This version of the form is not currently in use and is provided for reference only. Download this version of

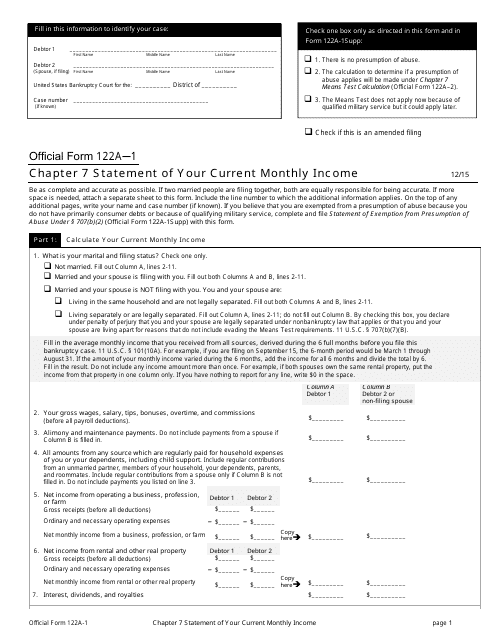

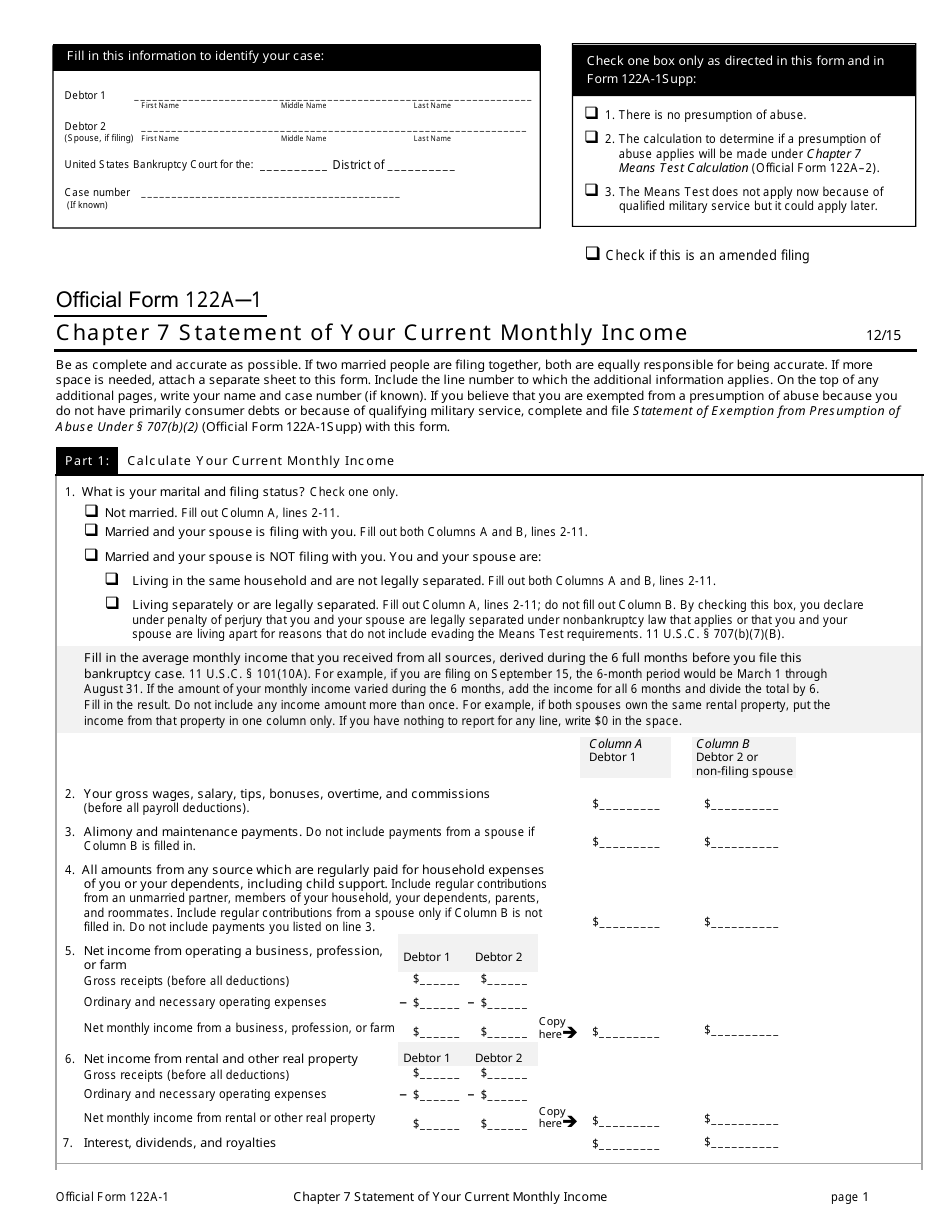

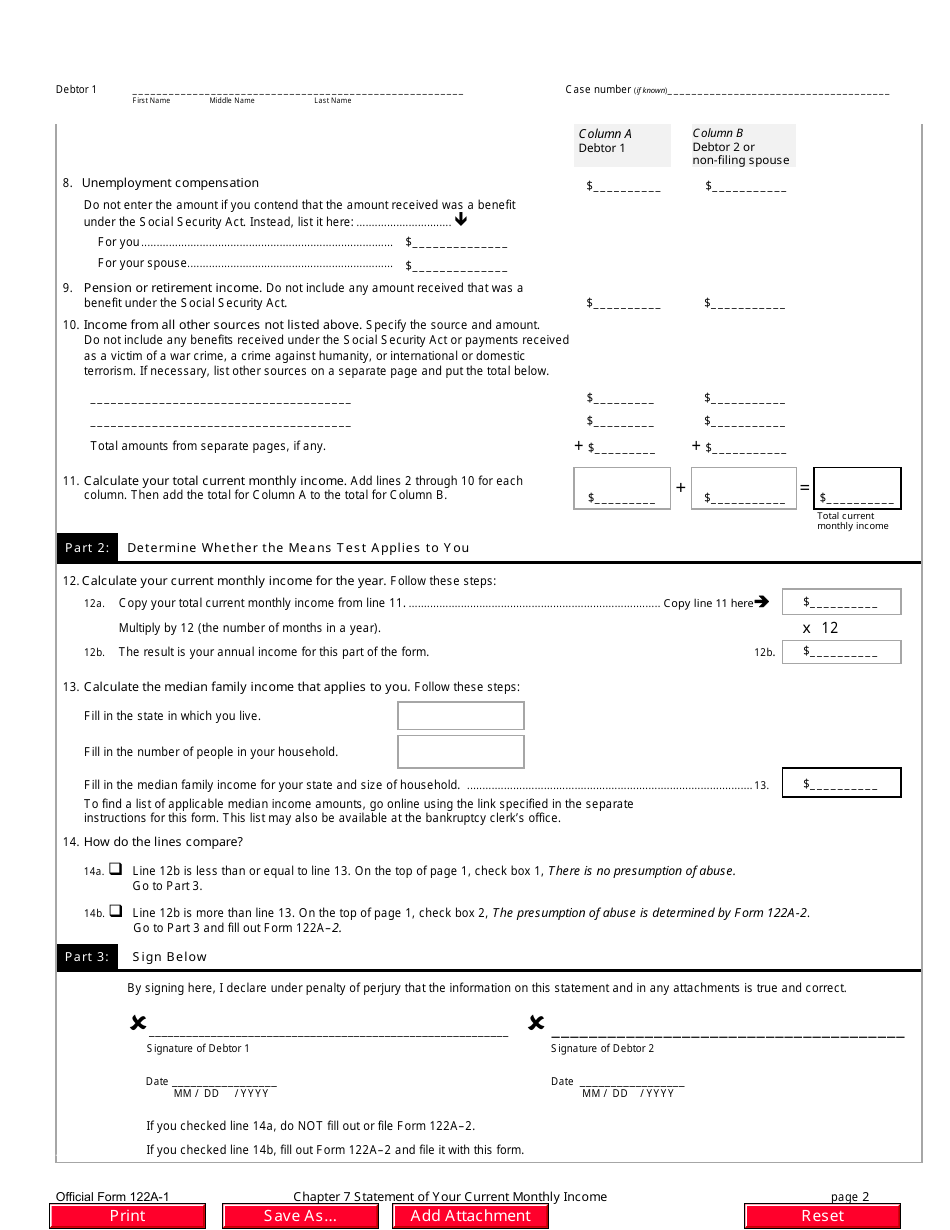

Official Form 122A-1

for the current year.

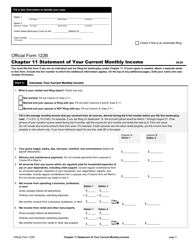

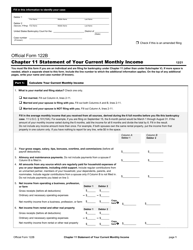

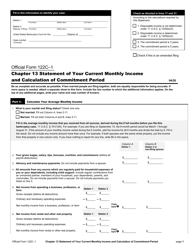

Official Form 122A-1 Chapter 7 Statement of Your Current Monthly Income

What Is Official Form 122A-1?

This is a legal form that was released by the United States Bankruptcy Court on December 1, 2015 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Official Form 122A-1?

A: Official Form 122A-1 is a form used in Chapter 7 bankruptcy cases to disclose your current monthly income.

Q: What is Chapter 7 bankruptcy?

A: Chapter 7 bankruptcy is a type of bankruptcy that allows individuals to wipe out their eligible debt and get a fresh start.

Q: What does the Official Form 122A-1 require?

A: The Official Form 122A-1 requires you to provide information about your income, expenses, and debt.

Q: Why do I need to disclose my current monthly income?

A: Disclosing your current monthly income is necessary to determine whether you qualify for Chapter 7 bankruptcy and to calculate your disposable income.

Q: What is disposable income?

A: Disposable income is the amount of money you have available to pay your debts after deducting certain allowed expenses.

Q: Can I keep any of my income if I file for Chapter 7 bankruptcy?

A: Yes, you can keep a certain amount of your income for basic living expenses and necessary expenses.

Q: What happens if my current monthly income is above the state median income?

A: If your current monthly income is above the state median income, you may have to complete an additional form called Official Form 122A-2.

Q: What are some examples of allowable expenses?

A: Allowable expenses include housing, transportation, food, and health care expenses.

Q: Can I include all my debt in a Chapter 7 bankruptcy?

A: Most types of debt can be included in a Chapter 7 bankruptcy, but there are some exceptions, such as certain tax debts and student loans.

Q: Do I need an attorney to file for Chapter 7 bankruptcy?

A: While it is not required to have an attorney, it is recommended to seek legal advice when filing for Chapter 7 bankruptcy to ensure you understand the process and your rights.

Form Details:

- Released on December 1, 2015;

- The latest available edition released by the United States Bankruptcy Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Official Form 122A-1 by clicking the link below or browse more documents and templates provided by the United States Bankruptcy Court.