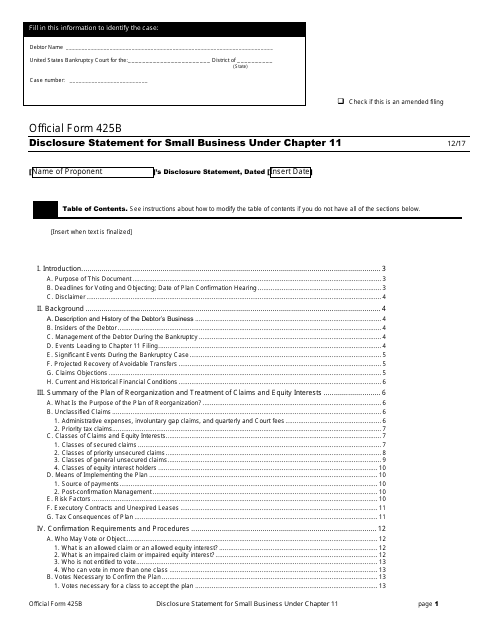

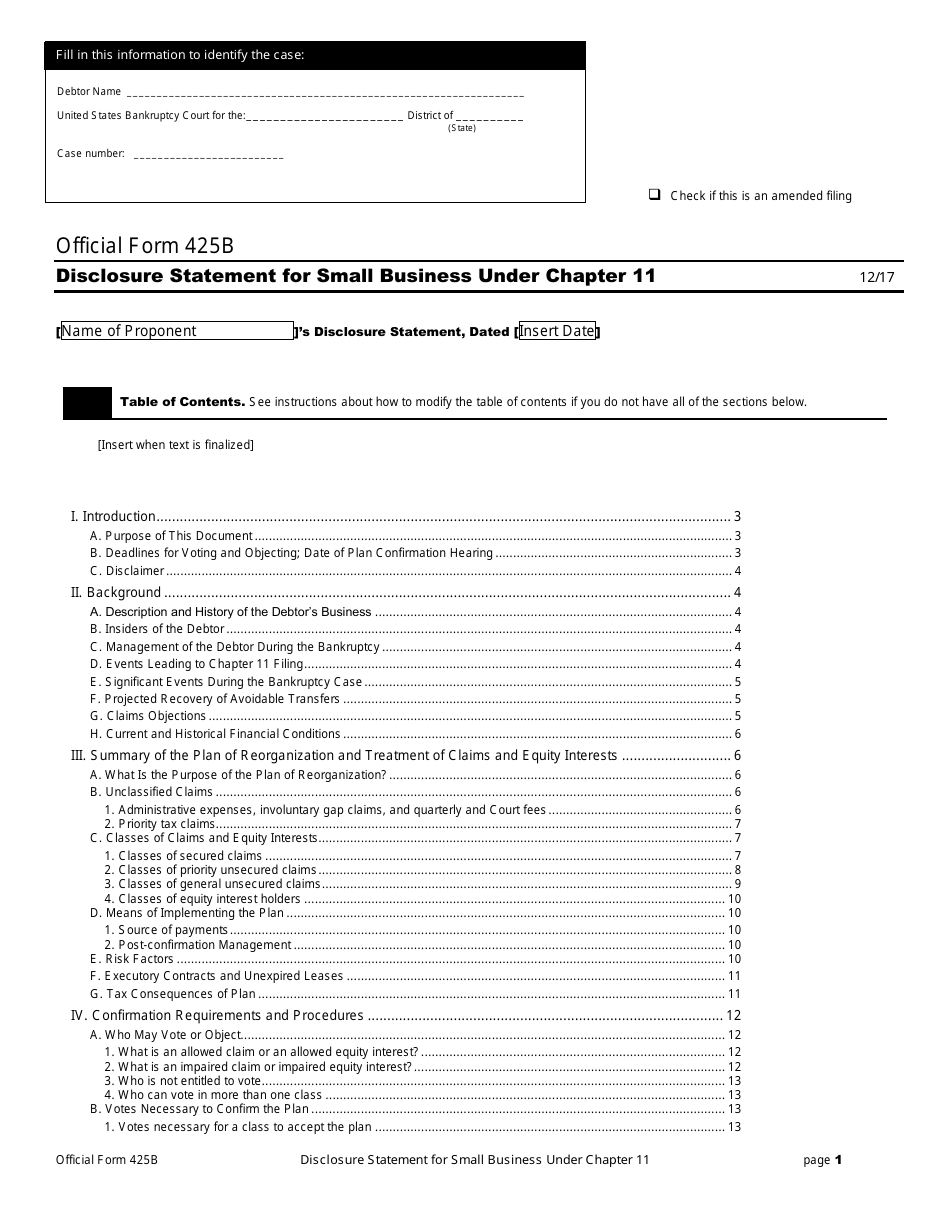

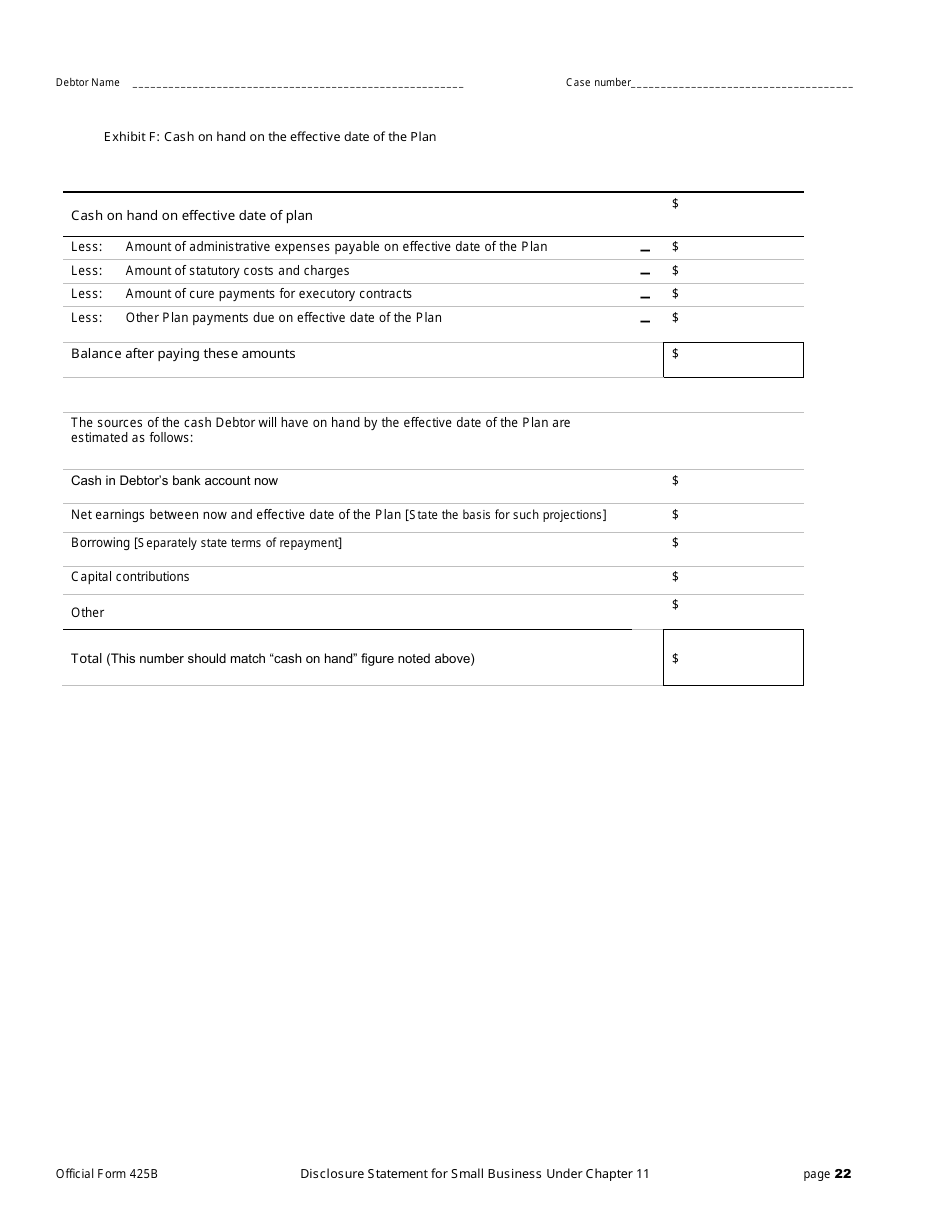

Official Form 425B Disclosure Statement for Small Business Under Chapter 11

What Is Official Form 425B?

This is a legal form that was released by the United States Bankruptcy Court on December 1, 2017 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 425B?

A: Form 425B is a disclosure statement for small businesses under Chapter 11 of the bankruptcy code.

Q: Who is required to file Form 425B?

A: Small businesses undergoing Chapter 11 bankruptcy are required to file Form 425B.

Q: What is the purpose of Form 425B?

A: Form 425B is used to provide important financial information to creditors and shareholders during a small business bankruptcy.

