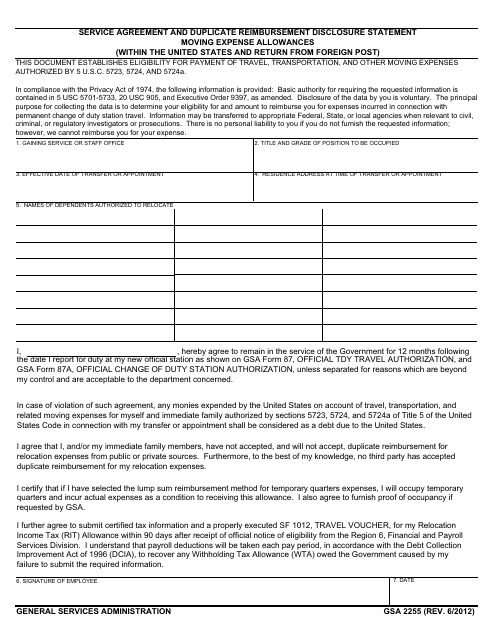

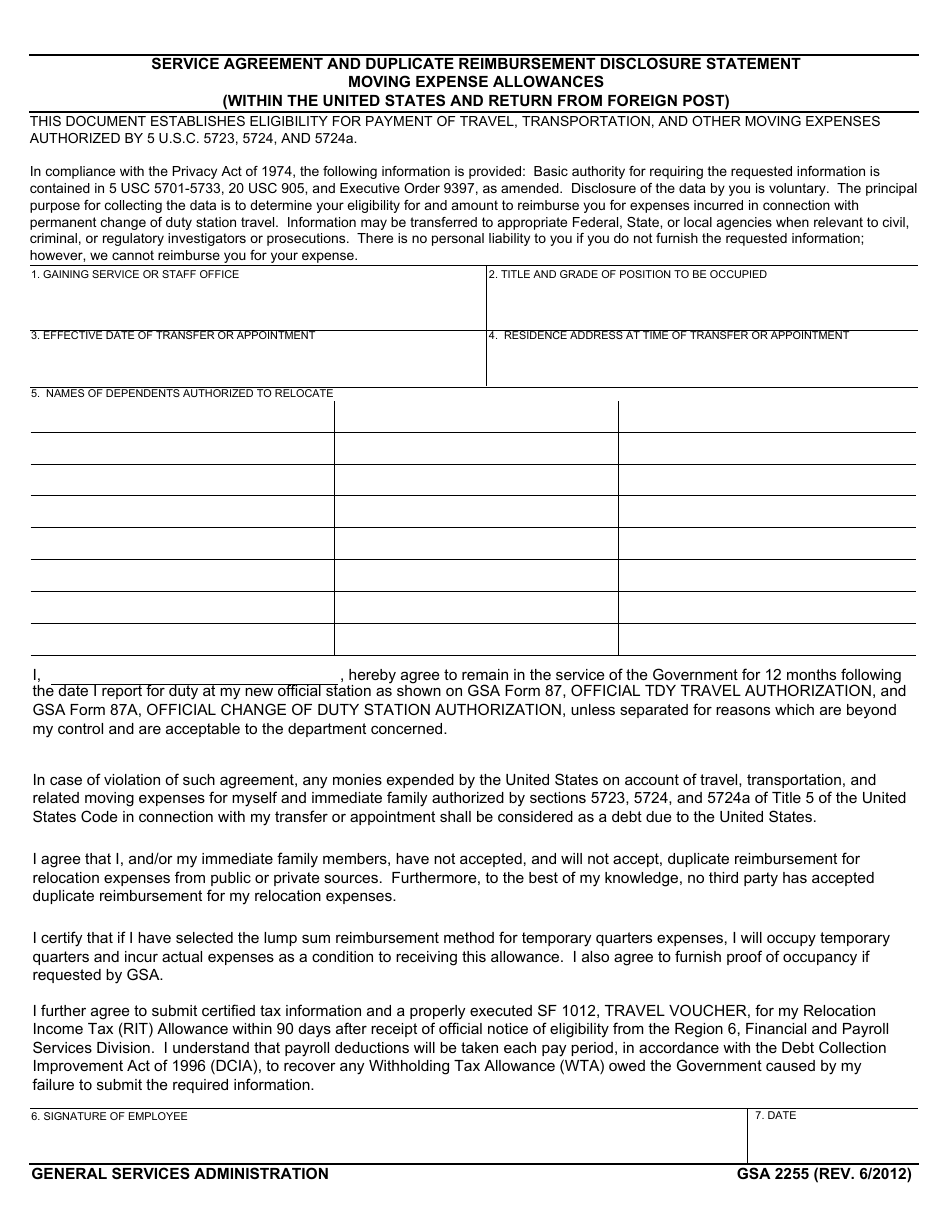

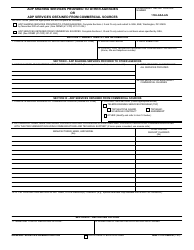

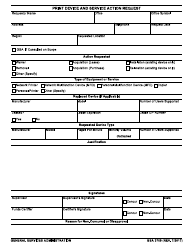

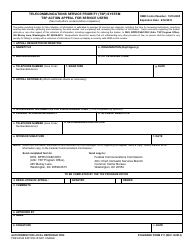

GSA Form 2255 Service Agreement and Duplicate Reimbursement Disclosure Statement Moving Expense Allowances (Within the United States and Return From Foreign Post)

What Is GSA Form 2255?

This is a legal form that was released by the U.S. General Services Administration on June 1, 2012 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GSA Form 2255?

A: GSA Form 2255 is a Service Agreement and Duplicate Reimbursement Disclosure Statement for moving expense allowances within the United States and return from foreign post.

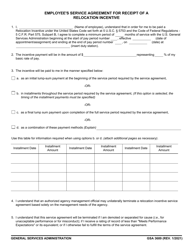

Q: What does GSA Form 2255 include?

A: GSA Form 2255 includes a service agreement and a duplicate reimbursement disclosure statement.

Q: What is the purpose of GSA Form 2255?

A: The purpose of GSA Form 2255 is to provide a written agreement between the employee and the government regarding moving expense allowances.

Q: Who needs to fill out GSA Form 2255?

A: Employees who are eligible for moving expense allowances within the United States and return from foreign post need to fill out GSA Form 2255.

Q: What information is required in GSA Form 2255?

A: GSA Form 2255 requires information such as employee's name, social security number, current address, current duty station, estimated date of transfer, and more.

Q: Is GSA Form 2255 mandatory?

A: Yes, GSA Form 2255 is mandatory for employees eligible for moving expense allowances within the United States and return from foreign post.

Form Details:

- Released on June 1, 2012;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of GSA Form 2255 by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.