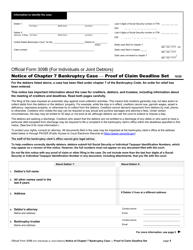

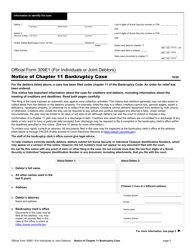

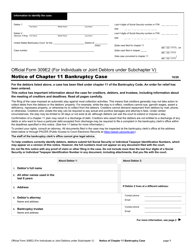

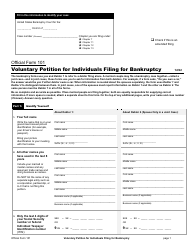

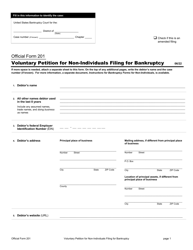

This version of the form is not currently in use and is provided for reference only. Download this version of

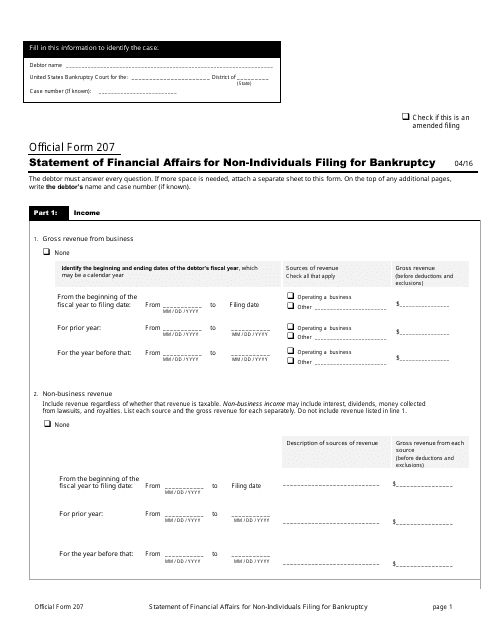

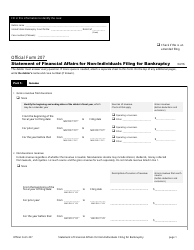

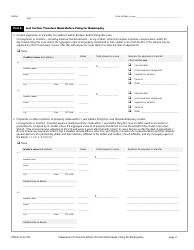

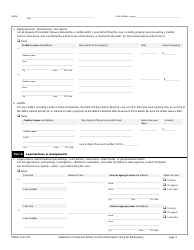

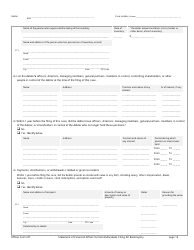

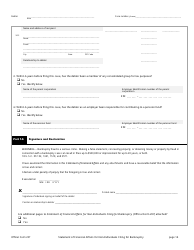

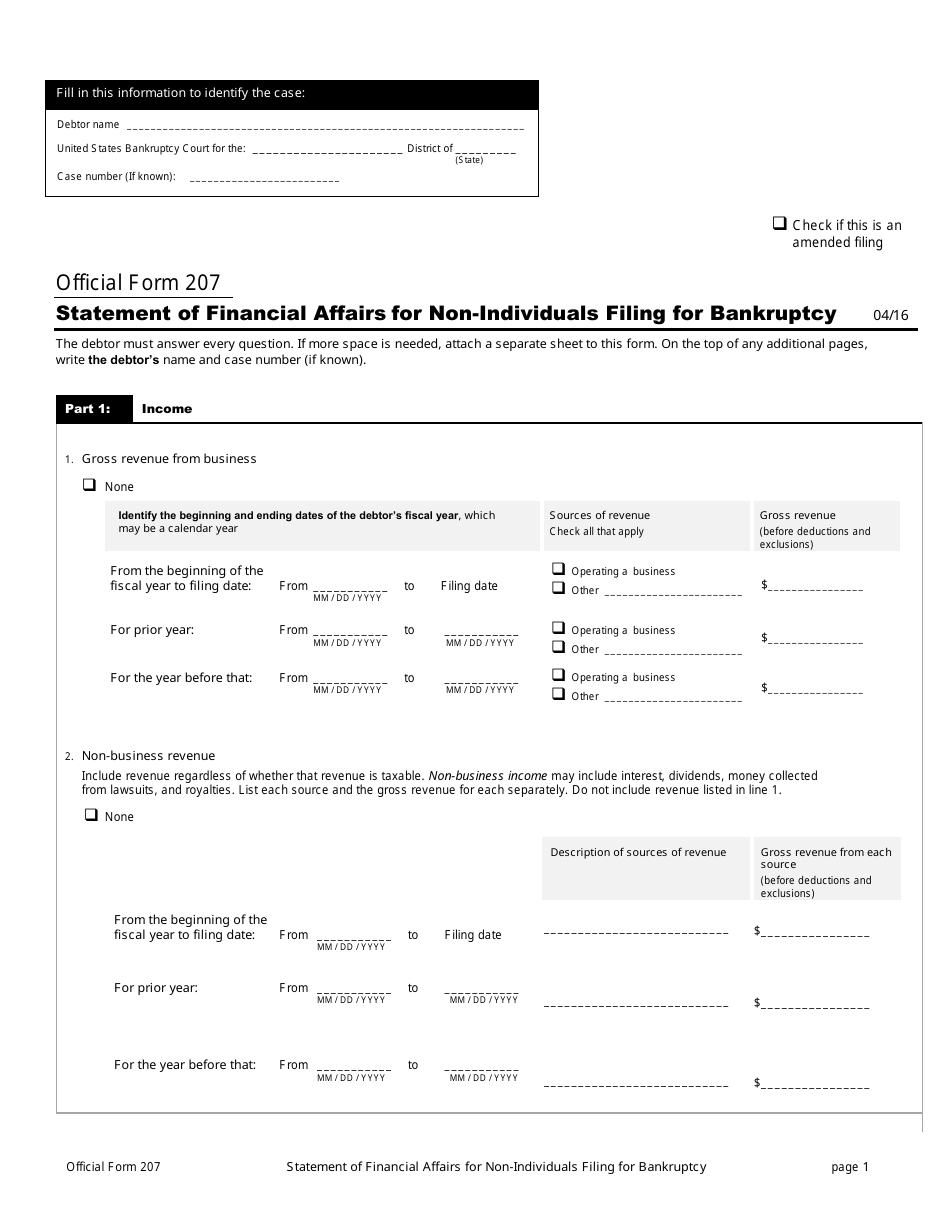

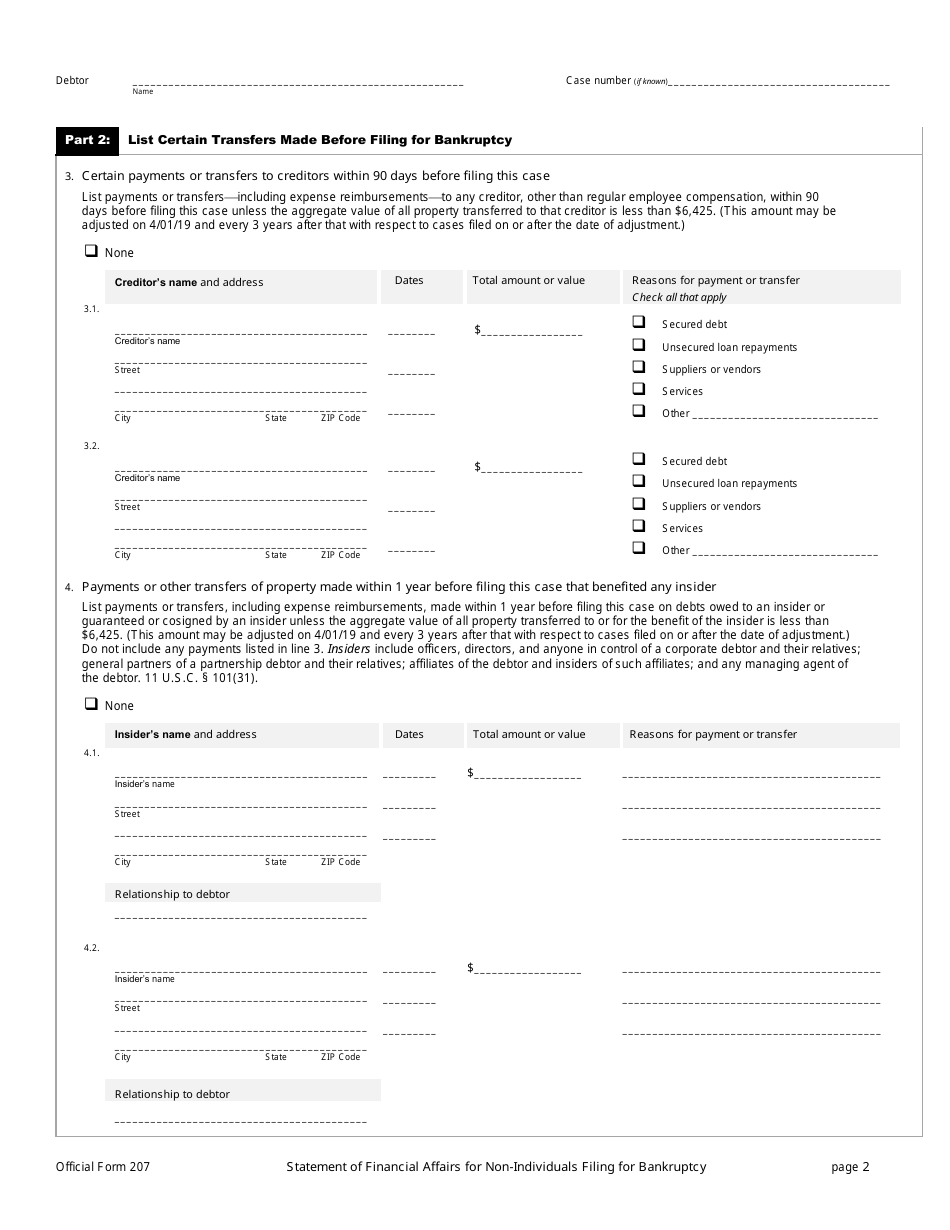

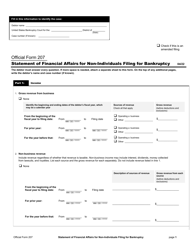

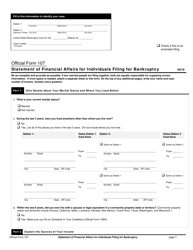

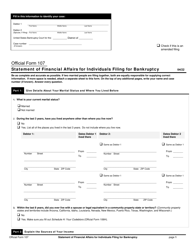

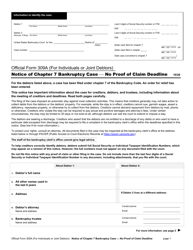

Official Form 207

for the current year.

