This version of the form is not currently in use and is provided for reference only. Download this version of

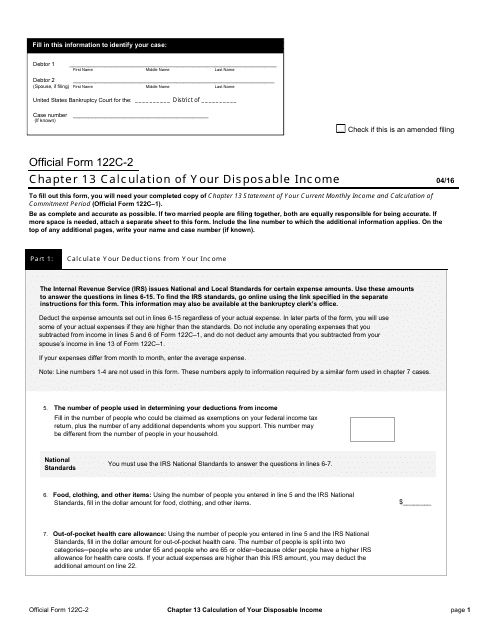

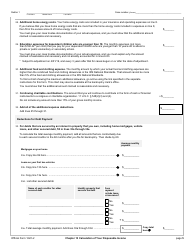

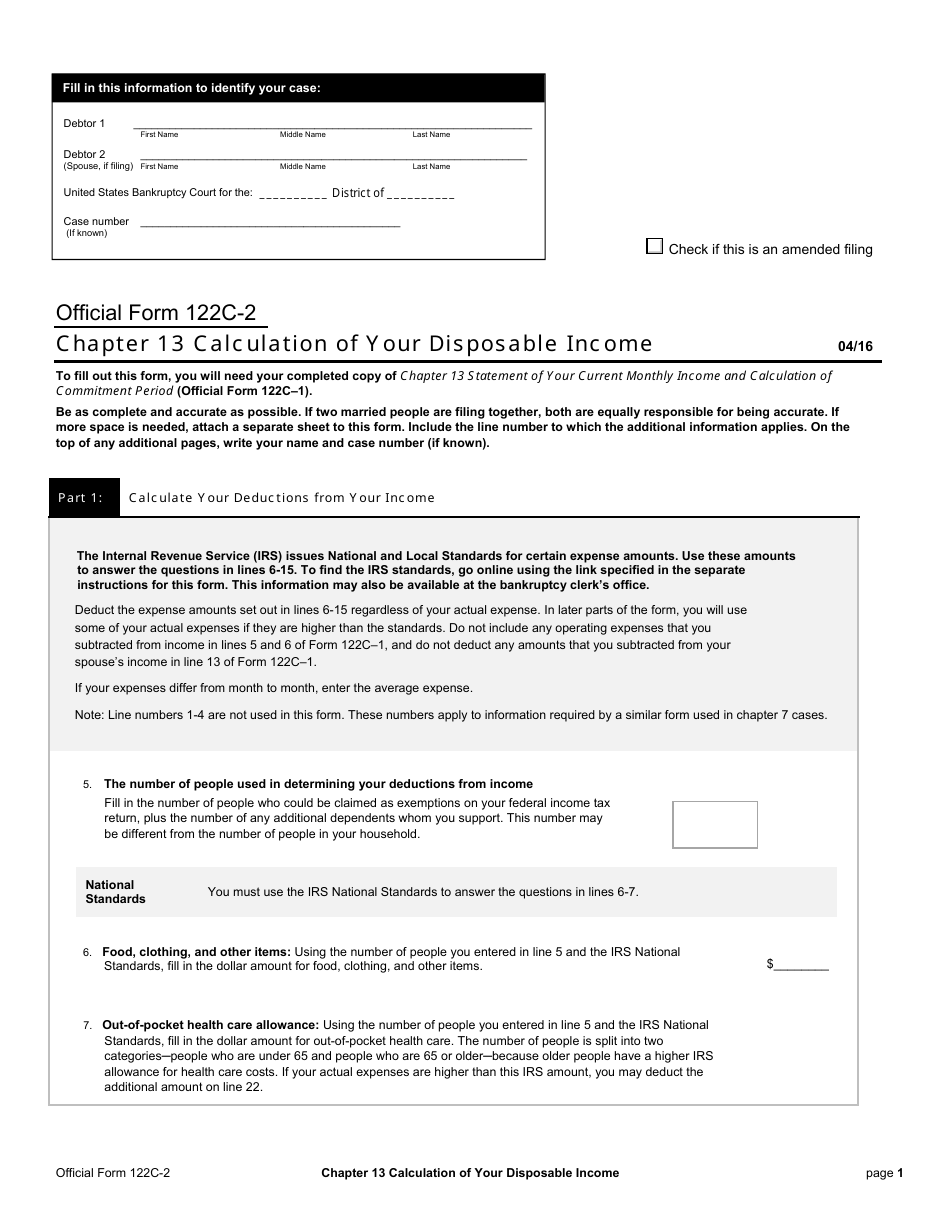

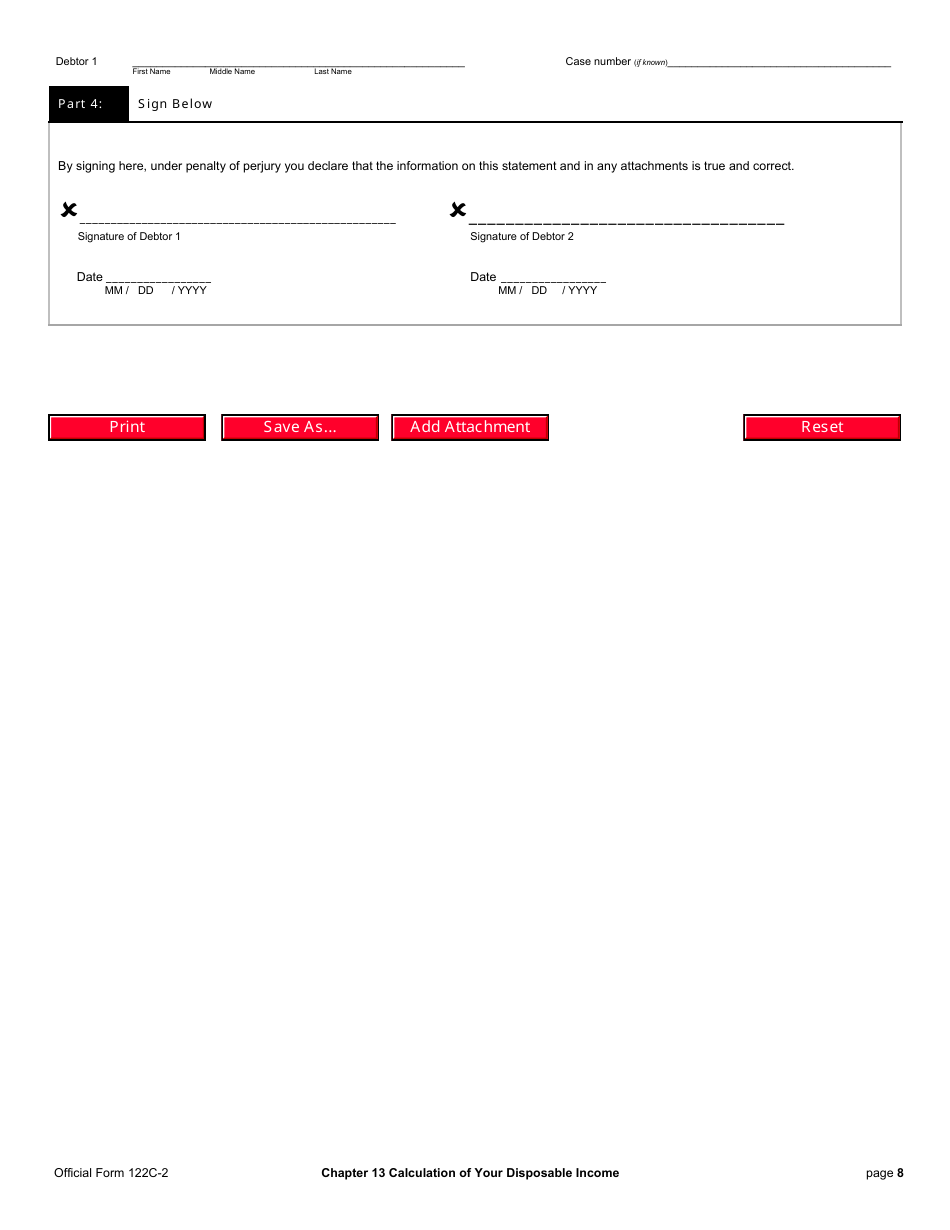

Official Form 122C-2

for the current year.

