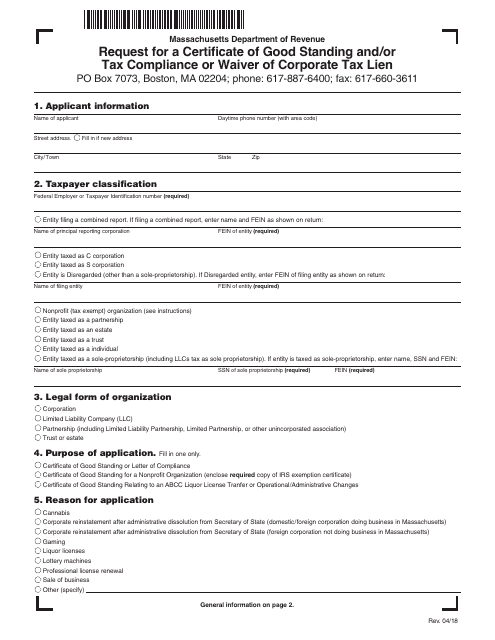

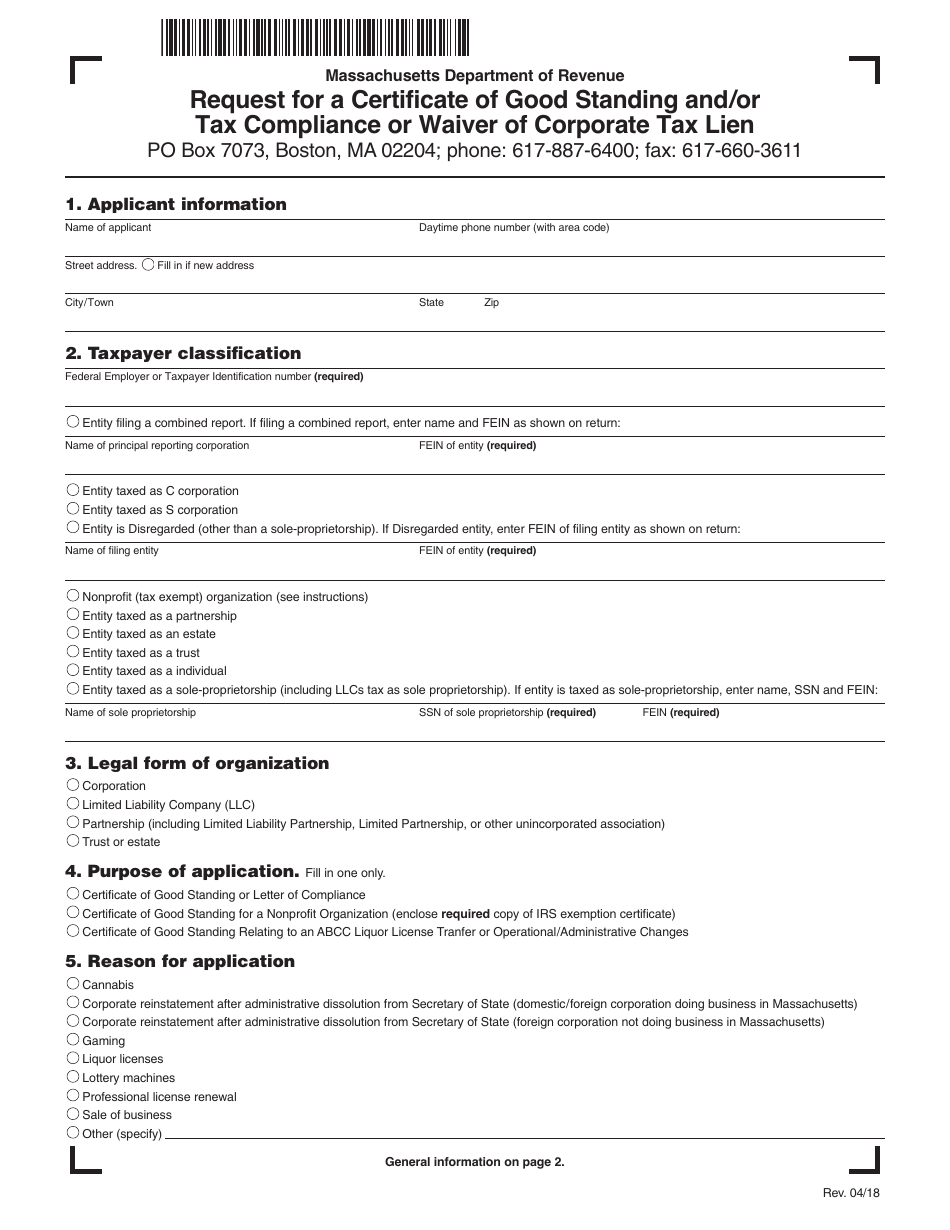

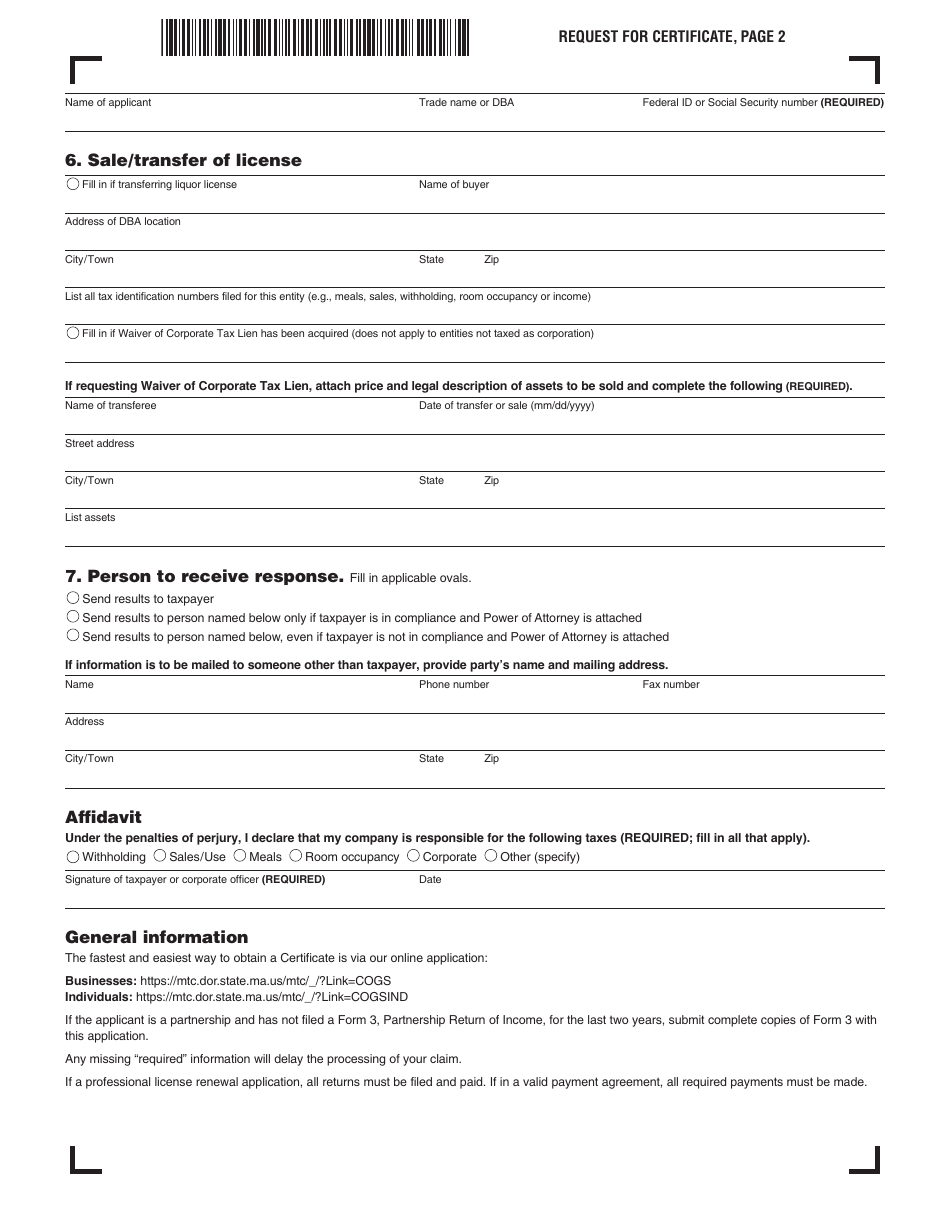

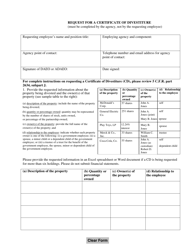

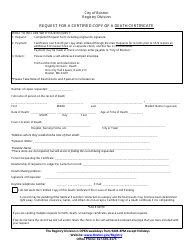

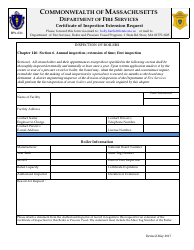

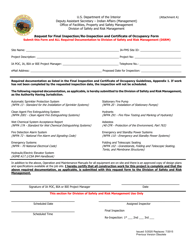

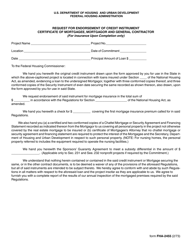

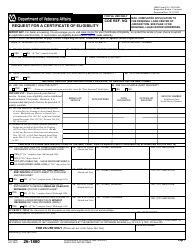

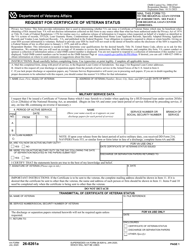

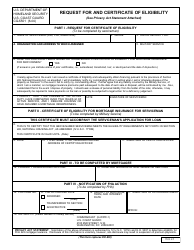

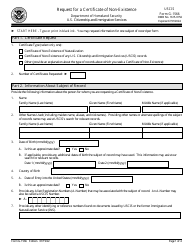

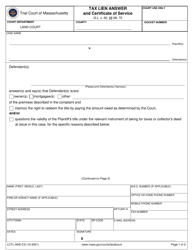

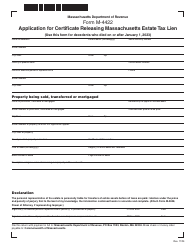

Request for a Certificate of Good Standing and / or Tax Compliance or Waiver of Corporate Tax Lien - Massachusetts

Request for a Certificate of Corporate Tax Lien is a legal document that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts.

FAQ

Q: What is a Certificate of Good Standing?

A: A Certificate of Good Standing is a document that confirms that a business entity is in compliance with its requirements, such as filings and payments, and is authorized to do business in a particular state.

Q: What is a Certificate of Tax Compliance?

A: A Certificate of Tax Compliance is a document that verifies that a business entity has paid all its state taxes and is in compliance with the state's tax laws.

Q: What is a Waiver of Corporate Tax Lien?

A: A Waiver of Corporate Tax Lien is a document that releases a business entity from a tax lien. It indicates that the entity has satisfied all outstanding tax liabilities and the lien is no longer in effect.

Form Details:

- Released on April 1, 2018;

- The latest edition currently provided by the Massachusetts Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.