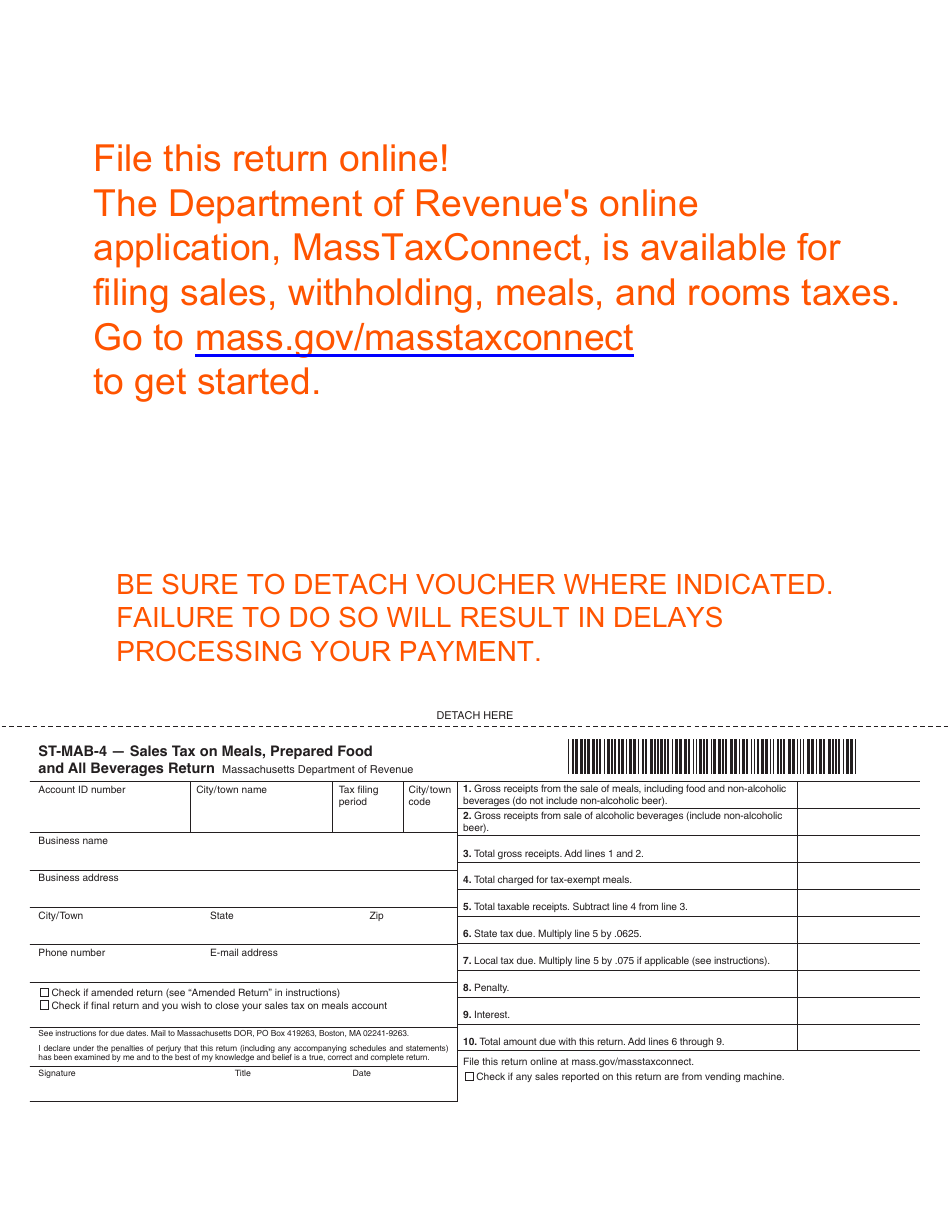

Form ST-MAB-4 Sales Tax on Meals, Prepared Food and All Beverages Return - Massachusetts

What Is Form ST-MAB-4?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form ST-MAB-4?

A: Form ST-MAB-4 is the Sales Tax on Meals, Prepared Food and All Beverages Return for Massachusetts.

Q: Who needs to file Form ST-MAB-4?

A: Any business that sells meals, prepared food, or beverages in Massachusetts needs to file Form ST-MAB-4.

Q: What is the purpose of Form ST-MAB-4?

A: The purpose of Form ST-MAB-4 is to report and remit the sales tax collected on meals, prepared food, and beverages.

Q: What information is required on Form ST-MAB-4?

A: Form ST-MAB-4 requires information such as the total sales, taxable sales, and the amount of sales tax collected.

Q: When is Form ST-MAB-4 due?

A: Form ST-MAB-4 is generally due on a monthly basis, with the due date falling on the 20th day of the following month.

Q: Are there any exemptions or deductions available on Form ST-MAB-4?

A: Yes, there are certain exemptions and deductions available for specific types of sales. Consult the form instructions or contact the Massachusetts Department of Revenue for more information.

Q: Is there a penalty for late filing of Form ST-MAB-4?

A: Yes, there may be penalties for late filing or non-filing of Form ST-MAB-4. It is important to file the form and remit the sales tax by the due date to avoid penalties.

Q: What should I do if I have questions about Form ST-MAB-4?

A: If you have any questions about Form ST-MAB-4, you can contact the Massachusetts Department of Revenue for assistance.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-MAB-4 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.