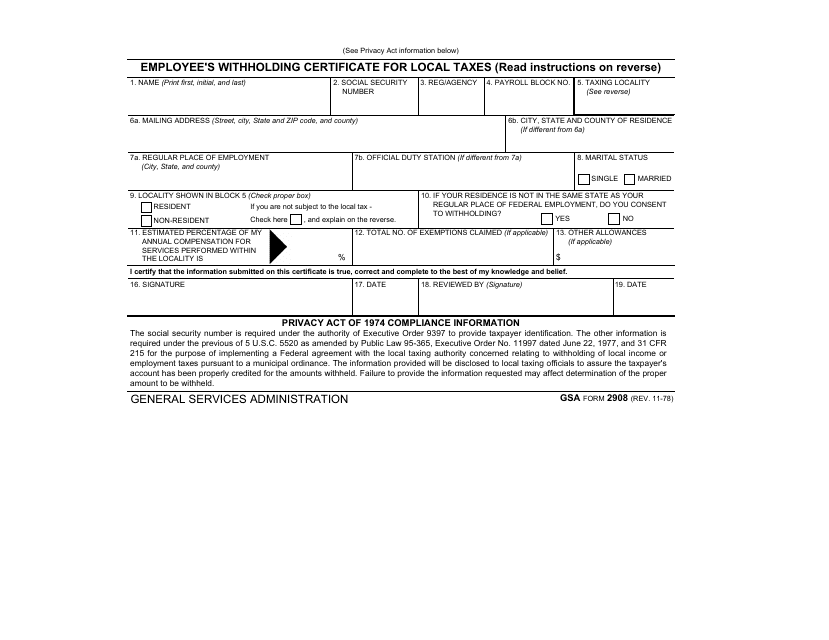

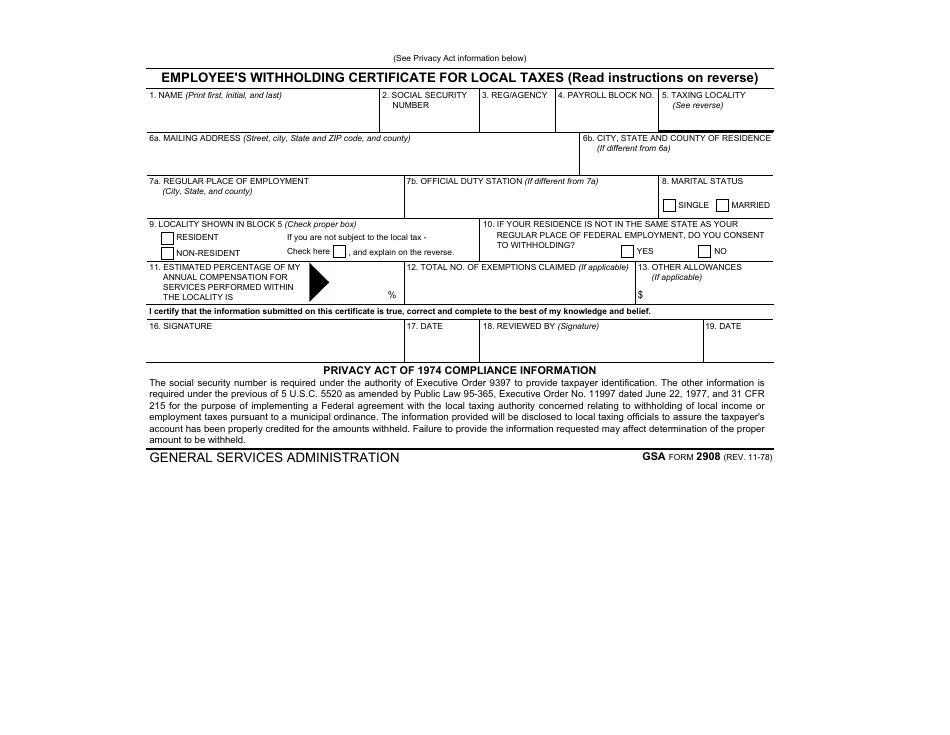

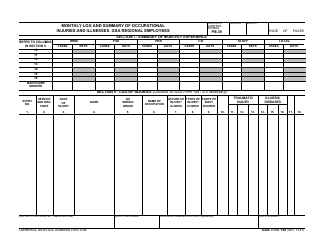

GSA Form 2908 Employee's Withholding Certificate for Local Taxes

What Is GSA Form 2908?