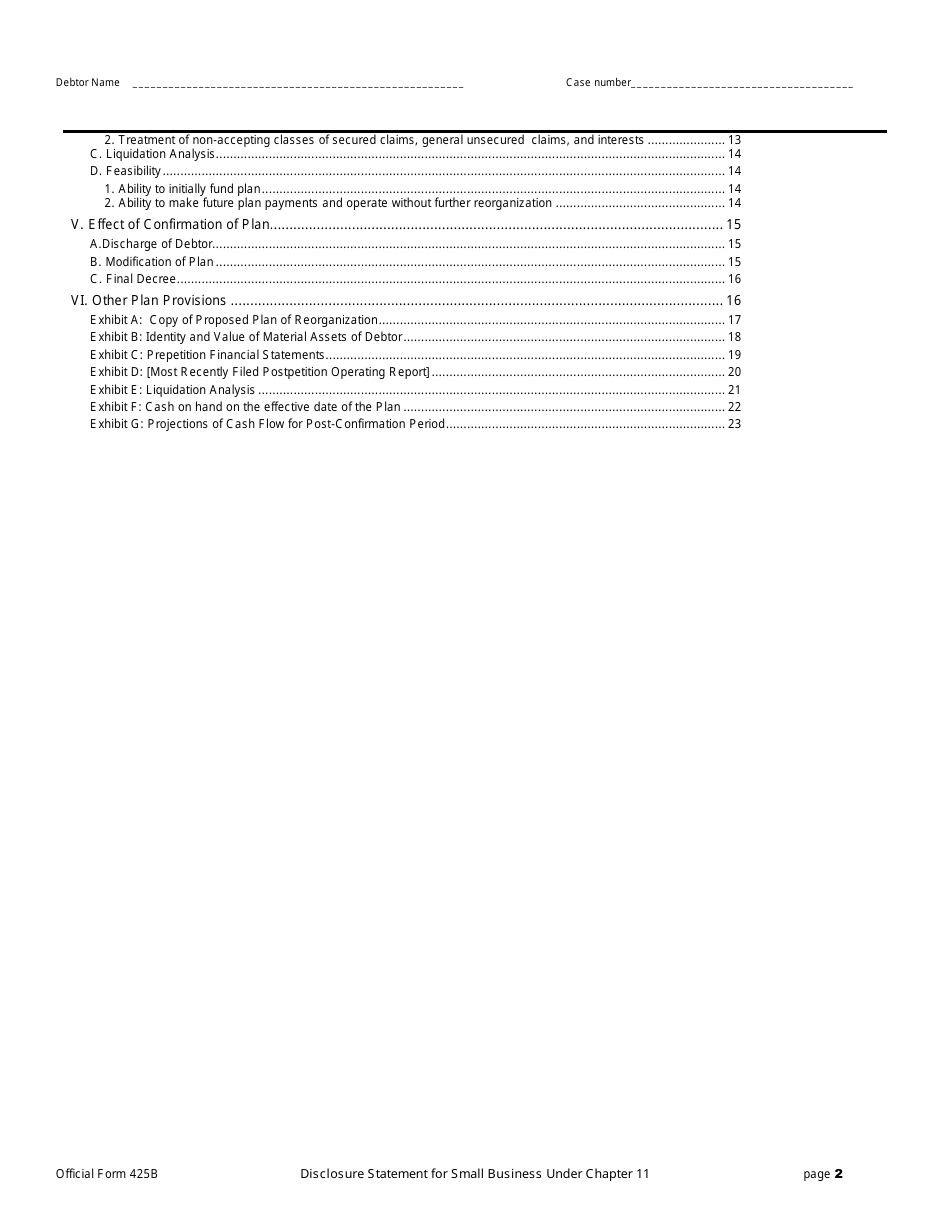

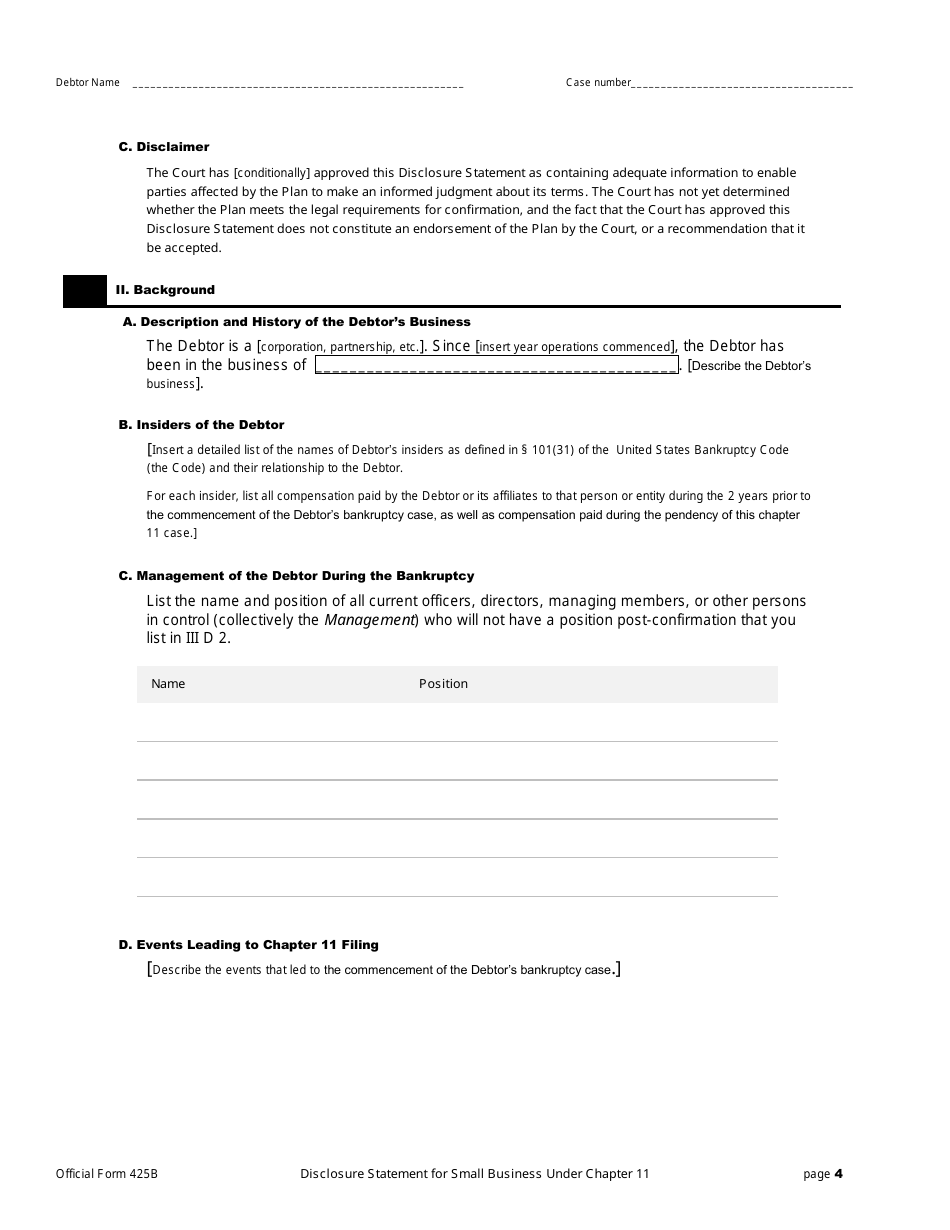

