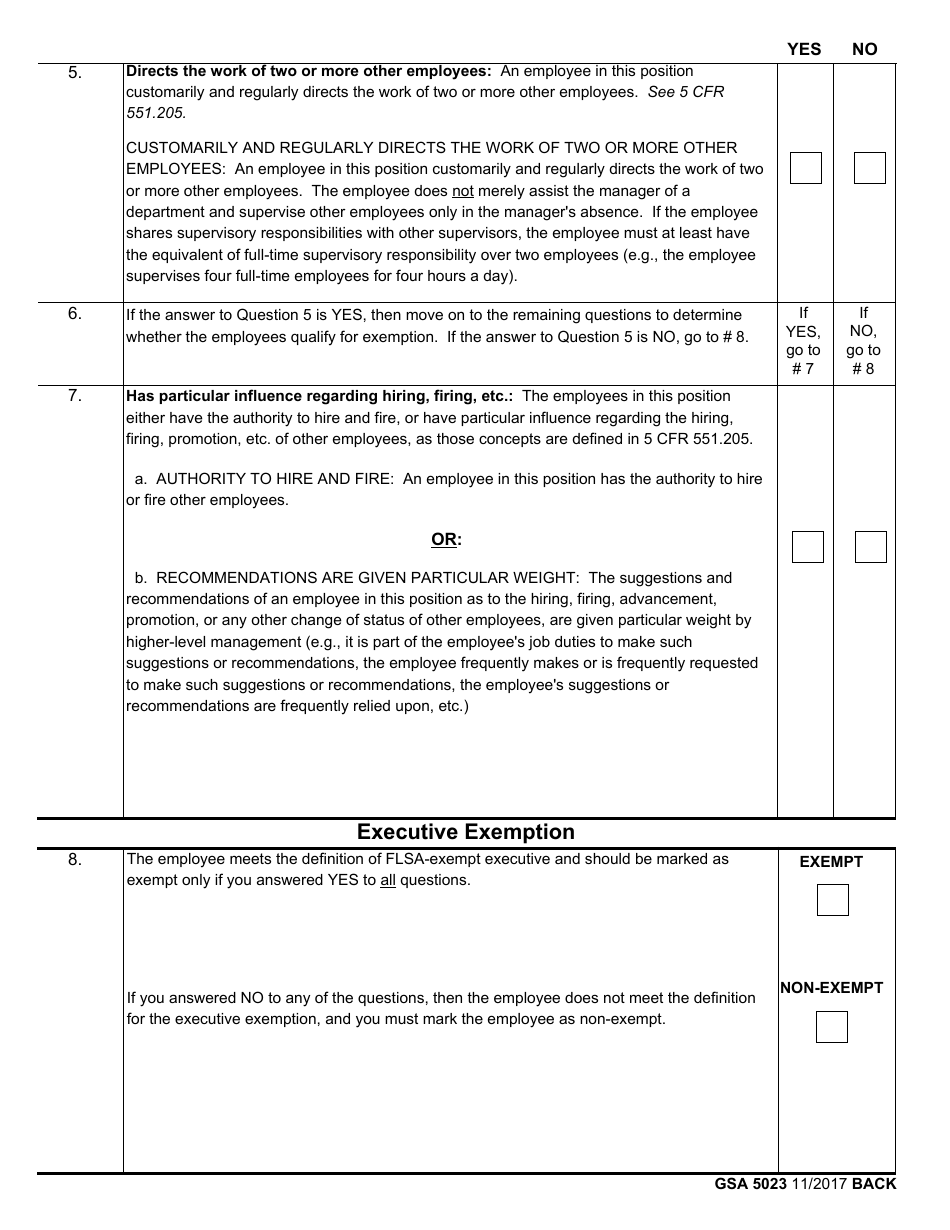

Q: What is the Executive Exemption?

A: The Executive Exemption is one of the exemptions under the FLSA that allows certain executive employees to be exempt from the overtime pay requirements.

Q: Who should complete GSA Form 5023?

A: This form should be completed by employers or HR professionals to determine if an employee qualifies for the Executive Exemption.

Q: What does the checklist in GSA Form 5023 include?

A: The checklist in GSA Form 5023 includes questions about the employee's job duties, authority, and responsibility to determine if they meet the requirements for the Executive Exemption.

Q: Why is it important to determine FLSA exemptions?

A: Determining FLSA exemptions is important to ensure compliance with federal labor laws and to properly classify employees as exempt or non-exempt for overtime pay purposes.

Q: Can employees who are exempt from FLSA receive overtime pay?

A: No, employees who are exempt from FLSA are not entitled to receive overtime pay.

Form Details:

- Released on November 1, 2017;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of GSA Form 5023 by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.