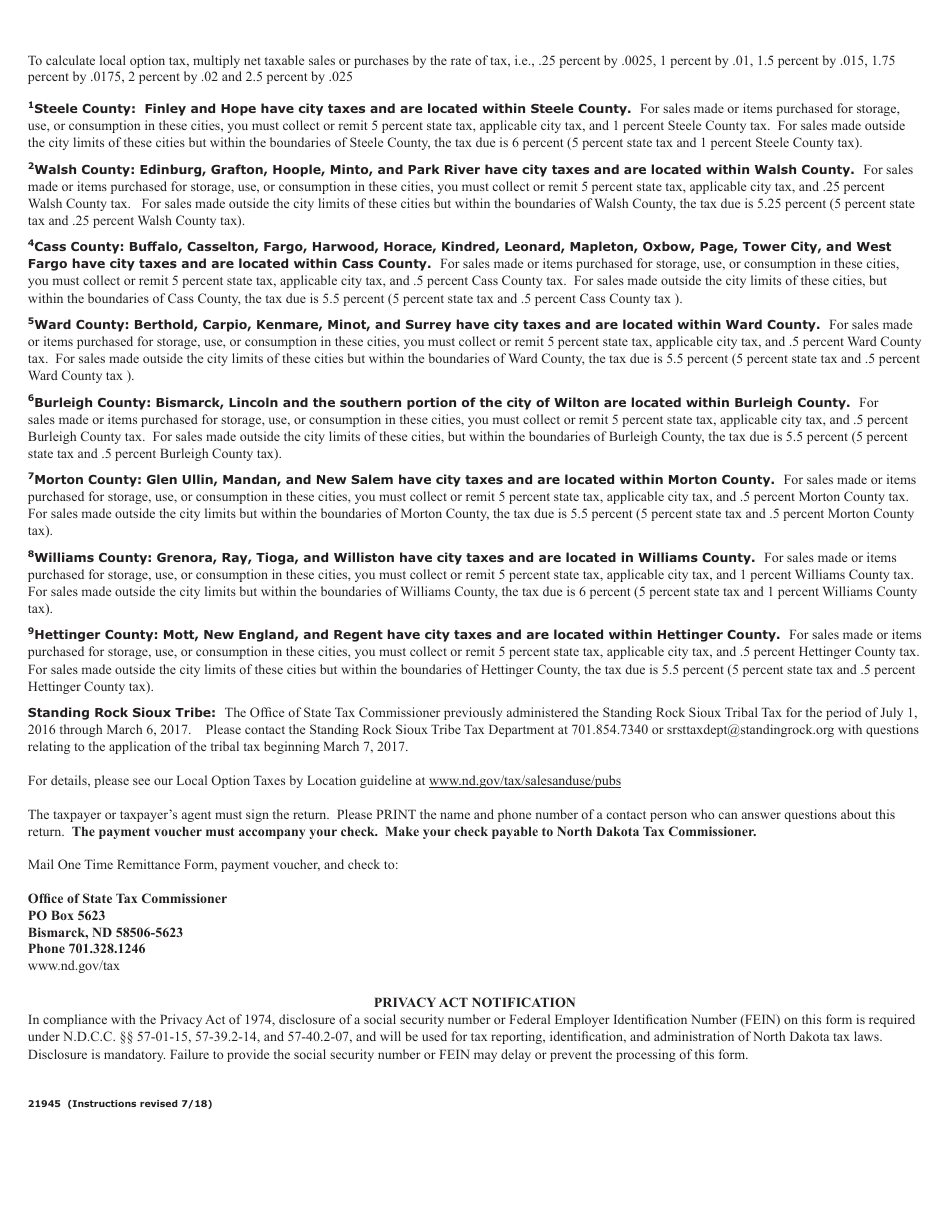

This version of the form is not currently in use and is provided for reference only. Download this version of

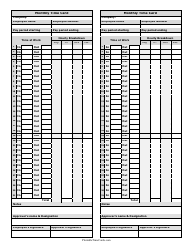

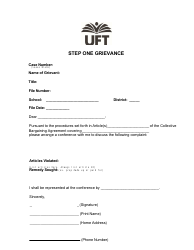

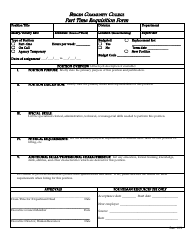

Form 21945

for the current year.

