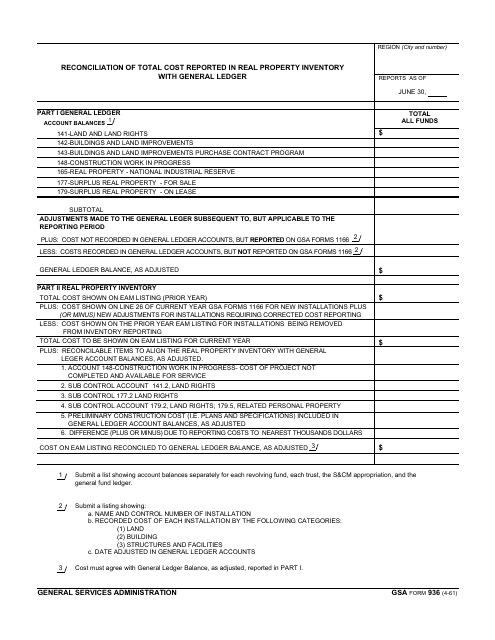

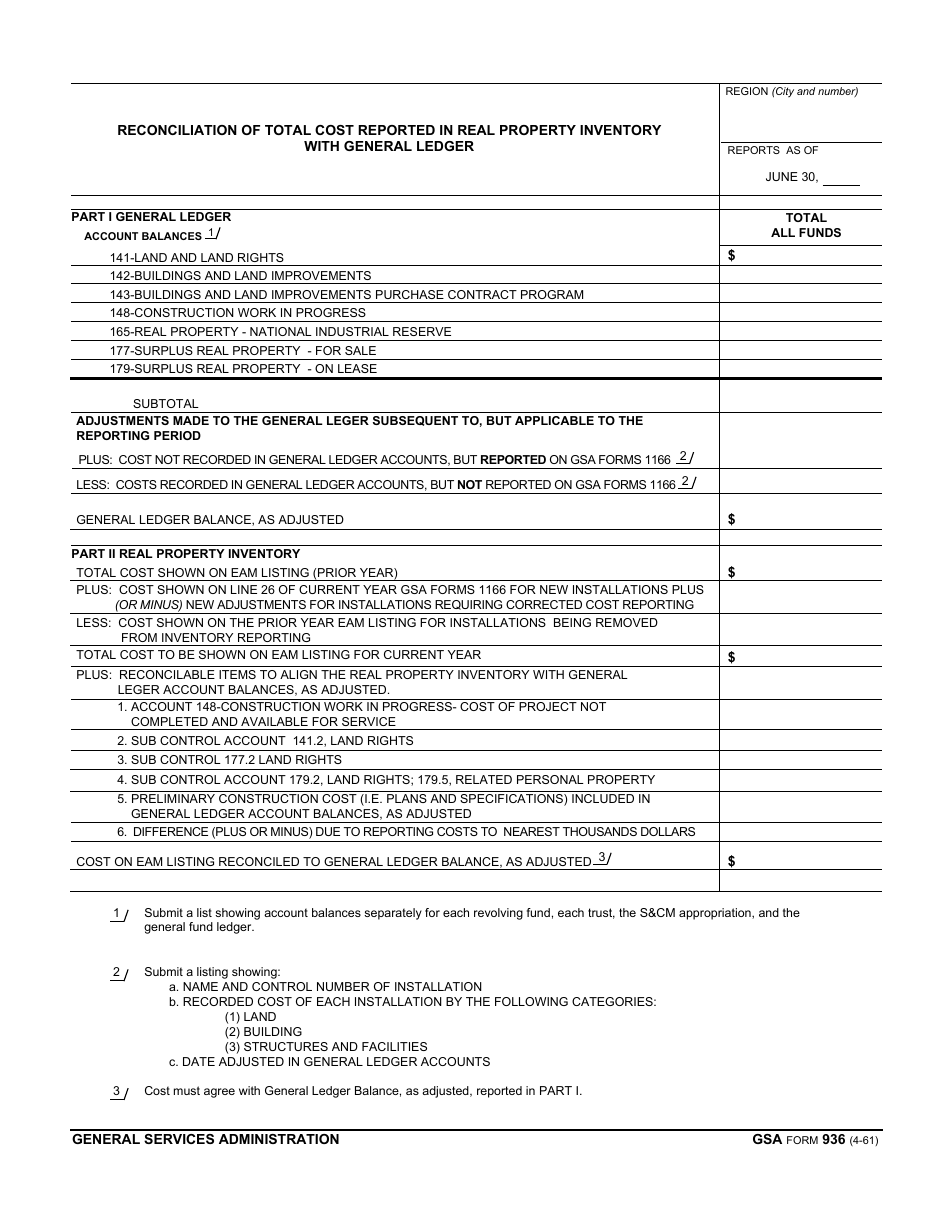

GSA Form 936 Reconciliation of Total Cost Reported in Real Property Inventory With General Ledger

What Is GSA Form 936?

This is a legal form that was released by the U.S. General Services Administration on April 1, 1961 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GSA Form 936?

A: GSA Form 936 is a form used to reconcile the total cost reported in the real property inventory with the general ledger.

Q: What is the purpose of GSA Form 936?

A: The purpose of GSA Form 936 is to ensure that the total cost reported in the real property inventory matches the total cost recorded in the general ledger.

Q: Who uses GSA Form 936?

A: GSA Form 936 is used by government agencies and organizations that maintain a real property inventory.

Q: What information is required on GSA Form 936?

A: GSA Form 936 requires information such as the agency or organization name, a list of real property assets, asset numbers, and the corresponding general ledger account numbers.

Q: Is GSA Form 936 mandatory?

A: Yes, GSA Form 936 is mandatory for government agencies and organizations that maintain a real property inventory.

Form Details:

- Released on April 1, 1961;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of GSA Form 936 by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.