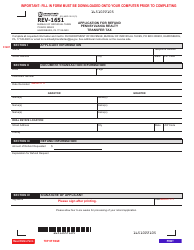

This version of the form is not currently in use and is provided for reference only. Download this version of

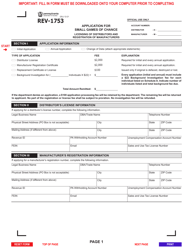

Form REV-1313

for the current year.

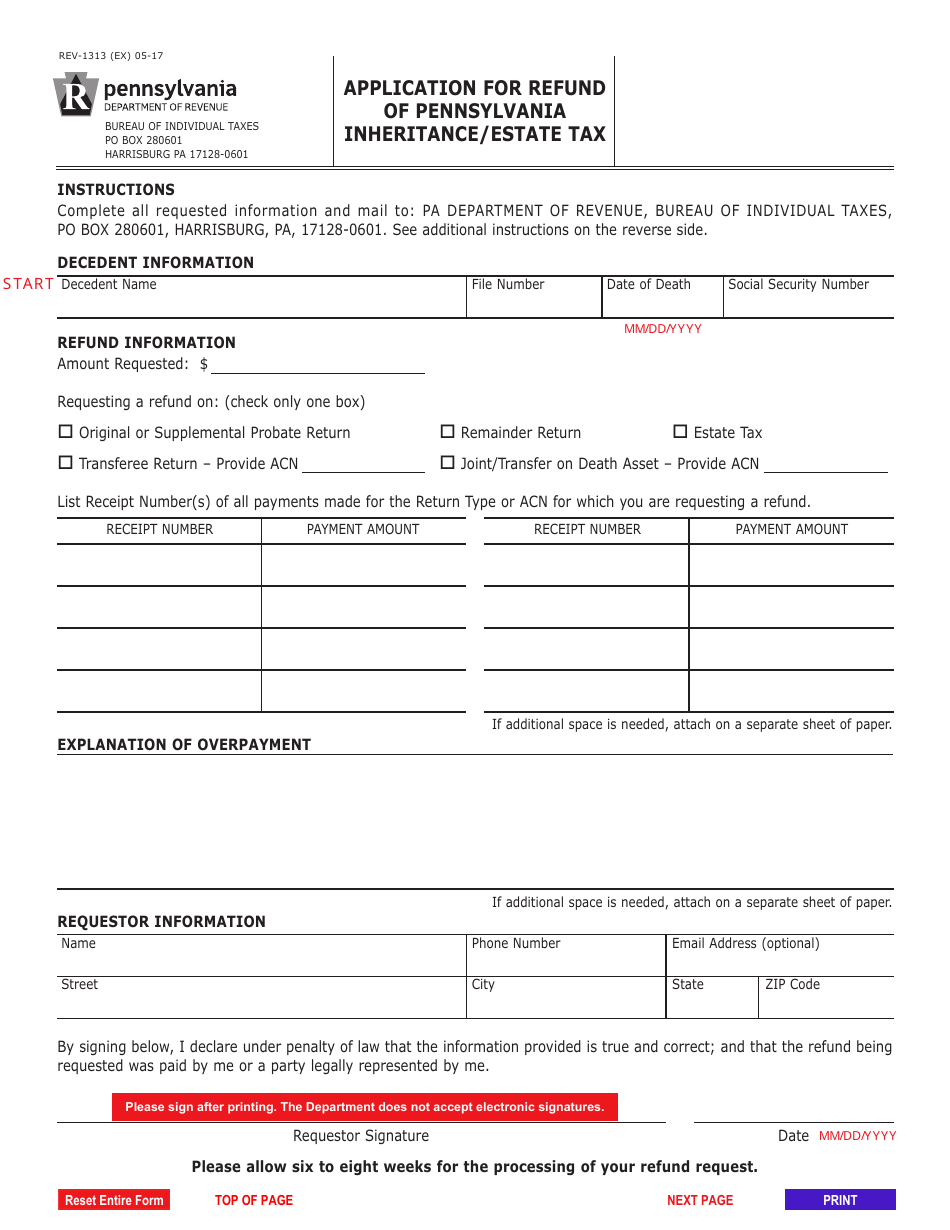

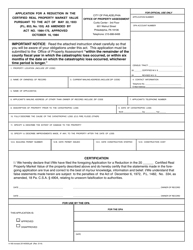

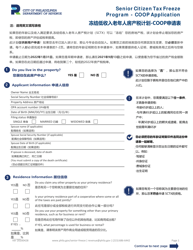

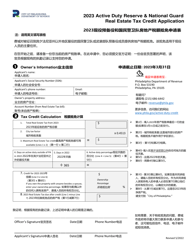

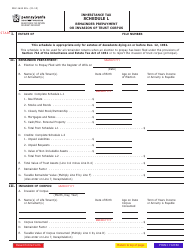

Form REV-1313 Application for Refund of Pennsylvania Inheritance / Estate Tax - Pennsylvania

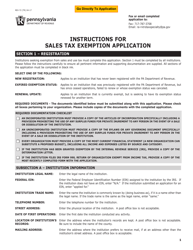

What Is Form REV-1313?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form REV-1313?

A: The Form REV-1313 is an application for refund of Pennsylvania Inheritance/Estate Tax.