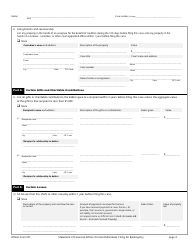

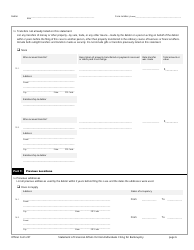

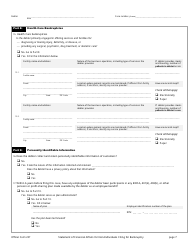

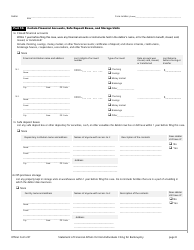

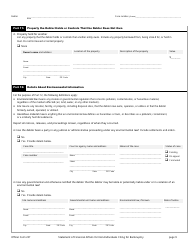

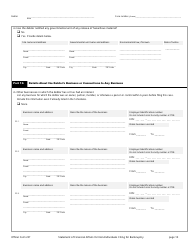

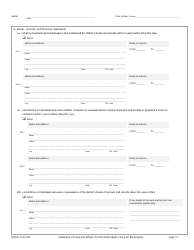

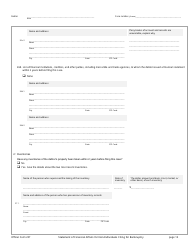

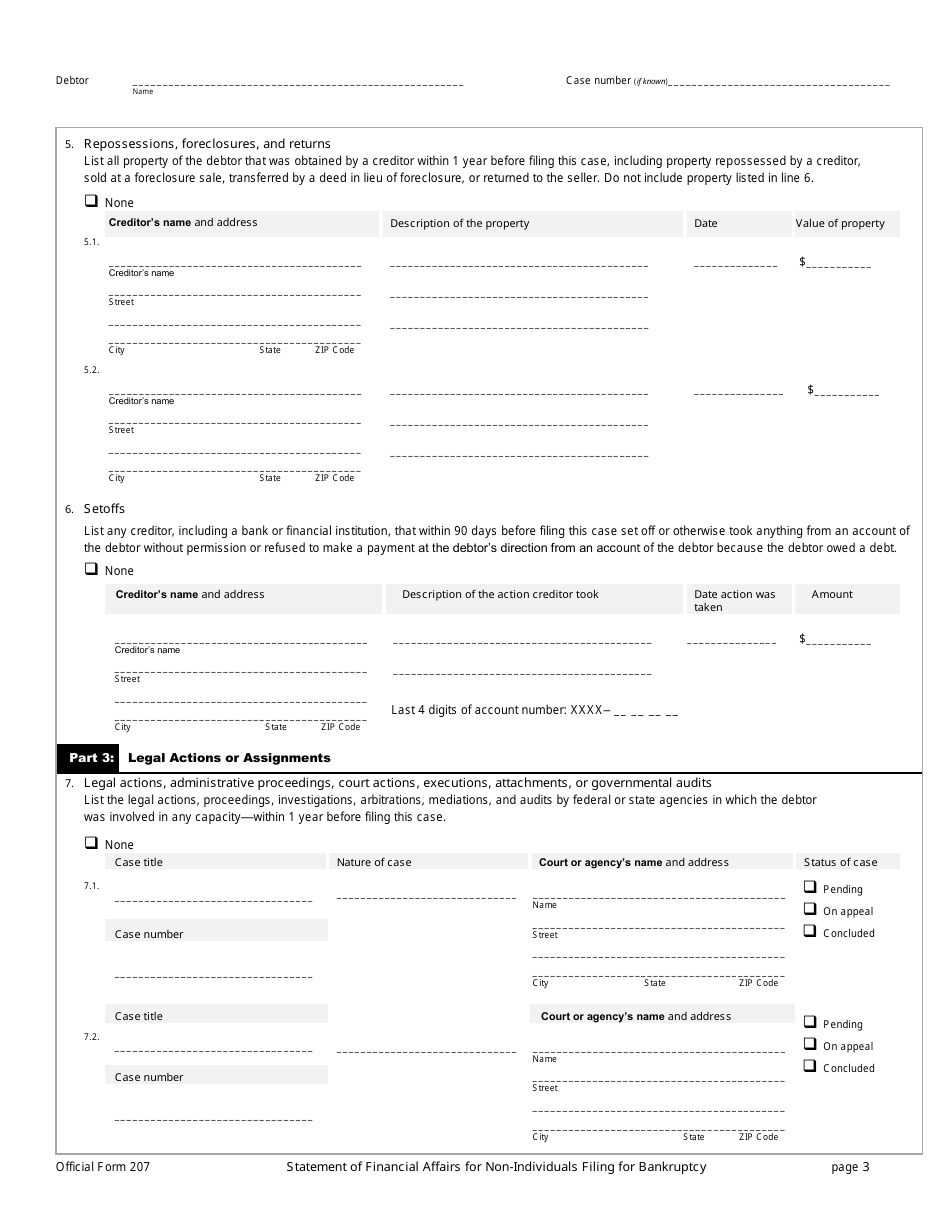

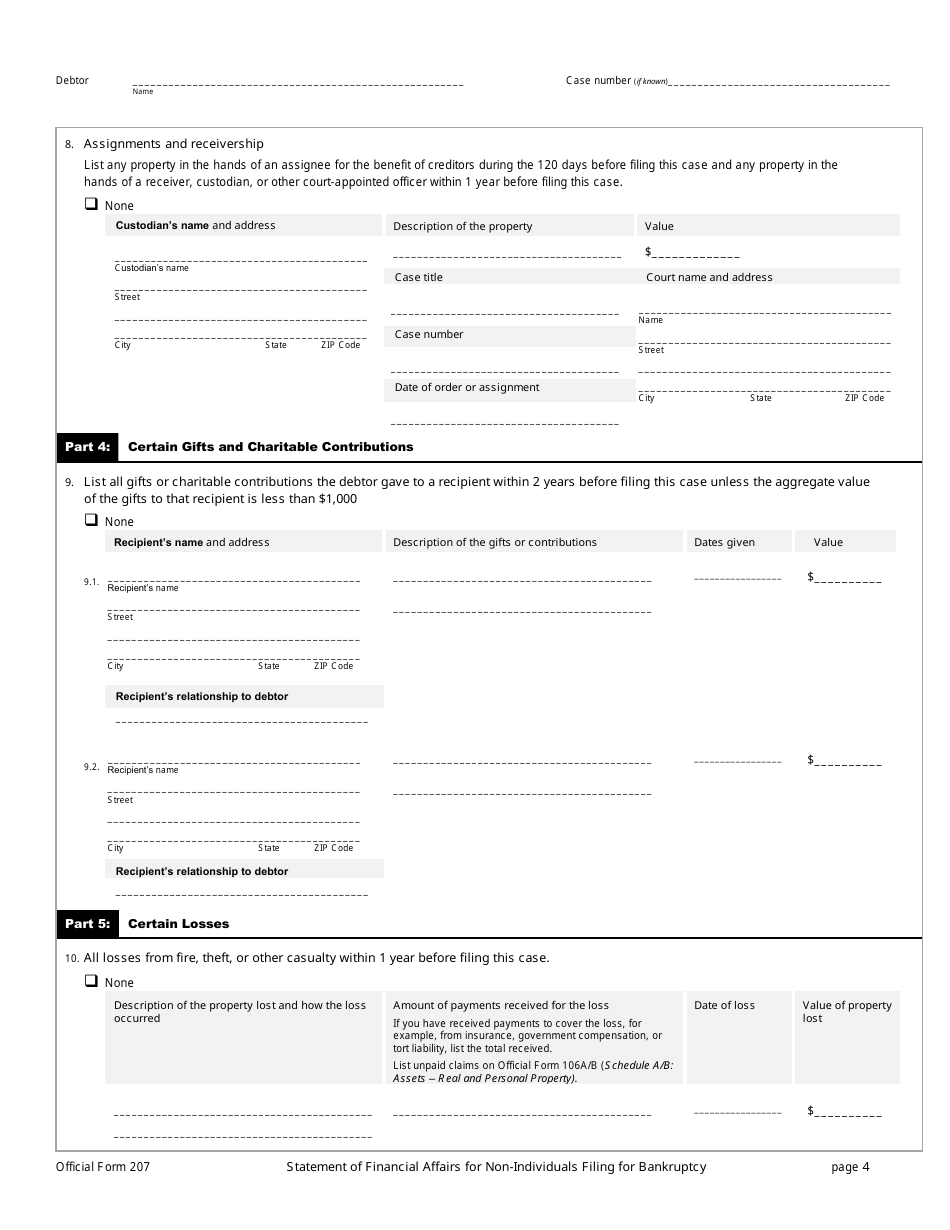