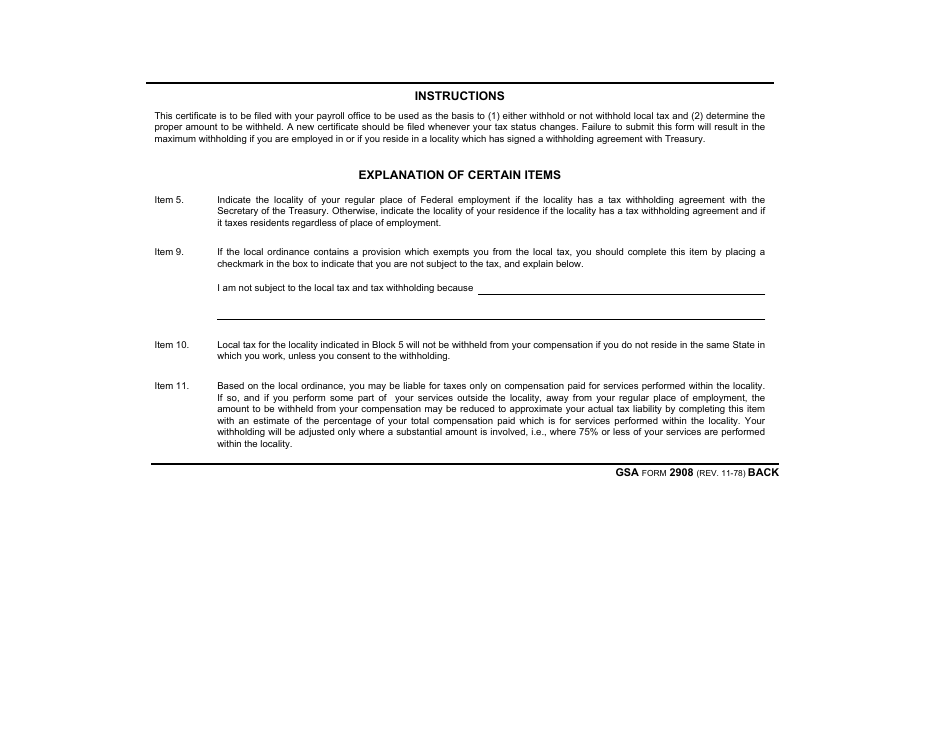

This is a legal form that was released by the U.S. General Services Administration on November 1, 1978 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GSA Form 2908?

A: GSA Form 2908 is the Employee's Withholding Certificate for Local Taxes.

Q: Who needs to fill out GSA Form 2908?

A: Employees who are subject to local taxes may need to fill out GSA Form 2908.

Q: What information is required on GSA Form 2908?

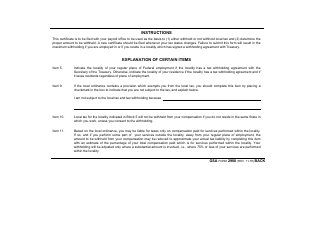

A: GSA Form 2908 requires information such as the employee's name, address, social security number, employer information, and details about local taxes.

Q: Why is GSA Form 2908 important?

A: GSA Form 2908 ensures that the correct amount of local taxes are withheld from an employee's wages.

Q: When should GSA Form 2908 be filled out?

A: GSA Form 2908 should be filled out when an employee starts a new job or when there are changes in the local tax rates or employee's circumstances.

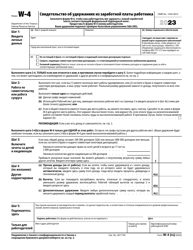

Q: Is GSA Form 2908 the same as W-4?

A: No, GSA Form 2908 is specifically for local taxes, while W-4 is for federal incometax withholding.

Q: Can I electronically submit GSA Form 2908?

A: The availability of electronic submission for GSA Form 2908 depends on the local tax authority. Check with your employer or the relevant tax authority for more information.

Form Details:

- Released on November 1, 1978;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of GSA Form 2908 by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.