This version of the form is not currently in use and is provided for reference only. Download this version of

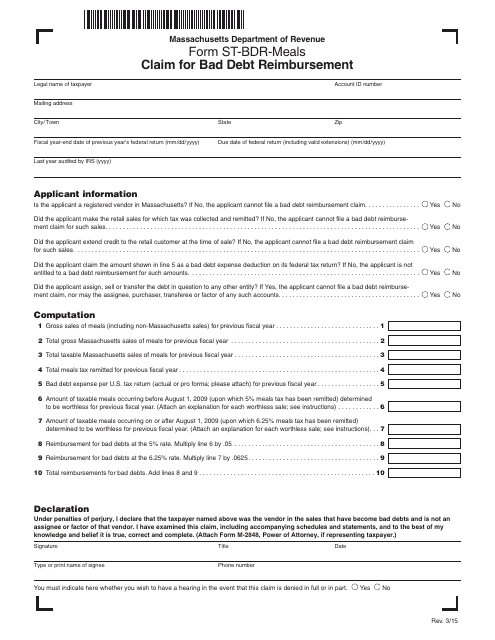

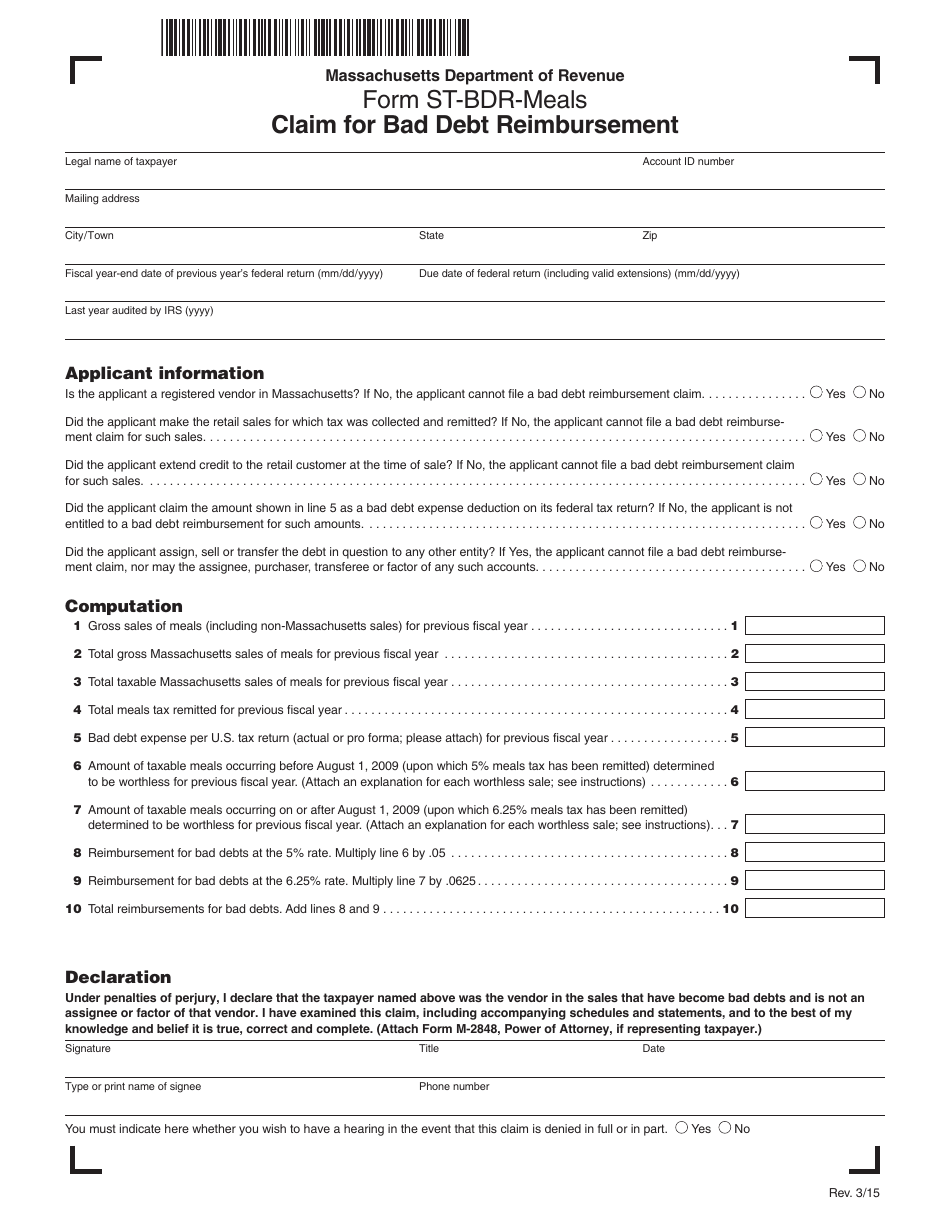

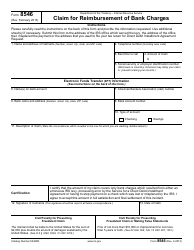

Form ST-BDR-MEALS

for the current year.

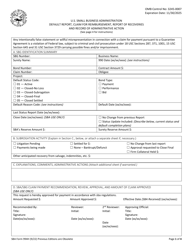

Form ST-BDR-MEALS Claim for Bad Debt Reimbursement - Massachusetts

What Is Form ST-BDR-MEALS?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-BDR-MEALS?

A: Form ST-BDR-MEALS is a claim form for bad debt reimbursement in Massachusetts.

Q: Who can use Form ST-BDR-MEALS?

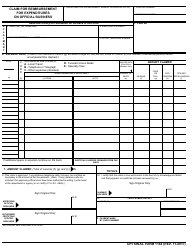

A: This form can be used by individuals or businesses in Massachusetts who incurred bad debts and are seeking reimbursement.

Q: What is bad debt reimbursement?

A: Bad debt reimbursement is a process where the state reimburses individuals or businesses for debts that are considered uncollectible.

Q: Why would someone use Form ST-BDR-MEALS?

A: Someone would use this form to request reimbursement for bad debts that cannot be collected.

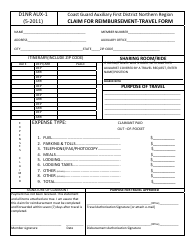

Q: How do I fill out Form ST-BDR-MEALS?

A: You need to provide your contact information, details of the bad debt, and supporting documentation.

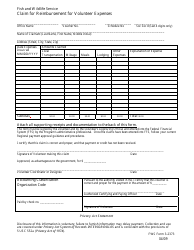

Q: Is there a deadline for submitting Form ST-BDR-MEALS?

A: Yes, the form must be filed within three years from the date the bad debt became uncollectible.

Q: What should I do after submitting Form ST-BDR-MEALS?

A: After submitting the form, you should keep a copy for your records and await further instructions from the Massachusetts Department of Revenue.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-BDR-MEALS by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.