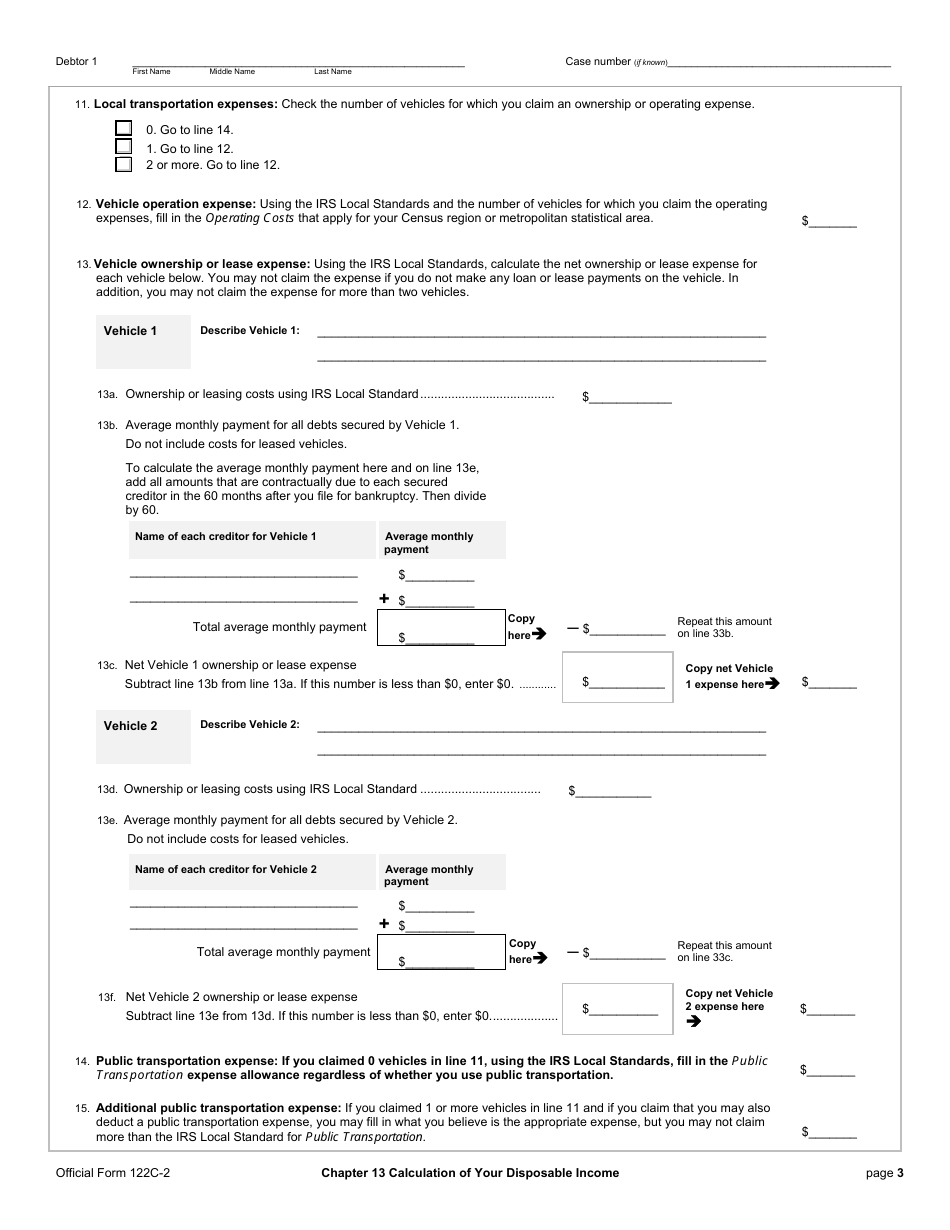

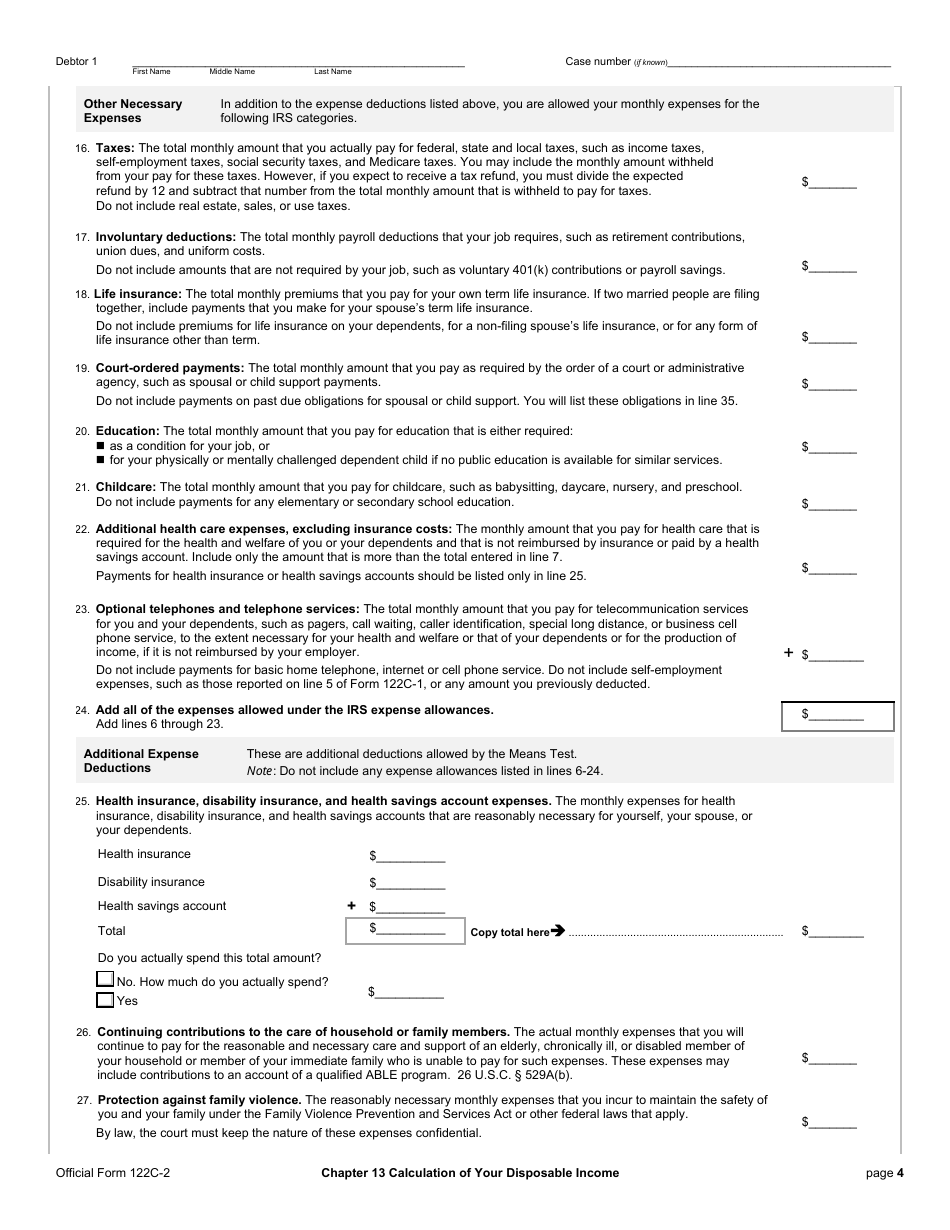

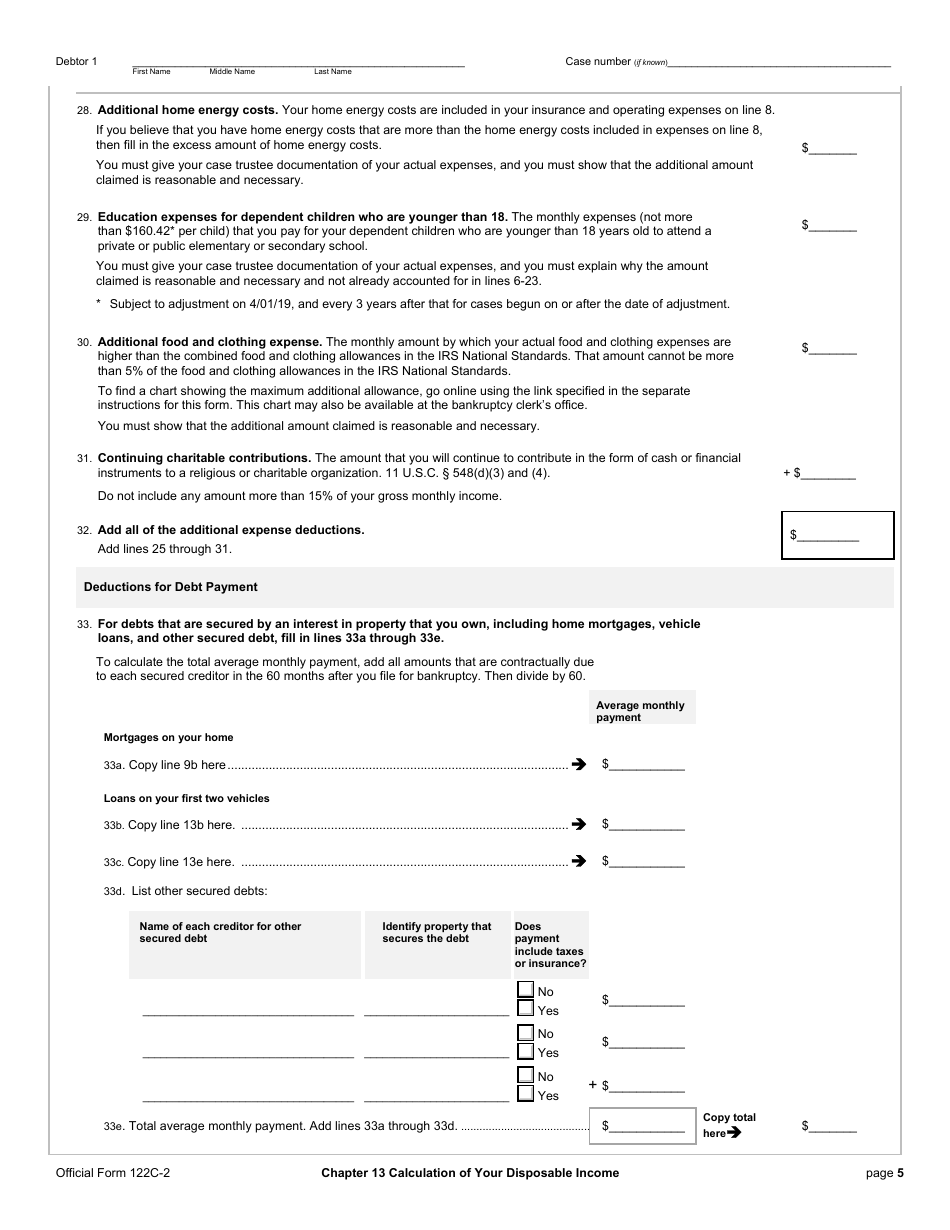

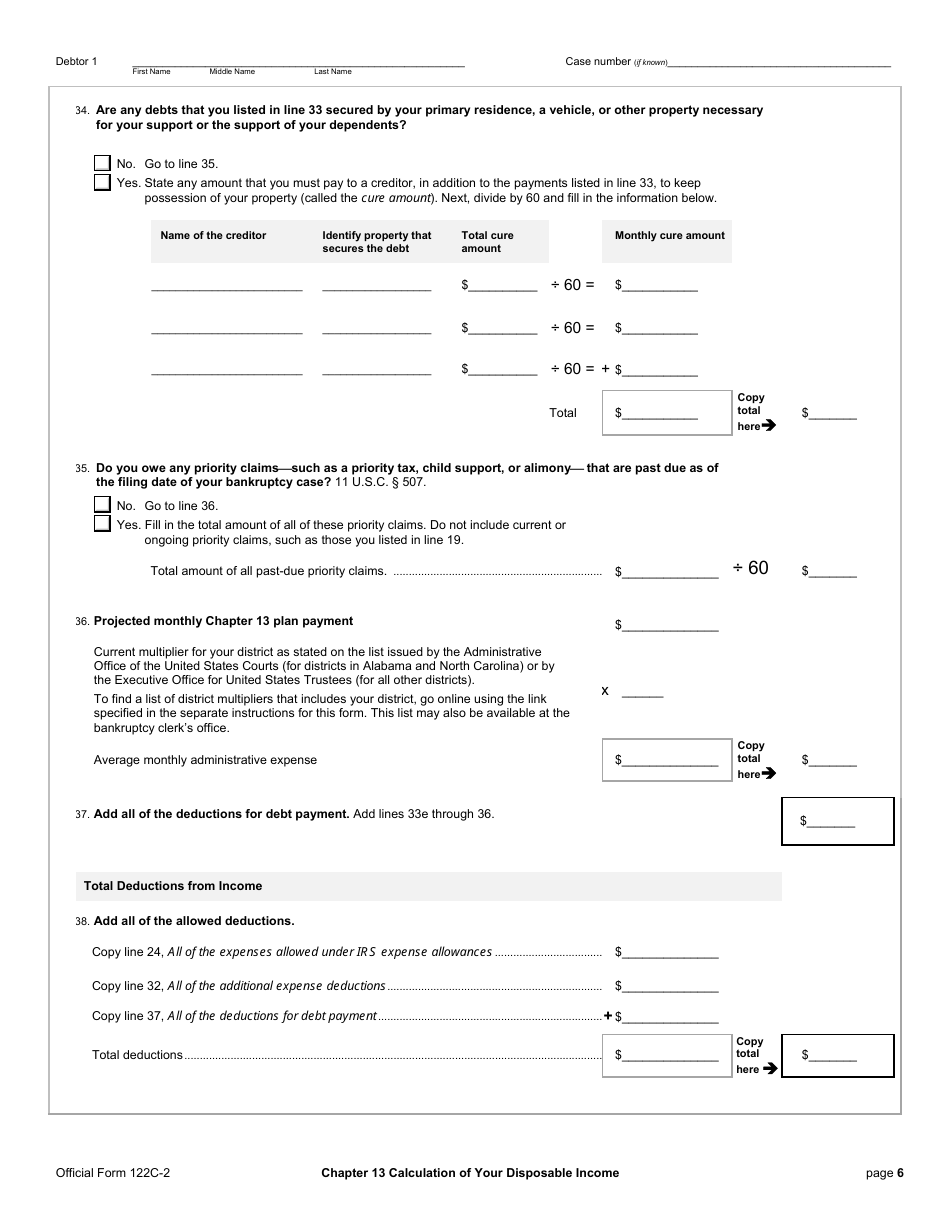

Official Form 122C-2 Chapter 13 Calculation of Your Disposable Income

What Is Official Form 122C-2?

This is a legal form that was released by the United States Bankruptcy Court on April 1, 2016 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 122C-2?

A: Form 122C-2 is an official form used in Chapter 13 bankruptcy cases.

Q: What does Chapter 13 bankruptcy involve?

A: Chapter 13 bankruptcy involves creating a plan to repay a portion of your debts over a period of time.

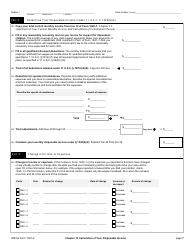

Q: What is disposable income?

