This version of the form is not currently in use and is provided for reference only. Download this version of

Form DEX-41

for the current year.

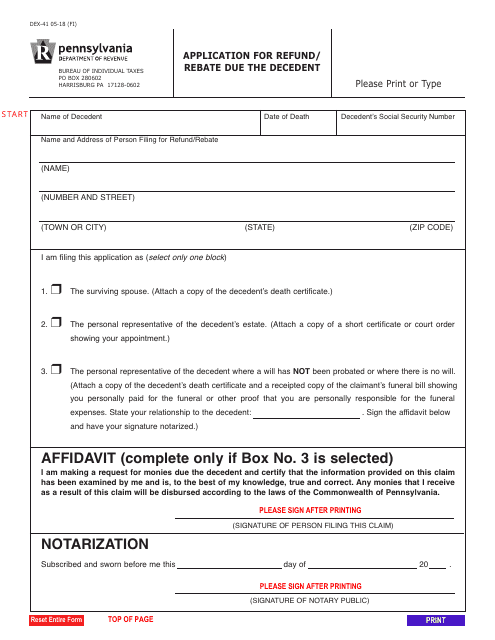

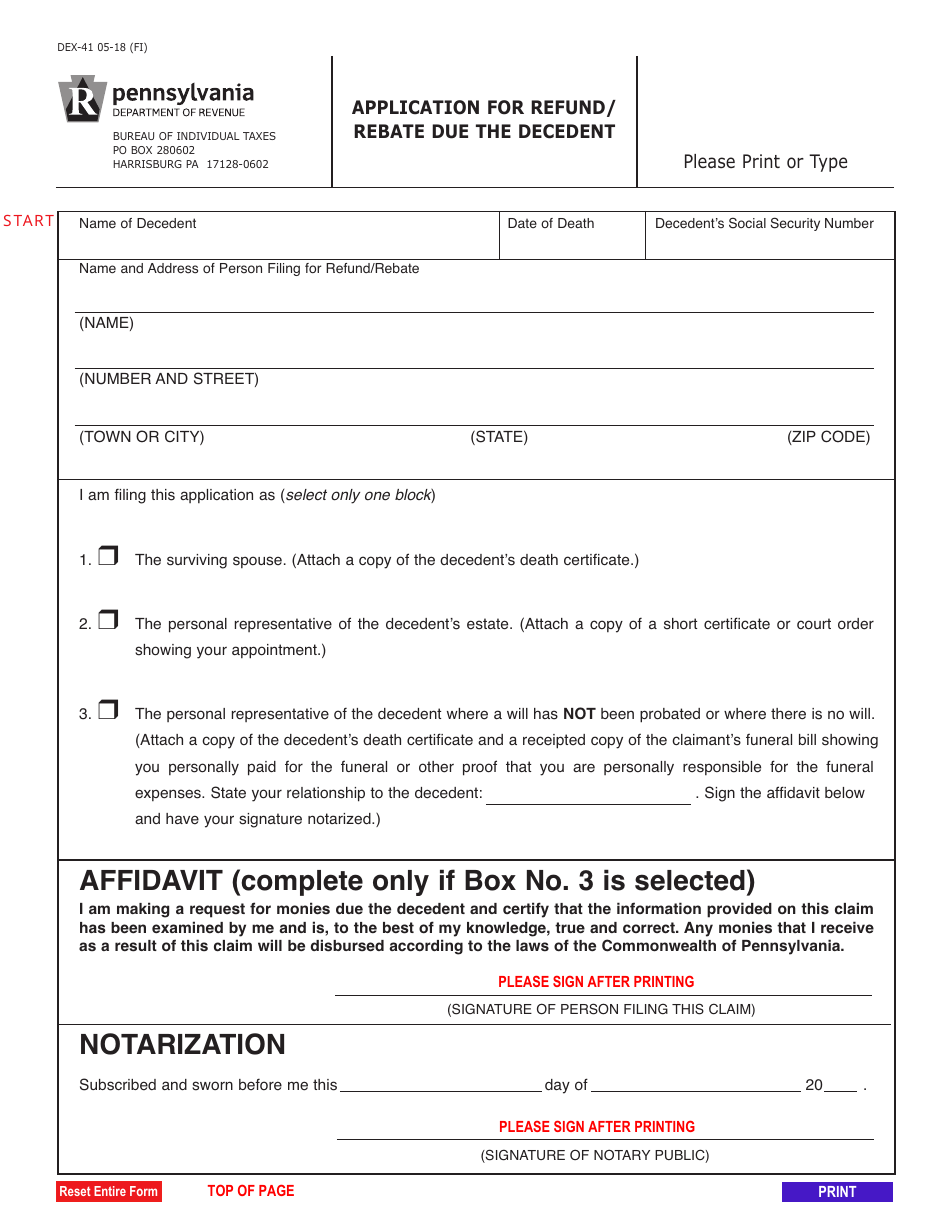

Form DEX-41 Application for Refund / Rebate Due the Decedent - Pennsylvania

What Is Form DEX-41?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DEX-41?

A: Form DEX-41 is the Application for Refund/Rebate Due the Decedent in Pennsylvania.

Q: Who can use Form DEX-41?

A: Form DEX-41 can be used by individuals who are seeking a refund or rebate owed to a deceased person in Pennsylvania.

Q: What is the purpose of Form DEX-41?

A: Form DEX-41 is used to claim any refund or rebate that may be due to a deceased person in Pennsylvania.

Q: How do I fill out Form DEX-41?

A: Form DEX-41 requires information about the deceased person, the specific refund or rebate being claimed, and any relevant supporting documents. It is important to carefully follow the instructions provided with the form.

Q: Are there any fees for filing Form DEX-41?

A: There are no fees for filing Form DEX-41.

Q: What should I do if I need help with Form DEX-41?

A: If you need assistance with Form DEX-41, you can contact the Pennsylvania Department of Revenue or seek help from a tax professional.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DEX-41 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.