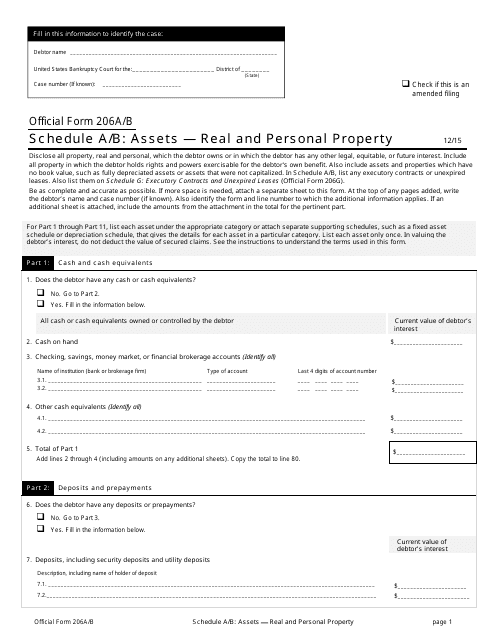

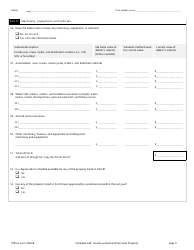

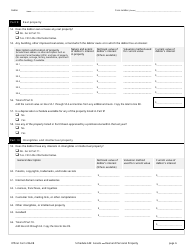

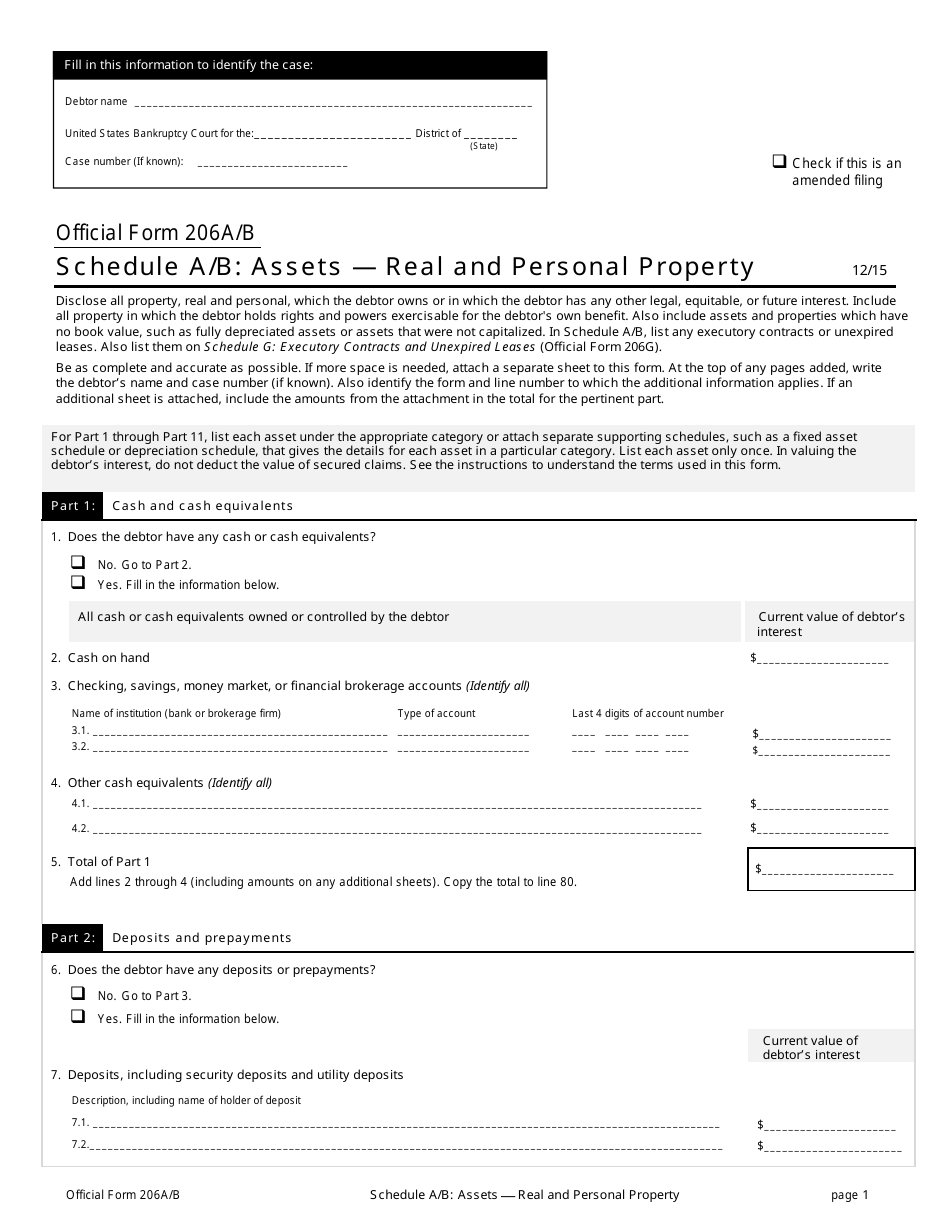

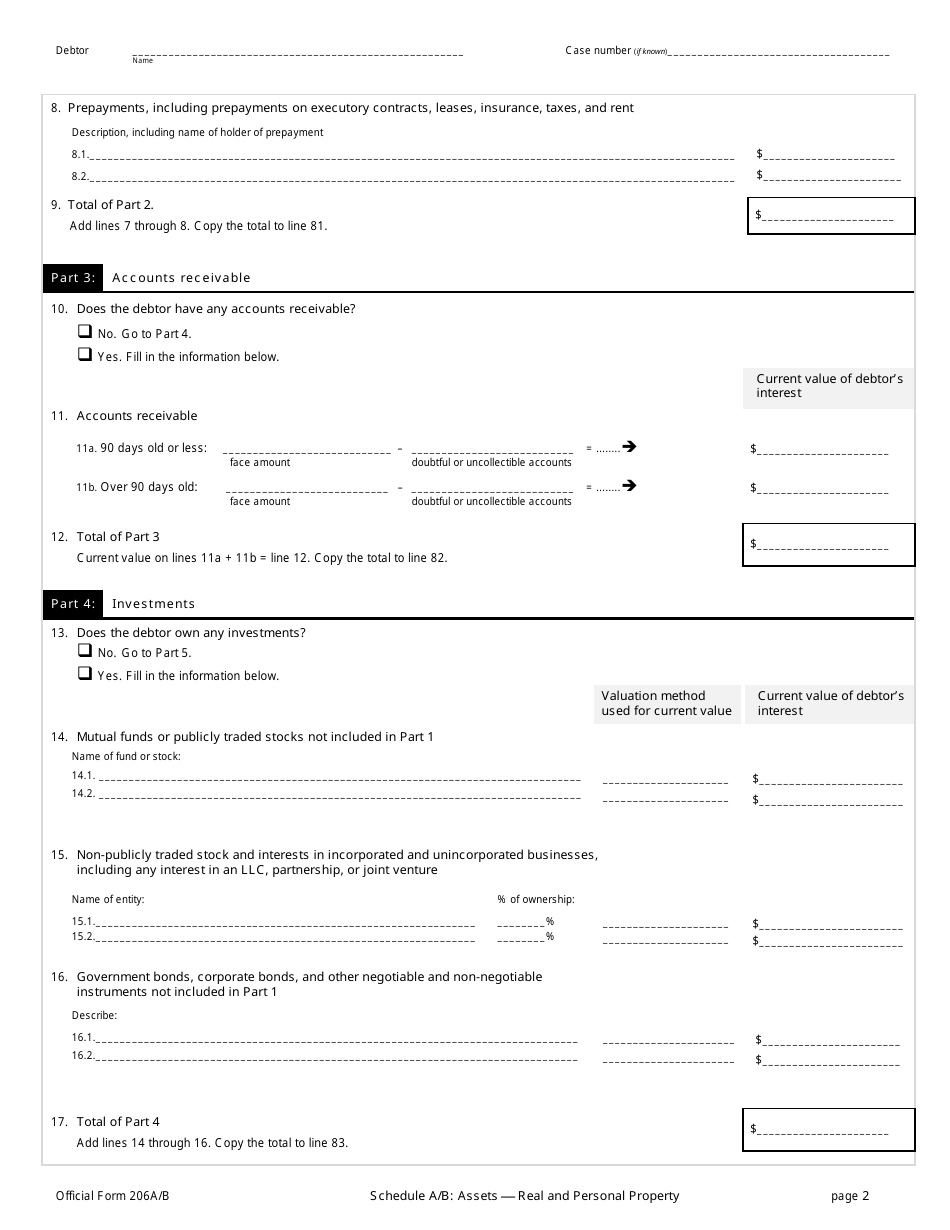

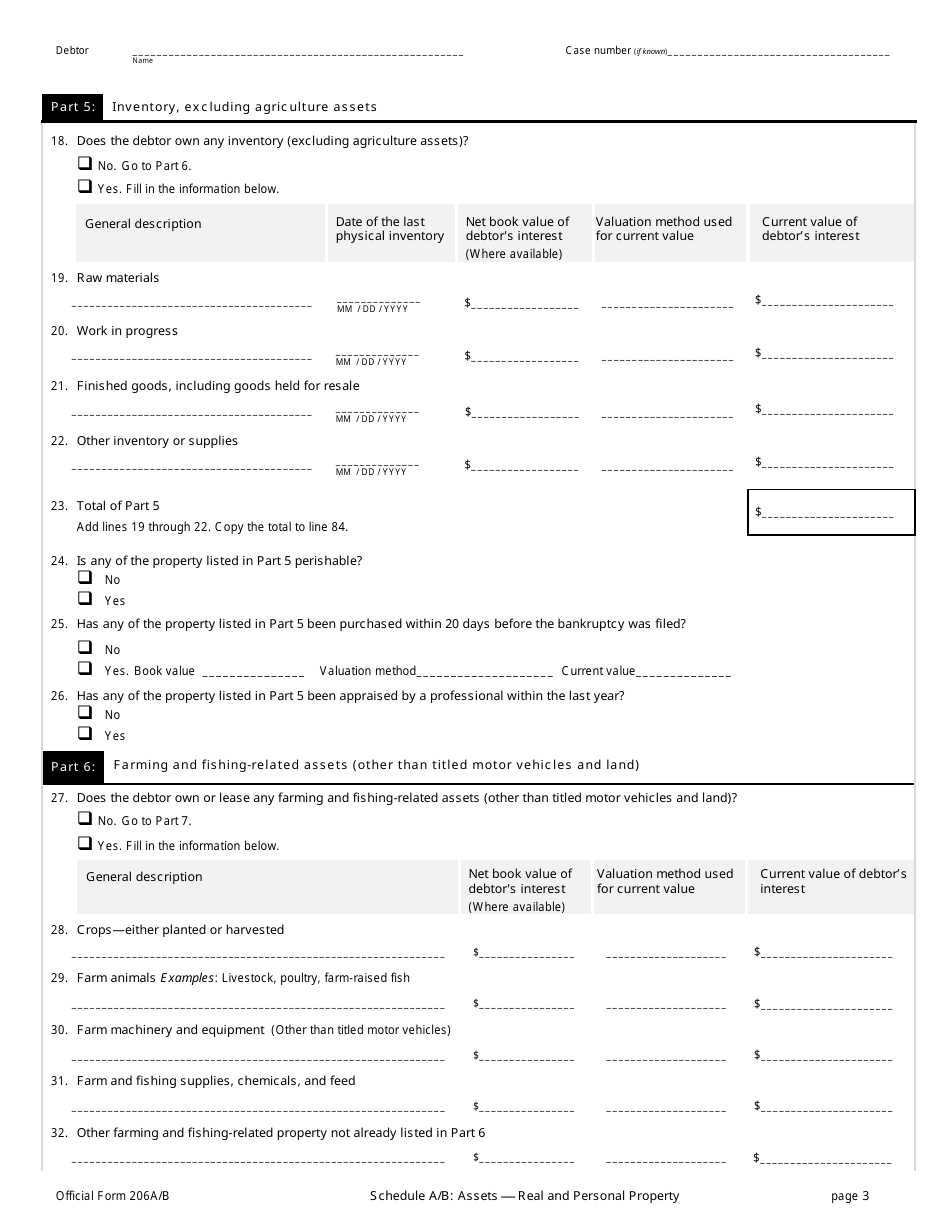

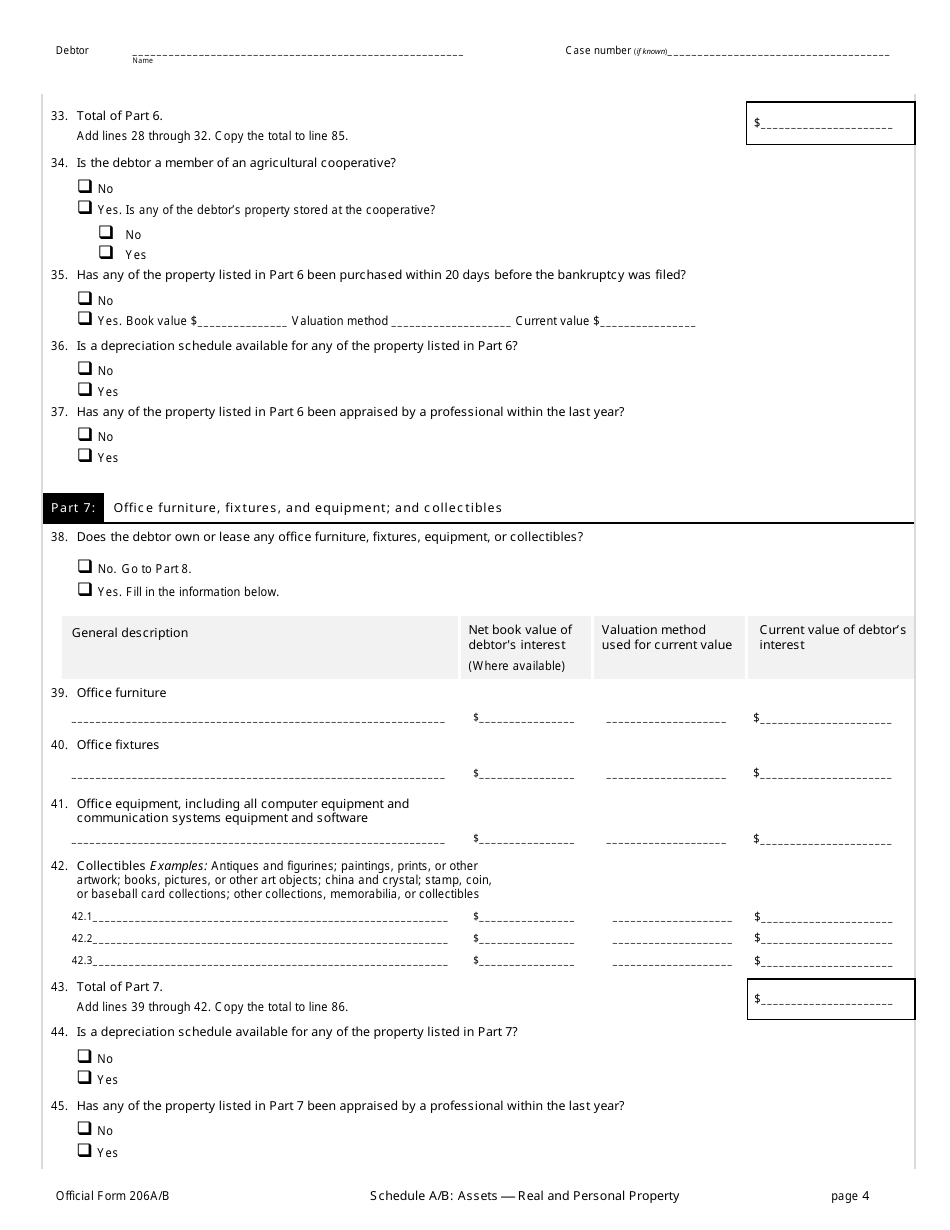

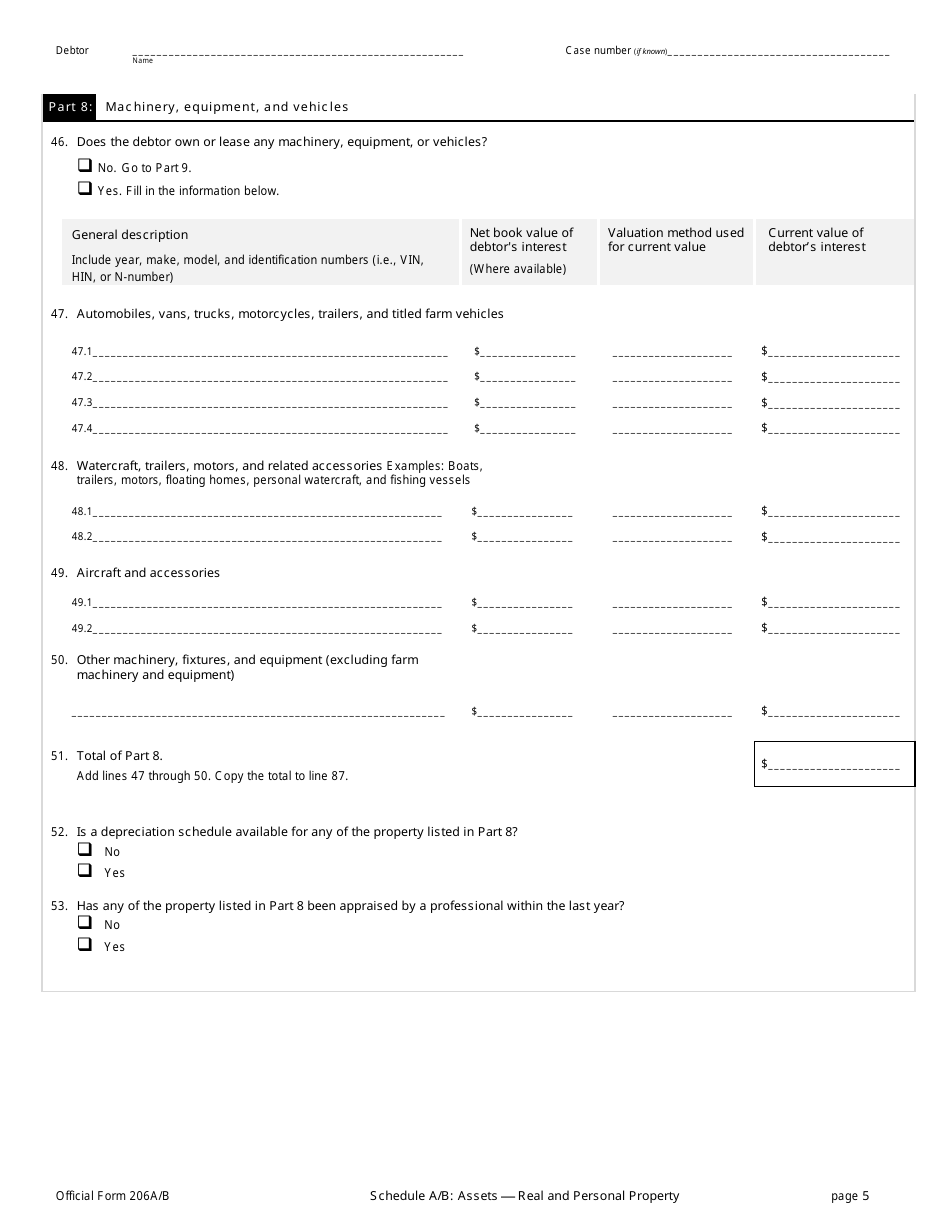