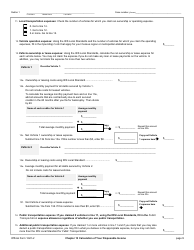

A: Disposable income is the amount of money left over after deducting necessary living expenses from your income.

Q: What is the purpose of Form 122C-2?

A: Form 122C-2 is used to calculate your disposable income, which determines the amount you must repay in a Chapter 13 bankruptcy plan.

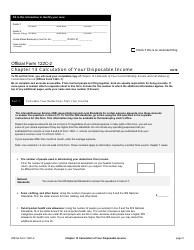

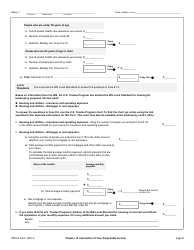

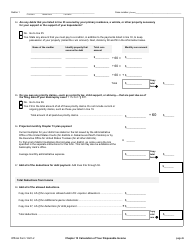

Q: What information is needed to complete Form 122C-2?

A: To complete Form 122C-2, you will need information about your income, expenses, and certain allowed deductions.

Q: What happens after completing Form 122C-2?

A: Once you have completed Form 122C-2, the calculated disposable income will be used to determine the amount of your Chapter 13 bankruptcy plan payments.

Q: Can I file for Chapter 13 bankruptcy without completing Form 122C-2?

A: No, Form 122C-2 is required to calculate your disposable income and determine your Chapter 13 bankruptcy plan payments.

Q: Do I need to consult a bankruptcy attorney to complete Form 122C-2?

A: While not required, consulting a bankruptcy attorney can be helpful in understanding and properly completing Form 122C-2.

Q: Is my disposable income the same as my net income?

A: No, disposable income is calculated by subtracting necessary living expenses from your income, while net income refers to the total amount of income you receive.

Q: Can my disposable income change over time?

A: Yes, your disposable income can change over time due to various factors such as changes in income, expenses, or allowed deductions.

Q: What if I disagree with the disposable income calculation on Form 122C-2?

A: If you disagree with the disposable income calculation on Form 122C-2, you can consult with your bankruptcy attorney or seek guidance from the bankruptcy court.

Form Details:

- Released on April 1, 2016;

- The latest available edition released by the United States Bankruptcy Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Official Form 122C-2 by clicking the link below or browse more documents and templates provided by the United States Bankruptcy Court.