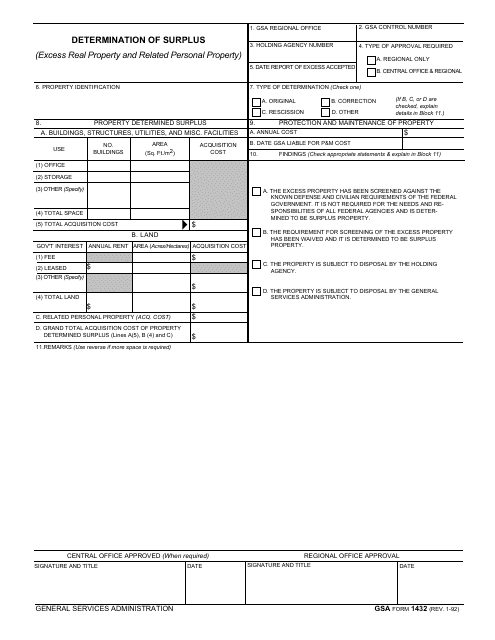

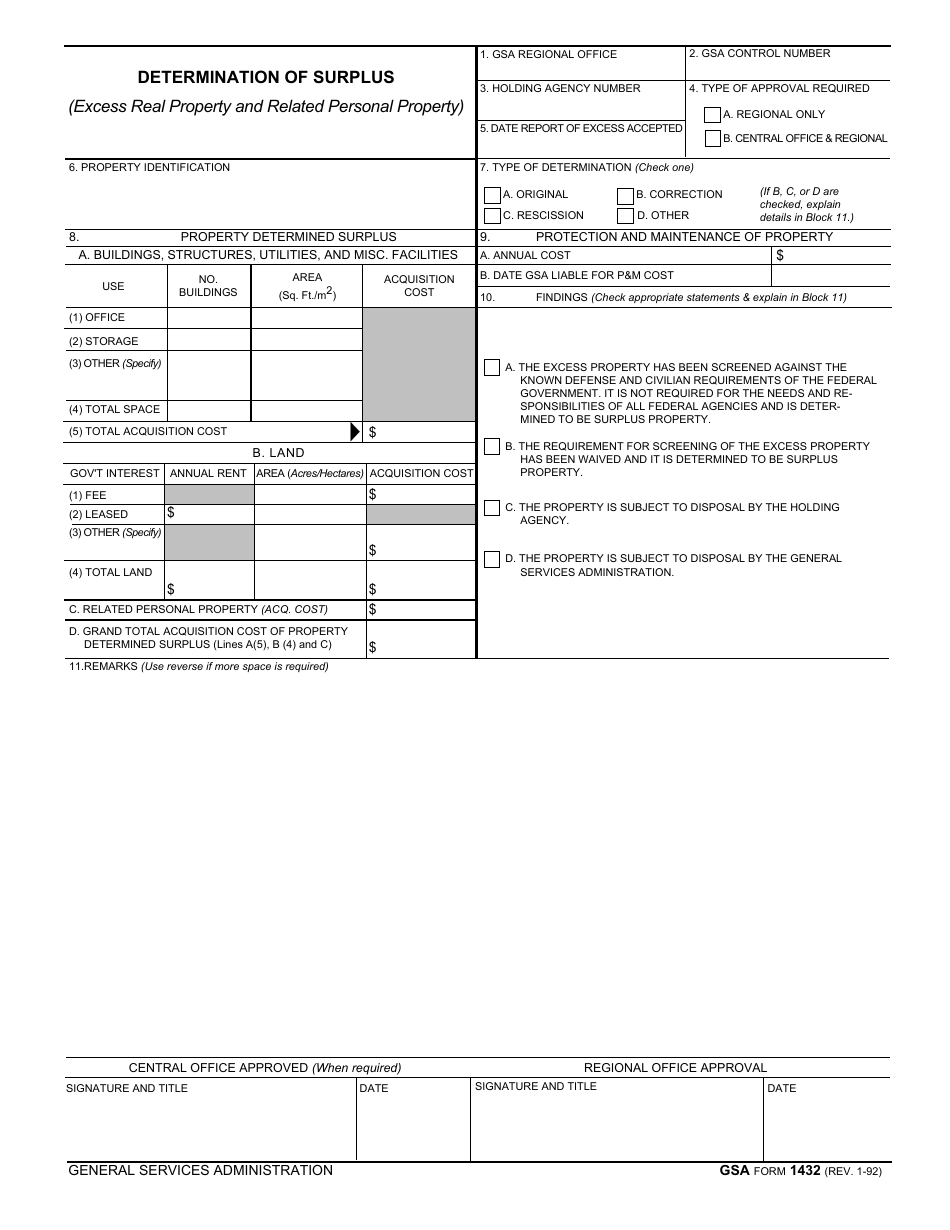

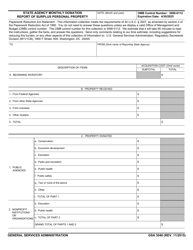

GSA Form 1432 Determination of Surplus

What Is GSA Form 1432?

This is a legal form that was released by the U.S. General Services Administration on January 1, 1992 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GSA Form 1432?

A: GSA Form 1432 is a form used to determine surplus property.

Q: What is surplus property?

A: Surplus property refers to any property that is no longer needed by the government and can be sold or disposed of.

Q: Who uses GSA Form 1432?

A: Government agencies and departments use GSA Form 1432 to determine surplus property.

Q: What information is included in GSA Form 1432?

A: GSA Form 1432 includes information about the property, its condition, and its estimated value.

Q: How is surplus property disposed of?

A: Surplus property can be sold, transferred to other agencies, donated, or destroyed depending on its condition and value.

Q: Is GSA Form 1432 specific to the United States?

A: Yes, GSA Form 1432 is specific to the United States government and its agencies.

Form Details:

- Released on January 1, 1992;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of GSA Form 1432 by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.