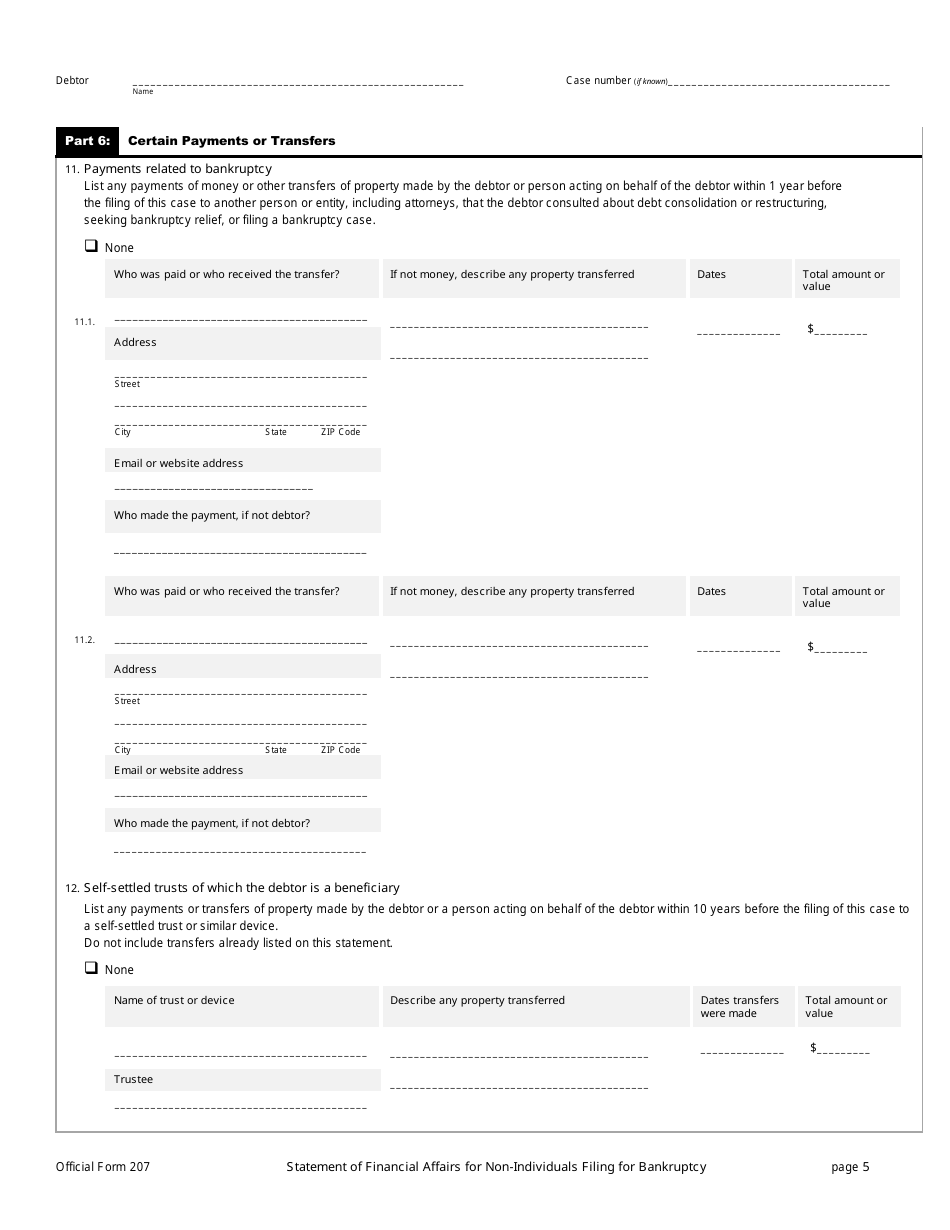

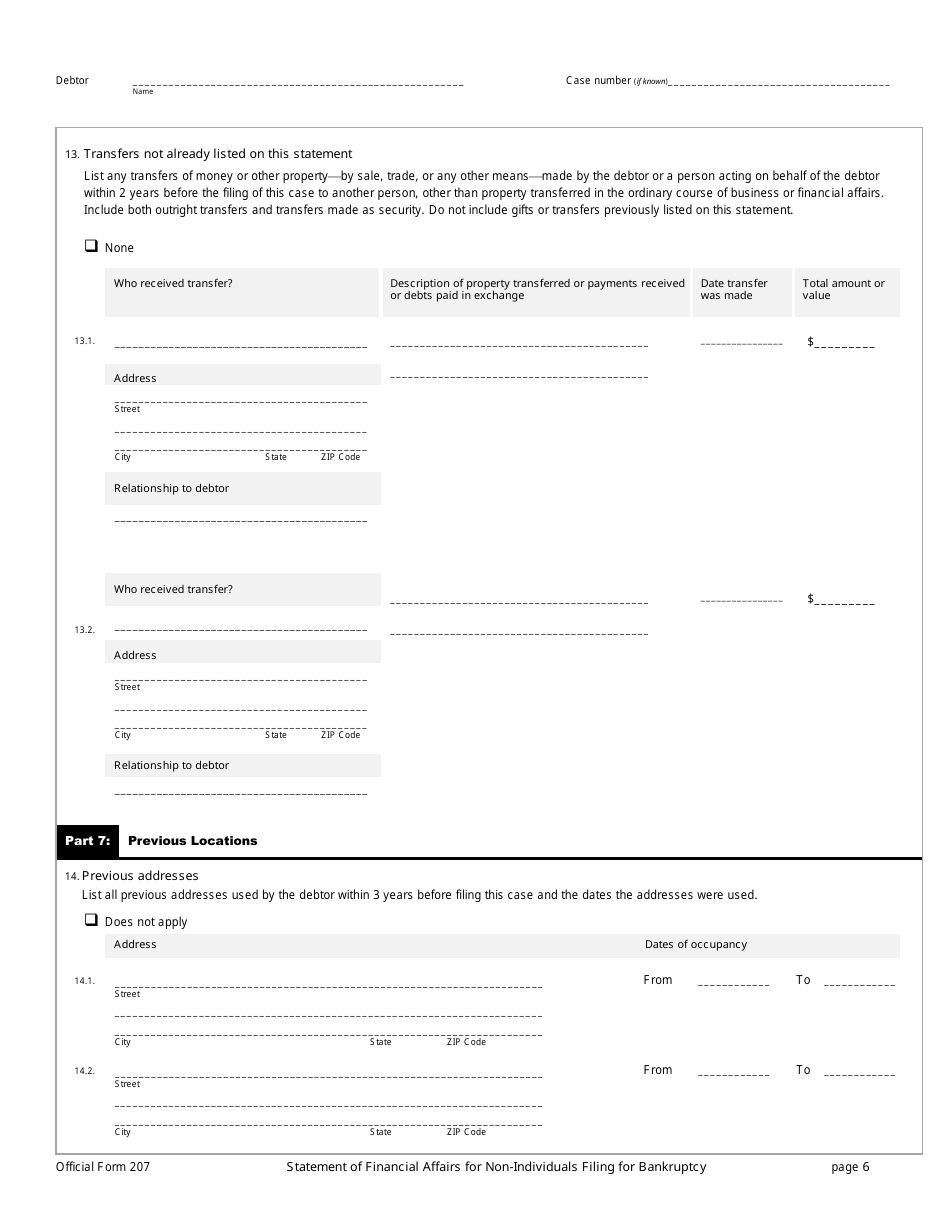

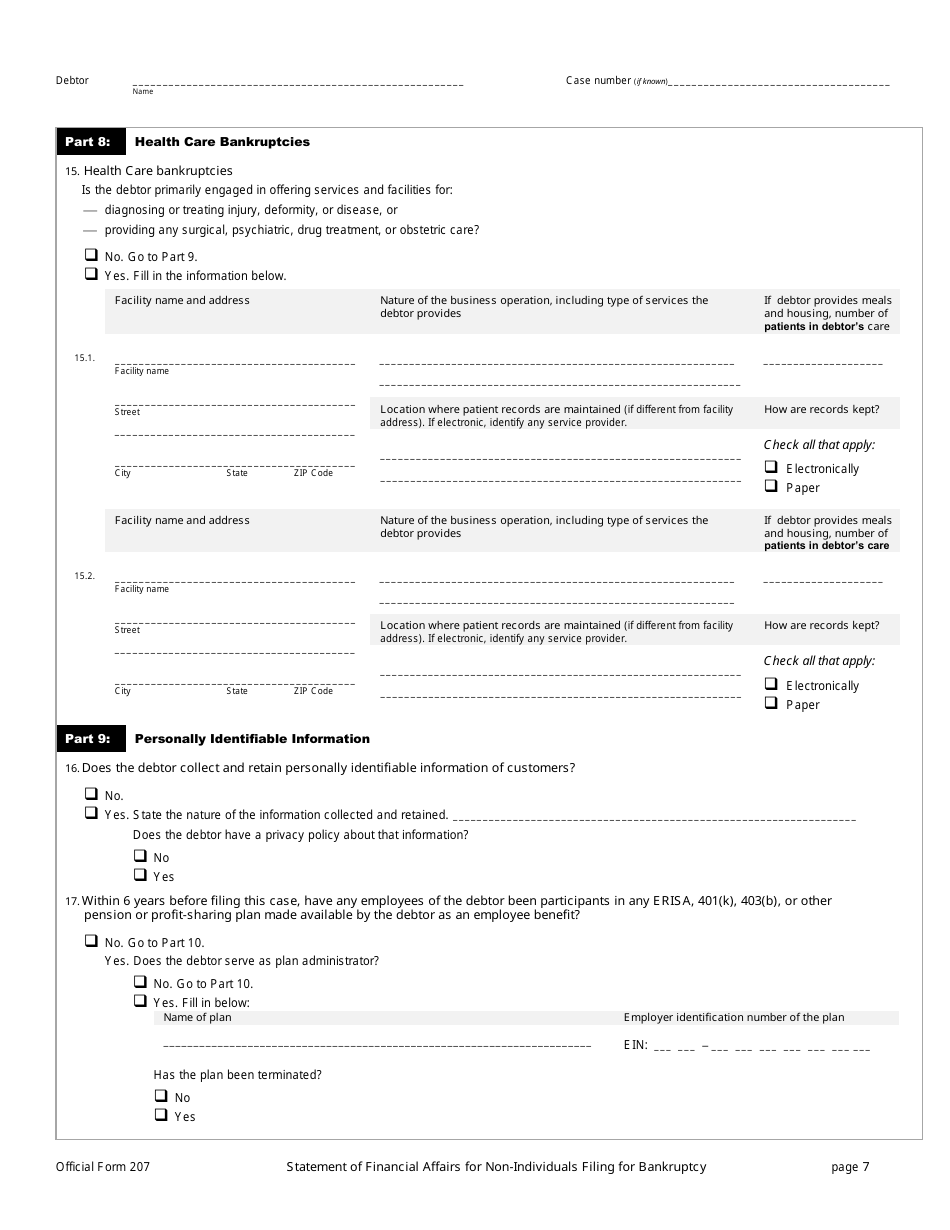

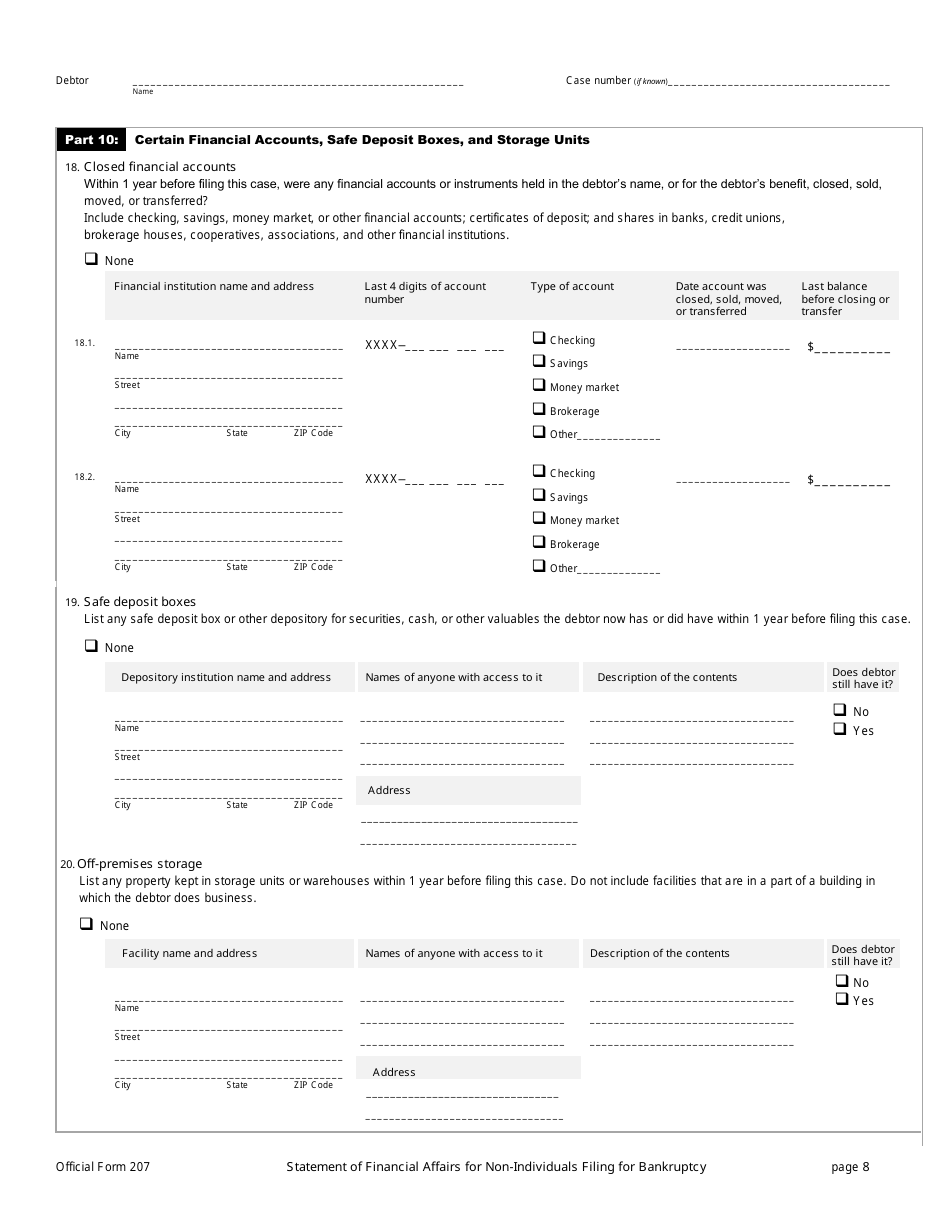

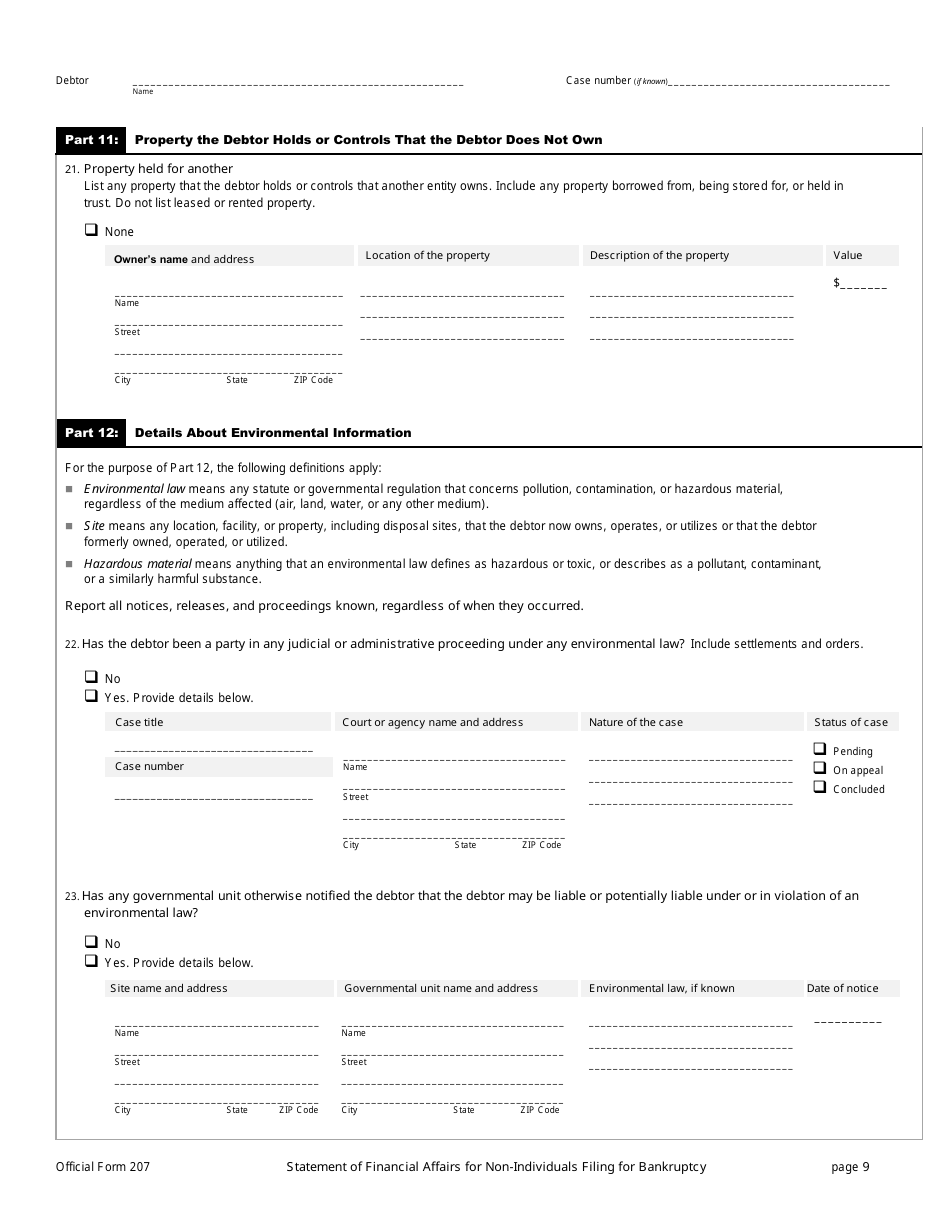

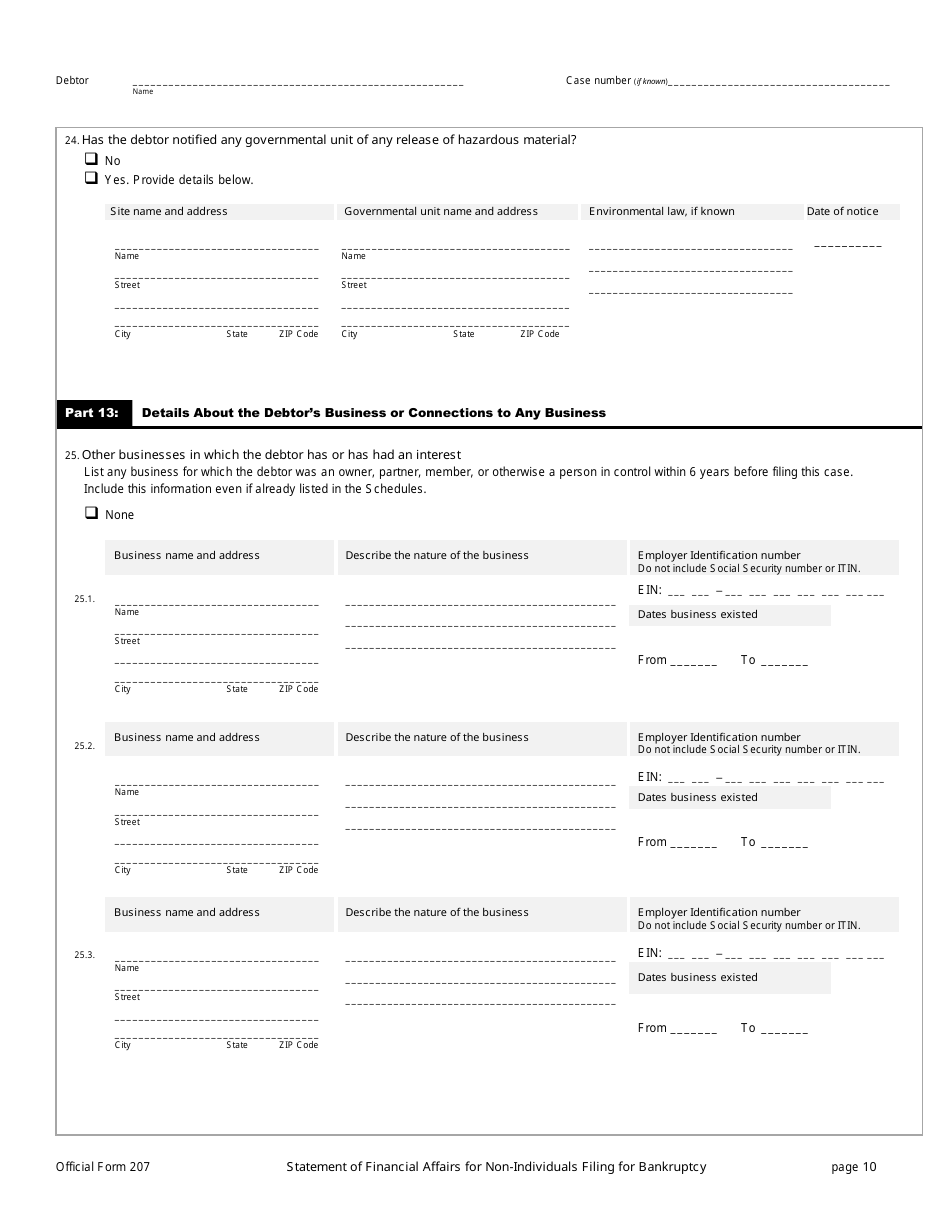

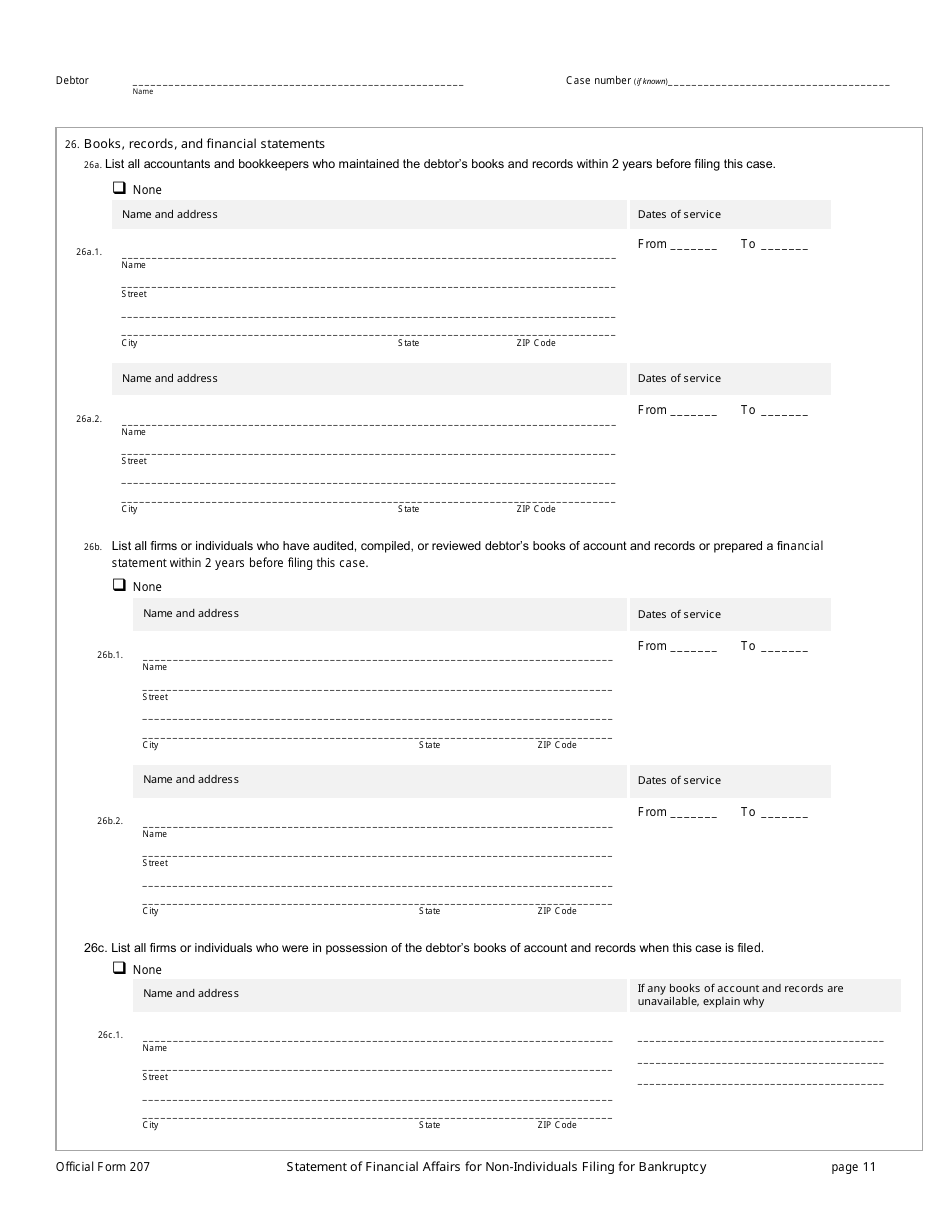

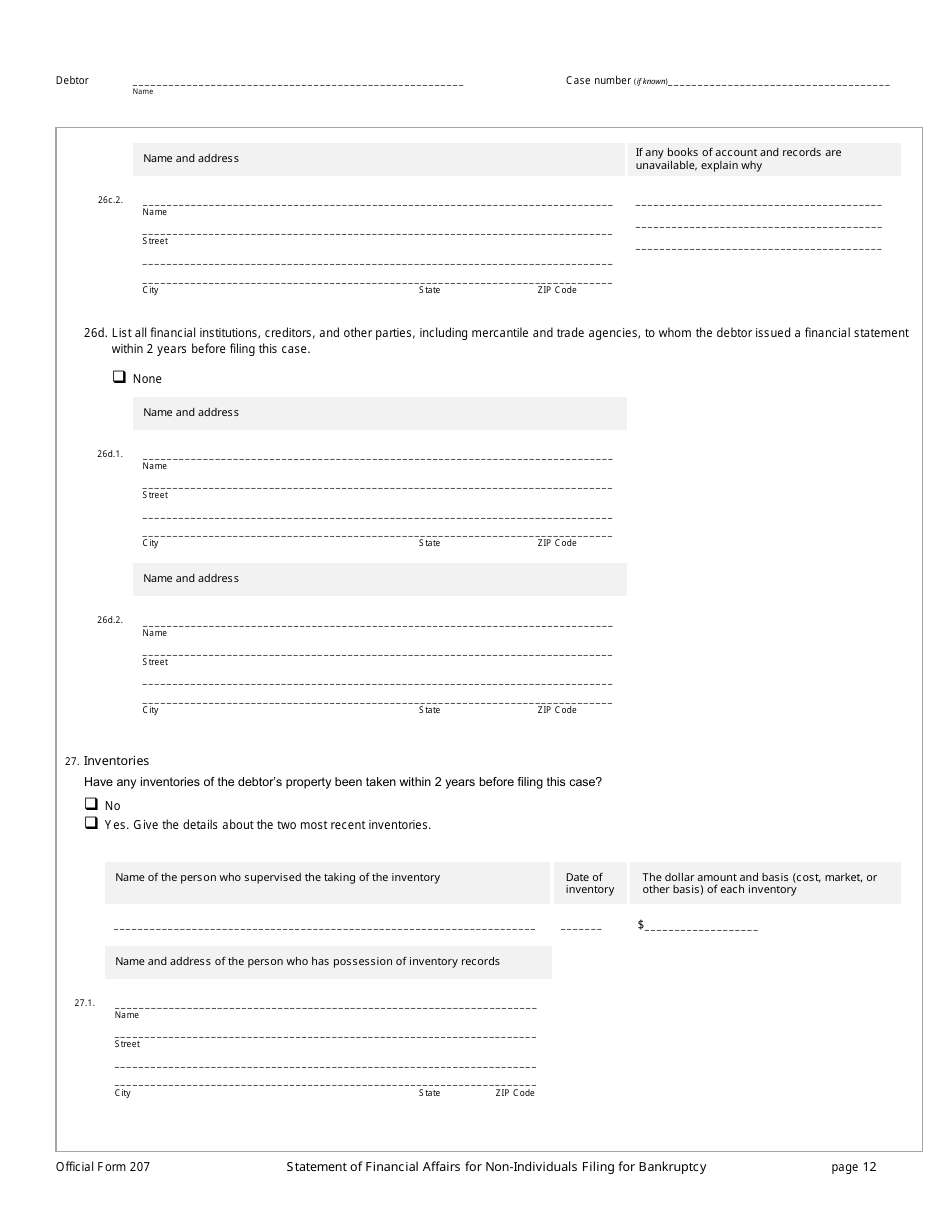

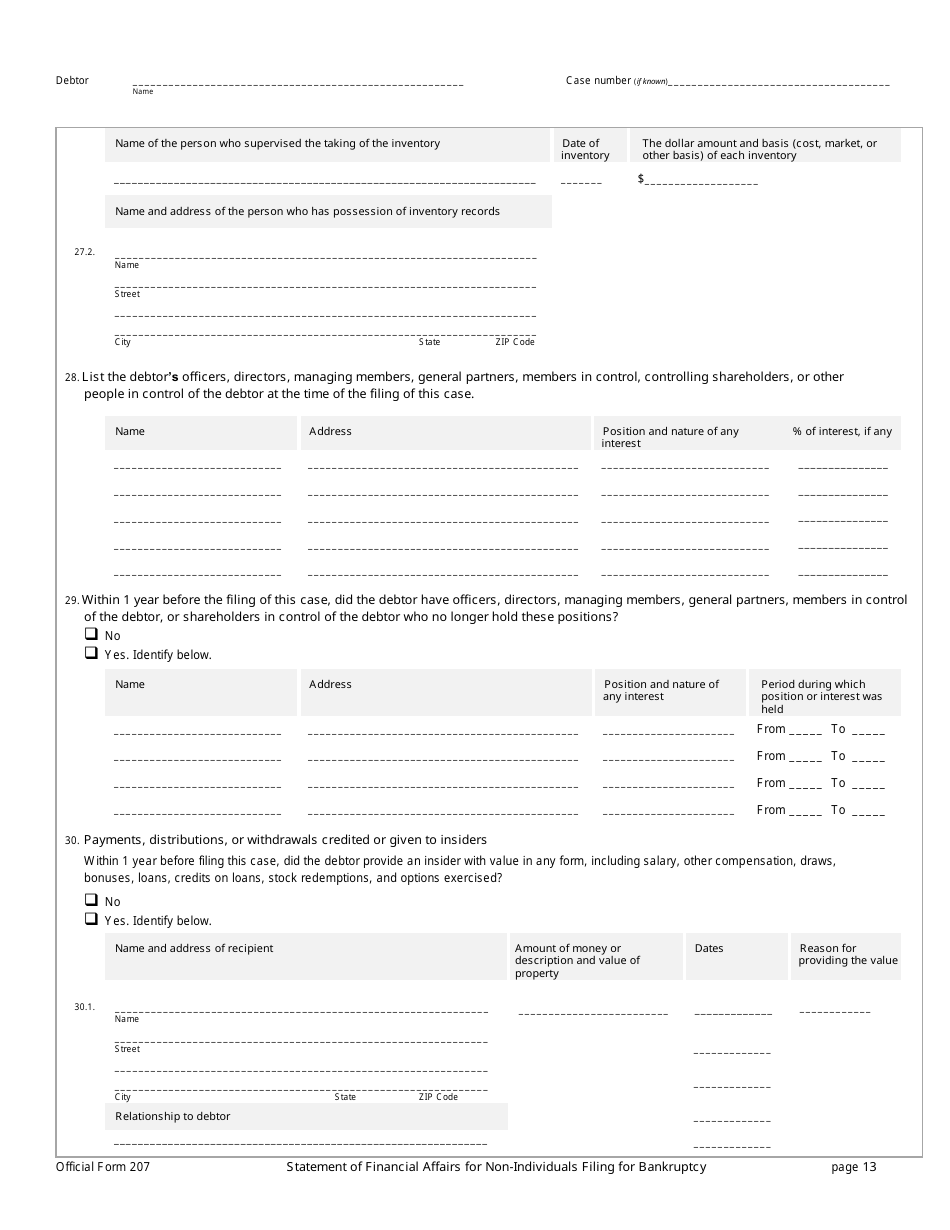

