This version of the form is not currently in use and is provided for reference only. Download this version of

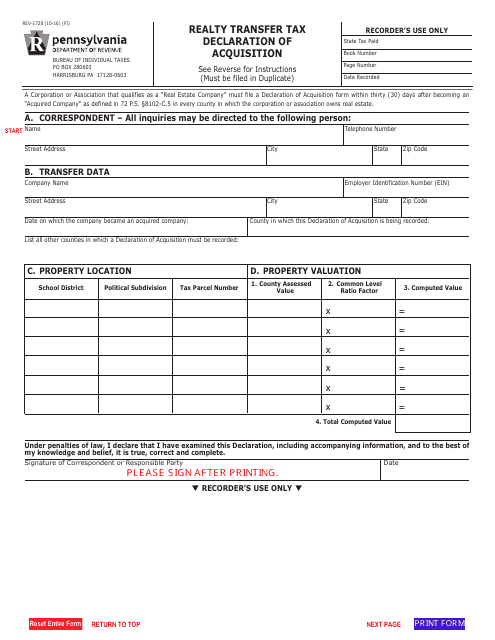

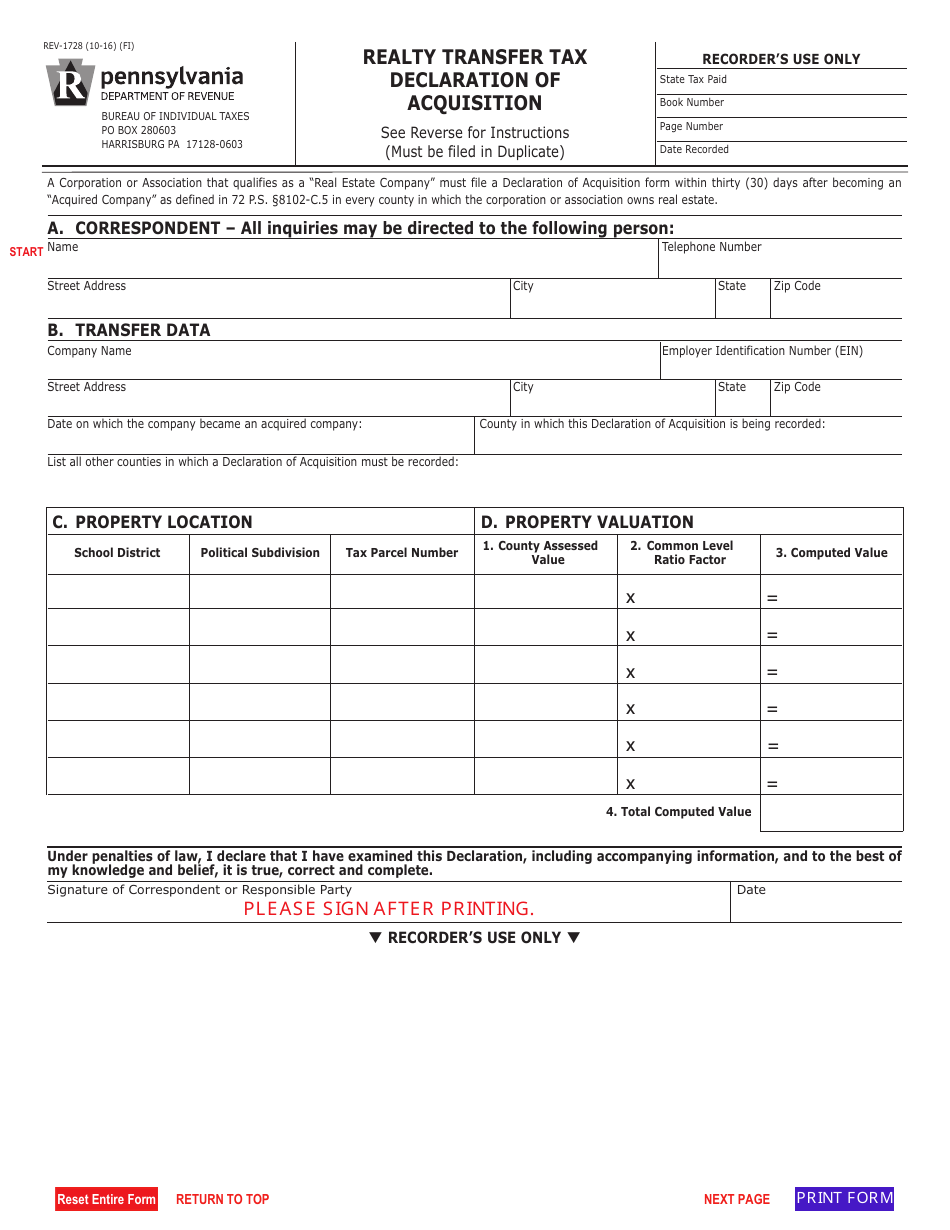

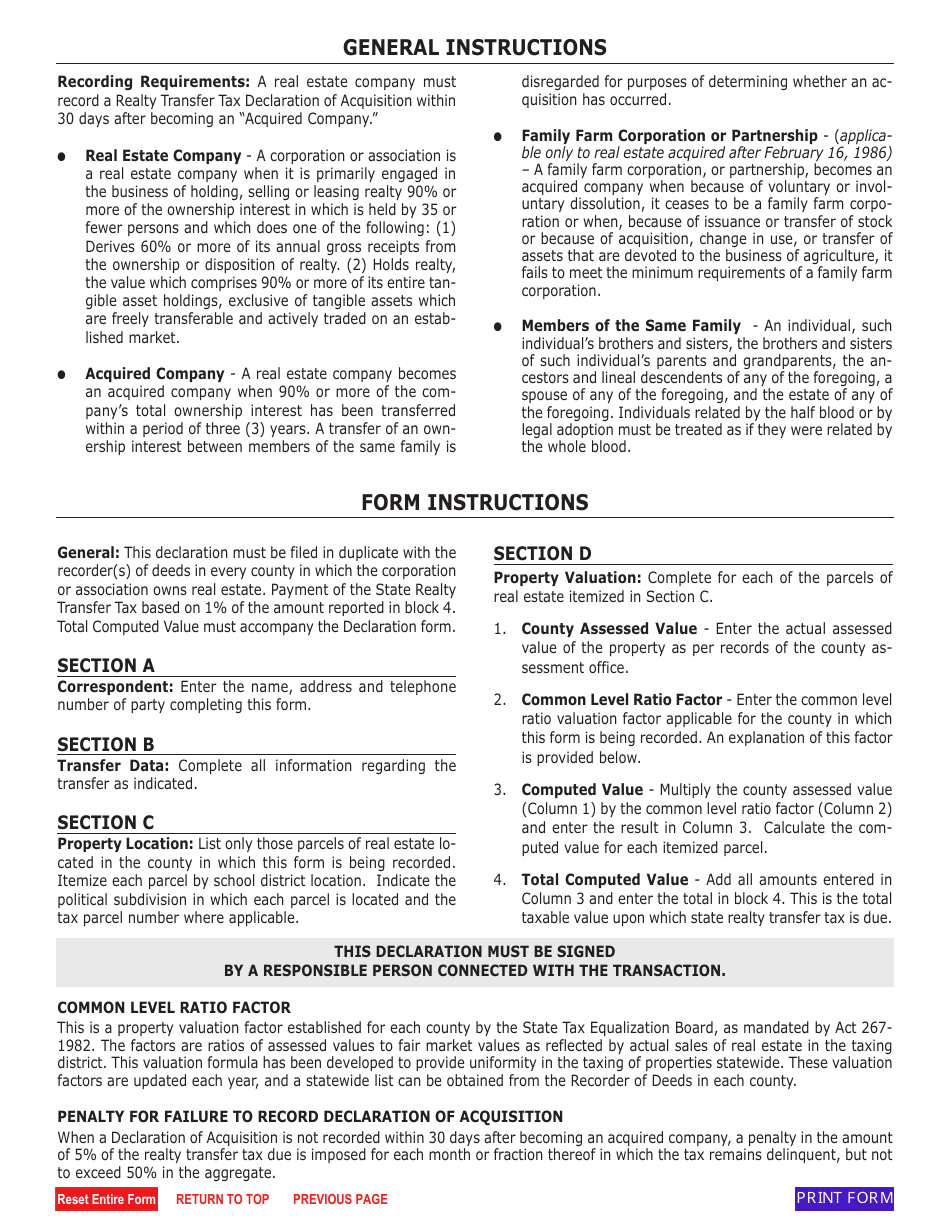

Form REV-1728

for the current year.

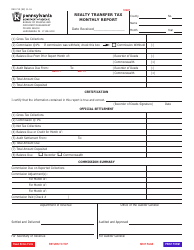

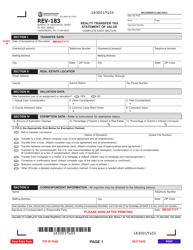

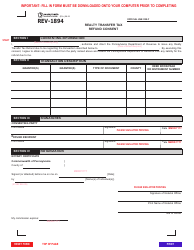

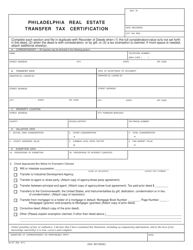

Form REV-1728 Realty Transfer Tax Declaration of Acquisition - Pennsylvania

What Is Form REV-1728?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the REV-1728 form?

A: The REV-1728 form is the Realty Transfer Tax Declaration of Acquisition form used in Pennsylvania.

Q: What is the purpose of the REV-1728 form?

A: The purpose of the REV-1728 form is to declare the acquisition of real property and calculate the realty transfer tax owed in Pennsylvania.

Q: Who needs to complete the REV-1728 form?

A: Any person or entity acquiring real property in Pennsylvania needs to complete the REV-1728 form.

Q: What information is required on the REV-1728 form?

A: The REV-1728 form requires information about the property being acquired, the parties involved in the transfer, and the consideration paid for the property.

Q: When should the REV-1728 form be filed?

A: The REV-1728 form should be filed within 30 days of the transfer of real property in Pennsylvania.

Q: How is the realty transfer tax calculated?

A: The realty transfer tax is calculated based on the consideration paid for the property, at a rate of 1% for most transfers in Pennsylvania.

Q: Are there any exemptions or exclusions from the realty transfer tax?

A: Yes, there are certain exemptions and exclusions from the realty transfer tax, such as transfers between family members or charitable organizations.

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1728 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.