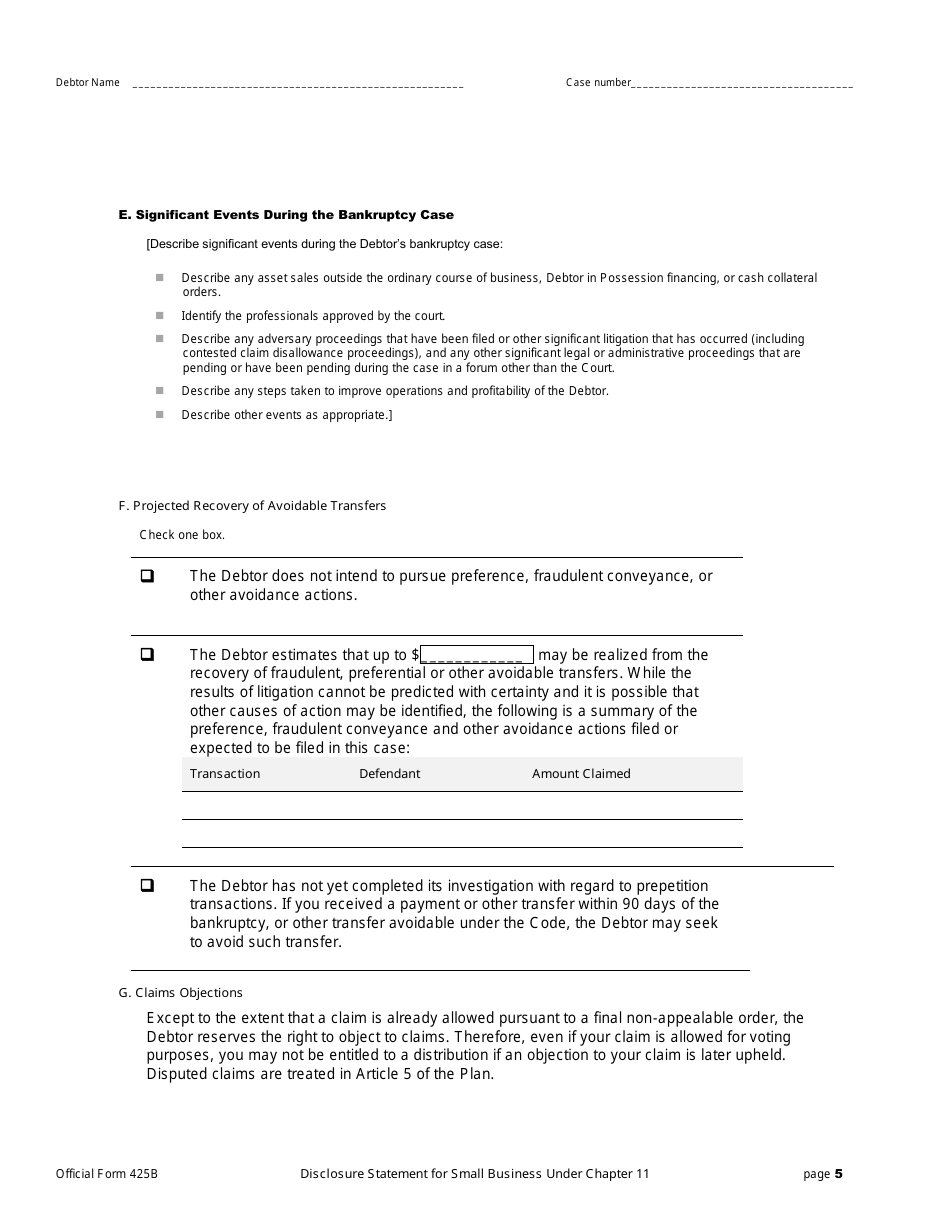

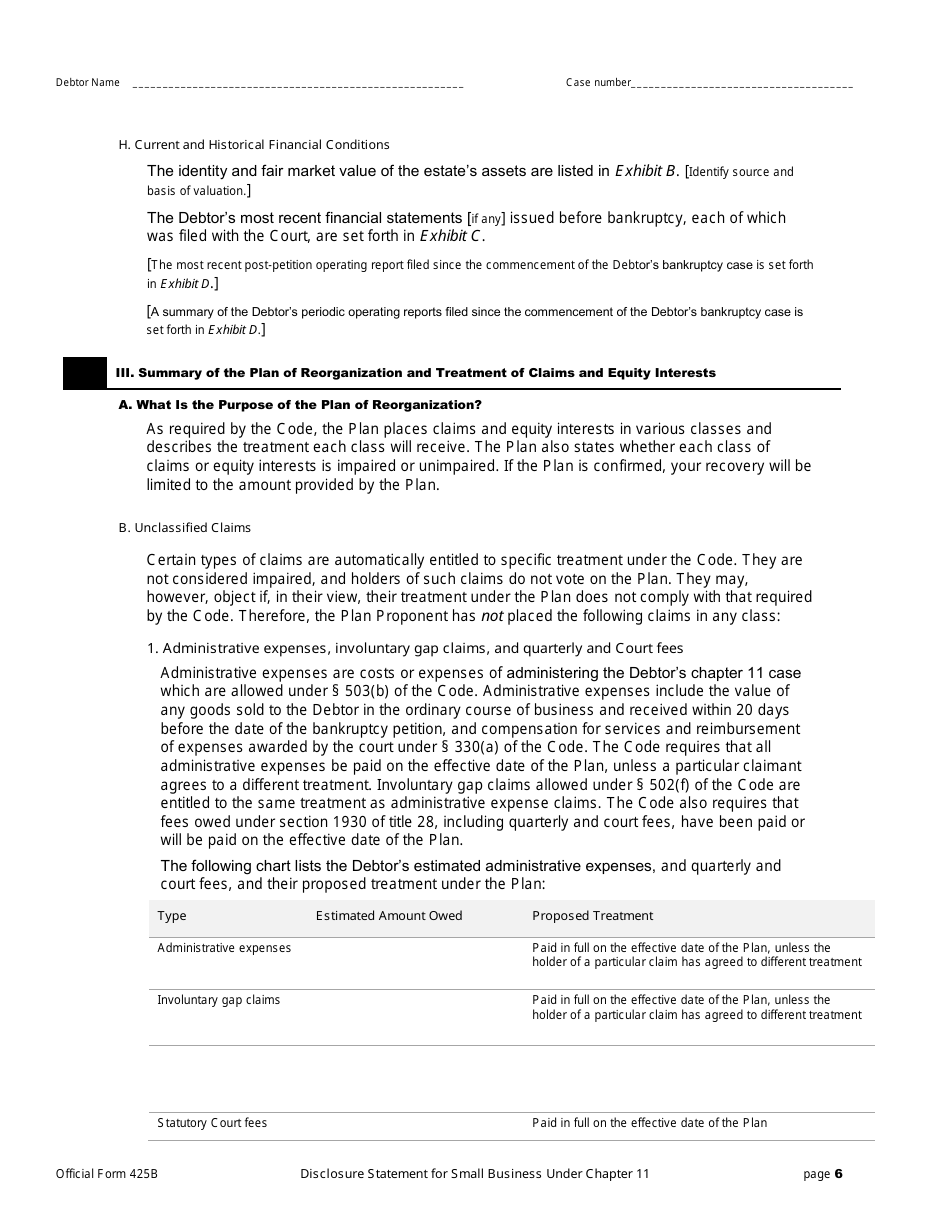

