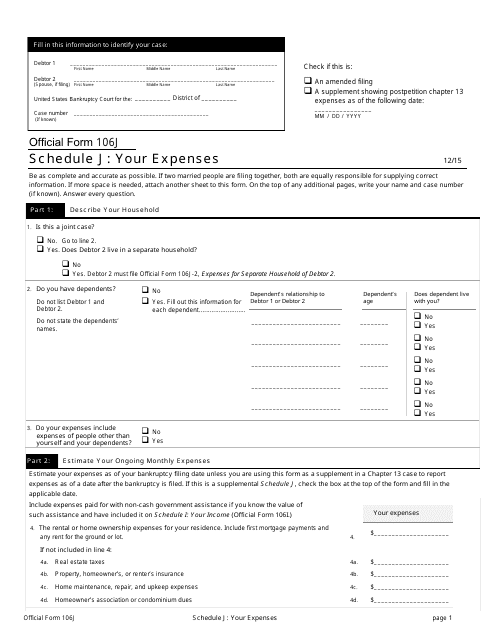

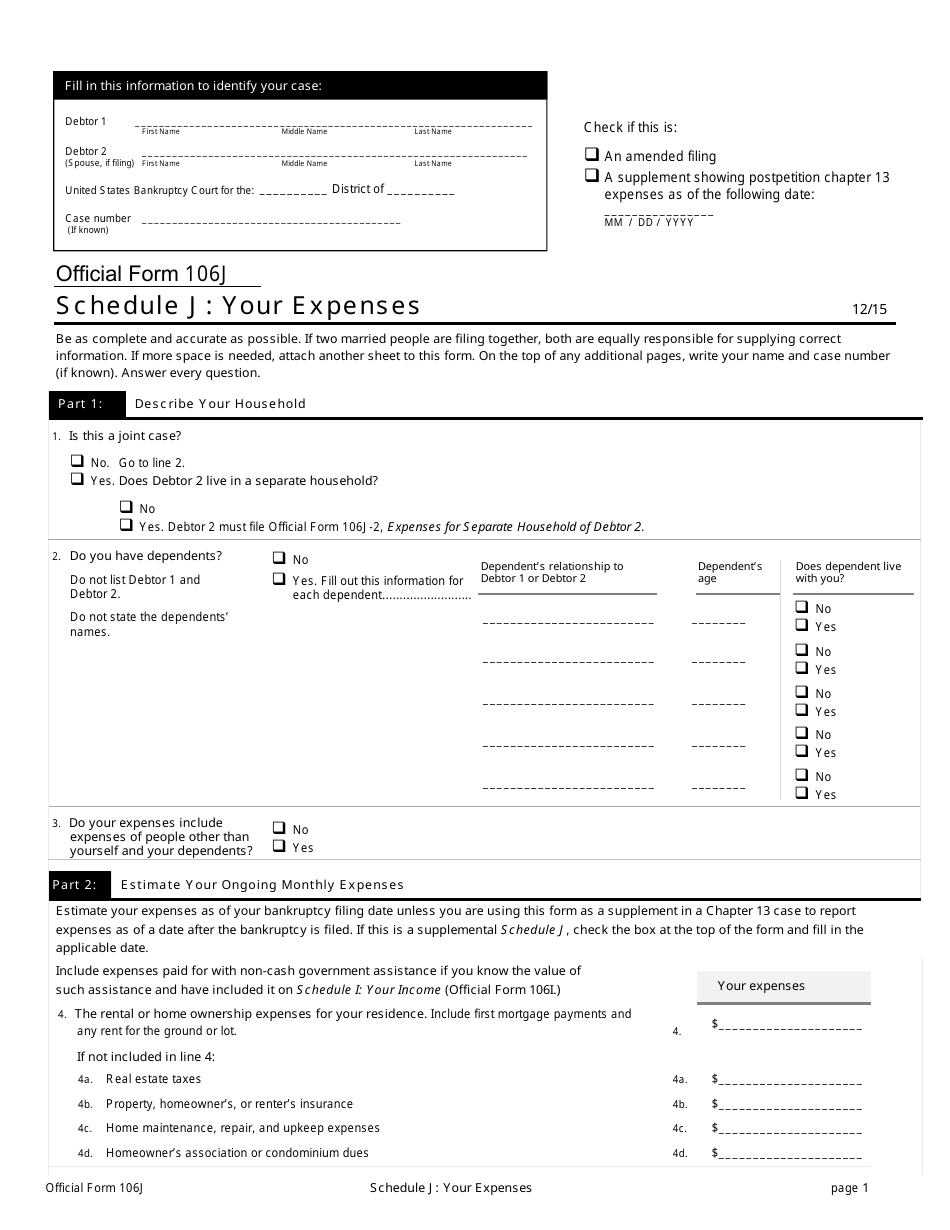

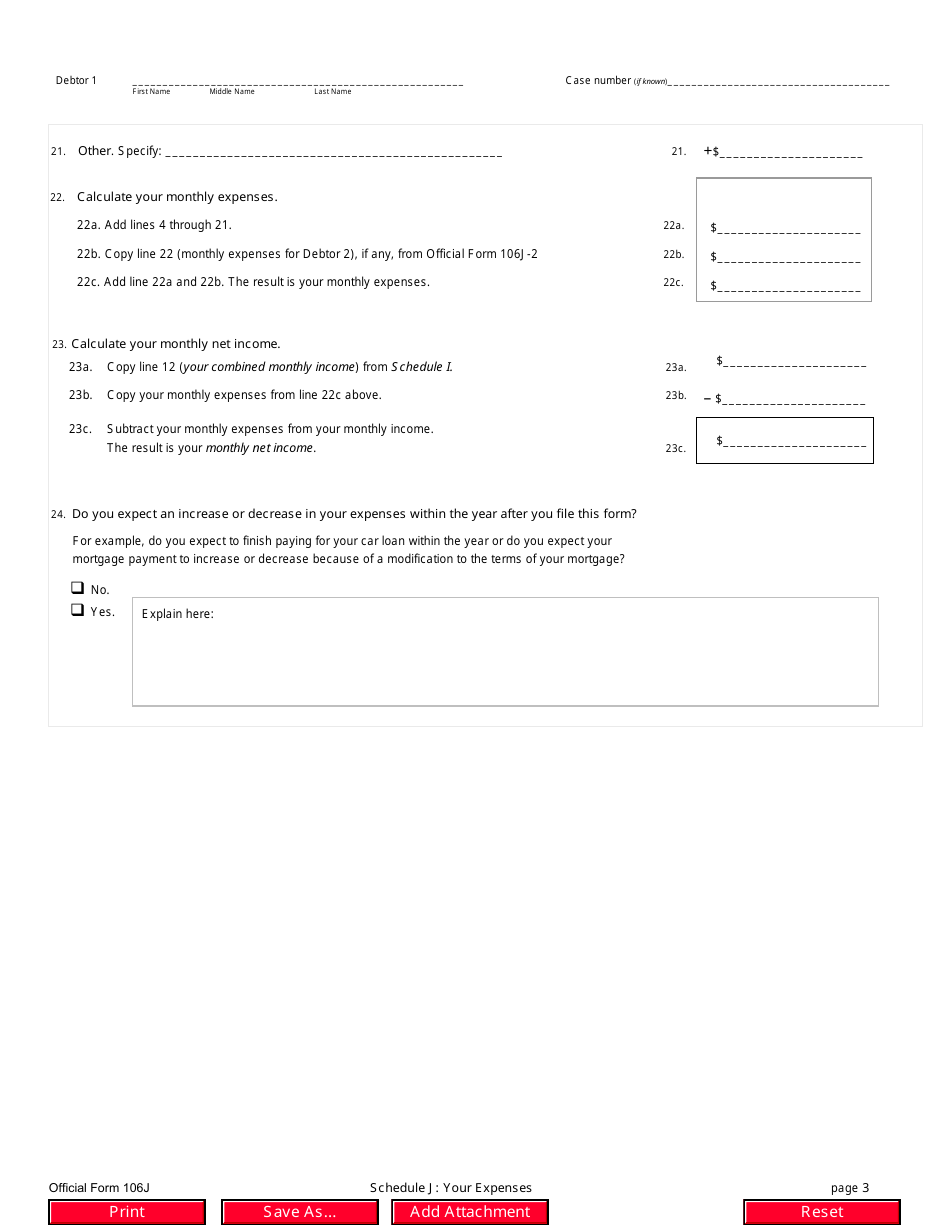

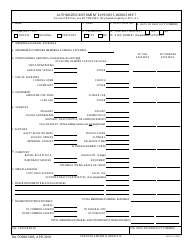

Official Form 106J Schedule J Your Expenses

What Is Official Form 106J Schedule J?

This is a legal form that was released by the United States Bankruptcy Court on December 1, 2015 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 106J Schedule J?

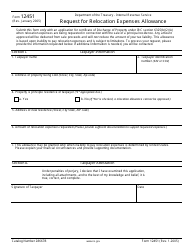

A: Form 106J Schedule J is an official IRS document used to report your expenses.

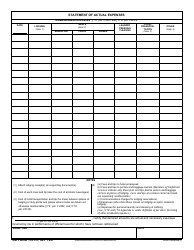

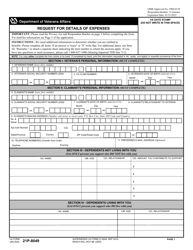

Q: What kind of expenses can be reported on Form 106J Schedule J?

A: Form 106J Schedule J is used to report your personal, living, and family expenses.

Q: Why do I need to report my expenses on Form 106J Schedule J?

A: Reporting your expenses on Form 106J Schedule J helps the IRS determine your ability to pay your tax liabilities.

Q: Do I need to file Form 106J Schedule J with my tax return?

A: Yes, if you are required to file Form 106J Schedule J, you must include it with your tax return.

Q: What happens if I don't report my expenses on Form 106J Schedule J?

A: Failure to report your expenses accurately on Form 106J Schedule J may result in incorrect tax calculations and potential penalties.

Q: Can I deduct all of my expenses on Form 106J Schedule J?

A: No, only certain expenses allowed by the IRS can be deducted on Form 106J Schedule J. Consult IRS guidelines or a tax professional to determine which expenses qualify.

Q: How often do I need to fill out Form 106J Schedule J?

A: You need to fill out Form 106J Schedule J each time you file your tax return, if applicable.

Q: What if I have questions about filling out Form 106J Schedule J?

A: If you have questions or need assistance with filling out Form 106J Schedule J, you can consult a tax professional or contact the IRS for guidance.

Form Details:

- Released on December 1, 2015;

- The latest available edition released by the United States Bankruptcy Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Official Form 106J Schedule J by clicking the link below or browse more documents and templates provided by the United States Bankruptcy Court.