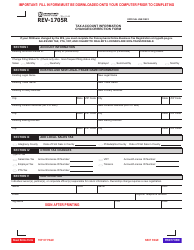

This version of the form is not currently in use and is provided for reference only. Download this version of

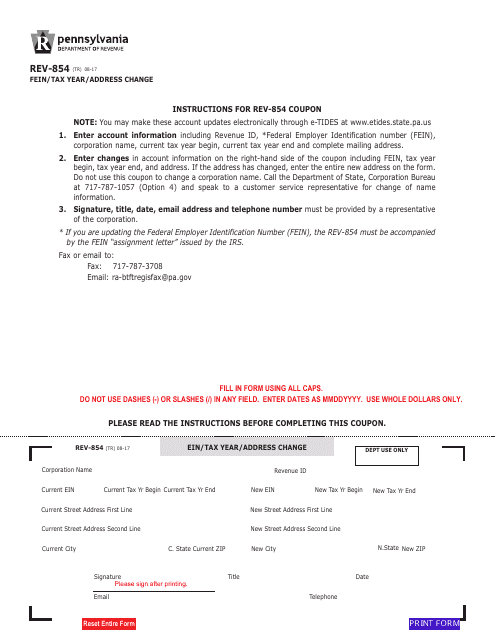

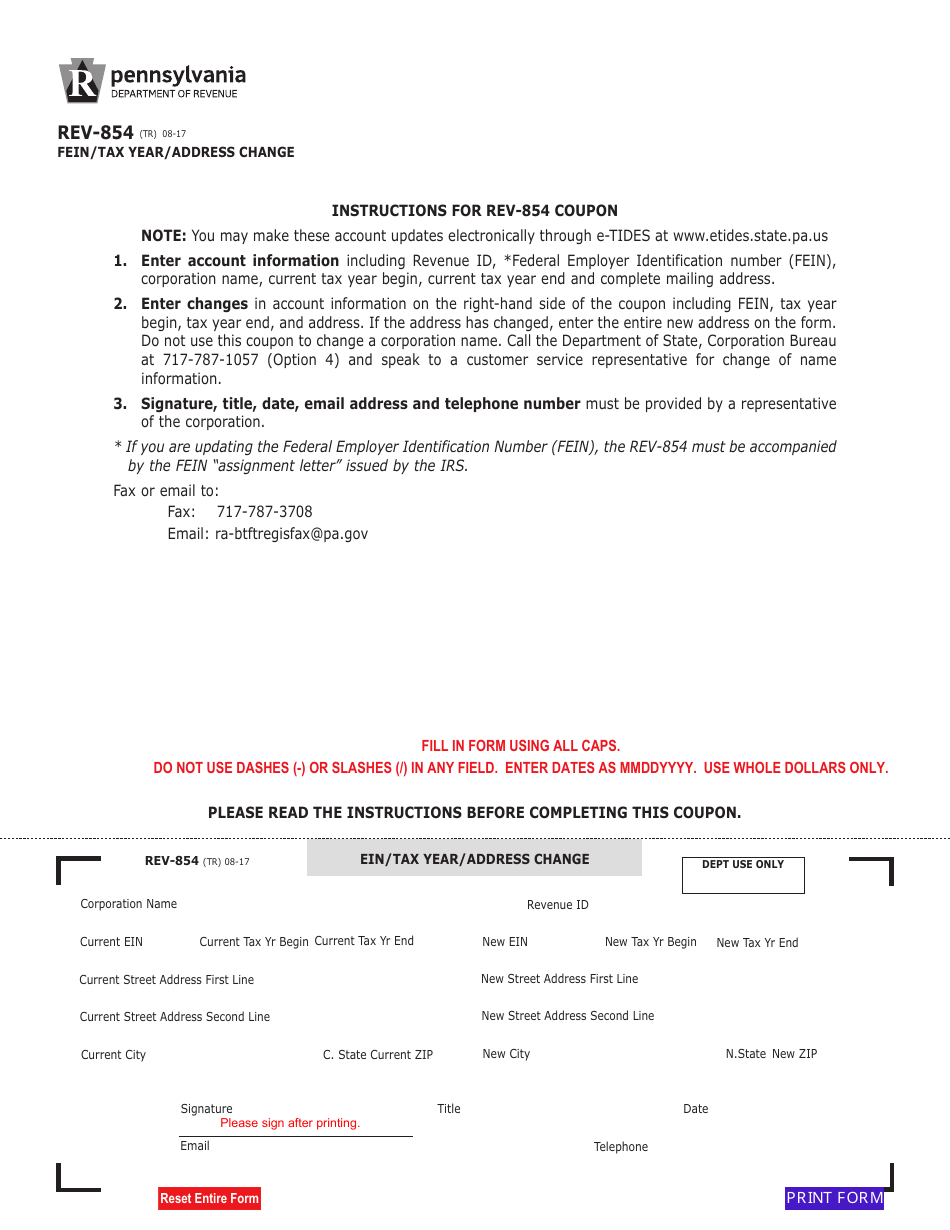

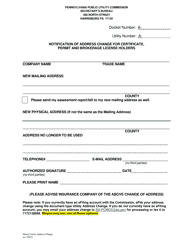

Form REV-854

for the current year.

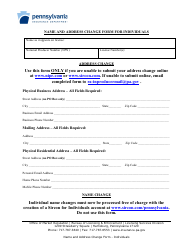

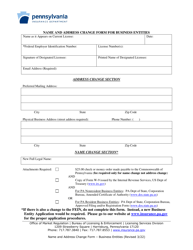

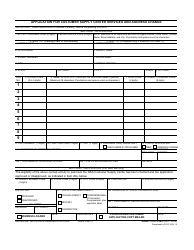

Form REV-854 Fein / Tax Year / Address Change - Pennsylvania

What Is Form REV-854?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

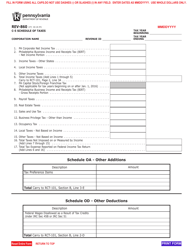

Q: What is Form REV-854?

A: Form REV-854 is a form used to report a Fein, Tax Year, or Address change in Pennsylvania.

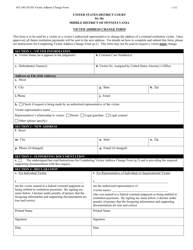

Q: When should I use Form REV-854?

A: You should use Form REV-854 if you need to report a Fein, Tax Year, or Address change in Pennsylvania.

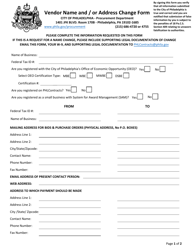

Q: What changes can I report using Form REV-854?

A: You can report Fein, Tax Year, or Address changes using Form REV-854.

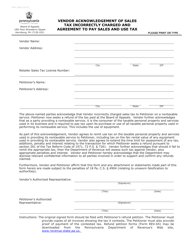

Q: Is there a deadline for filing Form REV-854?

A: There is no specific deadline mentioned for filing Form REV-854. It is recommended to file it as soon as possible after the change occurs.

Q: Do I need to include any attachments with Form REV-854?

A: The form instructions will provide details on any required attachments. Make sure to read and follow the instructions carefully.

Q: Can I submit Form REV-854 electronically?

A: Currently, electronic filing is not mentioned as an option for Form REV-854. Check the form instructions for any updates or changes regarding electronic filing.

Q: What should I do if I made an error on Form REV-854 after submitting it?

A: If you made an error on Form REV-854 after submitting it, you may need to file an amended form to correct the error. Consult the form instructions for guidance on amending the form.

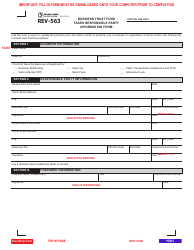

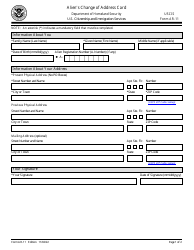

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-854 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.