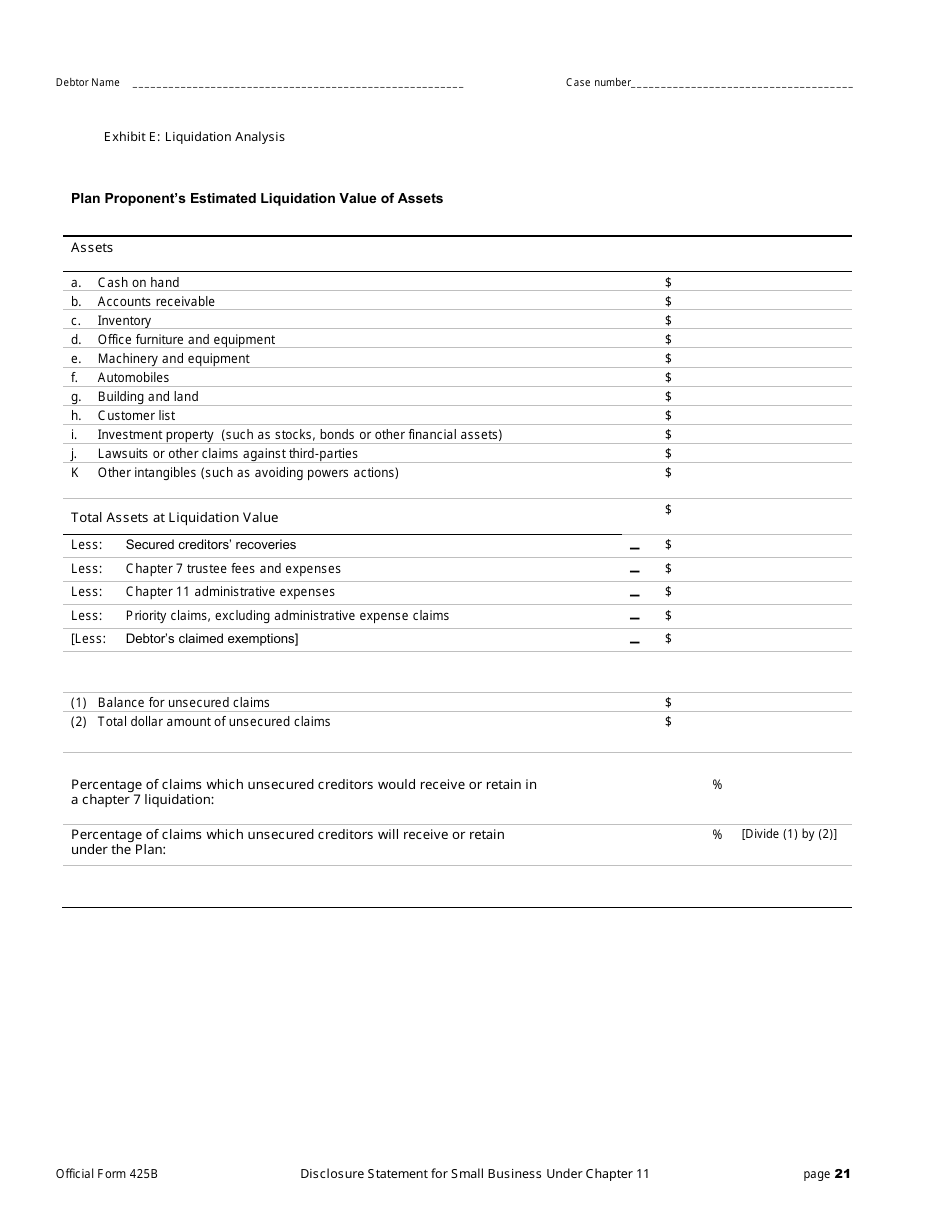

Q: What information is included in Form 425B?

