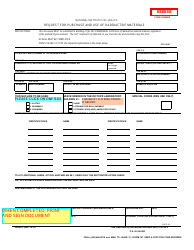

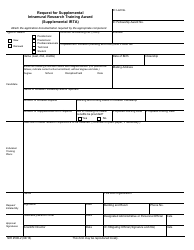

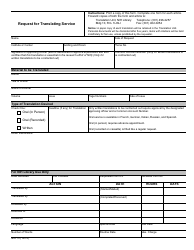

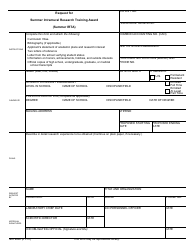

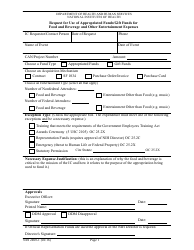

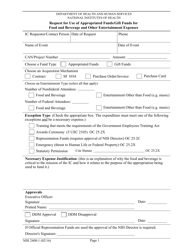

This version of the form is not currently in use and is provided for reference only. Download this version of

Form NIH-2851-1

for the current year.

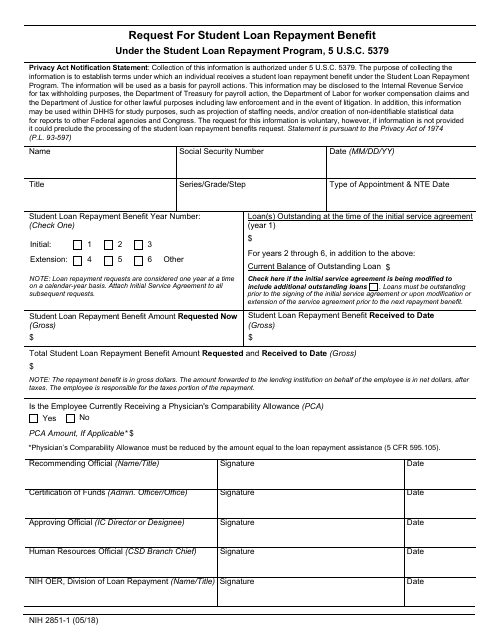

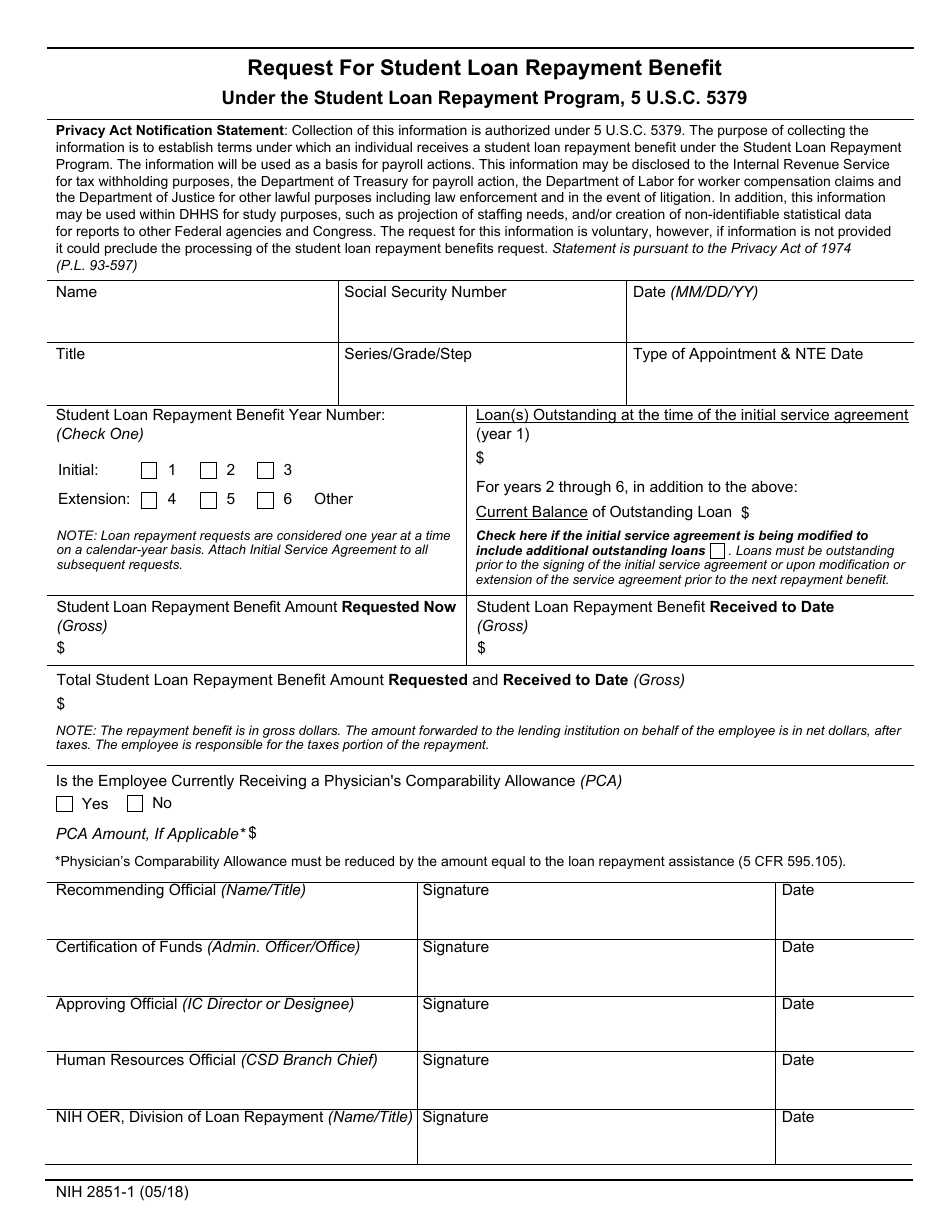

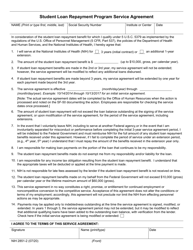

Form NIH-2851-1 Request for Student Loan Repayment Benefit

What Is Form NIH-2851-1?

This is a legal form that was released by the U.S. Department of Health and Human Services - National Institutes of Health on May 1, 2018 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NIH-2851-1?

A: NIH-2851-1 is a form used to request the Student Loan Repayment Benefit.

Q: What is the Student Loan Repayment Benefit?

A: The Student Loan Repayment Benefit is a program that helps eligible employees repay their student loans.

Q: How do I fill out NIH-2851-1?

A: Fill out the required information on the form, including your personal details and loan information.

Q: Who is eligible for the Student Loan Repayment Benefit?

A: Eligibility requirements vary depending on the program, but generally, federal employees are eligible.

Q: How does the Student Loan Repayment Benefit work?

A: If approved, the program pays a portion of your student loan debt directly to your lender, up to a specified amount.

Q: Are there any tax implications for the Student Loan Repayment Benefit?

A: Yes, the amount paid on your behalf is considered taxable income.

Q: Can I apply for the Student Loan Repayment Benefit if I have private student loans?

A: No, the program only applies to federal student loans.

Q: How long does it take to process NIH-2851-1?

A: Processing times for the form vary, but it usually takes several weeks.

Q: Is the Student Loan Repayment Benefit available for graduate student loans?

A: Yes, eligible graduate student loans can be considered for the program.

