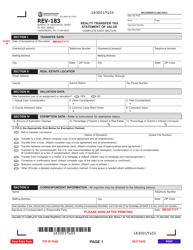

This version of the form is not currently in use and is provided for reference only. Download this version of

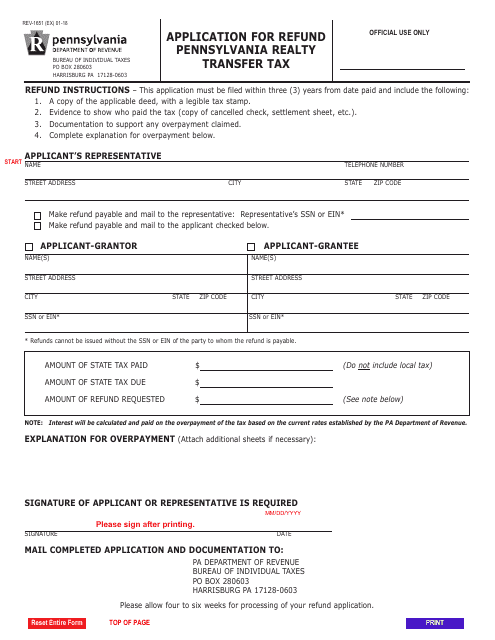

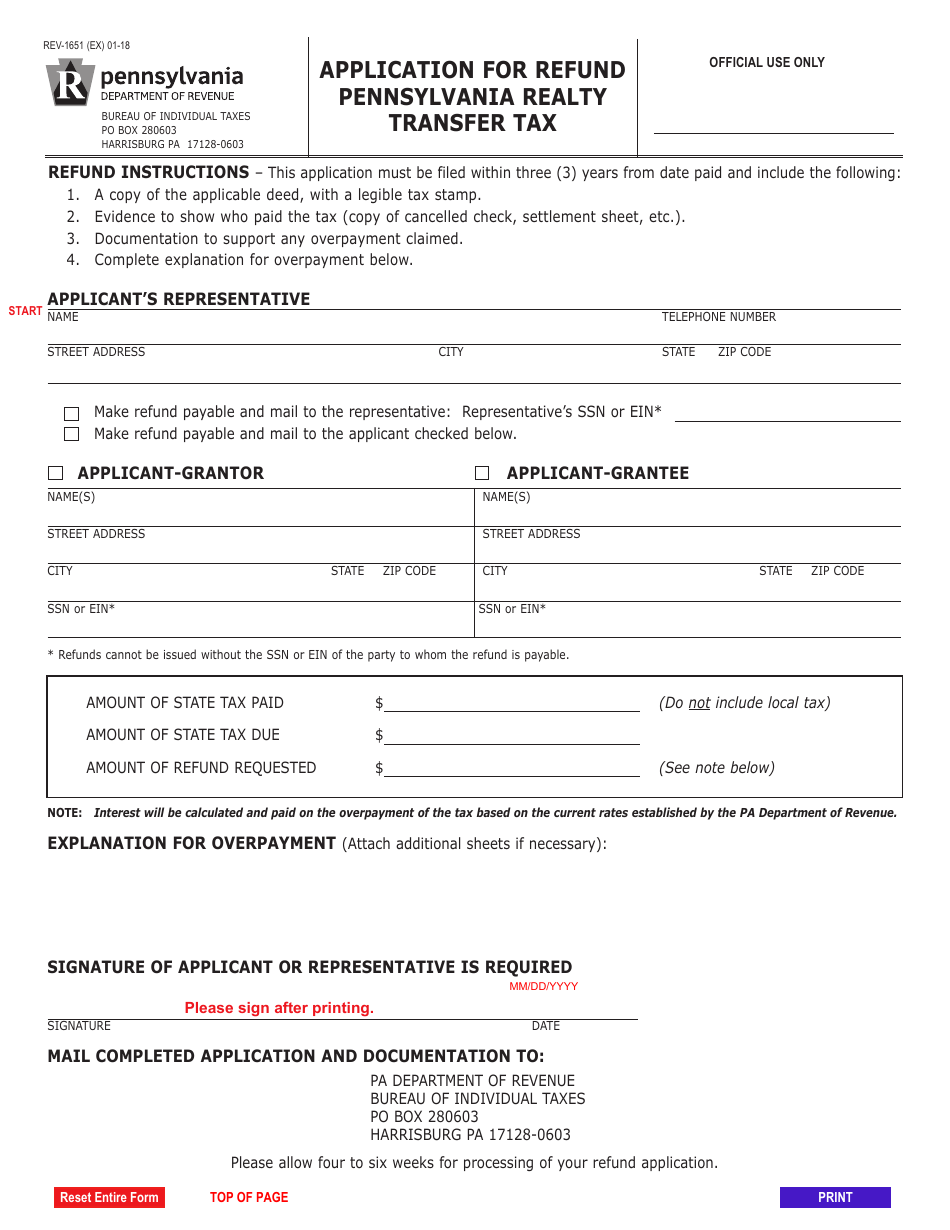

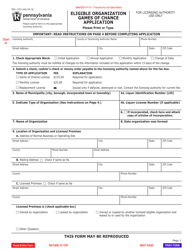

Form REV-1651

for the current year.

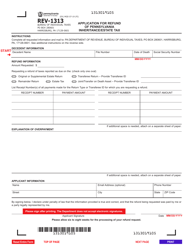

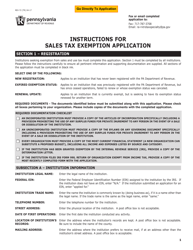

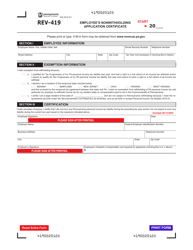

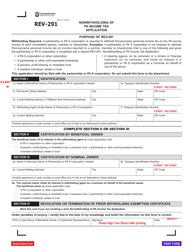

Form REV-1651 Application for Refund Pennsylvania Realty Transfer Tax - Pennsylvania

What Is Form REV-1651?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

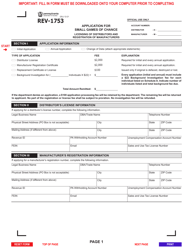

Q: What is Form REV-1651?

A: Form REV-1651 is the Application for Refund for Pennsylvania Realty Transfer Tax in Pennsylvania.

Q: What is the purpose of Form REV-1651?

A: The purpose of Form REV-1651 is to request a refund of the Pennsylvania Realty Transfer Tax.

Q: Who should use Form REV-1651?

A: Form REV-1651 should be used by individuals or entities who have overpaid or are eligible for a refund of the Pennsylvania Realty Transfer Tax.

Q: What information is required on Form REV-1651?

A: Form REV-1651 requires information such as the property details, the amount of tax paid, and the reason for the refund request.

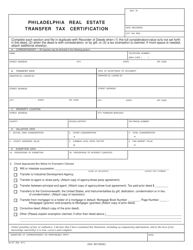

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1651 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.