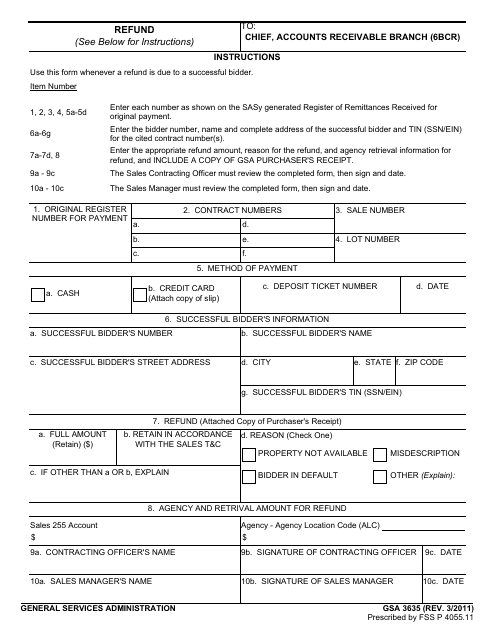

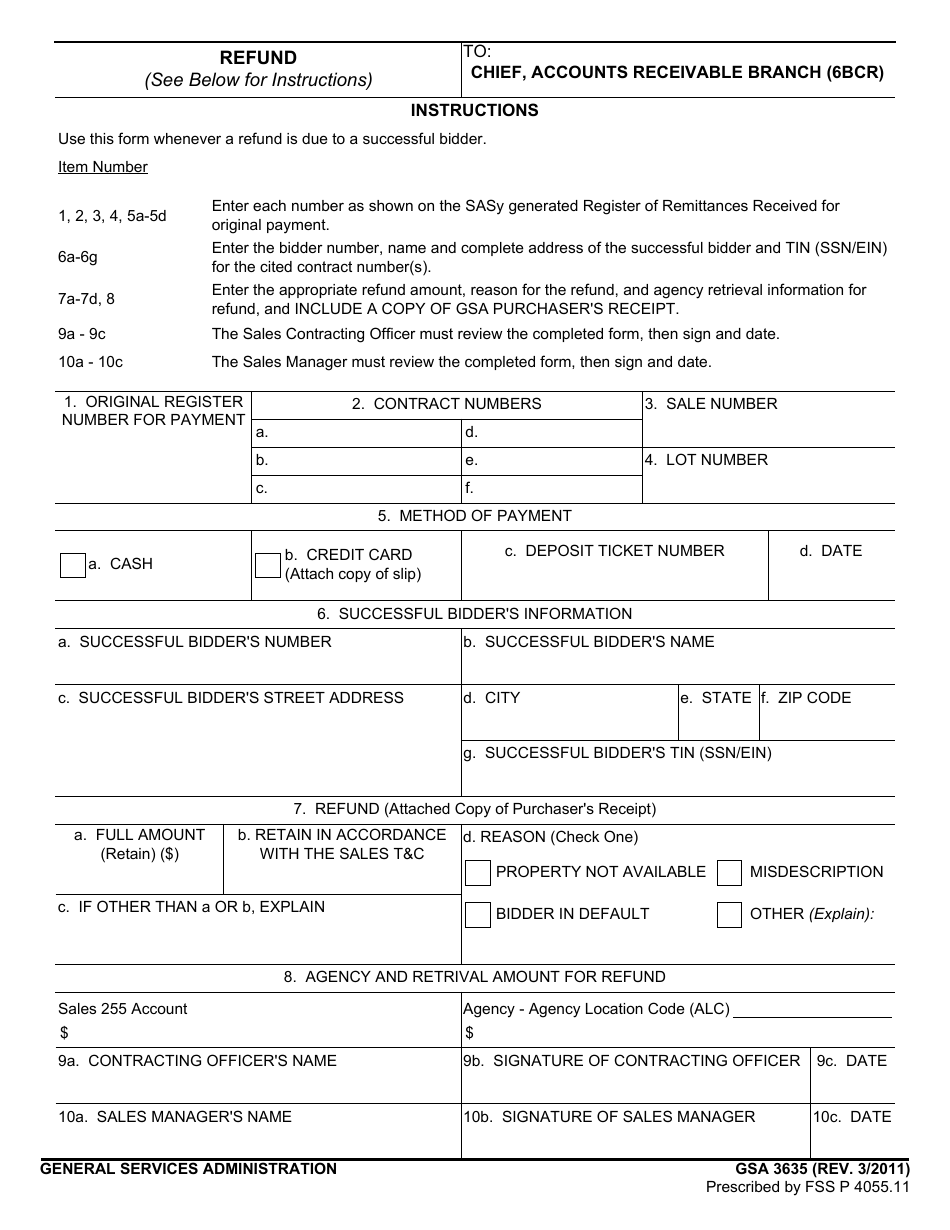

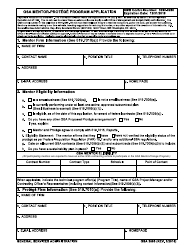

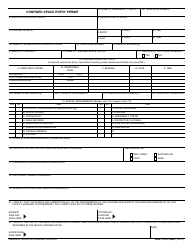

GSA Form 3635 Refund

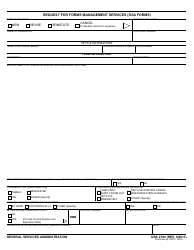

What Is GSA Form 3635?

This is a legal form that was released by the U.S. General Services Administration on March 1, 2011 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GSA Form 3635?

A: GSA Form 3635 is a form used for requesting a refund.

Q: What is the purpose of GSA Form 3635?

A: The purpose of GSA Form 3635 is to request a refund for a payment made to the General Services Administration (GSA).

Q: Who can use GSA Form 3635?

A: Anyone who has made a payment to the GSA and is eligible for a refund can use GSA Form 3635.

Q: What information is required on GSA Form 3635?

A: GSA Form 3635 requires information such as the payment details, reason for the refund request, and contact information of the requester.

Q: How long does it take to process a refund request with GSA Form 3635?

A: The processing time for a refund request with GSA Form 3635 may vary, but it typically takes several weeks.

Q: Is there a fee for filing GSA Form 3635?

A: No, there is no fee associated with filing GSA Form 3635.

Form Details:

- Released on March 1, 2011;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of GSA Form 3635 by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.