Form 21945 One Time Remittance Form - North Dakota

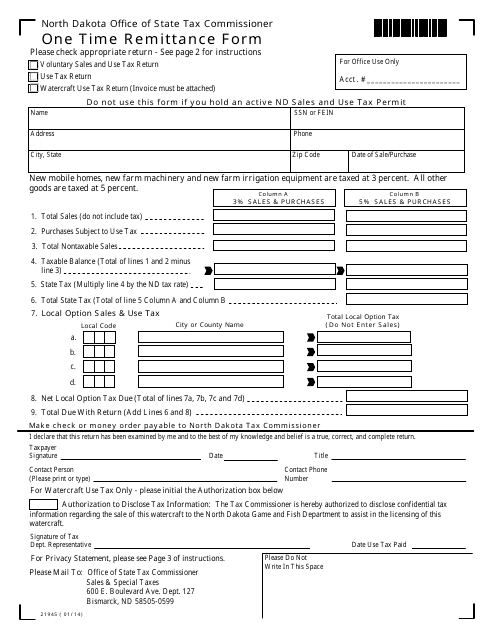

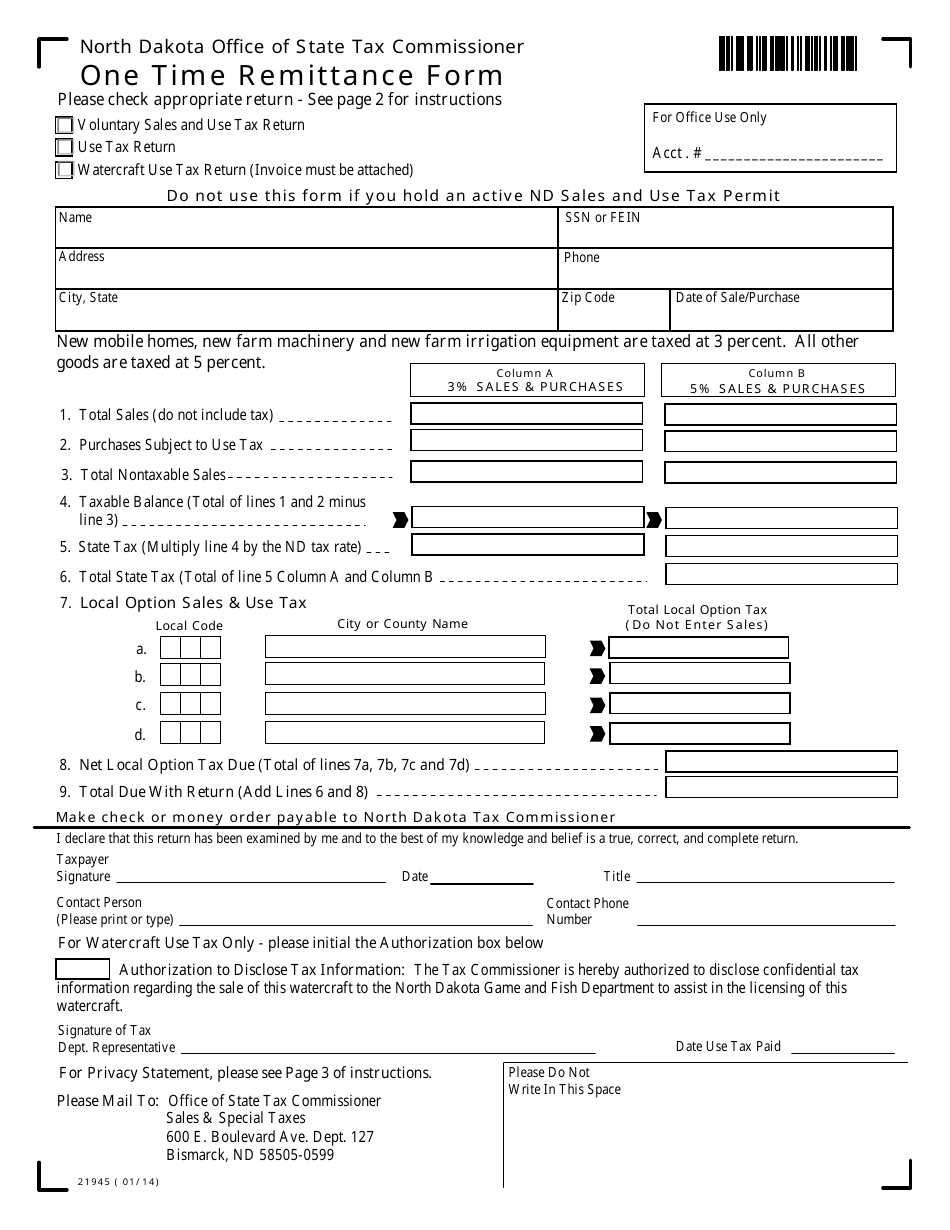

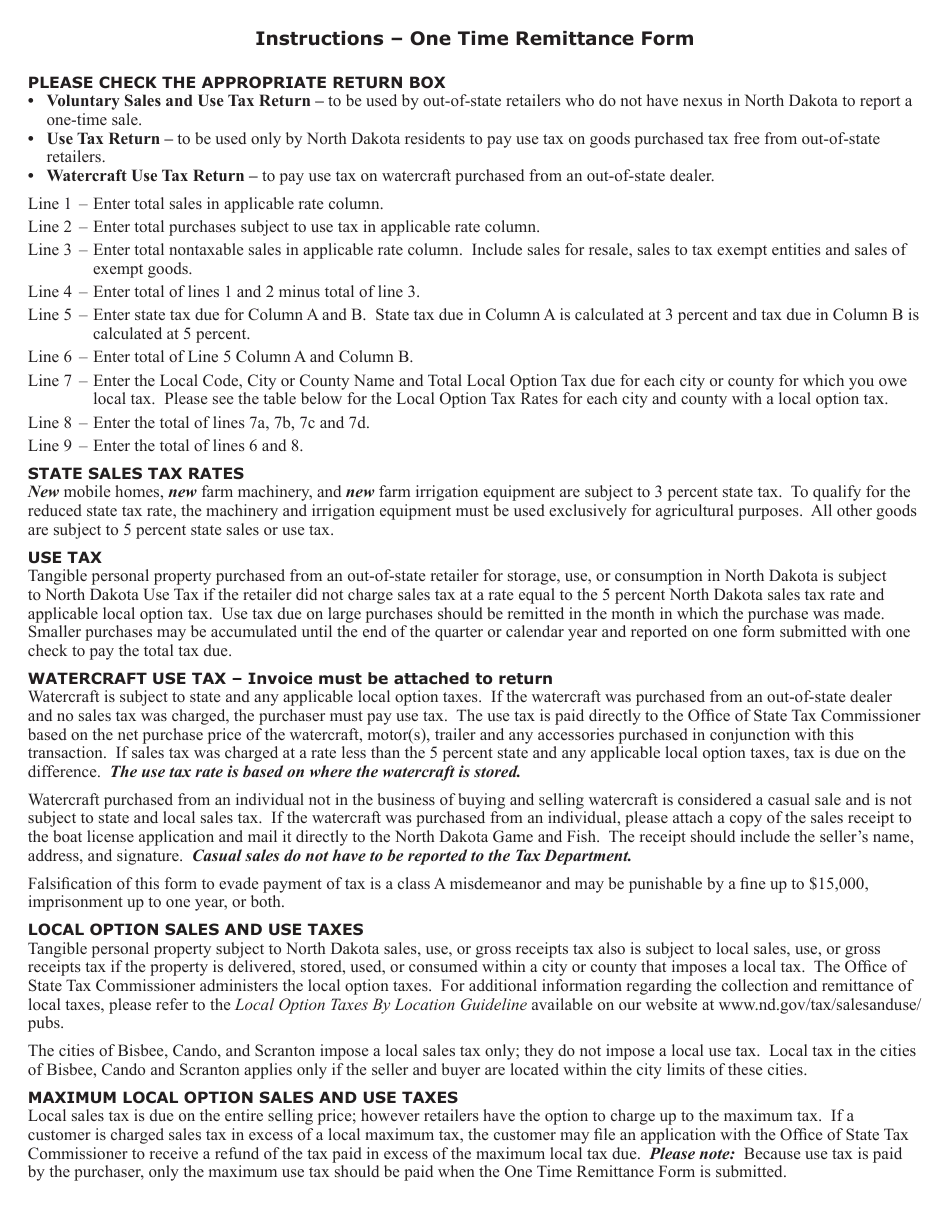

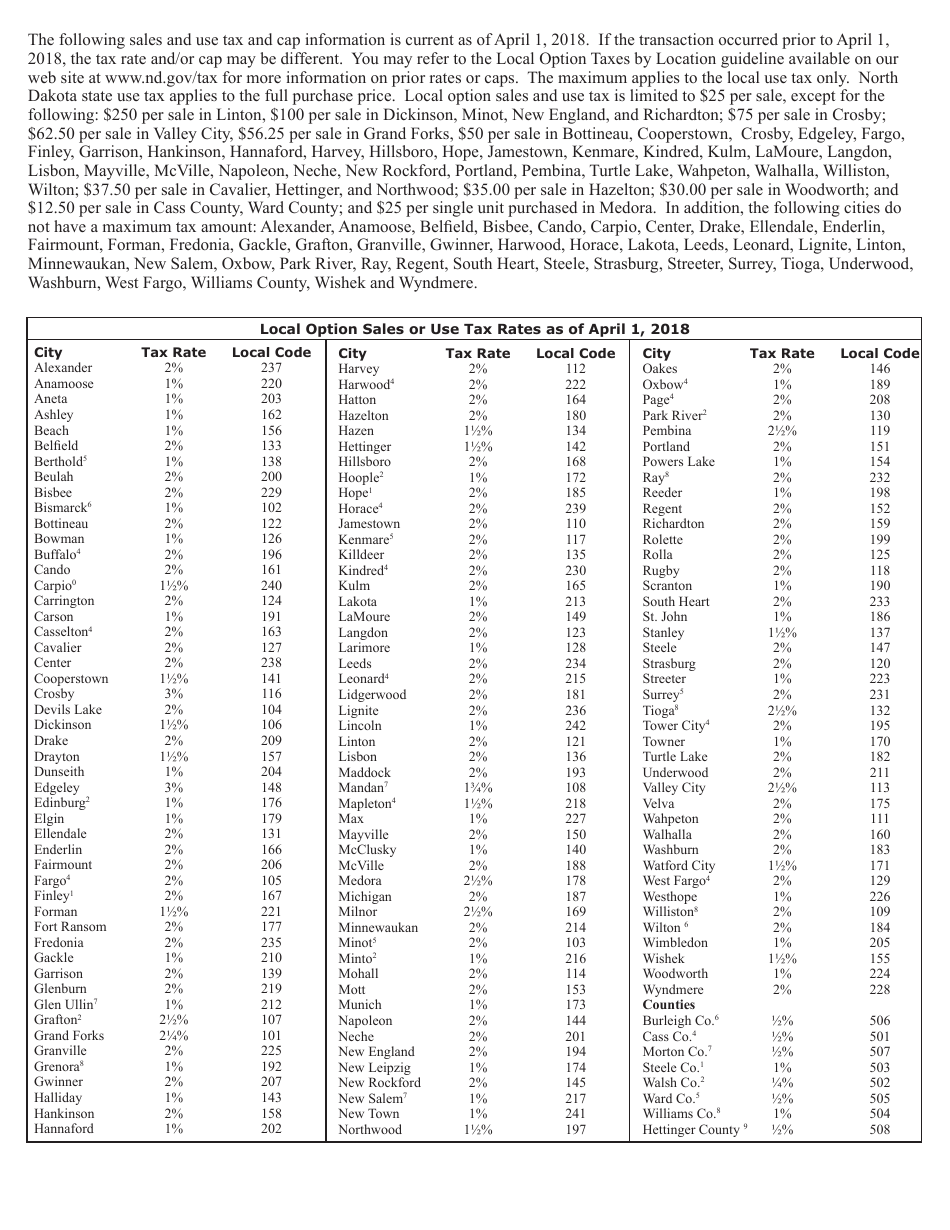

What Is Form 21945?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 21945 One Time Remittance Form?

A: Form 21945 is a one-time remittance form used in North Dakota.

Q: Who needs to use Form 21945?

A: Any individual or business making a one-time remittance in North Dakota needs to use Form 21945.

Q: What is the purpose of Form 21945?

A: The purpose of Form 21945 is to report and remit taxes or fees due to the state of North Dakota for a one-time transaction.

Q: What information is required on Form 21945?

A: Form 21945 requires information such as the taxpayer's information, transaction details, and the amount of tax or fee being remitted.

Q: How should Form 21945 be submitted?

A: Form 21945 should be filled out and mailed to the North Dakota Department of Revenue along with the payment for the taxes or fees being remitted.

Q: Are there any deadlines for submitting Form 21945?

A: Yes, the deadline for submitting Form 21945 and the associated payment is usually specified on the form or by the North Dakota Department of Revenue.

Q: What happens after I submit Form 21945?

A: After submitting Form 21945, the North Dakota Department of Revenue will process the form and apply the remittance to the appropriate account.

Q: What should I do if I have additional questions about Form 21945?

A: If you have additional questions about Form 21945, you should contact the North Dakota Department of Revenue for further assistance.

Form Details:

- Released on April 1, 2014;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 21945 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.