This version of the form is not currently in use and is provided for reference only. Download this version of

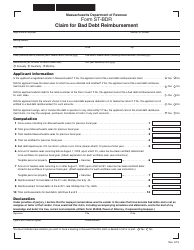

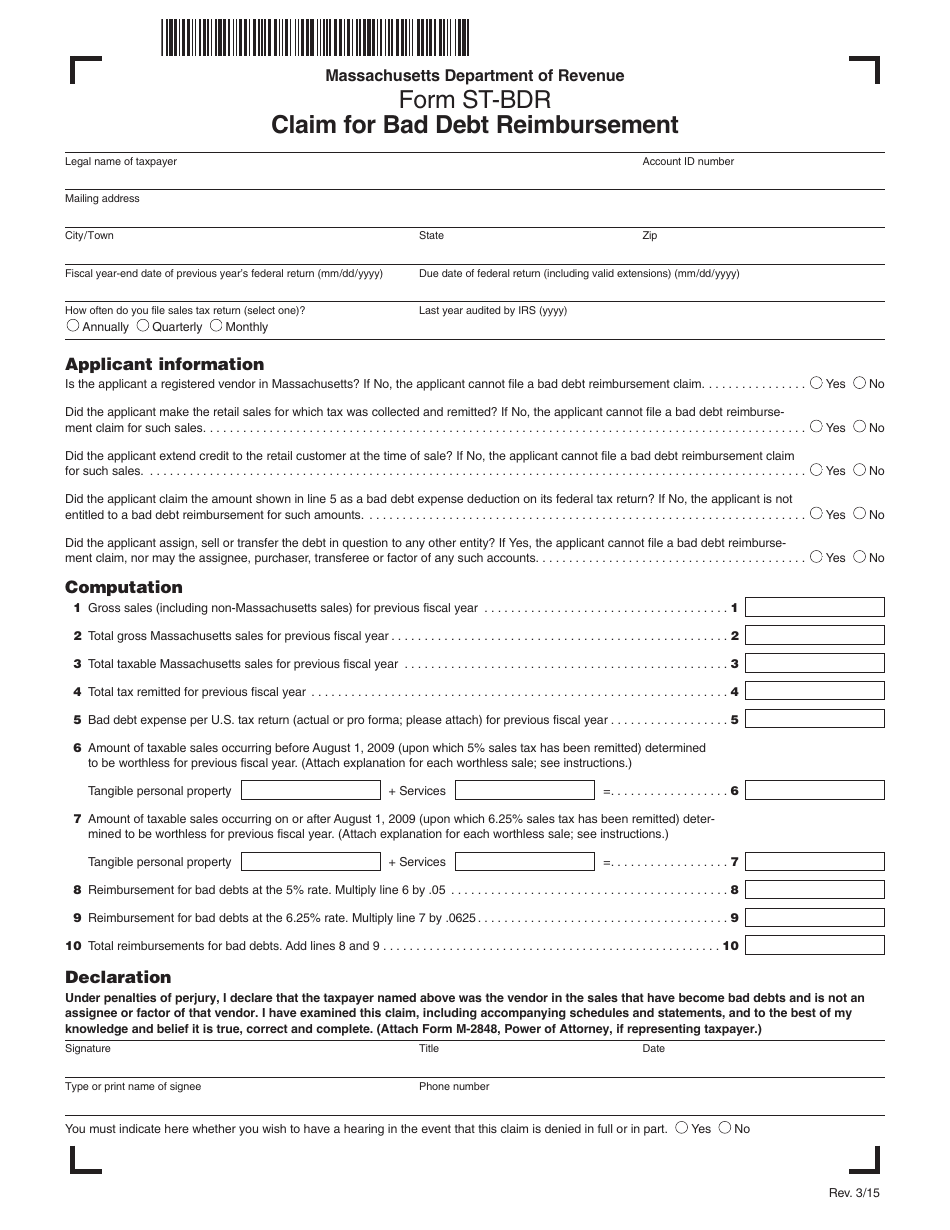

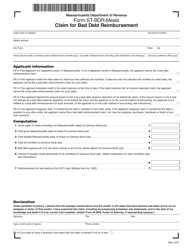

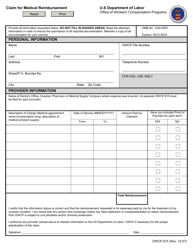

Form ST-BDR

for the current year.

Form ST-BDR Claim for Bad Debt Reimbursement - Massachusetts

What Is Form ST-BDR?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-BDR?

A: Form ST-BDR is a form used to claim reimbursement for bad debts in Massachusetts.

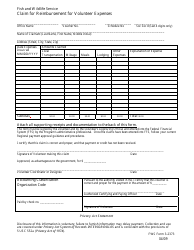

Q: What is bad debt reimbursement?

A: Bad debt reimbursement is a process by which a business can recover sales tax paid on debts that are deemed uncollectible.

Q: Who can use Form ST-BDR?