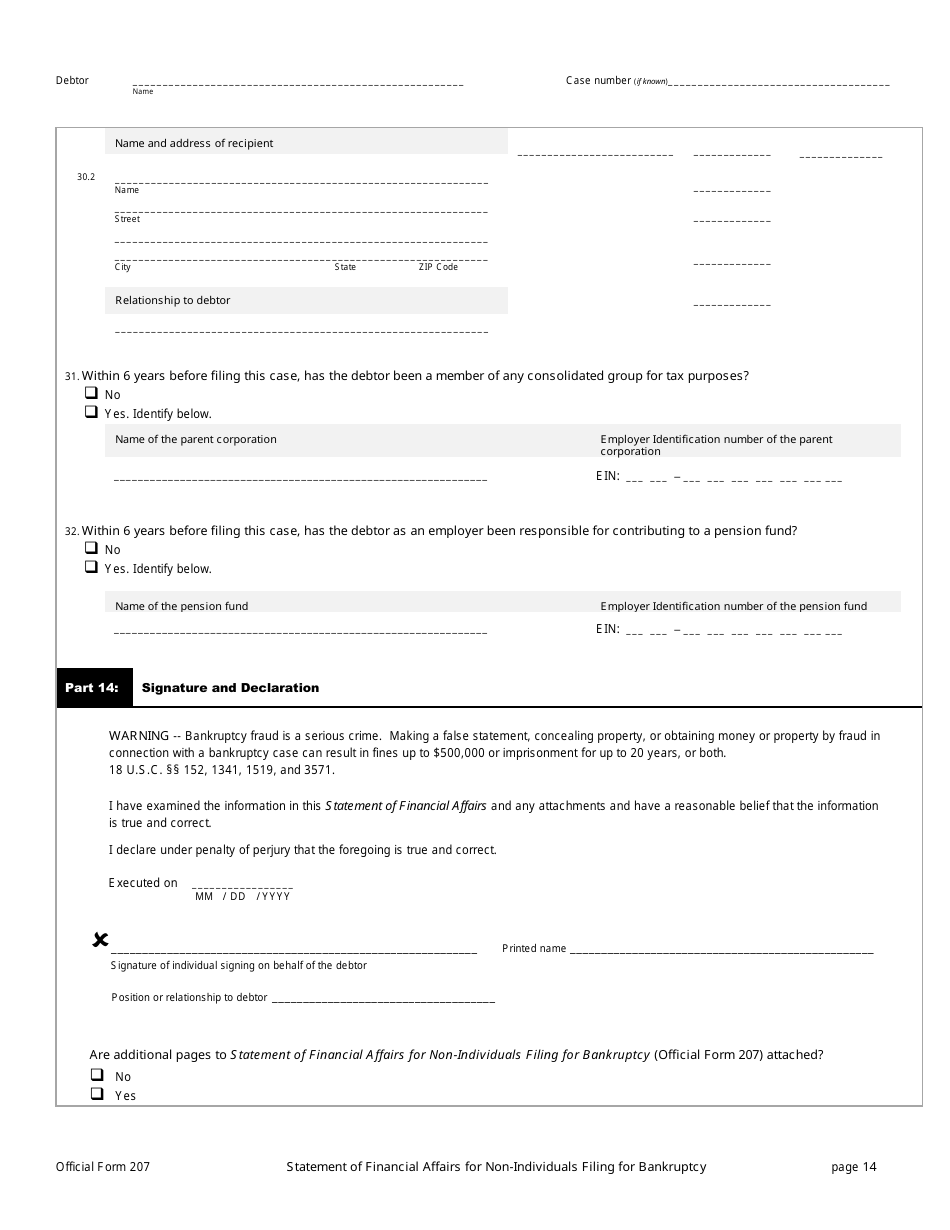

Official Form 207 Statement of Financial Affairs for Non-individuals Filing for Bankruptcy

What Is Official Form 207?

This is a legal form that was released by the United States Bankruptcy Court on April 1, 2016 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 207?

A: Form 207 is the Statement of Financial Affairs for non-individuals filing for bankruptcy.

