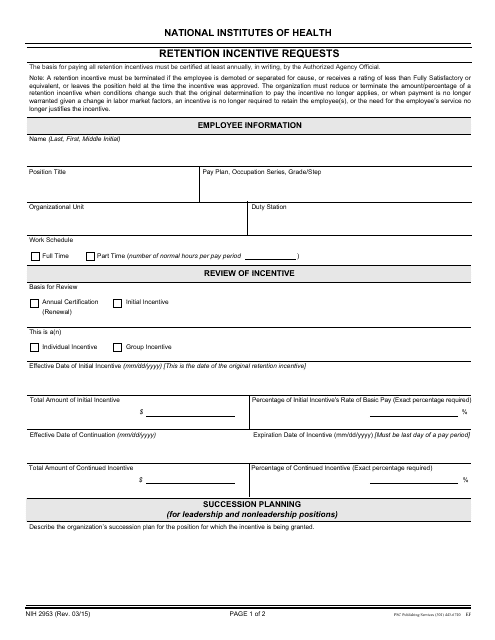

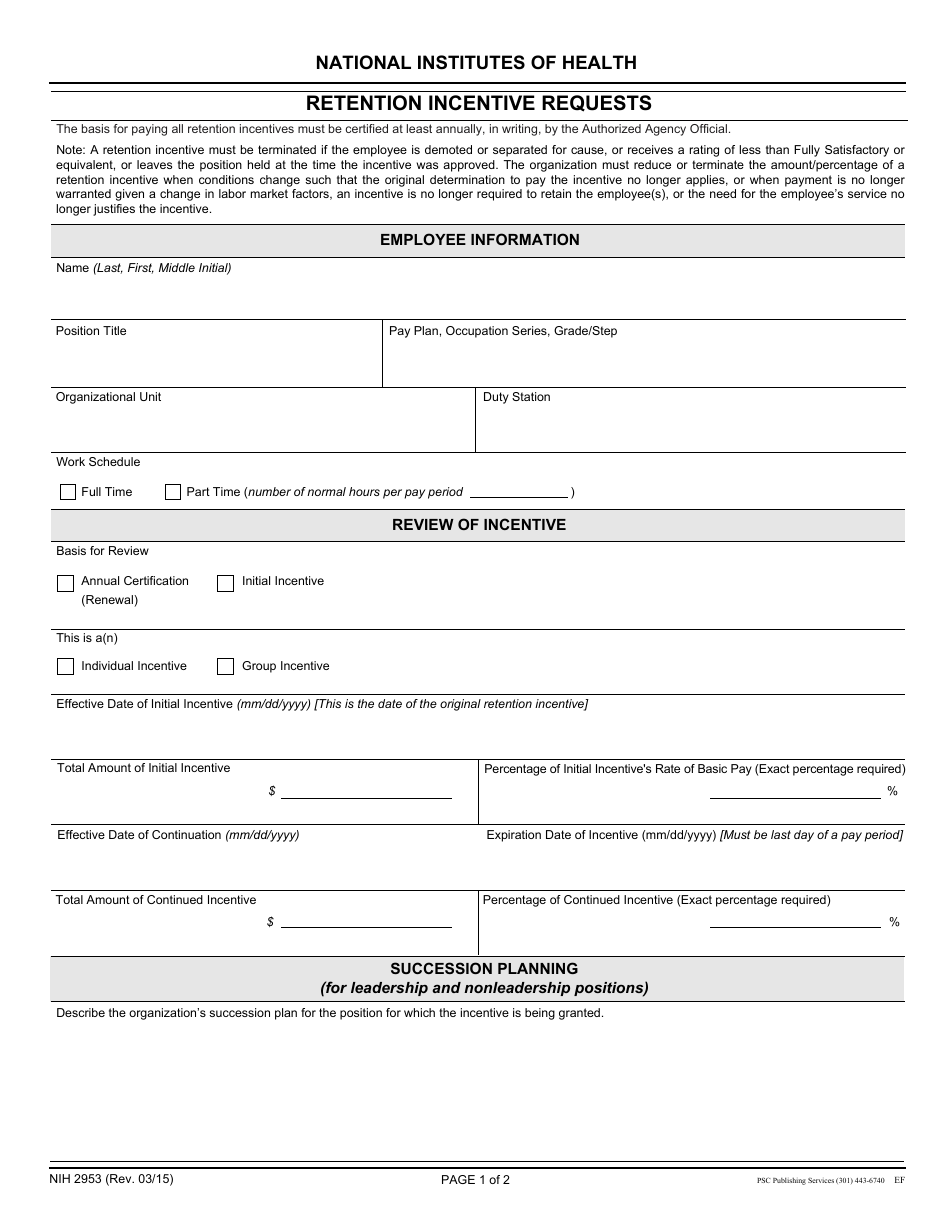

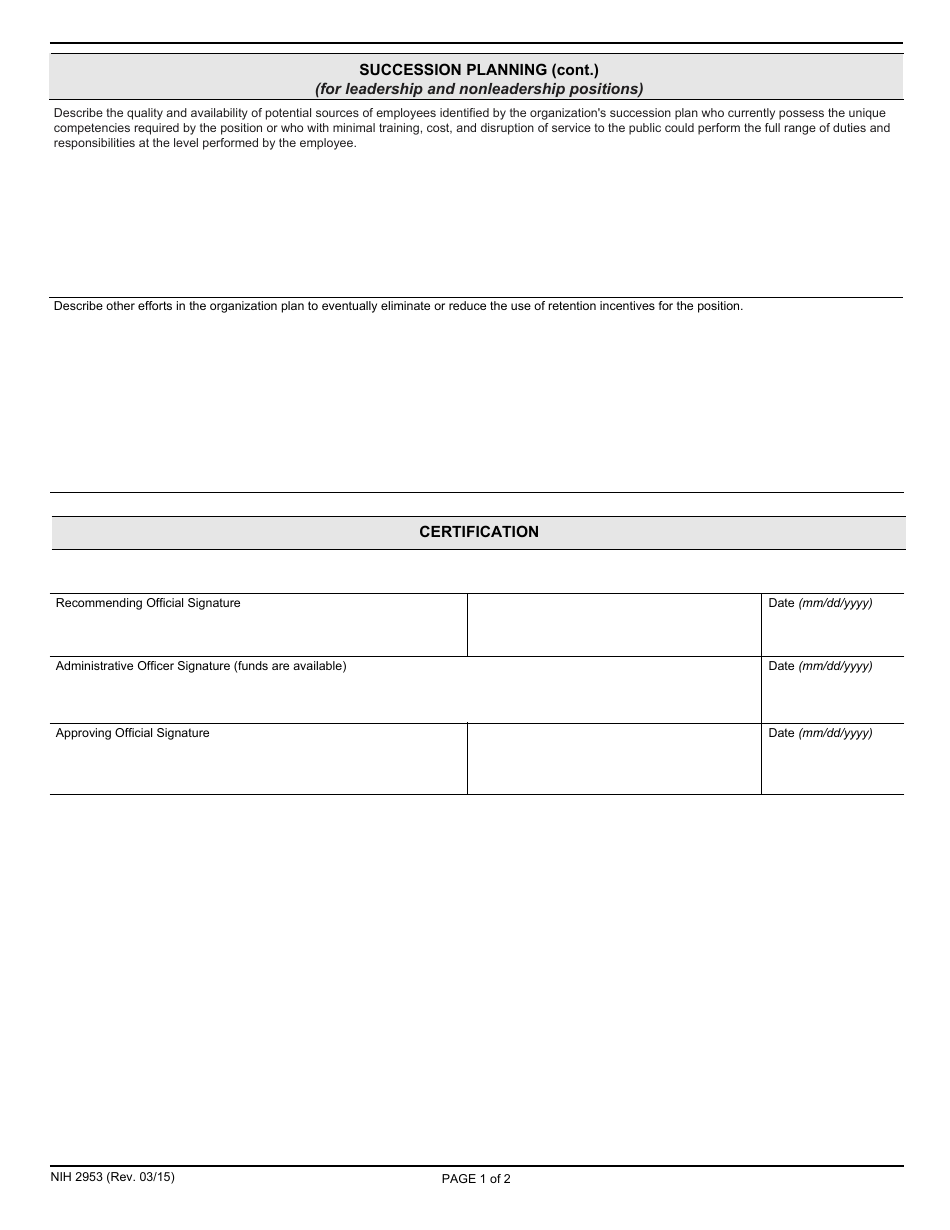

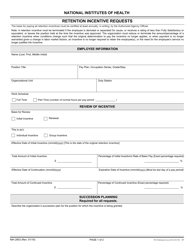

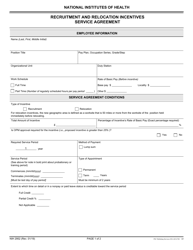

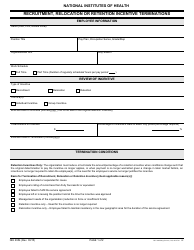

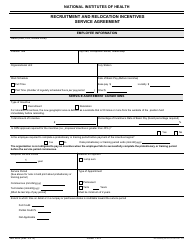

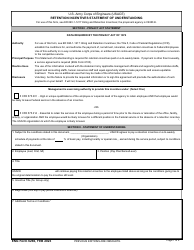

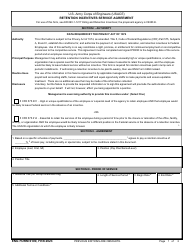

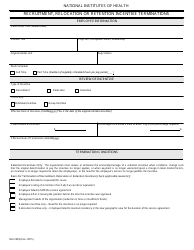

Form NIH-2953 Retention Incentive Requests

What Is Form NIH-2953?

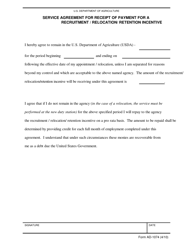

This is a legal form that was released by the U.S. Department of Health and Human Services - National Institutes of Health on March 1, 2015 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form NIH-2953?

A: Form NIH-2953 is a document used to request retention incentives.

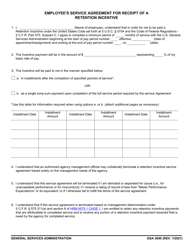

Q: What are retention incentives?