A: Form ST-BDR can be used by businesses in Massachusetts that have paid sales tax on bad debts.

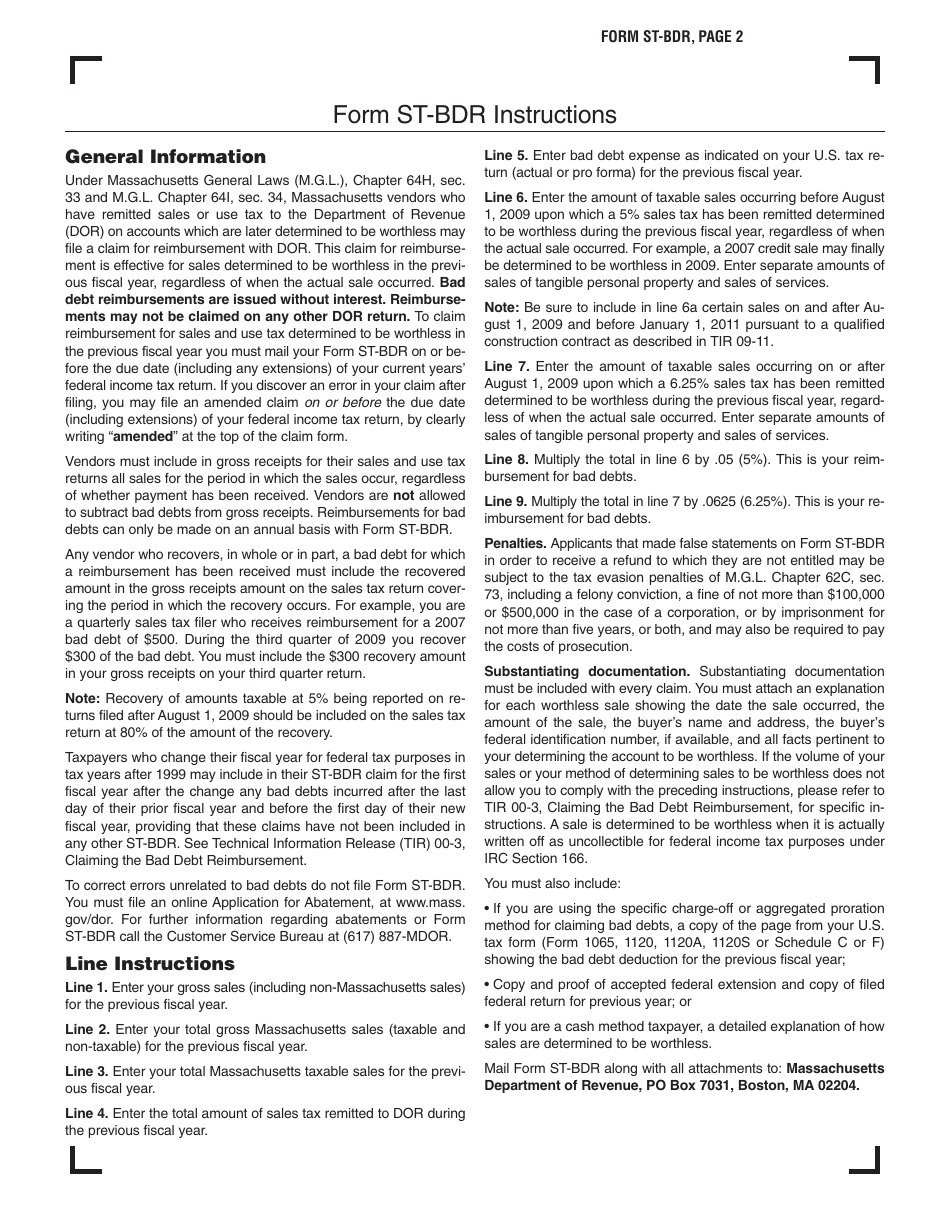

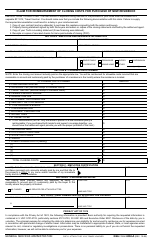

Q: How do I complete Form ST-BDR?

A: You need to provide detailed information about the bad debts, including the amount owed, the date of the sale, and the efforts made to collect the debt.

Q: What supporting documentation do I need to include with Form ST-BDR?

A: You need to include copies of invoices, statements, and any other documents that show evidence of the bad debts.

Q: When should I submit Form ST-BDR?

A: You should submit Form ST-BDR within three years from the due date of the original sales tax return.

Q: Is there a fee for filing Form ST-BDR?

A: No, there is no fee for filing Form ST-BDR.

Q: Can I claim reimbursement for all bad debts?

A: No, you can only claim reimbursement for bad debts that are considered uncollectible.

Q: Can I claim reimbursement for bad debts incurred outside of Massachusetts?

A: No, Form ST-BDR is specific to bad debts incurred in Massachusetts.

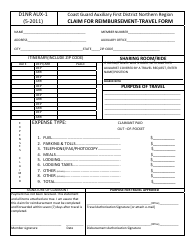

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-BDR by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.