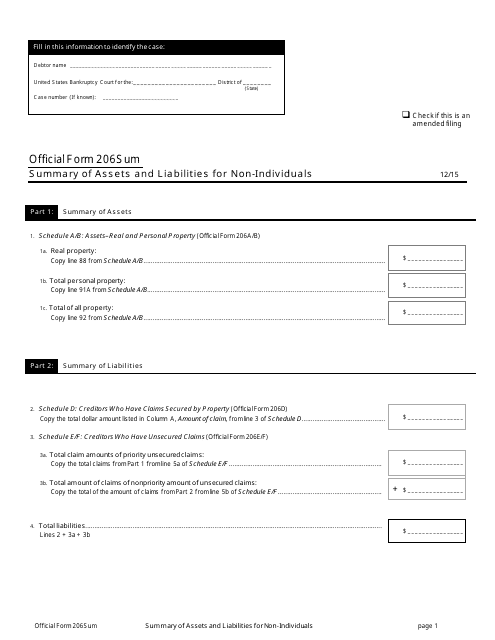

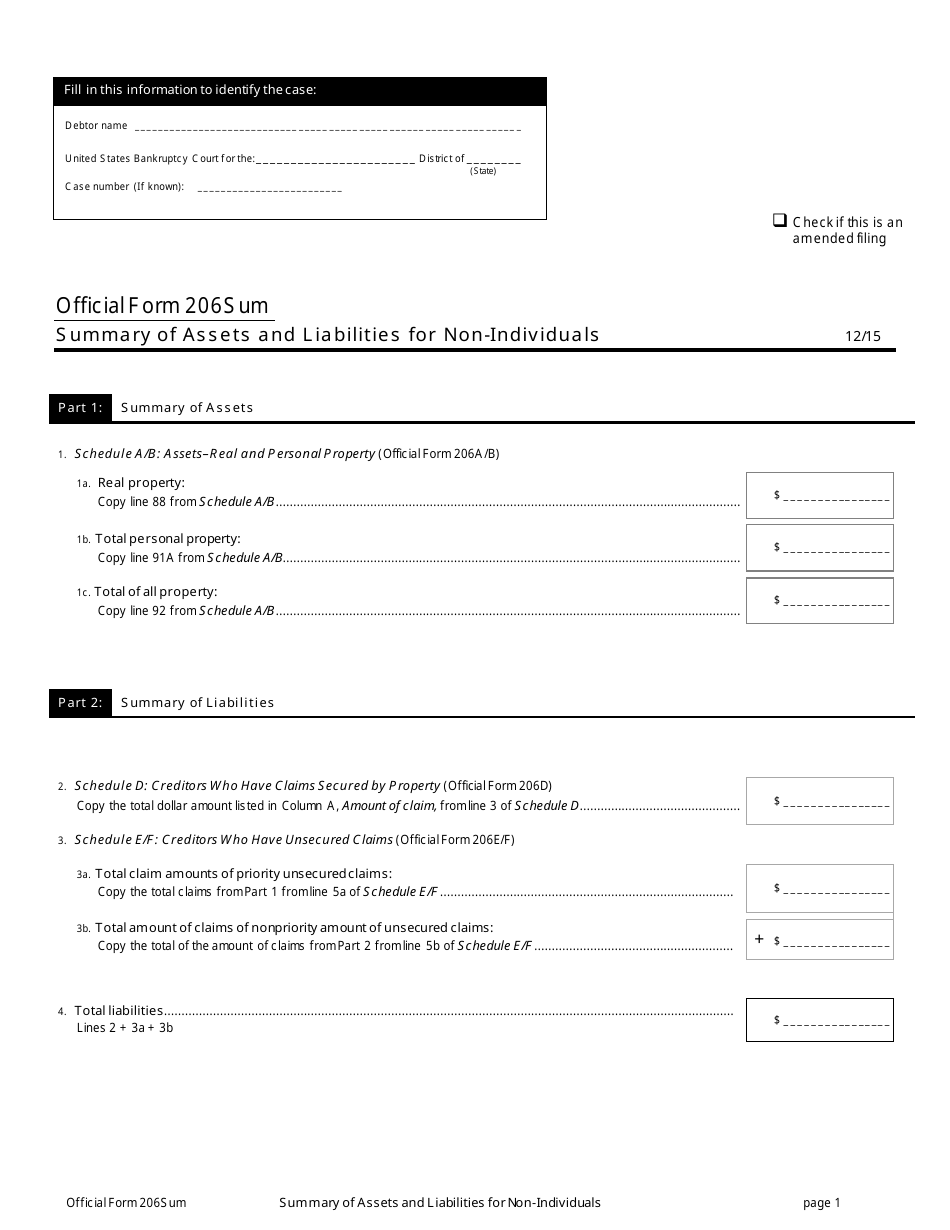

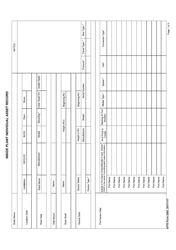

Official Form 206SUM Summary of Assets and Liabilities for Non-individuals

What Is Official Form 206SUM?

This is a legal form that was released by the United States Bankruptcy Court on December 1, 2015 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Official Form 206SUM?

A: Official Form 206SUM is a Summary of Assets and Liabilities for Non-individuals.

Q: Who needs to use Official Form 206SUM?

A: Non-individuals, such as corporations or partnerships, need to use Official Form 206SUM.

Q: What does Official Form 206SUM summarize?

A: Official Form 206SUM summarizes the assets and liabilities of non-individual entities.

Q: Why is Official Form 206SUM important?

A: Official Form 206SUM is important for accurately reporting the financial status of non-individual entities.

Q: Is Official Form 206SUM required by law?

A: The requirement to file Official Form 206SUM may vary depending on the jurisdiction and legal requirements.

Q: Can individuals use Official Form 206SUM?

A: No, Official Form 206SUM is specifically for non-individual entities and cannot be used by individuals.

Q: What information should be included in Official Form 206SUM?

A: Official Form 206SUM should include a comprehensive list of assets and liabilities, including their respective values.

Q: Are there any deadlines for filing Official Form 206SUM?

A: Deadlines for filing Official Form 206SUM may vary depending on the jurisdiction and legal requirements.

Q: Is the information on Official Form 206SUM confidential?

A: The confidentiality of information on Official Form 206SUM may vary depending on the jurisdiction and legal requirements.

Form Details:

- Released on December 1, 2015;

- The latest available edition released by the United States Bankruptcy Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Official Form 206SUM by clicking the link below or browse more documents and templates provided by the United States Bankruptcy Court.