A: Retention incentives are benefits provided to employees to encourage them to stay with an organization.

Q: Who can use form NIH-2953?

A: Form NIH-2953 can be used by employees who wish to request retention incentives.

Q: Why would someone request a retention incentive?

A: Someone may request a retention incentive if they have valuable skills or knowledge and the organization wants to ensure they stay.

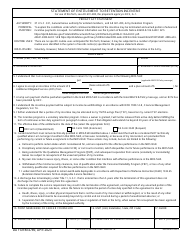

Q: What information is required on form NIH-2953?

A: Form NIH-2953 requires information such as the employee's name, position, and reasons for requesting a retention incentive.

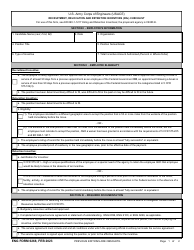

Q: Are there any eligibility requirements for retention incentives?

A: Yes, eligibility requirements for retention incentives may vary depending on the organization and the specific circumstances.

Q: How long does it take to process a request for a retention incentive?

A: The processing time for a request for a retention incentive can vary depending on the organization and the complexity of the request.

Q: Can a retention incentive request be denied?

A: Yes, a retention incentive request can be denied if it does not meet the organization's criteria or if there are budgetary constraints.

Q: Are retention incentives taxable?

A: Retention incentives may be subject to taxes, but the specific tax implications can vary depending on the individual's circumstances and the organization's policies.

Form Details:

- Released on March 1, 2015;

- The latest available edition released by the U.S. Department of Health and Human Services - National Institutes of Health;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NIH-2953 by clicking the link below or browse more documents and templates provided by the U.S. Department of Health and Human Services - National Institutes of Health.