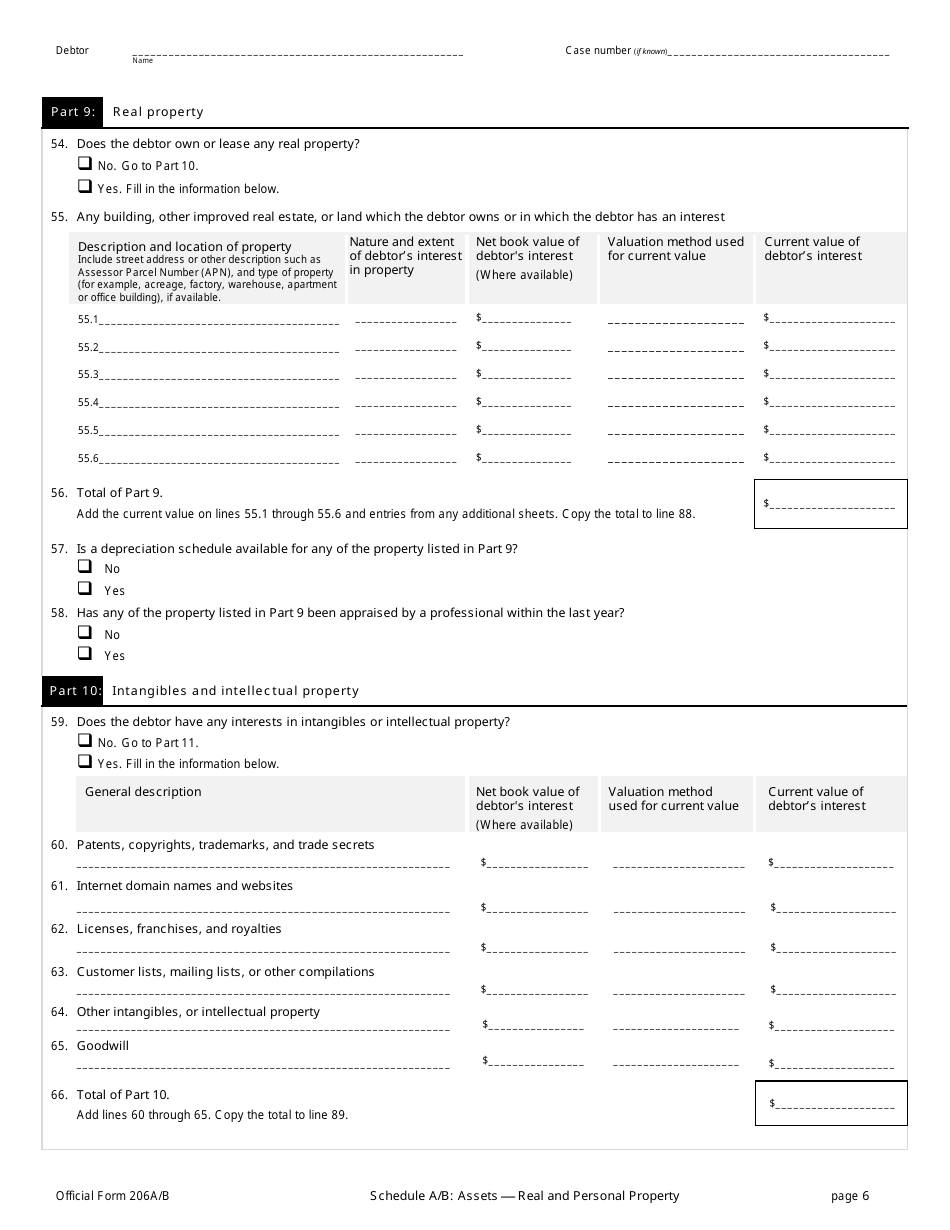

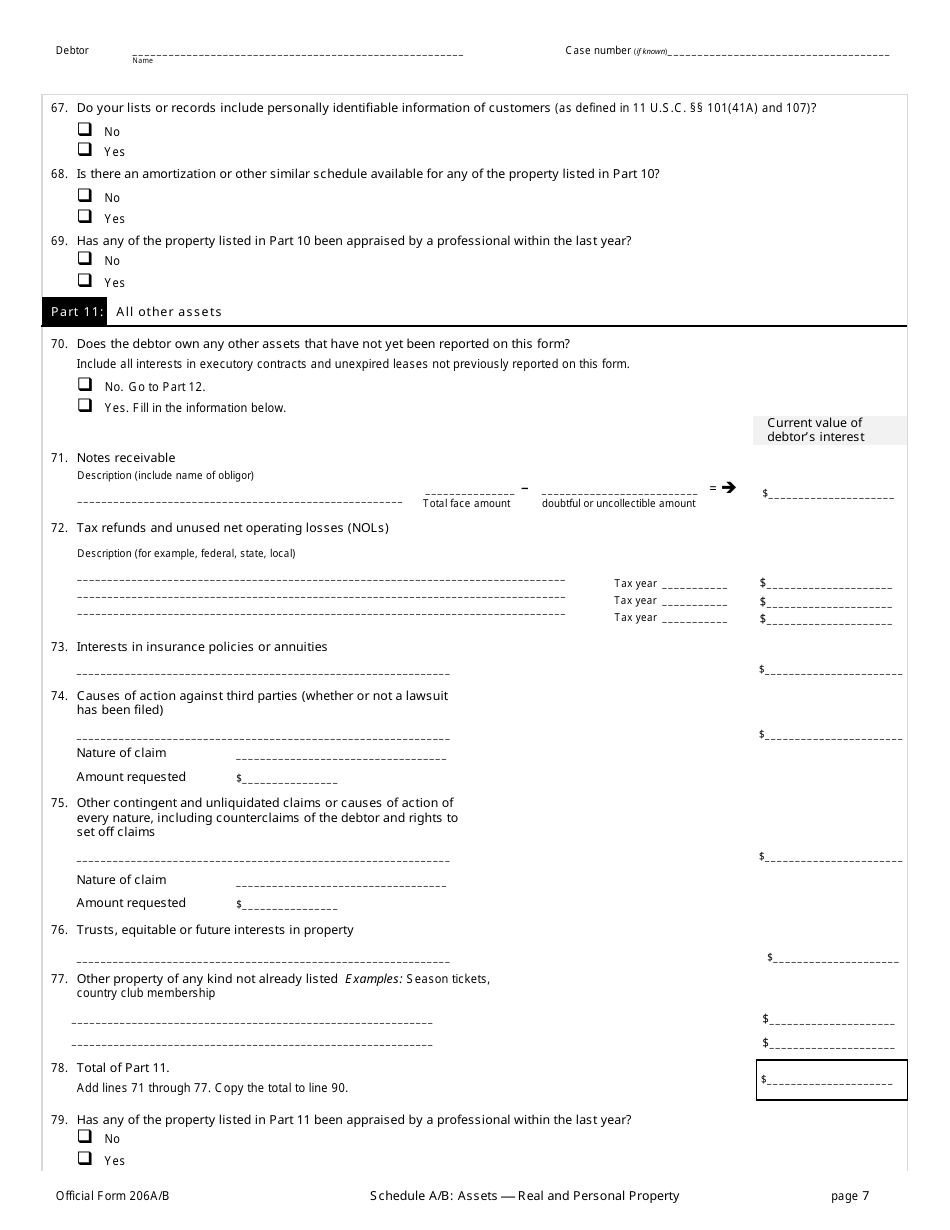

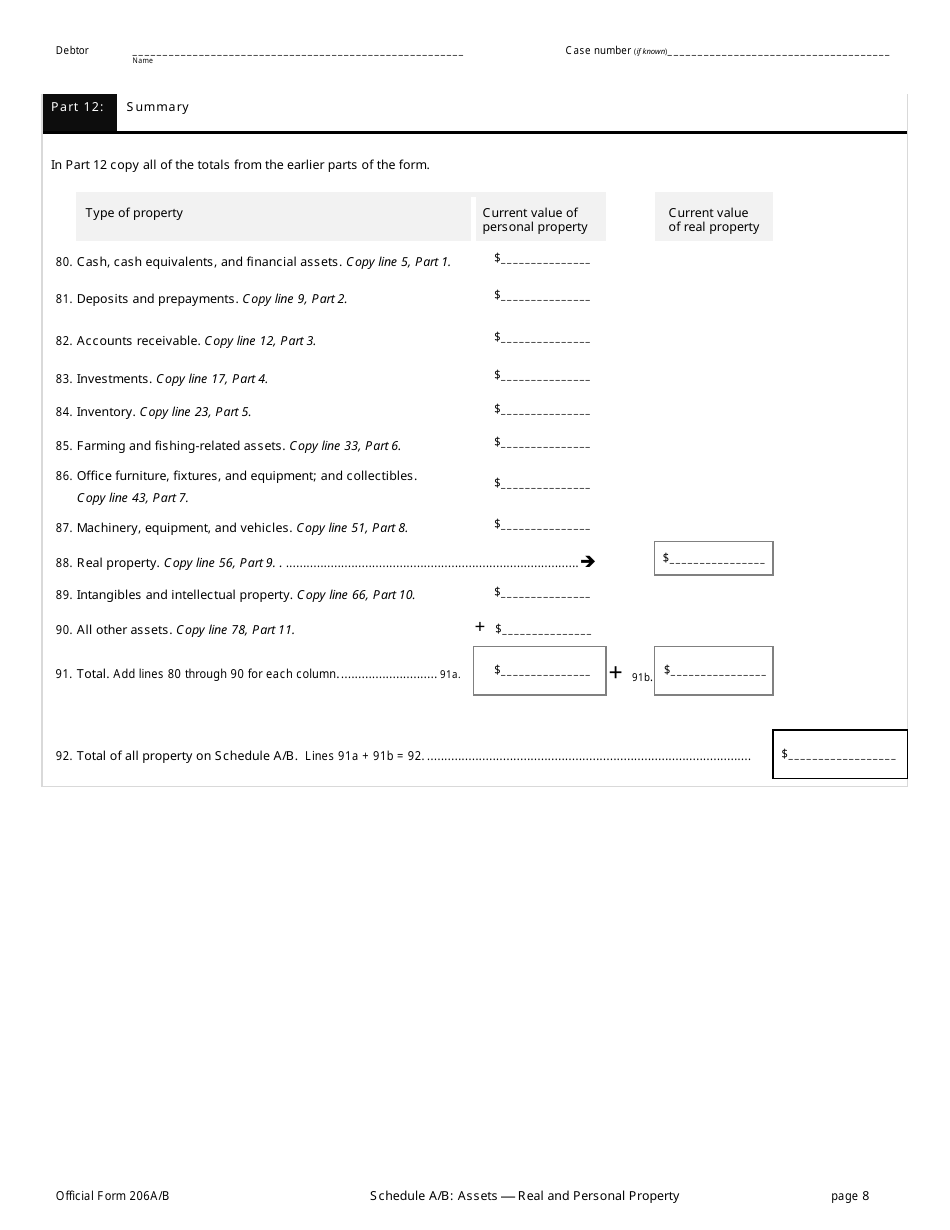

Official Form 206A / B Schedule A / B Assets - Real and Personal Property

What Is Official Form 206A/B Schedule A/B?

This is a legal form that was released by the United States Bankruptcy Court on December 1, 2015 