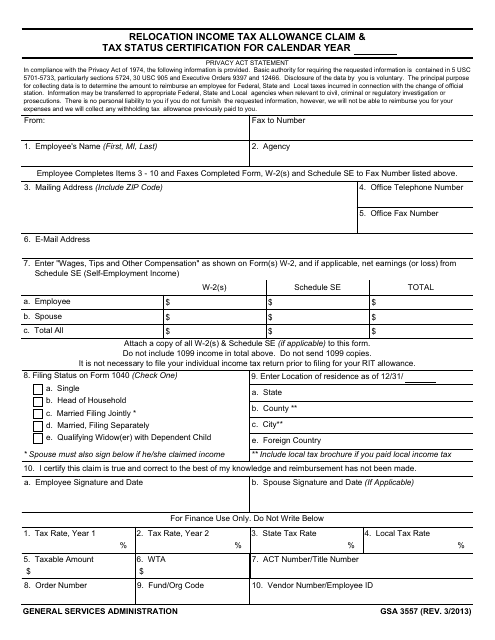

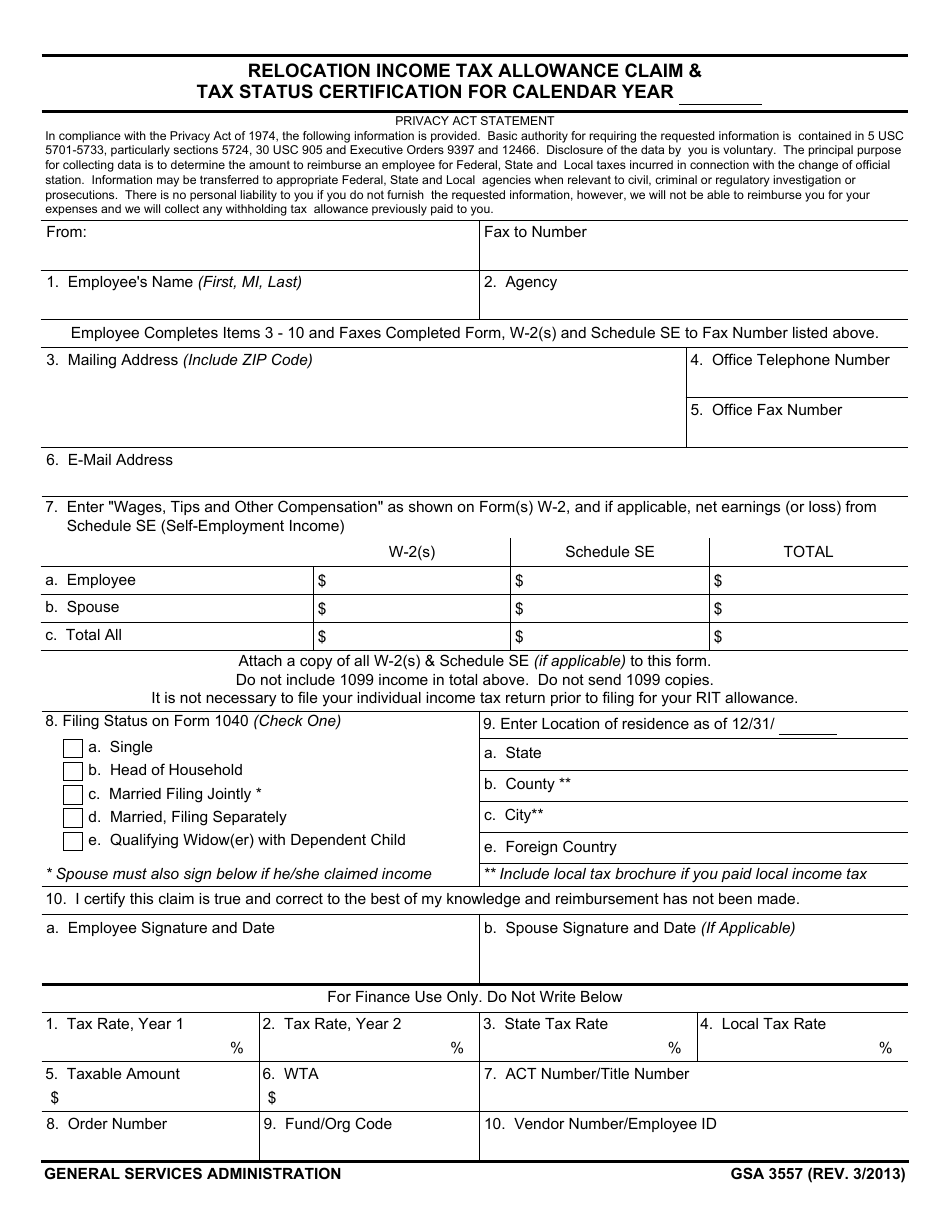

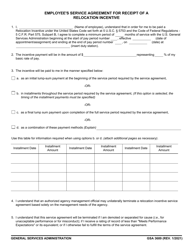

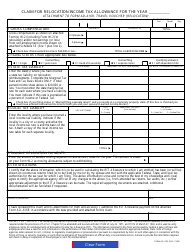

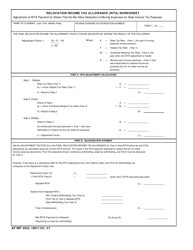

GSA Form 3557 Relocation Income Tax Allowance Claim & Tax Status Certification

What Is GSA Form 3557?

This is a legal form that was released by the U.S. General Services Administration on March 1, 2013 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GSA Form 3557?

A: GSA Form 3557 is a form used to claim Relocation Income Tax Allowance.

Q: What is Relocation Income Tax Allowance?

A: Relocation Income Tax Allowance is a benefit provided to federal government employees to compensate for additional taxes incurred during a permanent change of station.

Q: Who is eligible to claim Relocation Income Tax Allowance?

A: Federal government employees who are relocating due to a permanent change of station and meet certain eligibility criteria are eligible to claim Relocation Income Tax Allowance.

Q: What is the purpose of the Tax Status Certification in GSA Form 3557?

A: The Tax Status Certification in GSA Form 3557 is used to certify the taxpayer's tax status and determine the tax treatment of the relocation benefits.

Form Details:

- Released on March 1, 2013;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of GSA Form 3557 by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.