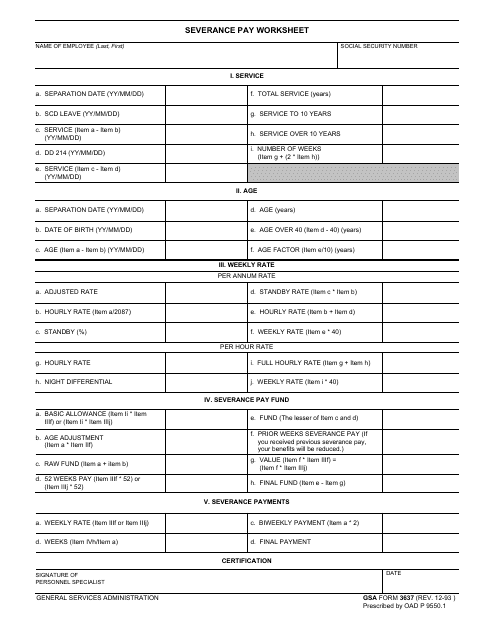

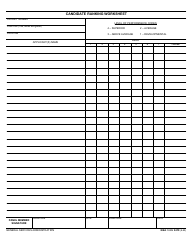

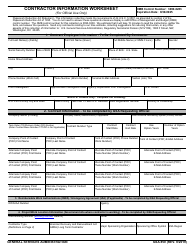

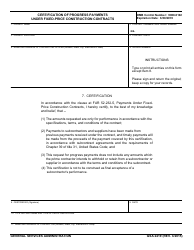

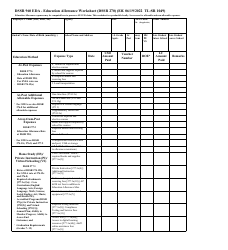

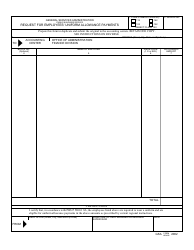

GSA Form 3637 Severance Pay Worksheet

What Is GSA Form 3637?

This is a legal form that was released by the U.S. General Services Administration on December 1, 1993 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the GSA Form 3637 Severance Pay Worksheet?

A: The GSA Form 3637 Severance Pay Worksheet is a document used to calculate severance pay for federal government employees.

Q: Who uses the GSA Form 3637 Severance Pay Worksheet?

A: The GSA Form 3637 Severance Pay Worksheet is used by federal government agencies to determine severance pay for their employees.

Q: What is severance pay?

A: Severance pay is the compensation provided to an employee who is involuntarily terminated from their job.

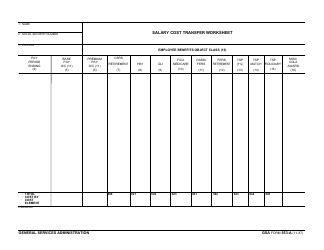

Q: How is severance pay calculated using the GSA Form 3637 Severance Pay Worksheet?

A: The GSA Form 3637 Severance Pay Worksheet uses factors such as length of service, pay rate, and leave balance to calculate the amount of severance pay.

Q: Are all federal government employees eligible for severance pay?

A: No, not all federal government employees are eligible for severance pay. Eligibility may depend on factors such as length of service and the reason for termination.

Q: Is severance pay taxable?

A: Yes, severance pay is generally subject to federal income tax, as well as state and local income taxes.

Q: Can severance pay affect unemployment benefits?

A: Yes, receiving severance pay may impact a person's eligibility or the amount they can receive in unemployment benefits.

Q: Can I request a copy of the GSA Form 3637 Severance Pay Worksheet?

A: Yes, you can request a copy of the GSA Form 3637 Severance Pay Worksheet from your federal government agency's human resources department.

Form Details:

- Released on December 1, 1993;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of GSA Form 3637 by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.