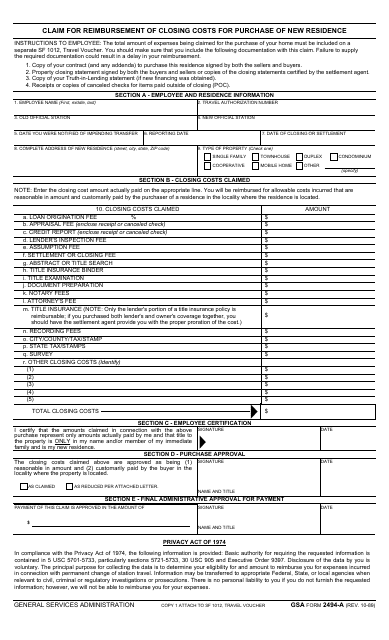

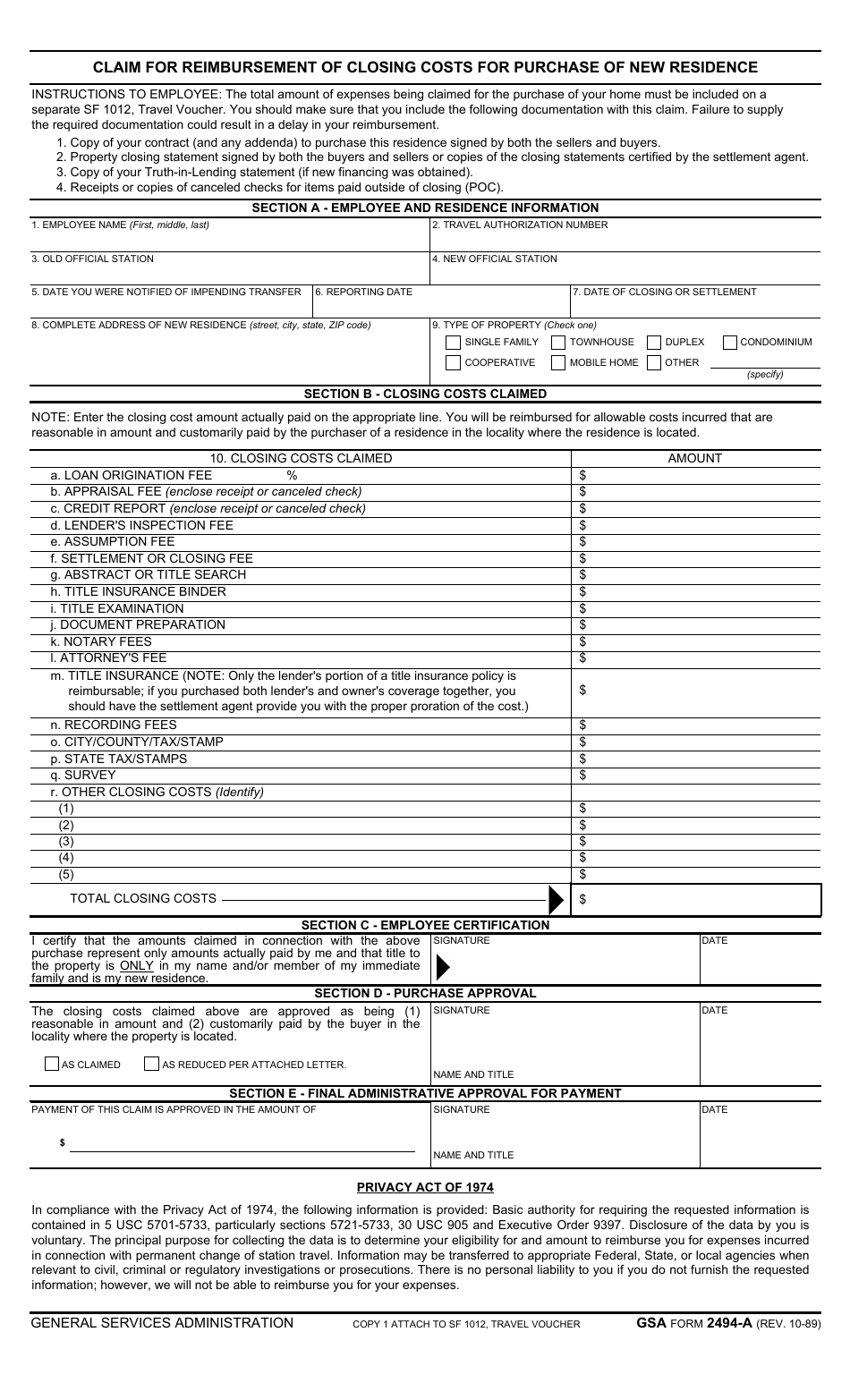

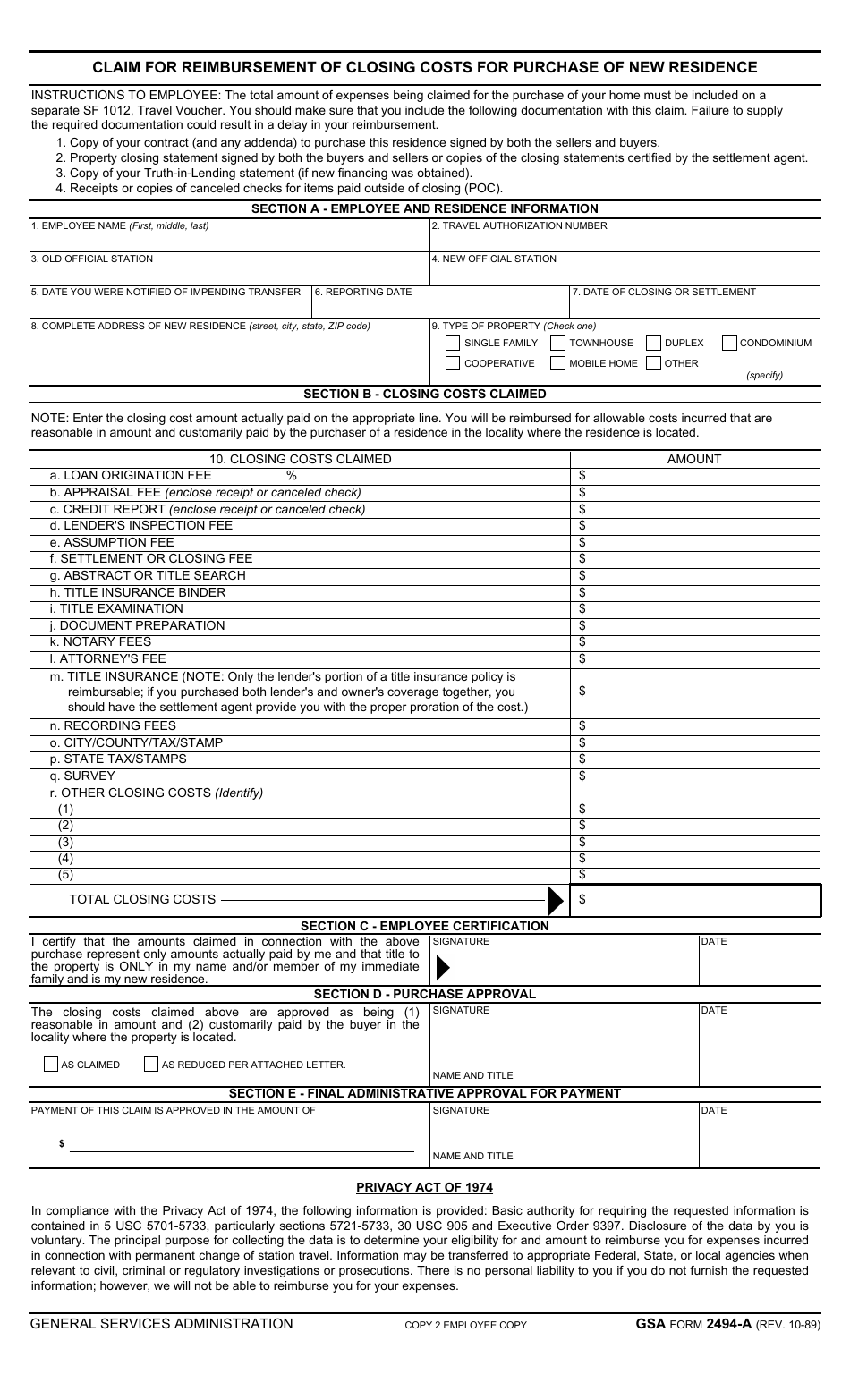

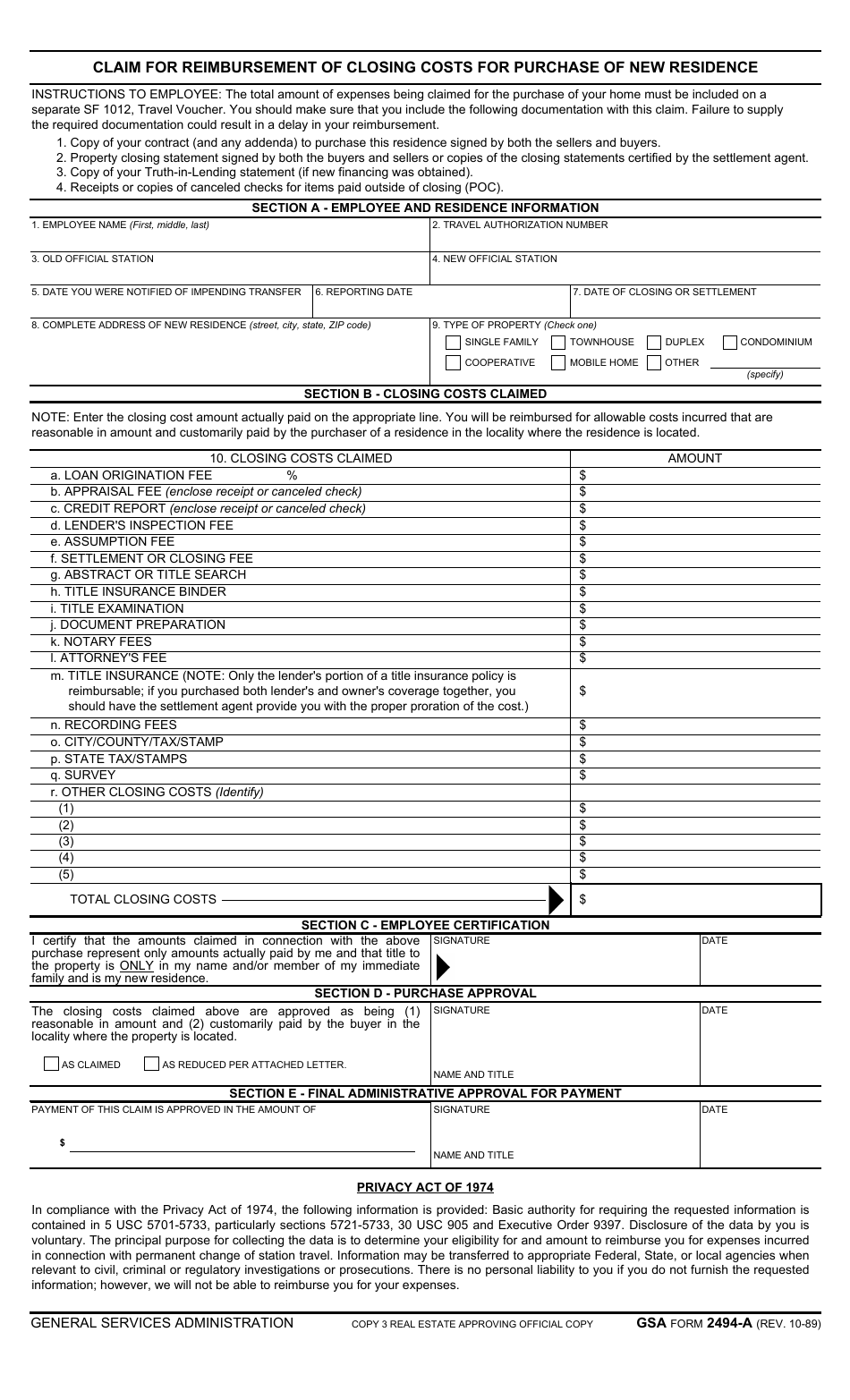

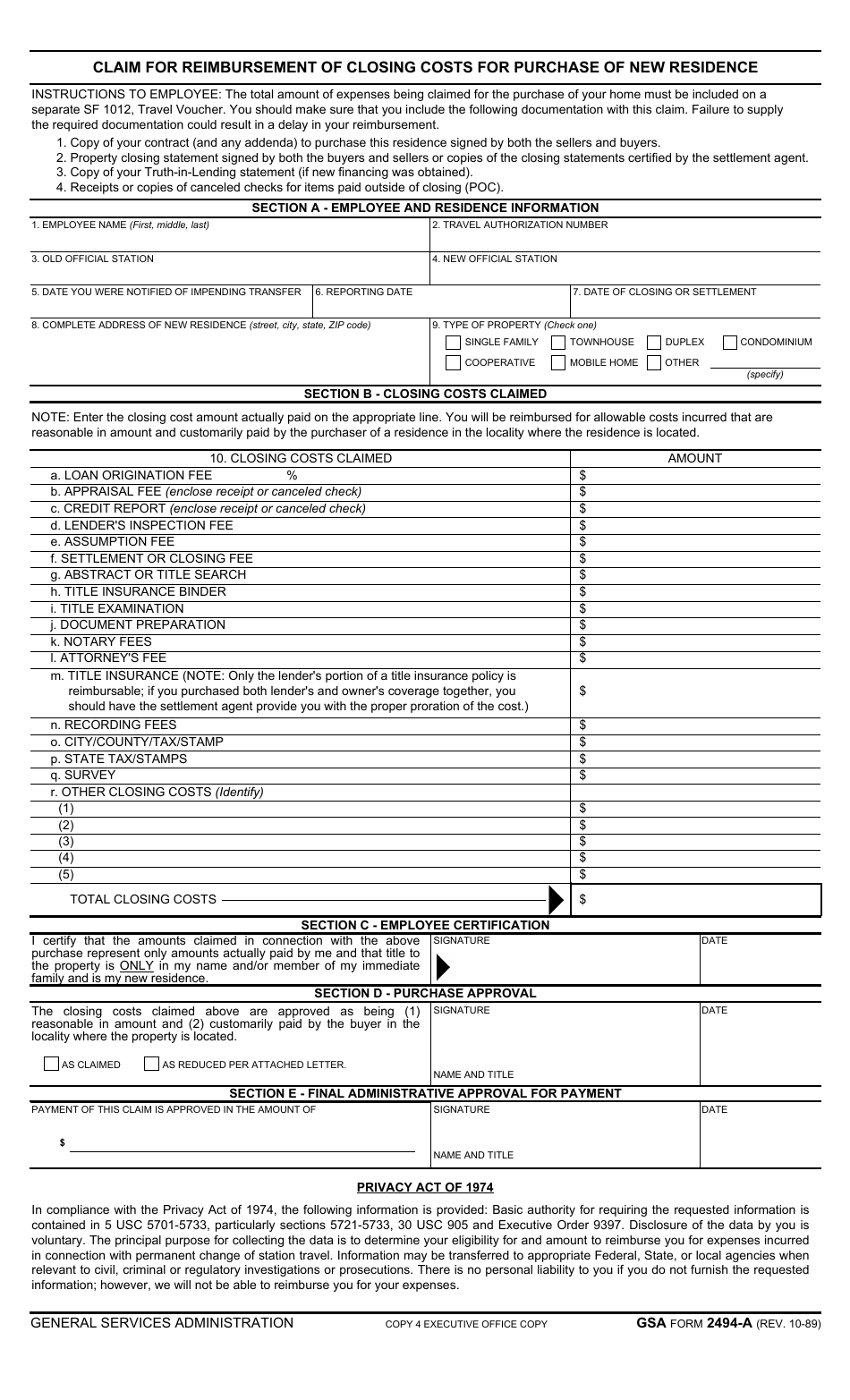

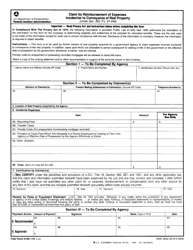

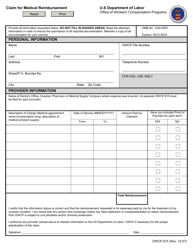

GSA Form 2494A Claim for Reimbursement of Closing Costs for Purchase of New Residence

What Is GSA Form 2494A?

This is a legal form that was released by the U.S. General Services Administration on October 1, 1989 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GSA Form 2494A?

A: GSA Form 2494A is a claim for reimbursement of closing costs for the purchase of a new residence.

Q: Who can use GSA Form 2494A?

A: Federal employees who are relocating to a new duty station and are eligible for reimbursement of closing costs.

Q: What expenses can be claimed with GSA Form 2494A?

A: Expenses such as title search, appraisal fees, credit report fees, and more can be claimed.

Q: How to submit GSA Form 2494A?

A: The form should be completed and submitted to the appropriate department or agency for processing.

Q: Is there a deadline to submit GSA Form 2494A?

A: Yes, the form should be submitted within 2 years from the date of purchase of the new residence.

Q: What documents should be attached with GSA Form 2494A?

A: Documents such as the settlement statement, receipts, and proof of payment should be attached to the form.

Q: Can closing costs for a second home be reimbursed?

A: No, GSA Form 2494A is specifically for the purchase of a new primary residence.

Form Details:

- Released on October 1, 1989;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of GSA Form 2494A by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.