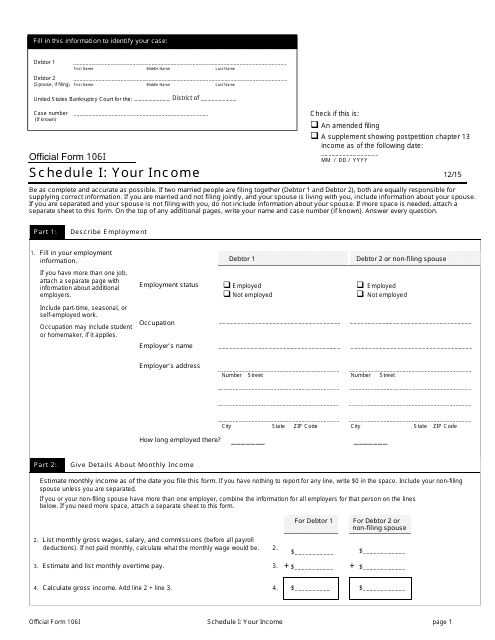

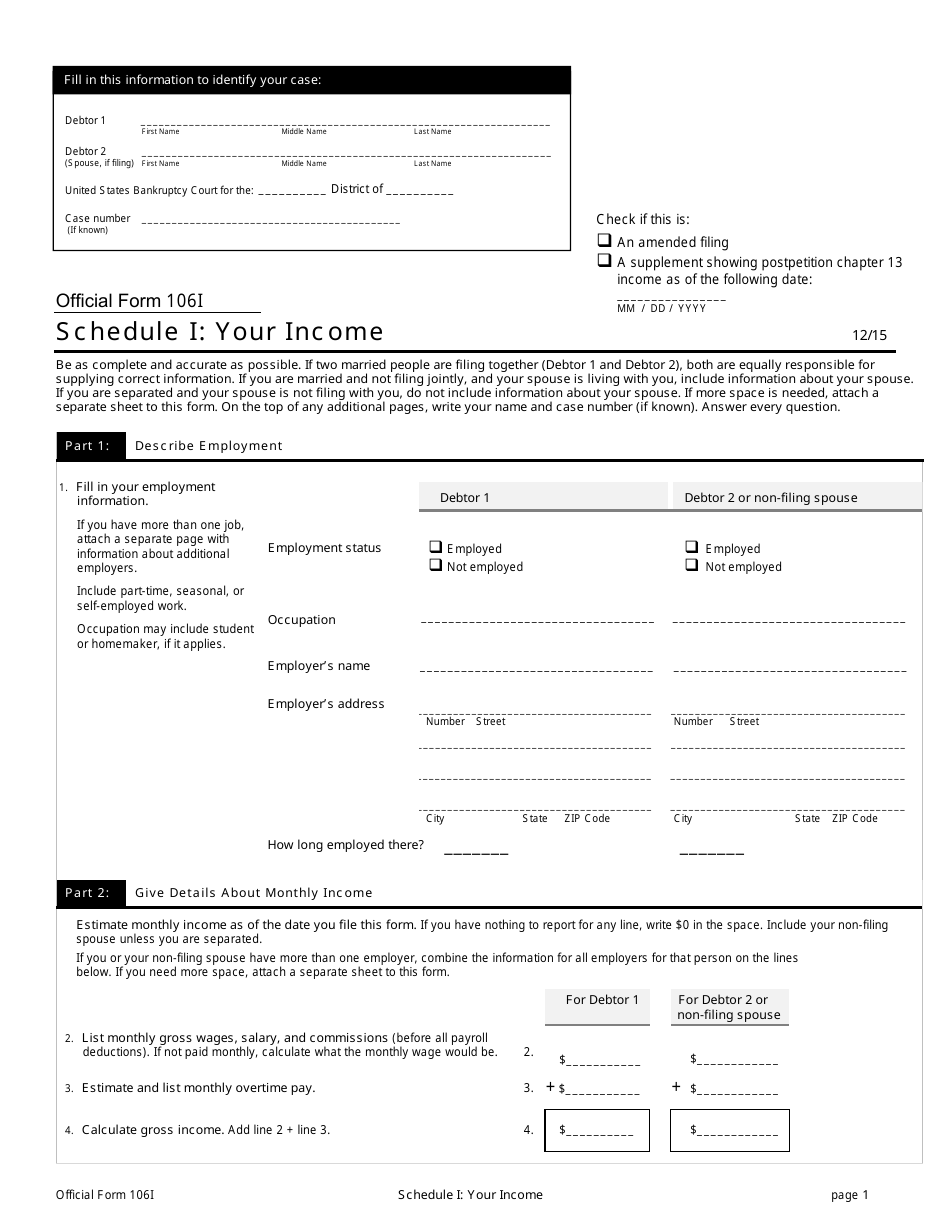

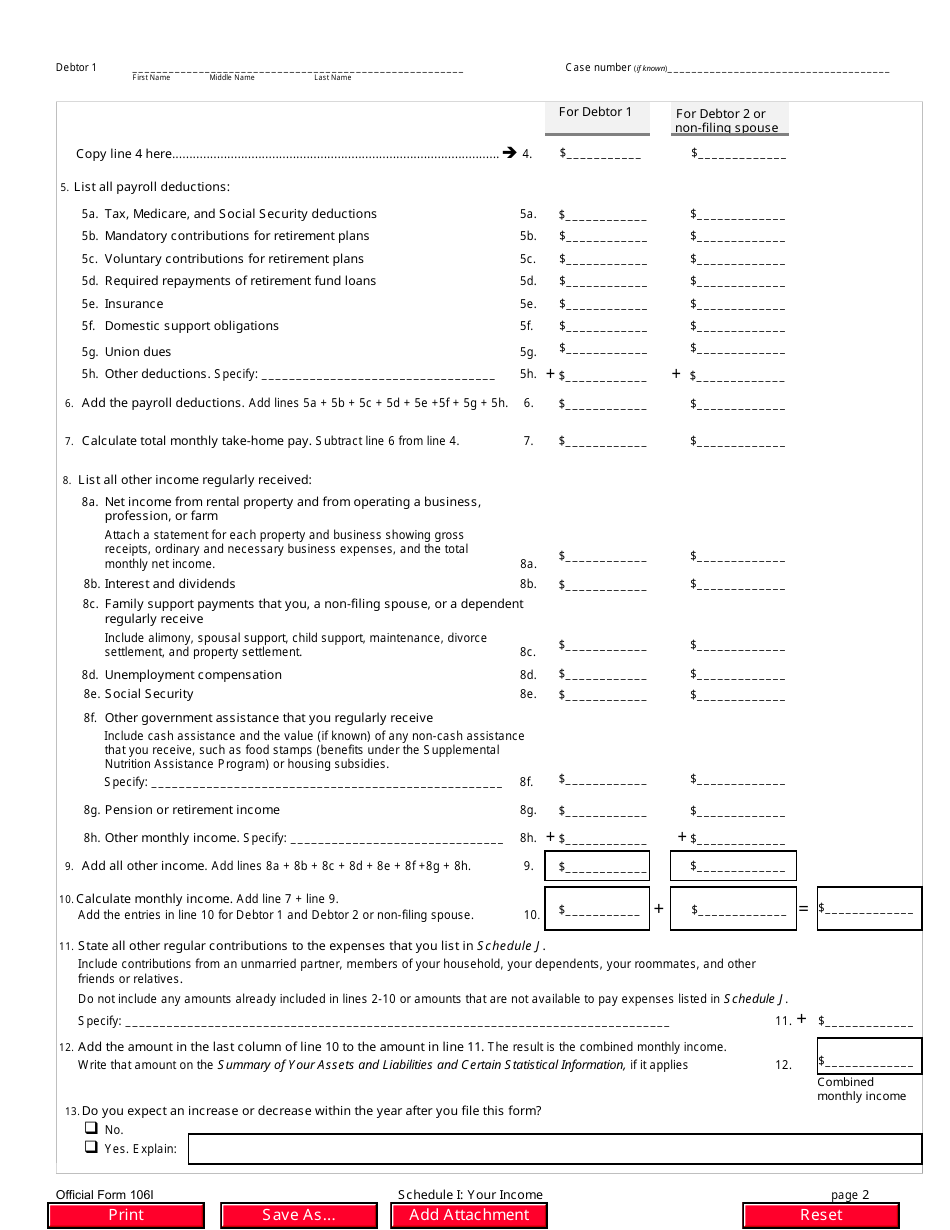

Official Form 106I Schedule I Your Income

What Is Official Form 106I Schedule I?

This is a legal form that was released by the United States Bankruptcy Court on December 1, 2015 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 106I Schedule I?

A: Form 106I Schedule I is an official tax form.

Q: What is the purpose of Form 106I Schedule I?

A: Form 106I Schedule I is used to report your income.

Q: Who needs to file Form 106I Schedule I?

A: Anyone who has income that needs to be reported for tax purposes.

Q: What types of income should be reported on Form 106I Schedule I?

A: All types of income should be reported on Form 106I Schedule I, including wages, self-employment income, rental income, interest income, and more.

Q: When is the deadline for filing Form 106I Schedule I?

A: The deadline for filing Form 106I Schedule I is usually April 15th, but it may be extended in certain circumstances.

Q: What happens if I don't file Form 106I Schedule I?

A: Failure to file Form 106I Schedule I or underreporting your income can result in penalties and interest charges.

Q: Do I need to attach any documents to Form 106I Schedule I?

A: You may need to attach supporting documents, such as W-2 forms or 1099 forms, depending on your sources of income.

Q: Can I e-file Form 106I Schedule I?

A: Yes, you can e-file Form 106I Schedule I if you choose to file your taxes electronically.

Q: Can I file Form 106I Schedule I if I have no income?

A: Yes, you can still file Form 106I Schedule I even if you have no income to report.

Form Details:

- Released on December 1, 2015;

- The latest available edition released by the United States Bankruptcy Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Official Form 106I Schedule I by clicking the link below or browse more documents and templates provided by the United States Bankruptcy Court.