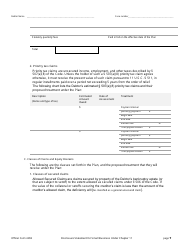

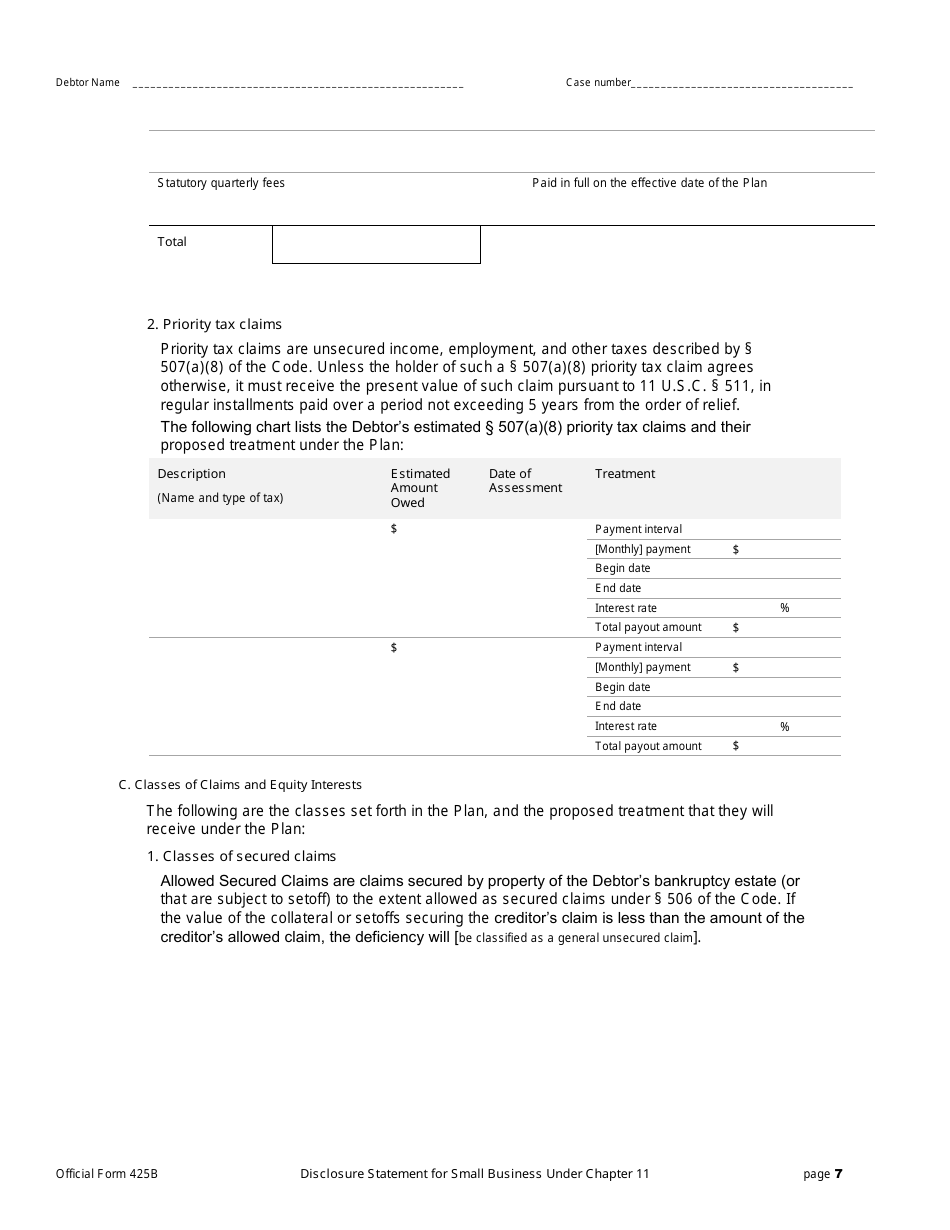

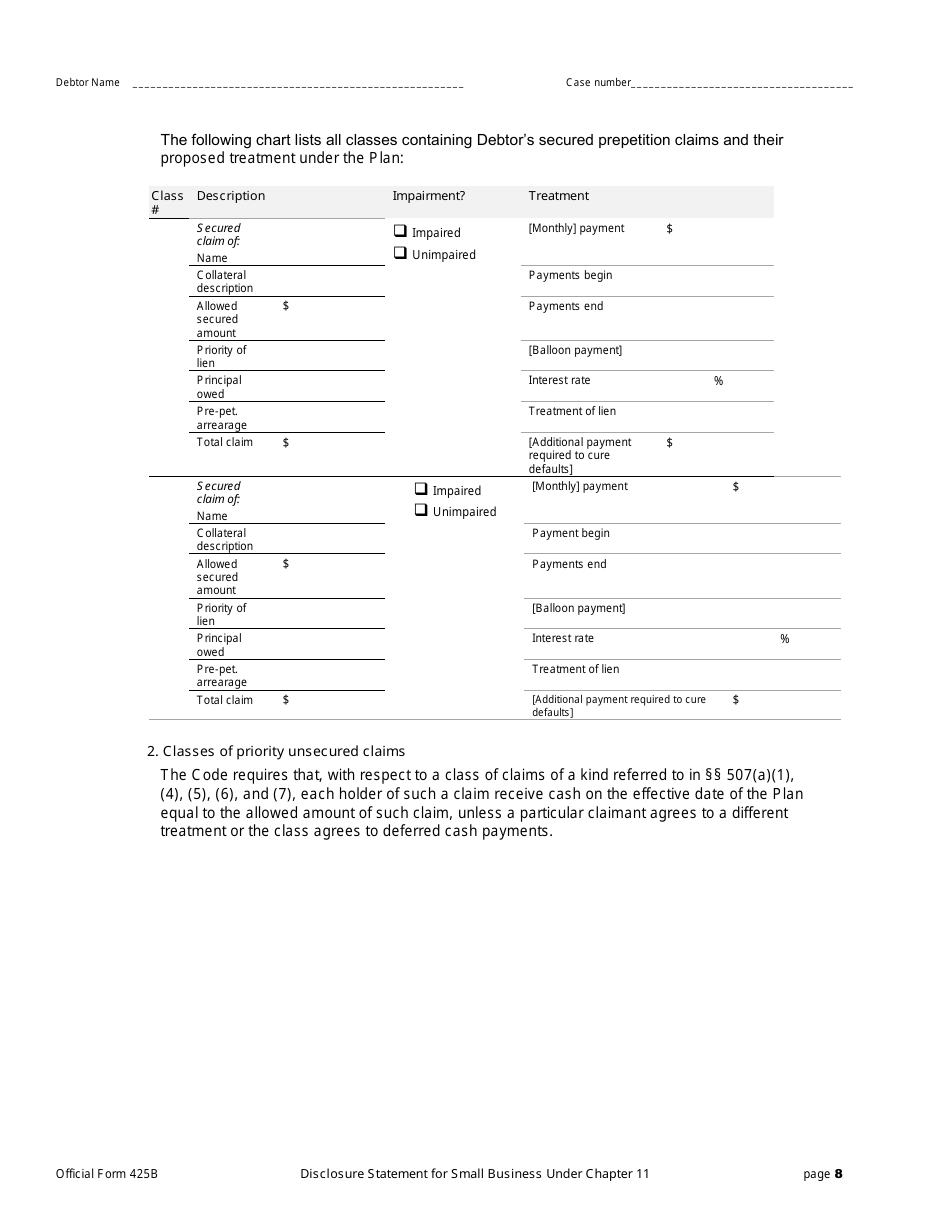

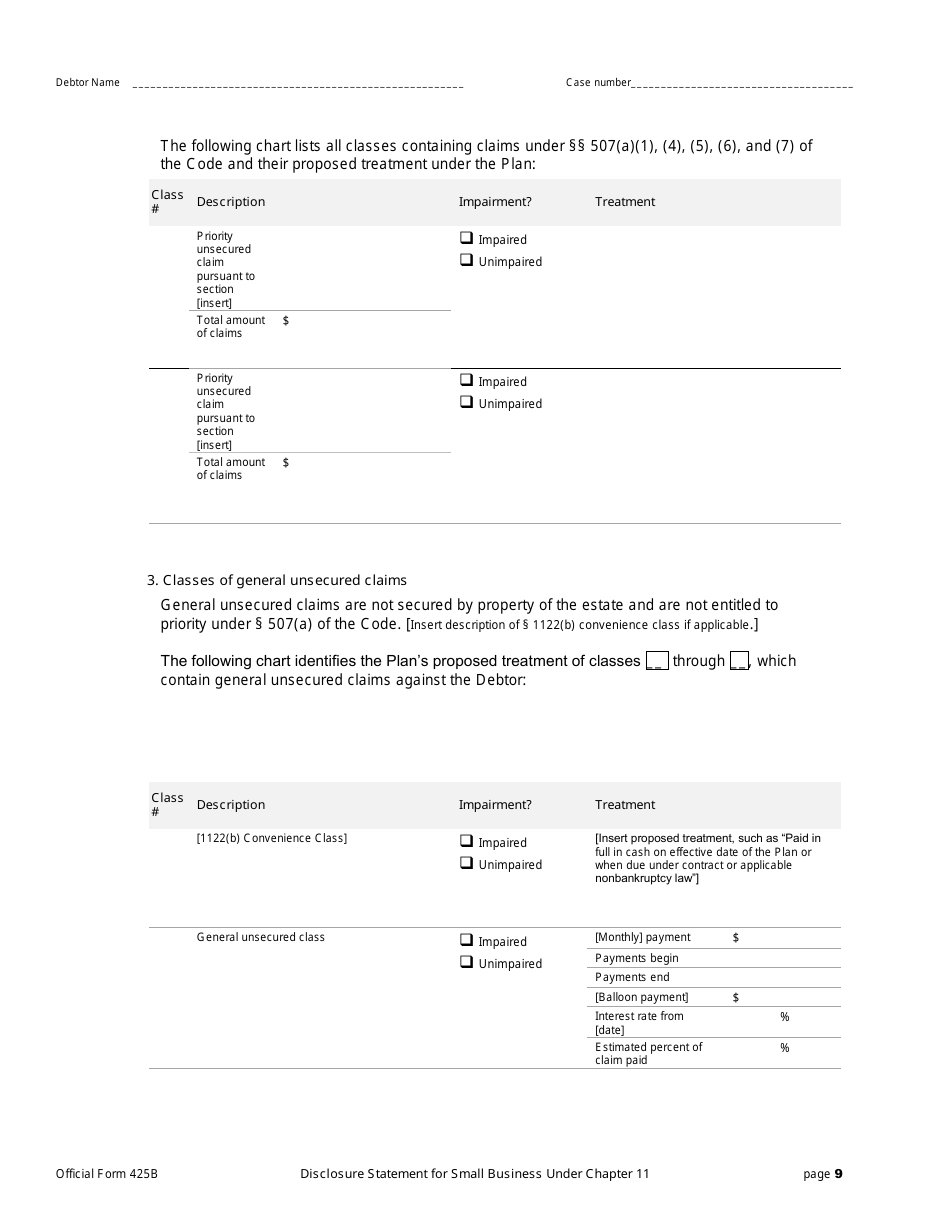

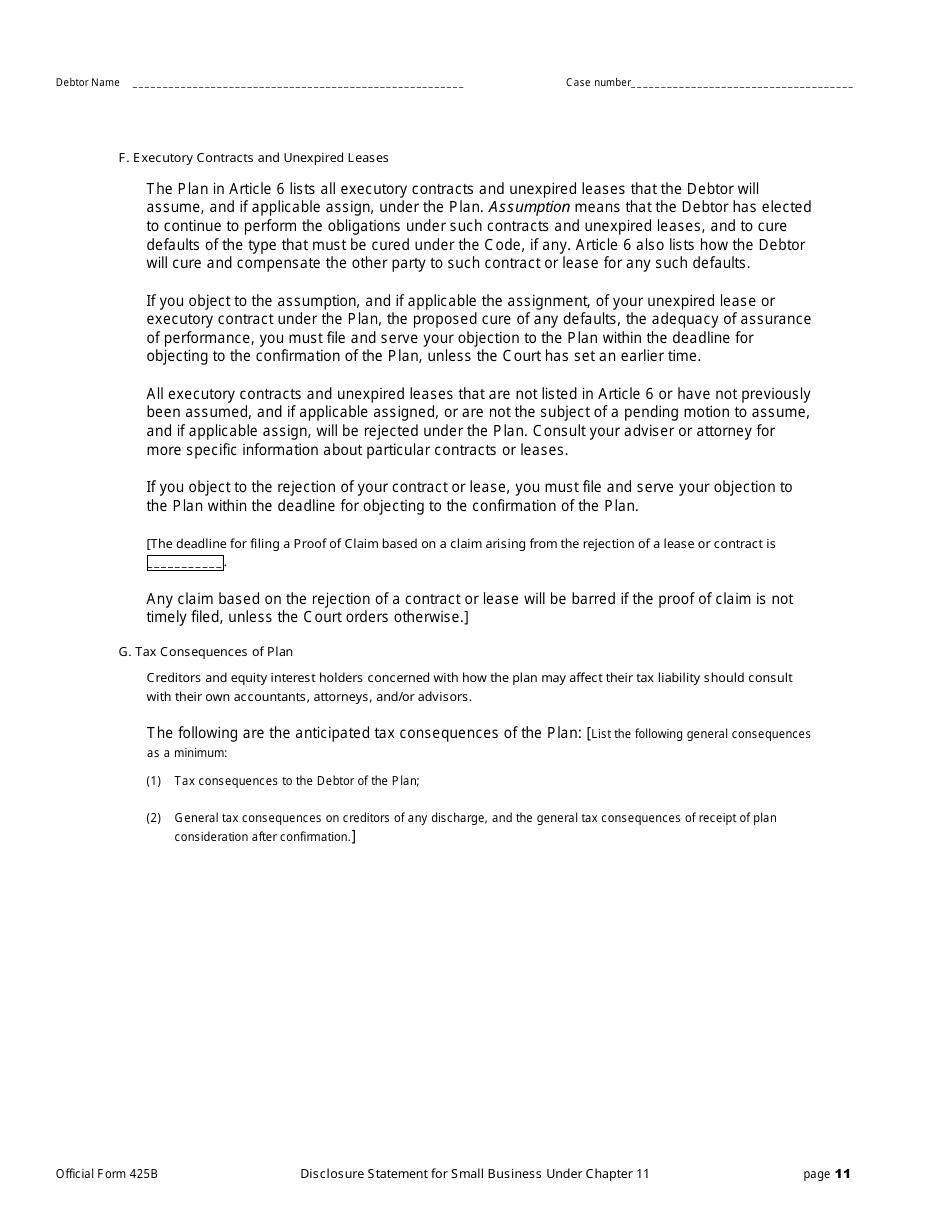

A: Form 425B includes information about the small business's financial status, assets, liabilities, and proposed reorganization plan.

Q: Do I need legal assistance to file Form 425B?

A: While it is recommended to seek legal assistance, it is possible to complete and file Form 425B without a lawyer.

Q: What happens after filing Form 425B?

A: After filing Form 425B, the court will review the disclosure statement and hold a hearing to determine whether to approve the reorganization plan.

Q: What happens if Form 425B is not filed?

A: Failure to file Form 425B may result in the dismissal of the Chapter 11 bankruptcy case.

Q: Can creditors object to the information provided in Form 425B?

A: Yes, creditors have the right to object to the information provided in Form 425B if they believe it is inaccurate or incomplete.

Q: Can Form 425B be amended?

A: Yes, Form 425B can be amended if there are changes or updates to the small business's financial information or reorganization plan.

Form Details:

- Released on December 1, 2017;

- The latest available edition released by the United States Bankruptcy Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Official Form 425B by clicking the link below or browse more documents and templates provided by the United States Bankruptcy Court.