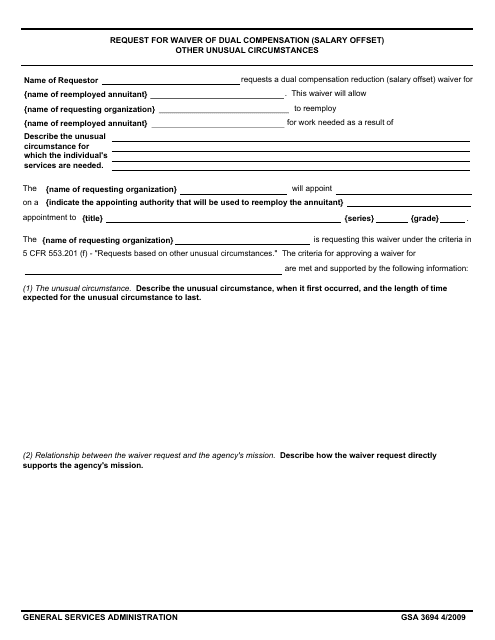

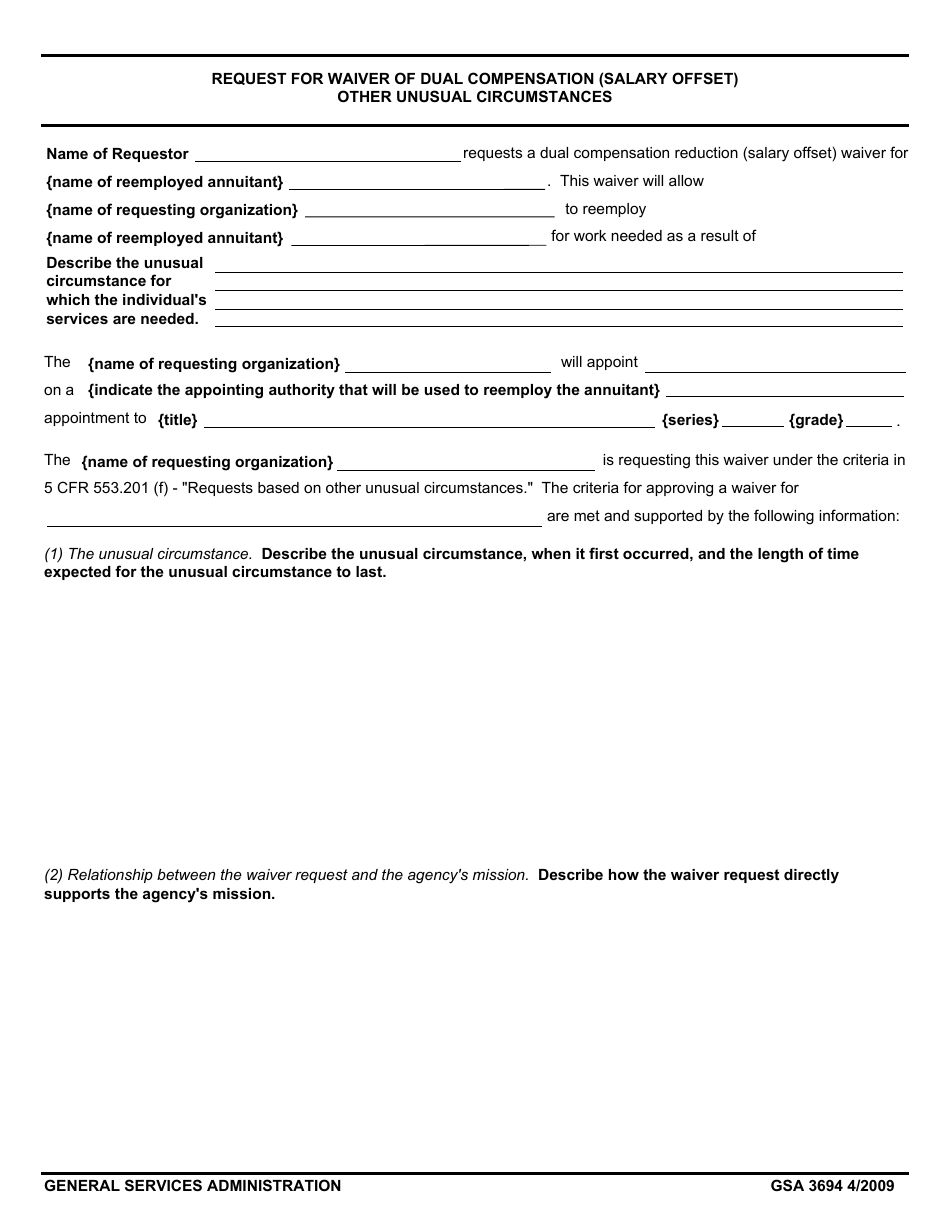

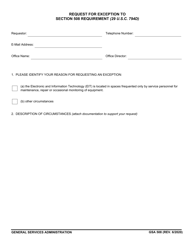

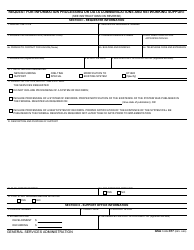

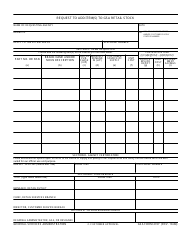

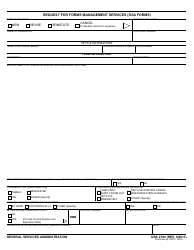

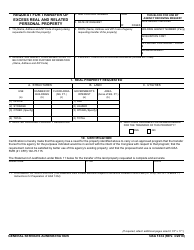

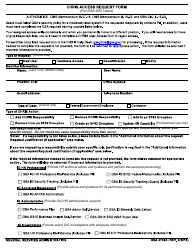

GSA Form 3694 Request for Waiver of Dual Compensation (Salary Offset) Other Unusual Circumstances

What Is GSA Form 3694?

This is a legal form that was released by the U.S. General Services Administration on April 1, 2009 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GSA Form 3694?

A: GSA Form 3694 is a request form for waiver of dual compensation or salary offset due to other unusual circumstances.

Q: What is the purpose of GSA Form 3694?

A: The purpose of GSA Form 3694 is to request a waiver of the dual compensation or salary offset that may be required in certain situations.

Q: What is dual compensation?

A: Dual compensation refers to the situation when an individual receives two sources of income simultaneously, such as a salary from a government agency and retirement pay.

Q: What are other unusual circumstances?

A: Other unusual circumstances refer to situations that are not covered by the standard dual compensation rules, but still require a waiver of the salary offset.

Q: Who needs to fill out GSA Form 3694?

A: Any individual who needs a waiver of the dual compensation or salary offset due to other unusual circumstances must fill out GSA Form 3694.

Q: What happens after I submit GSA Form 3694?

A: After you submit GSA Form 3694, the appropriate government agency will review your request and determine whether to grant the waiver of dual compensation or salary offset.

Q: How long does it take to process a waiver request on GSA Form 3694?

A: The processing time for a waiver request on GSA Form 3694 can vary depending on the specific circumstances. It is best to check with the appropriate government agency for an estimated time frame.

Q: Can I appeal if my waiver request on GSA Form 3694 is denied?

A: Yes, you can appeal the decision if your waiver request on GSA Form 3694 is denied. The appeals process may vary depending on the government agency involved.

Form Details:

- Released on April 1, 2009;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of GSA Form 3694 by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.