Q: Can the Student Loan Repayment Benefit be used to pay off the entire loan?

A: The program has a cap on the amount it can pay towards your student loan debt.

Q: Can I use the Student Loan Repayment Benefit for past loan payments?

A: No, the program can only pay for future loan payments.

Q: What happens if I leave my federal job after receiving the Student Loan Repayment Benefit?

A: You may be required to reimburse the program for the amount paid on your behalf.

Q: Can I apply for the Student Loan Repayment Benefit more than once?

A: Eligible employees can reapply for the benefit during specific periods.

Q: Are there any penalties for not repaying the student loans?

A: Failure to repay your student loans can result in penalties, such as increased interest rates and collection actions.

Q: Can I get the Student Loan Repayment Benefit for loans taken for my child's education?

A: The program generally does not cover loans taken for someone else's education.

Q: Can the Student Loan Repayment Benefit be used for any type of educational loans?

A: The program is generally limited to federal educational loans.

Q: Can I have multiple student loans covered by the Student Loan Repayment Benefit?

A: Yes, if all of the loans meet the eligibility criteria.

Q: Will the Student Loan Repayment Benefit pay off my entire student loan debt?

A: The program is limited to a specified amount, so it may not cover the entire debt.

Q: Can I apply for the Student Loan Repayment Benefit if I work for a state or local government agency?

A: The program is generally only available to federal employees.

Q: What should I do if I have questions about filling out NIH-2851-1?

A: Contact the program administrator or refer to the instructions provided with the form.

Form Details:

- Released on May 1, 2018;

- The latest available edition released by the U.S. Department of Health and Human Services - National Institutes of Health;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NIH-2851-1 by clicking the link below or browse more documents and templates provided by the U.S. Department of Health and Human Services - National Institutes of Health.