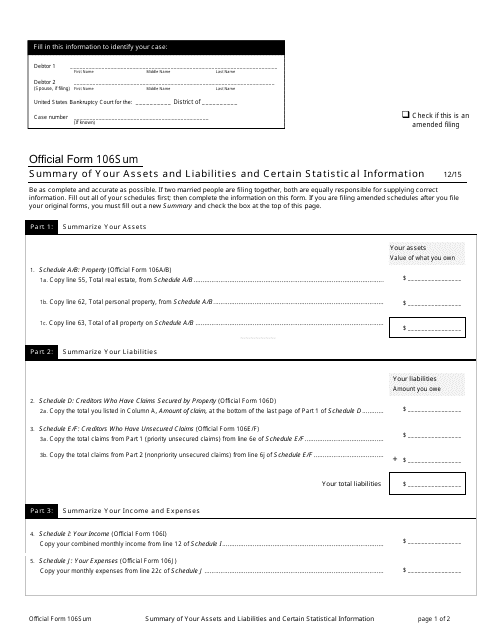

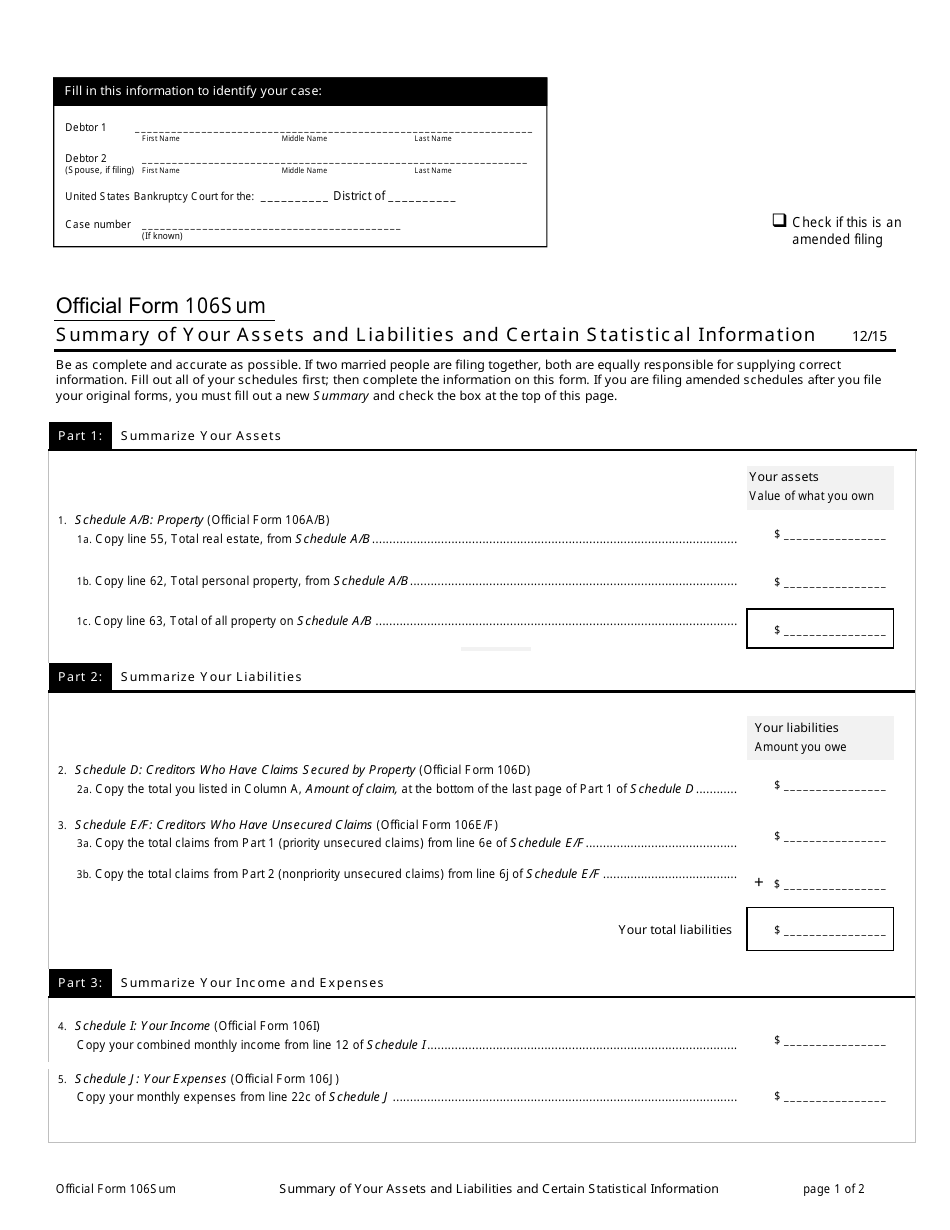

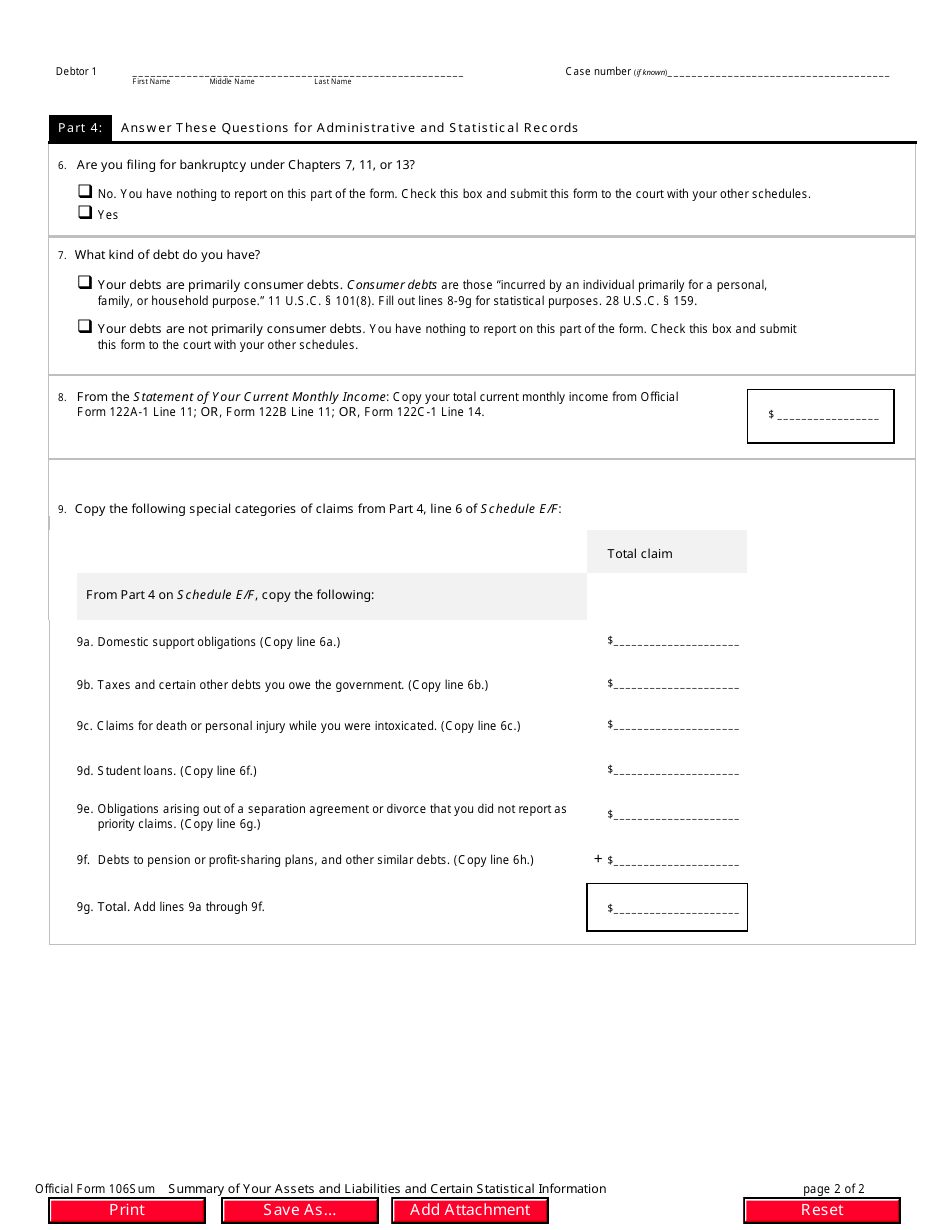

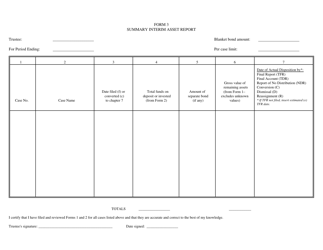

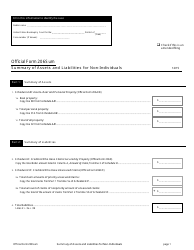

Official Form 106SUM Summary of Your Assets and Liabilities and Certain Statistical Information

What Is Official Form 106SUM?

This is a legal form that was released by the United States Bankruptcy Court on December 1, 2015 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 106SUM?

A: Form 106SUM is a summary of your assets and liabilities and certain statistical information.

Q: Who needs to fill out Form 106SUM?

A: Individuals who are required to file a bankruptcy case or have already filed for bankruptcy may need to fill out Form 106SUM.

Q: What information does Form 106SUM require?

A: Form 106SUM requires you to provide information about your assets, liabilities, and certain statistical information related to your bankruptcy case.

Q: What is the purpose of Form 106SUM?

A: The purpose of Form 106SUM is to provide a summary of your assets and liabilities for the bankruptcy court.

Q: Is Form 106SUM required for every bankruptcy case?

A: Form 106SUM is not required for every bankruptcy case. It depends on the specific requirements of your bankruptcy court.

Q: Can I fill out Form 106SUM myself?

A: Yes, you can fill out Form 106SUM yourself. However, it is recommended to seek the assistance of a bankruptcy attorney to ensure accuracy and completeness of the information.

Q: When do I need to submit Form 106SUM?

A: The deadline for submitting Form 106SUM will be specified by the bankruptcy court. It is important to submit the form within the given timeframe.

Q: What happens if I don't fill out Form 106SUM?

A: If you are required to fill out Form 106SUM and fail to do so, it may result in penalties or delays in your bankruptcy case.

Q: Is the information provided on Form 106SUM confidential?

A: The information provided on Form 106SUM is generally not considered confidential and may be accessible by the bankruptcy court and other relevant parties.

Form Details:

- Released on December 1, 2015;

- The latest available edition released by the United States Bankruptcy Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Official Form 106SUM by clicking the link below or browse more documents and templates provided by the United States Bankruptcy Court.