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 206A/B?

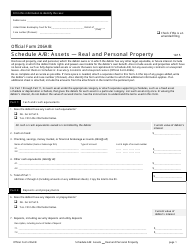

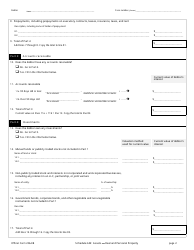

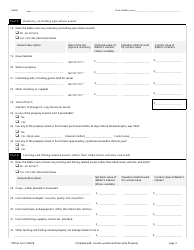

A: Form 206A/B is an official document for reporting your real and personal property assets.

Q: What is Schedule A?

A: Schedule A is a section of Form 206A/B where you provide details of your real property assets.

Q: What is Schedule B?

A: Schedule B is a section of Form 206A/B where you provide details of your personal property assets.

Q: What is considered real property?

A: Real property refers to land and any permanent structures built on it, such as houses or buildings.

Q: What is considered personal property?

A: Personal property refers to any movable possessions that you own, such as vehicles, furniture, or jewelry.

Q: Why do I need to fill out Form 206A/B?

A: You need to fill out Form 206A/B to report your assets accurately for legal purposes, such as bankruptcy filings or estate planning.

Q: Do I need to file Form 206A/B every year?

A: The filing requirements for Form 206A/B may vary depending on your specific situation. It is best to consult a tax professional or refer to the official guidelines.

Q: What should I do if I have questions about filling out Form 206A/B?

A: If you have questions or need assistance with Form 206A/B, it is advisable to seek help from a tax professional or contact the relevant government agency.

Q: Is it mandatory to fill out Form 206A/B?

A: The requirement to fill out Form 206A/B may depend on various factors, such as your jurisdiction and specific circumstances. Consult a tax professional or refer to official guidelines to determine your obligation.

Form Details:

- Released on December 1, 2015;

- The latest available edition released by the United States Bankruptcy Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Official Form 206A/B Schedule A/B by clicking the link below or browse more documents and templates provided by the United States Bankruptcy Court.