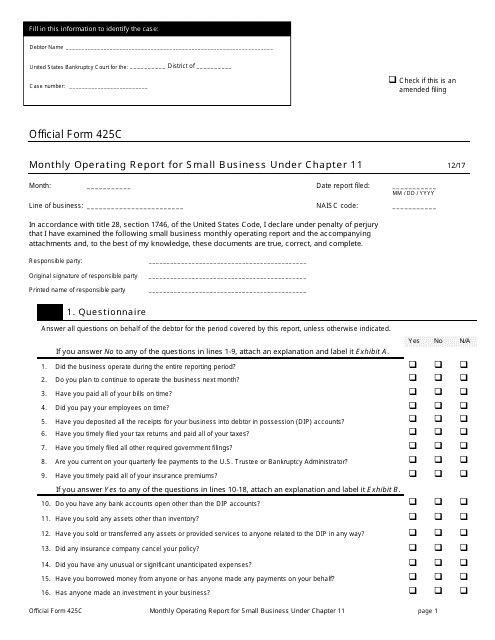

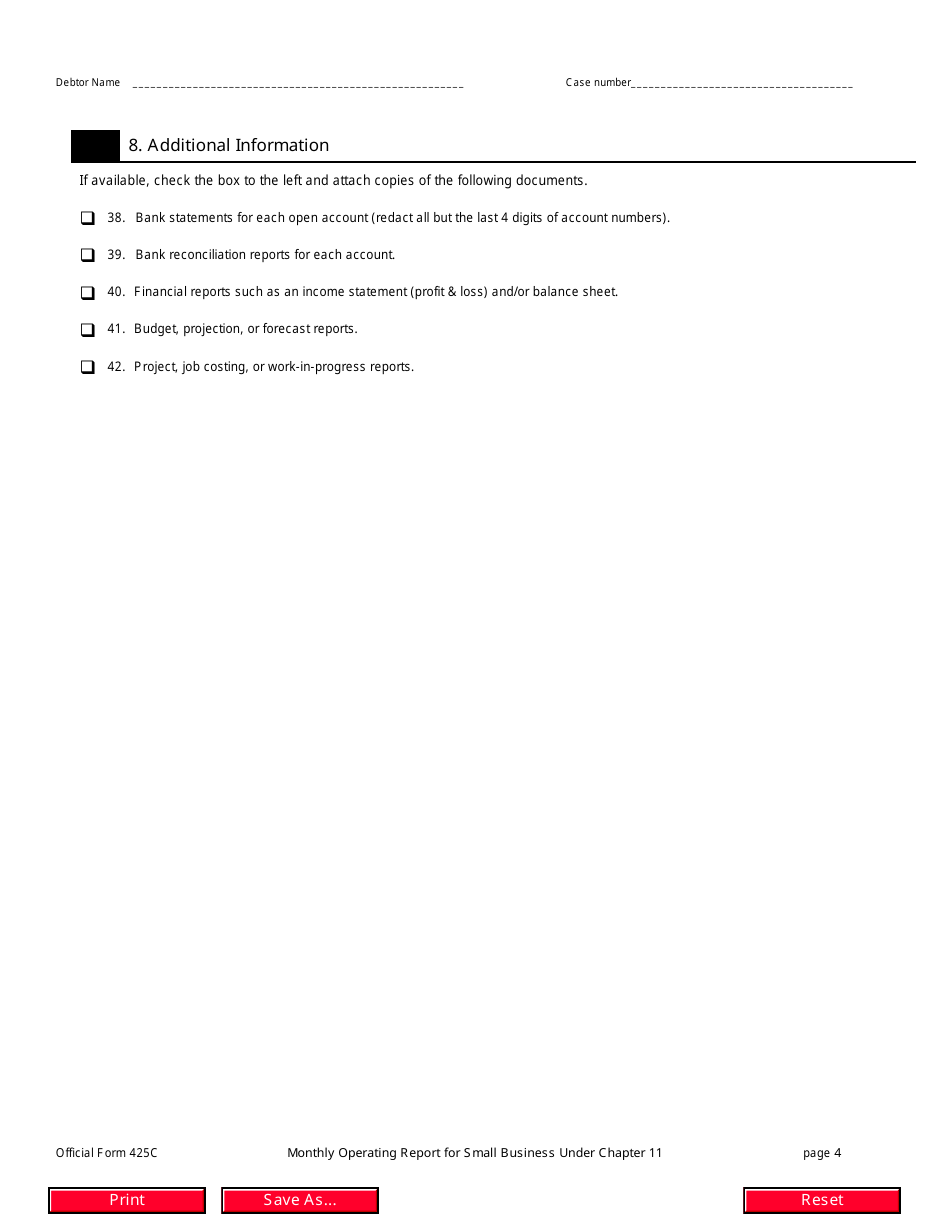

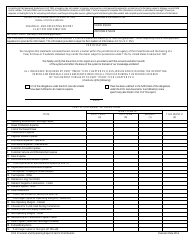

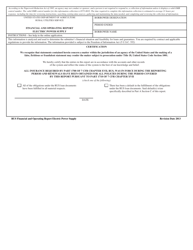

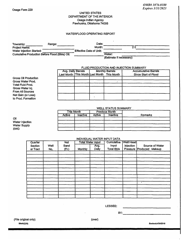

Official Form 425C Monthly Operating Report for Small Business Under Chapter 11

What Is Official Form 425C?

This is a legal form that was released by the United States Bankruptcy Court on December 1, 2017 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 425C?

A: Form 425C is the Monthly Operating Report for Small Business filed under Chapter 11 bankruptcy.

Q: Who needs to file Form 425C?

A: Small businesses operating under Chapter 11 bankruptcy need to file Form 425C.

Q: What is the purpose of Form 425C?

A: Form 425C is used to report the monthly financial performance and operating activities of a small business under Chapter 11 bankruptcy.