Q: Who needs to file Form 207?

A: Non-individuals filing for bankruptcy need to file Form 207.

Q: What is the purpose of Form 207?

A: Form 207 is used to gather information about the financial situation of non-individuals filing for bankruptcy.

Q: What information is required on Form 207?

A: Form 207 requires information about the business's assets, liabilities, income, expenses, and other financial details.

Q: Are there any filing fees for Form 207?

A: Yes, there are filing fees associated with Form 207. The amount may vary depending on the jurisdiction.

Q: Is Form 207 the only form required for bankruptcy filing?

A: No, Form 207 is one of the forms required for bankruptcy filing. Other forms may also be necessary depending on the specific case.

Q: Can I complete Form 207 on my own?

A: While it is possible to complete Form 207 on your own, it is highly recommended to seek assistance from a bankruptcy attorney to ensure accuracy and compliance with bankruptcy laws.

Q: What happens after Form 207 is filed?

A: After Form 207 is filed, it becomes part of the bankruptcy case and will be reviewed by the bankruptcy court and trustee.

Q: Can Form 207 be amended after it is filed?

A: Yes, Form 207 can be amended if there are any changes or updates to the financial information provided.

Form Details:

- Released on April 1, 2016;

- The latest available edition released by the United States Bankruptcy Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Official Form 207 by clicking the link below or browse more documents and templates provided by the United States Bankruptcy Court.