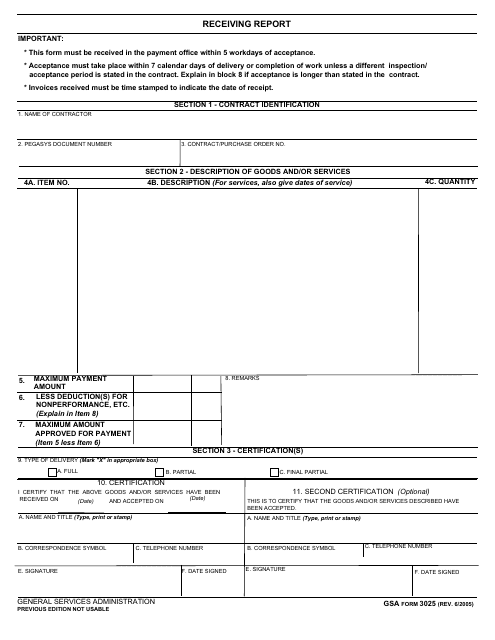

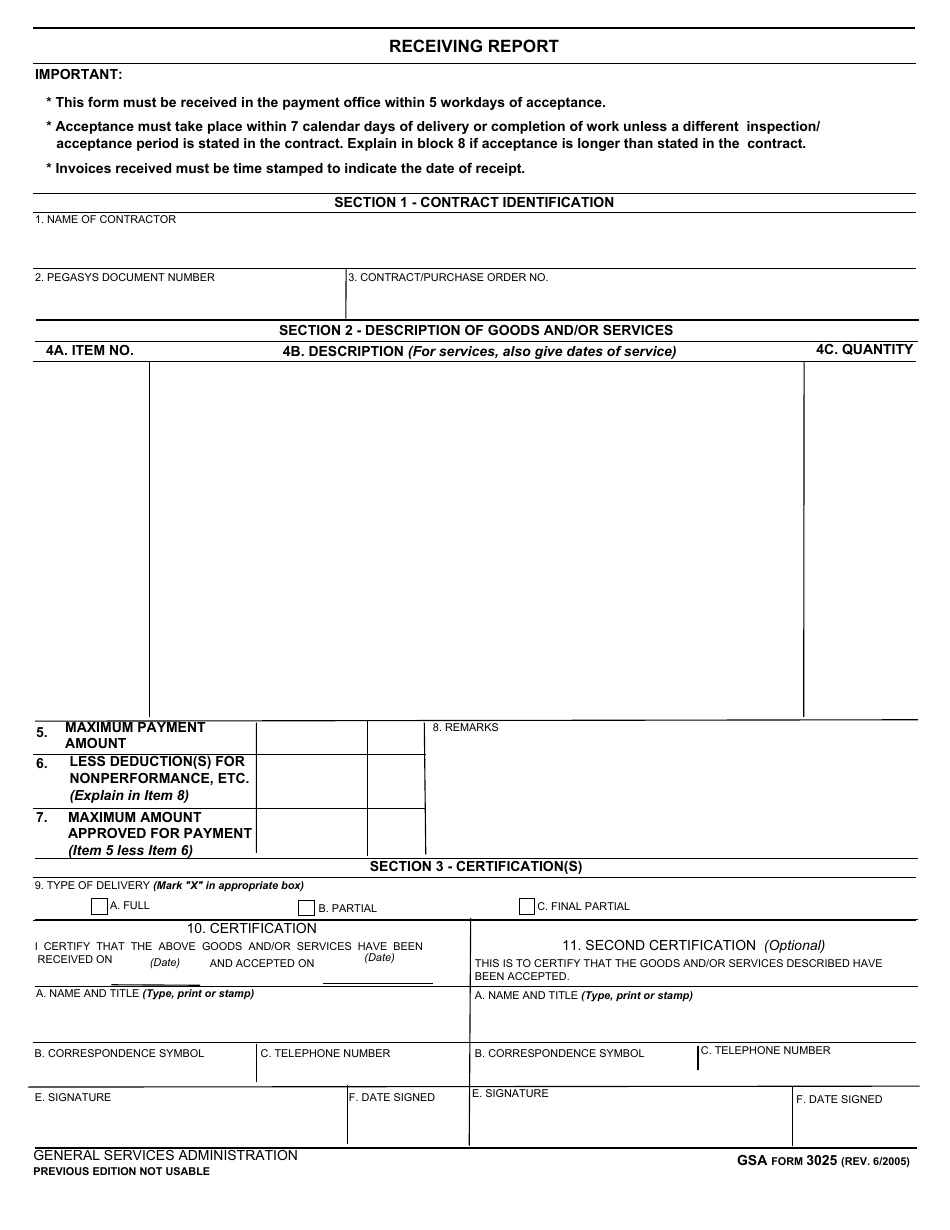

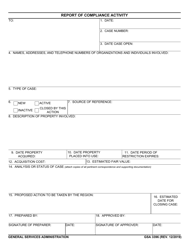

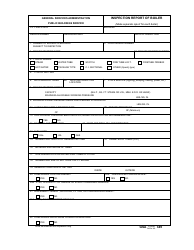

GSA Form 3025 Receiving Report

What Is GSA Form 3025?

This is a legal form that was released by the U.S. General Services Administration on June 1, 2005 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GSA Form 3025?

A: GSA Form 3025 is a receiving report.

Q: What is a receiving report?

A: A receiving report is a document used to record the receipt of goods or services.

Q: What is the purpose of GSA Form 3025?

A: The purpose of GSA Form 3025 is to document the receipt of goods or services obtained through the General Services Administration (GSA).

Q: When should GSA Form 3025 be completed?

A: GSA Form 3025 should be completed at the time of receiving goods or services.

Q: Who should complete GSA Form 3025?

A: The person responsible for receiving the goods or services should complete GSA Form 3025.

Q: What information should be included in GSA Form 3025?

A: GSA Form 3025 should include details such as the date of receipt, description of the goods or services, quantity received, and any damages or discrepancies.

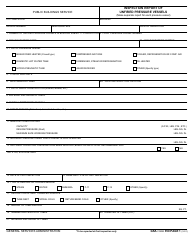

Q: Is GSA Form 3025 required for all GSA transactions?

A: Yes, GSA Form 3025 is required for all GSA transactions to ensure proper documentation of receipt.

Q: What should I do if there are damages or discrepancies in the received goods or services?

A: If there are damages or discrepancies, they should be noted on GSA Form 3025 and reported to the appropriate GSA representative.

Q: Can GSA Form 3025 be used for non-GSA transactions?

A: While GSA Form 3025 is designed for GSA transactions, it can potentially be used for non-GSA transactions as well, depending on the specific requirements of the organization or agency.

Form Details:

- Released on June 1, 2005;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of GSA Form 3025 by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.