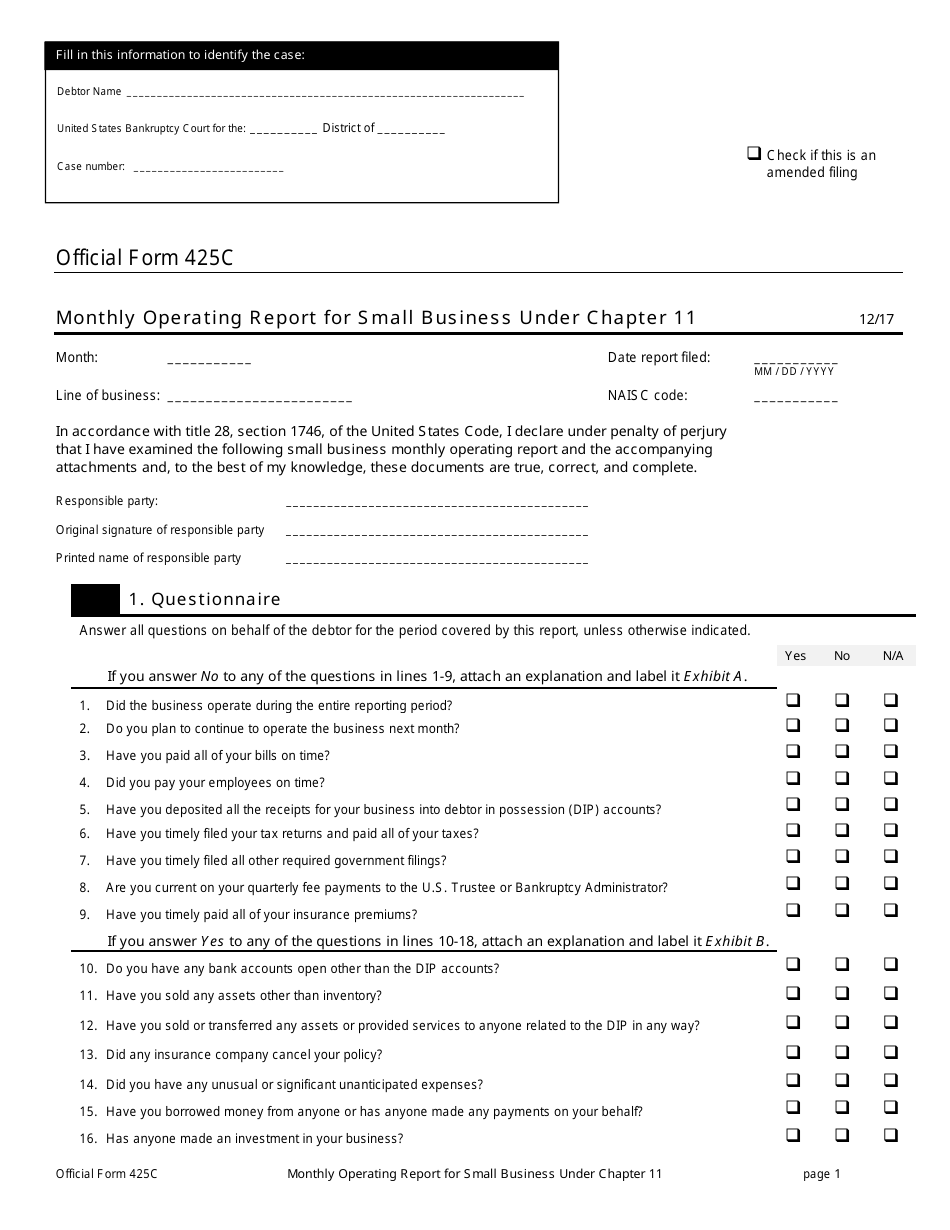

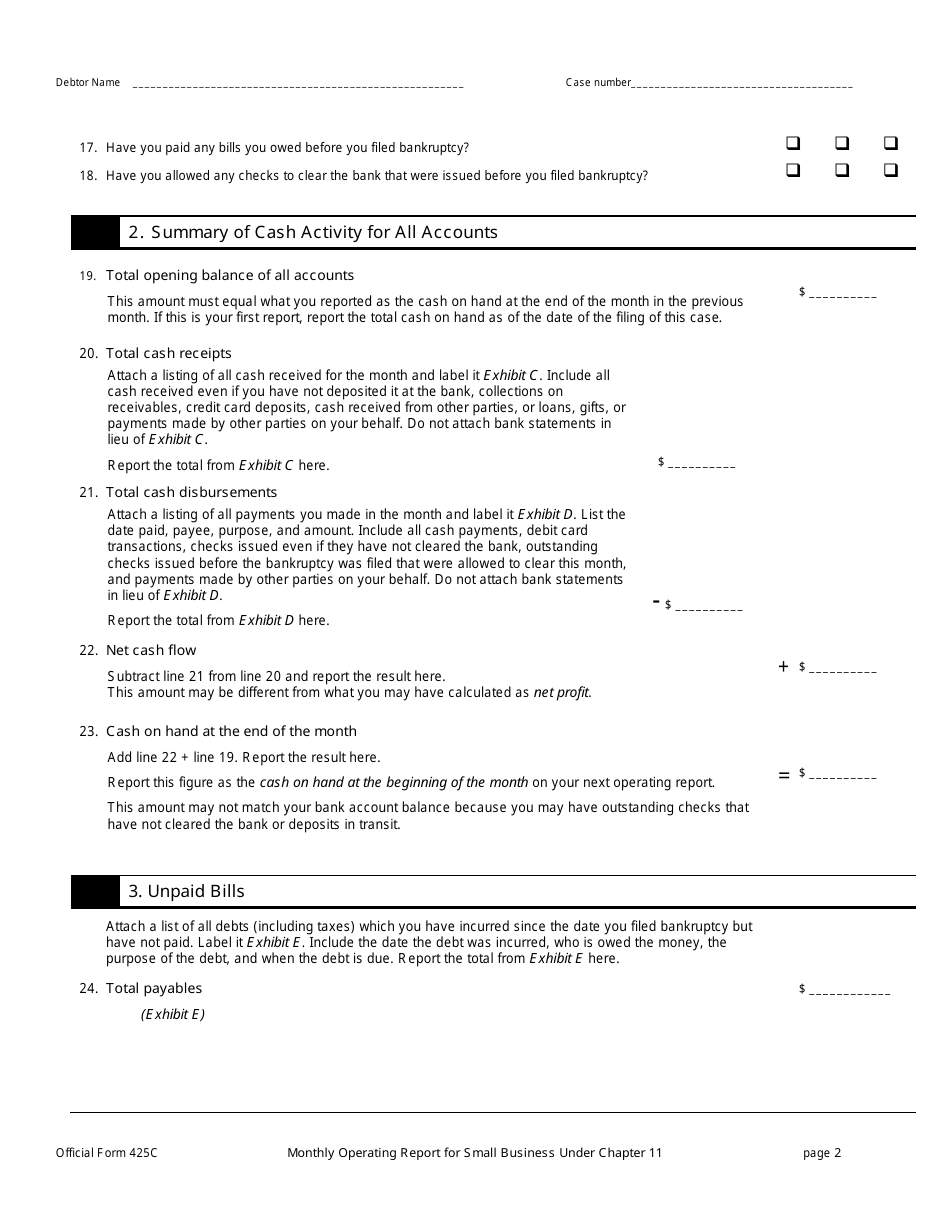

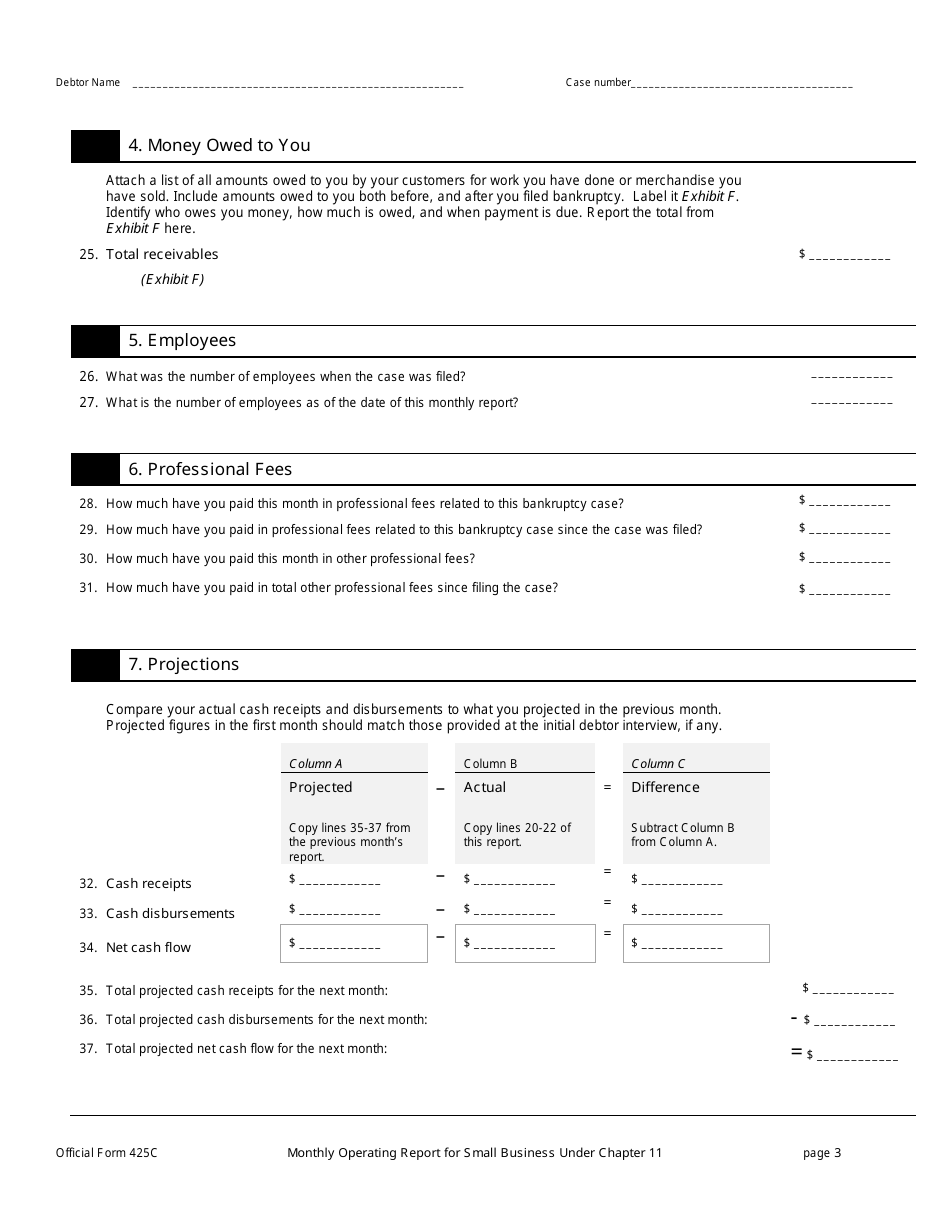

Q: What information is included in Form 425C?

A: Form 425C includes details such as sales, expenses, cash receipts, and disbursements of the small business.

Q: When should Form 425C be filed?

A: Form 425C should be filed on a monthly basis, usually within 20 days after the end of each month.

Q: Are there any filing fees for Form 425C?

A: Filing fees may apply for Form 425C, and the amount can vary depending on the bankruptcy court.

Q: Can Form 425C be filed electronically?

A: Yes, Form 425C can be filed electronically through the court's Electronic Case Filing (ECF) system, if available.

Q: Is Form 425C confidential?

A: Form 425C is not generally considered confidential, as it becomes part of the public record in the bankruptcy proceedings.

Q: What happens if Form 425C is not filed?

A: Failure to file Form 425C can result in penalties, fines, or other legal consequences imposed by the bankruptcy court.

Form Details:

- Released on December 1, 2017;

- The latest available edition released by the United States Bankruptcy Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Official Form 425C by clicking the link below or browse more documents and templates provided by the United States Bankruptcy Court.