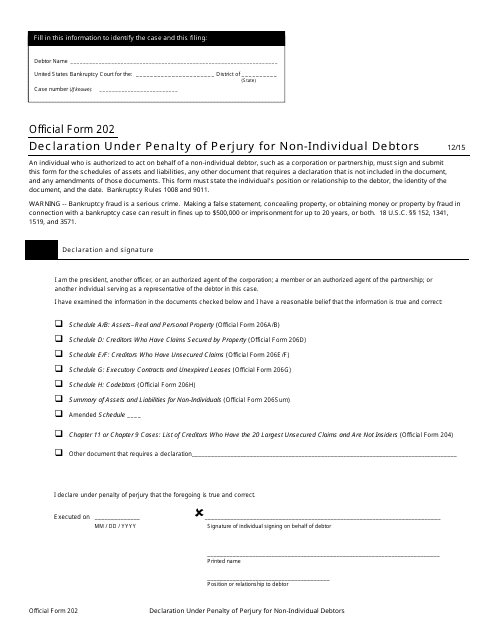

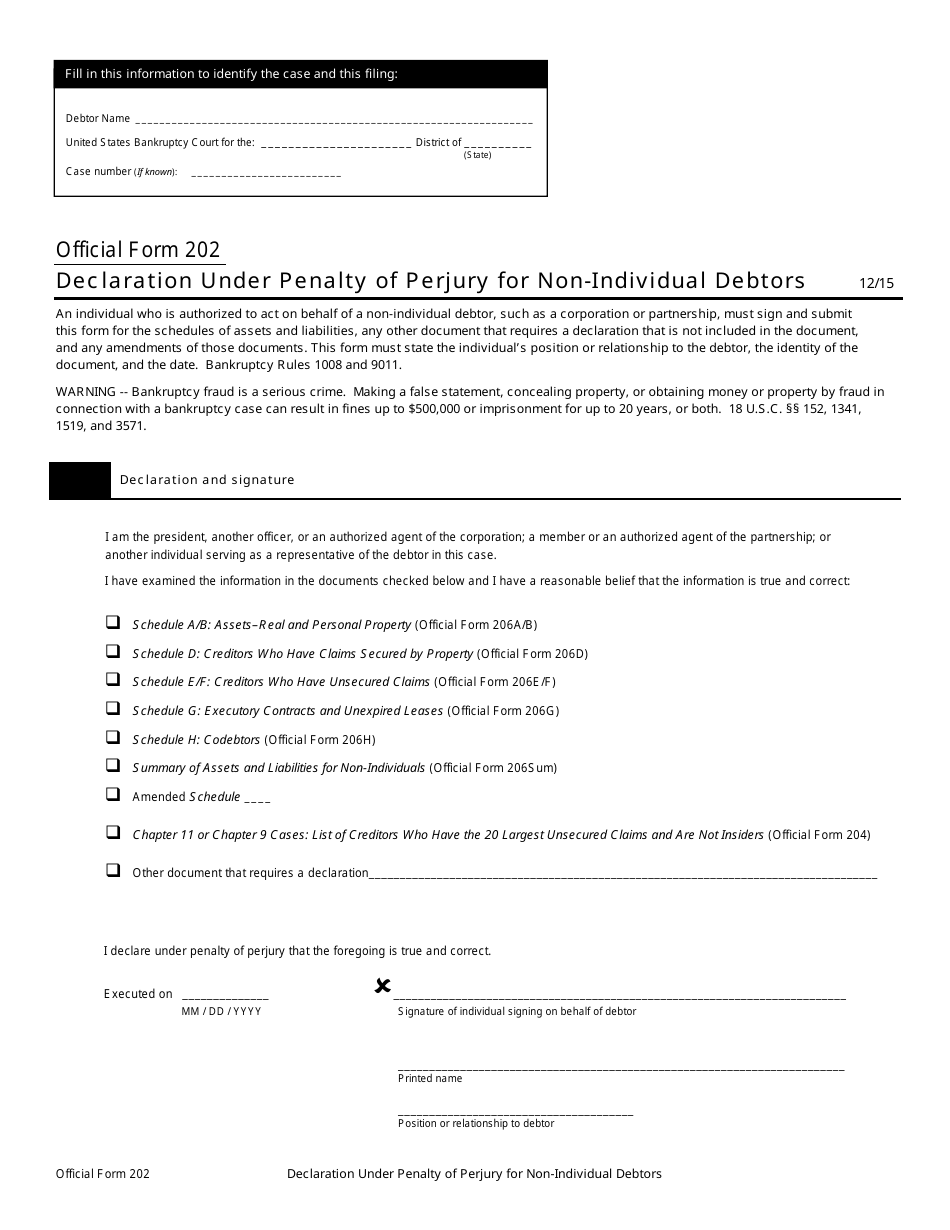

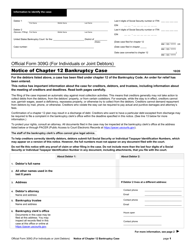

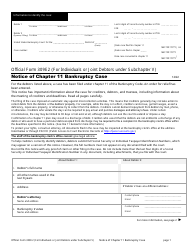

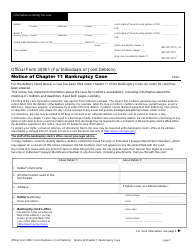

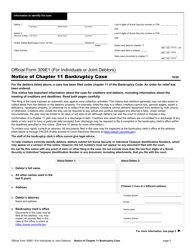

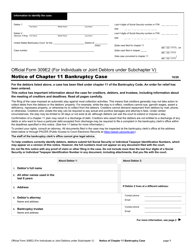

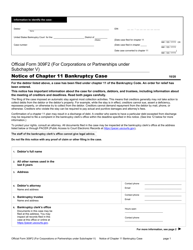

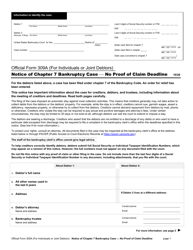

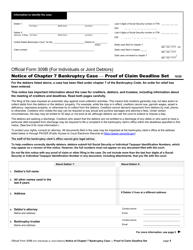

Official Form 202 Declaration Under Penalty of Perjury for Non-individual Debtors

What Is Official Form 202?

This is a legal form that was released by the United States Bankruptcy Court on December 1, 2015 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 202?

A: Form 202 is a declaration form for non-individual debtors.

Q: What is the purpose of Form 202?

A: The purpose of Form 202 is to declare certain information under penalty of perjury.

Q: Who needs to fill out Form 202?

A: Non-individual debtors need to fill out Form 202.

Q: What information needs to be provided on Form 202?

A: Form 202 requires the debtor to provide specific information about their financial situation.

Q: What does 'under penalty of perjury' mean?

A: 'Under penalty of perjury' means that the information provided on the form is true and accurate to the best of the debtor's knowledge.

Q: Are there any consequences for providing false information on Form 202?

A: Yes, providing false information on Form 202 can result in legal consequences.

Q: Can Form 202 be filed electronically?

A: The availability of electronic filing for Form 202 may vary depending on the specific jurisdiction or organization.

Form Details:

- Released on December 1, 2015;

- The latest available edition released by the United States Bankruptcy Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Official Form 202 by clicking the link below or browse more documents and templates provided by the United States Bankruptcy Court.