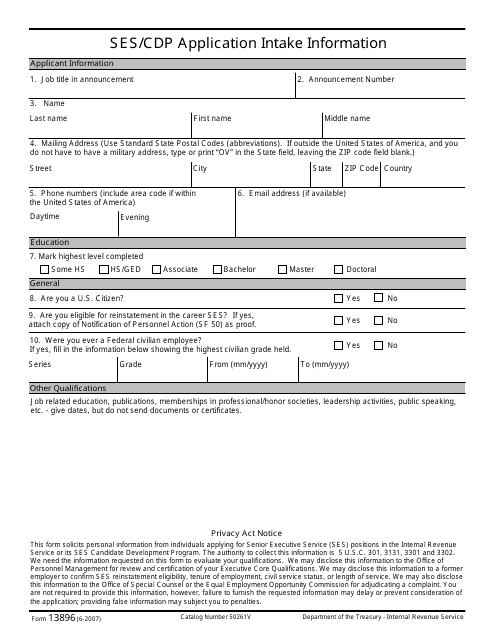

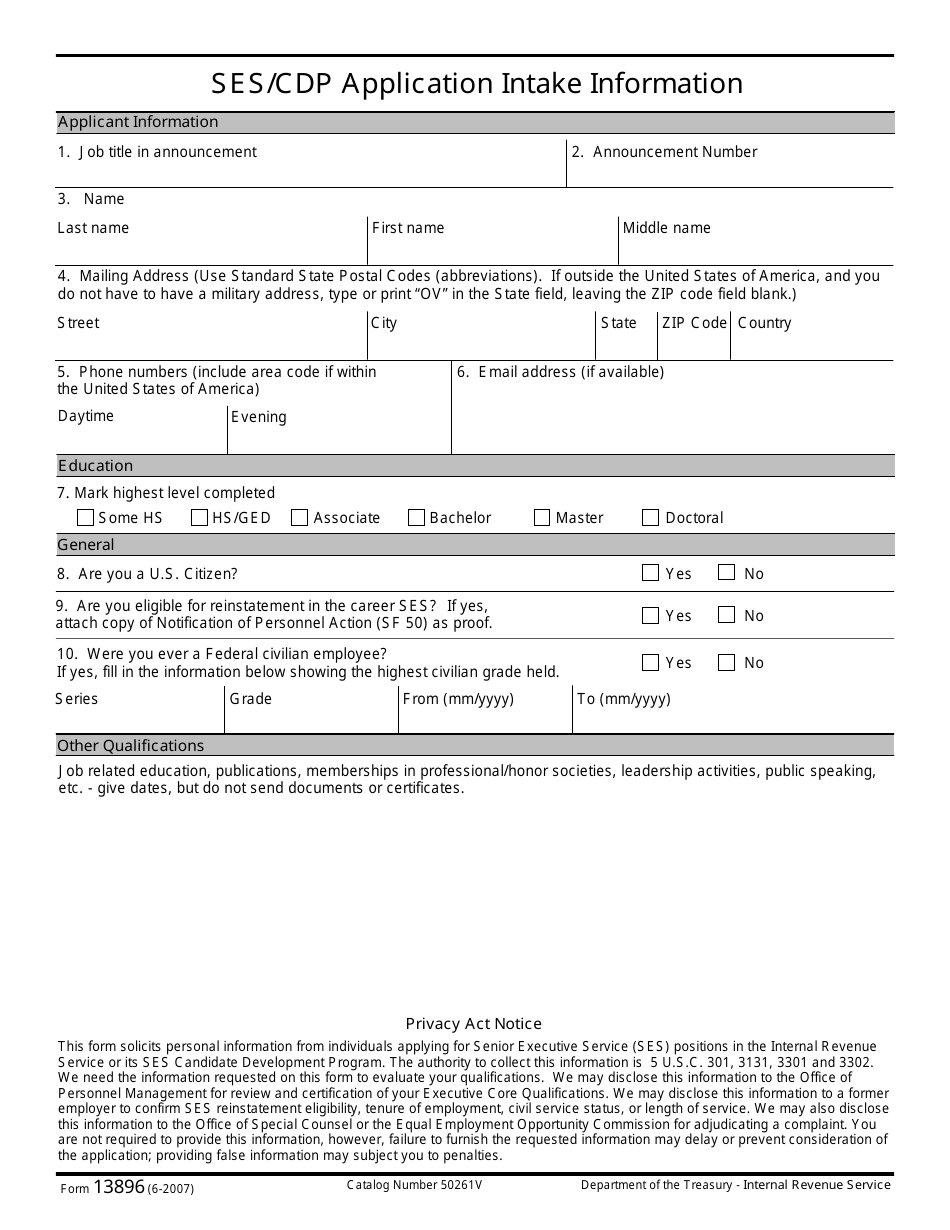

IRS Form 13896 Ses / Cdp Application Intake Information

What Is IRS Form 13896?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2007. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 13896 Ses/Cdp?

A: IRS Form 13896 Ses/Cdp is a form used for the application intake information for the Supplemental or Collection Due Process (CDP) program.

Q: What is the purpose of IRS Form 13896 Ses/Cdp?

A: The purpose of IRS Form 13896 Ses/Cdp is to provide information to the IRS regarding a taxpayer's request for a hearing under the Supplemental or Collection Due Process (CDP) program.

Q: Who needs to fill out IRS Form 13896 Ses/Cdp?

A: Taxpayers who want to request a hearing under the Supplemental or Collection Due Process (CDP) program need to fill out IRS Form 13896 Ses/Cdp.

Q: Are there any fees associated with IRS Form 13896 Ses/Cdp?

A: No, there are no fees associated with filling out IRS Form 13896 Ses/Cdp.

Q: What information do I need to provide on IRS Form 13896 Ses/Cdp?

A: You will need to provide your personal information, tax identification number, tax period, and the reason for your request for a hearing on IRS Form 13896 Ses/Cdp.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 13896 through the link below or browse more documents in our library of IRS Forms.