Q: Who can use the Form REV-1313?

A: Individuals who have paid Pennsylvania Inheritance/Estate Tax and believe they are eligible for a refund can use the Form REV-1313.

Q: What is the purpose of the Form REV-1313?

A: The Form REV-1313 is used to apply for a refund of Pennsylvania Inheritance/Estate Tax that was overpaid or improperly paid.

Q: What information do I need to complete the Form REV-1313?

A: To complete the Form REV-1313, you will need to provide information about the decedent, the estate, and the taxes paid.

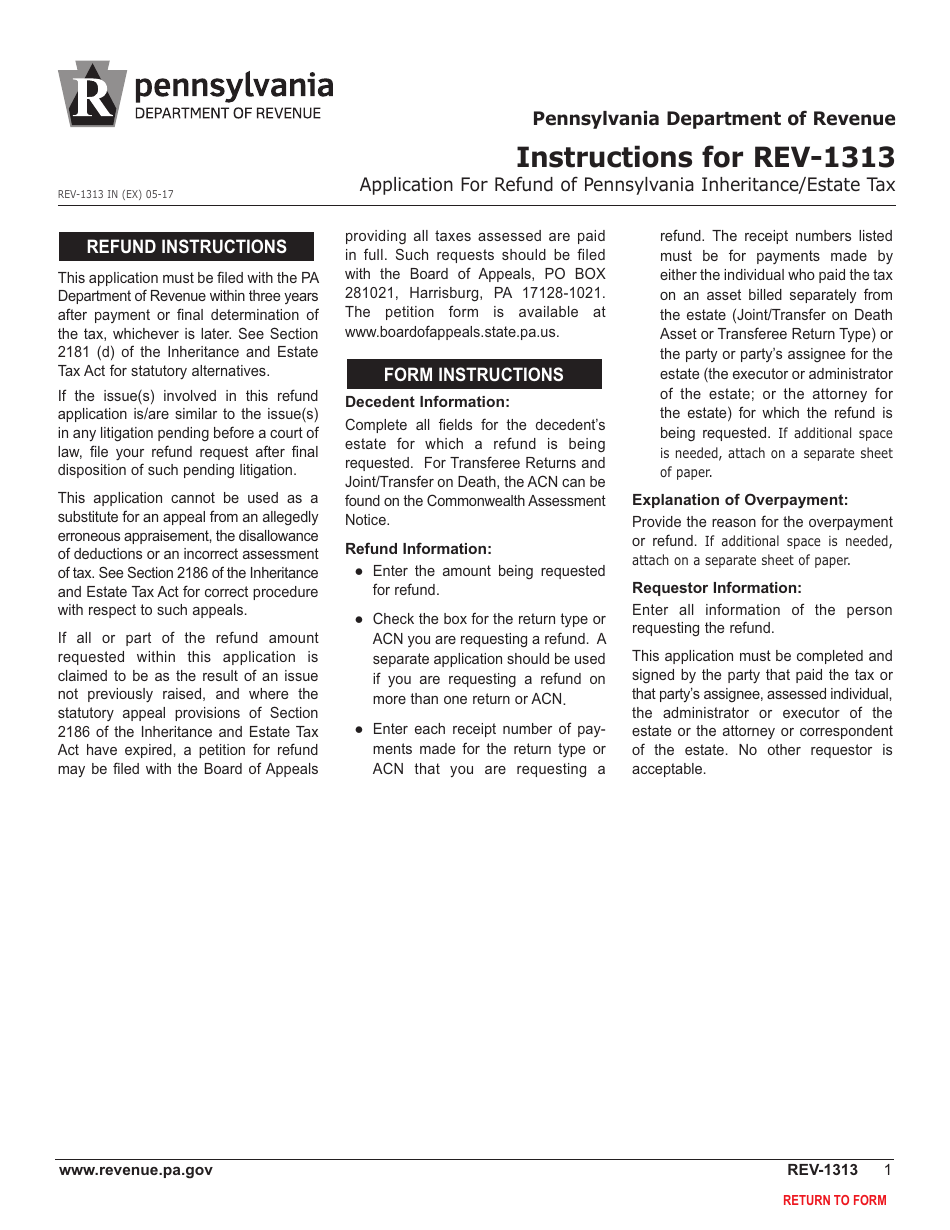

Q: How do I submit the Form REV-1313?

A: You can submit the Form REV-1313 by mail to the Pennsylvania Department of Revenue's address provided on the form.

Q: Is there a deadline for filing the Form REV-1313?

A: Yes, the Form REV-1313 must be filed within three years from the date of payment of the tax or one year from the date of an overassessment determination, whichever is later.

Q: Can I file the Form REV-1313 electronically?

A: No, the Form REV-1313 cannot be filed electronically. It must be filed by mail.

Q: Is there a fee for filing the Form REV-1313?

A: No, there is no fee for filing the Form REV-1313.

Q: What happens after I submit the Form REV-1313?

A: After you submit the Form REV-1313, the Pennsylvania Department of Revenue will review your application and notify you of their decision.

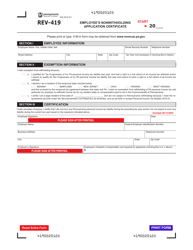

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1313 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.