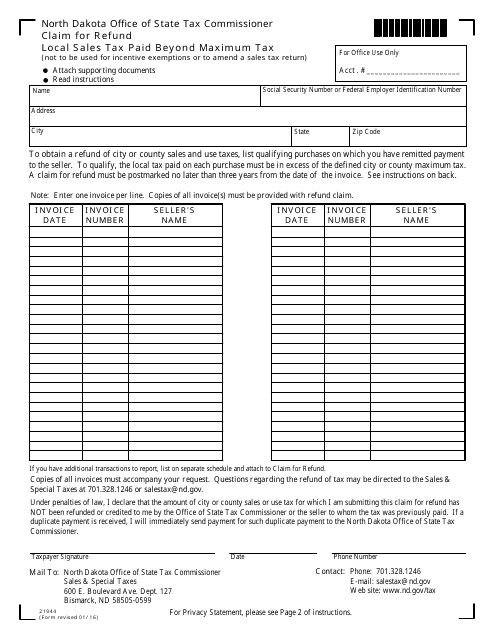

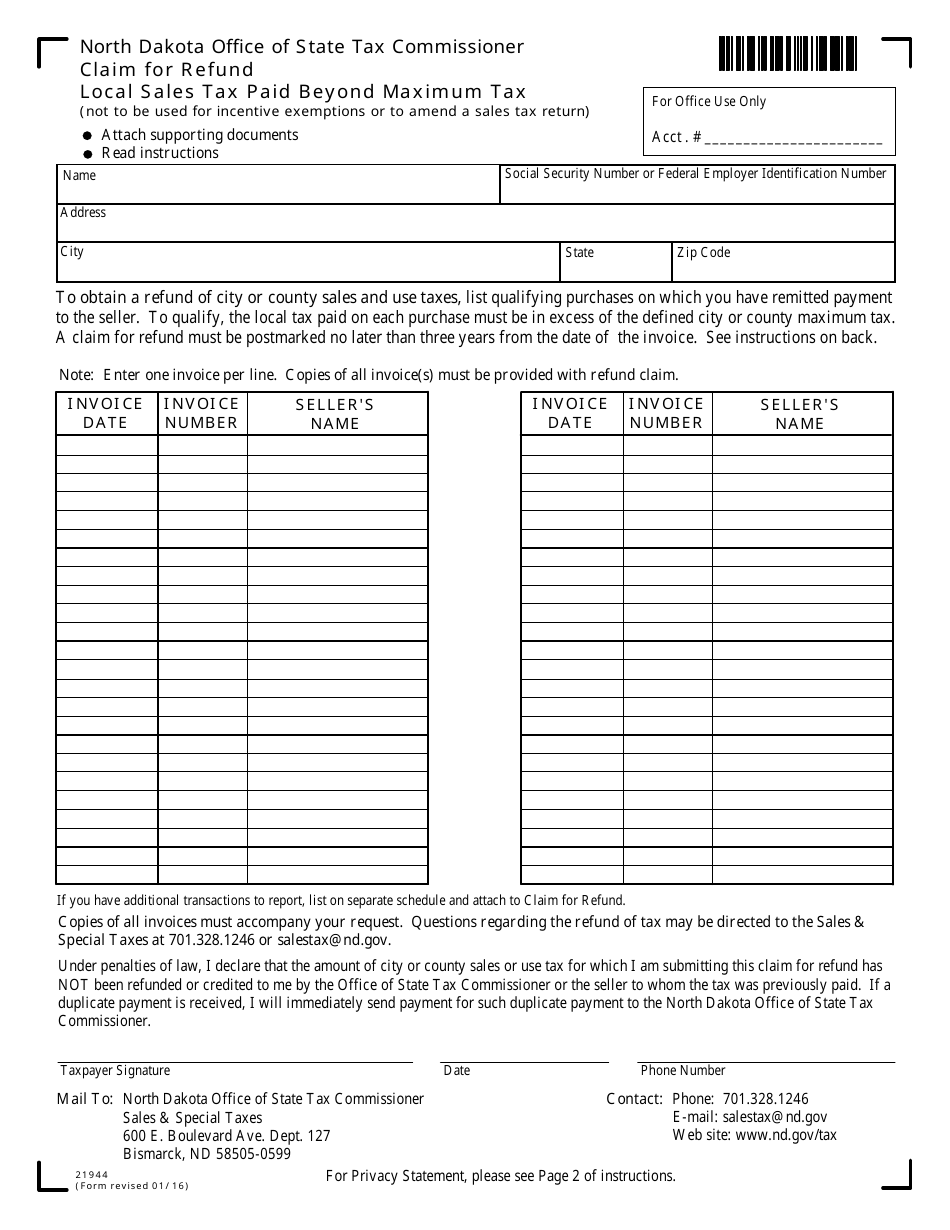

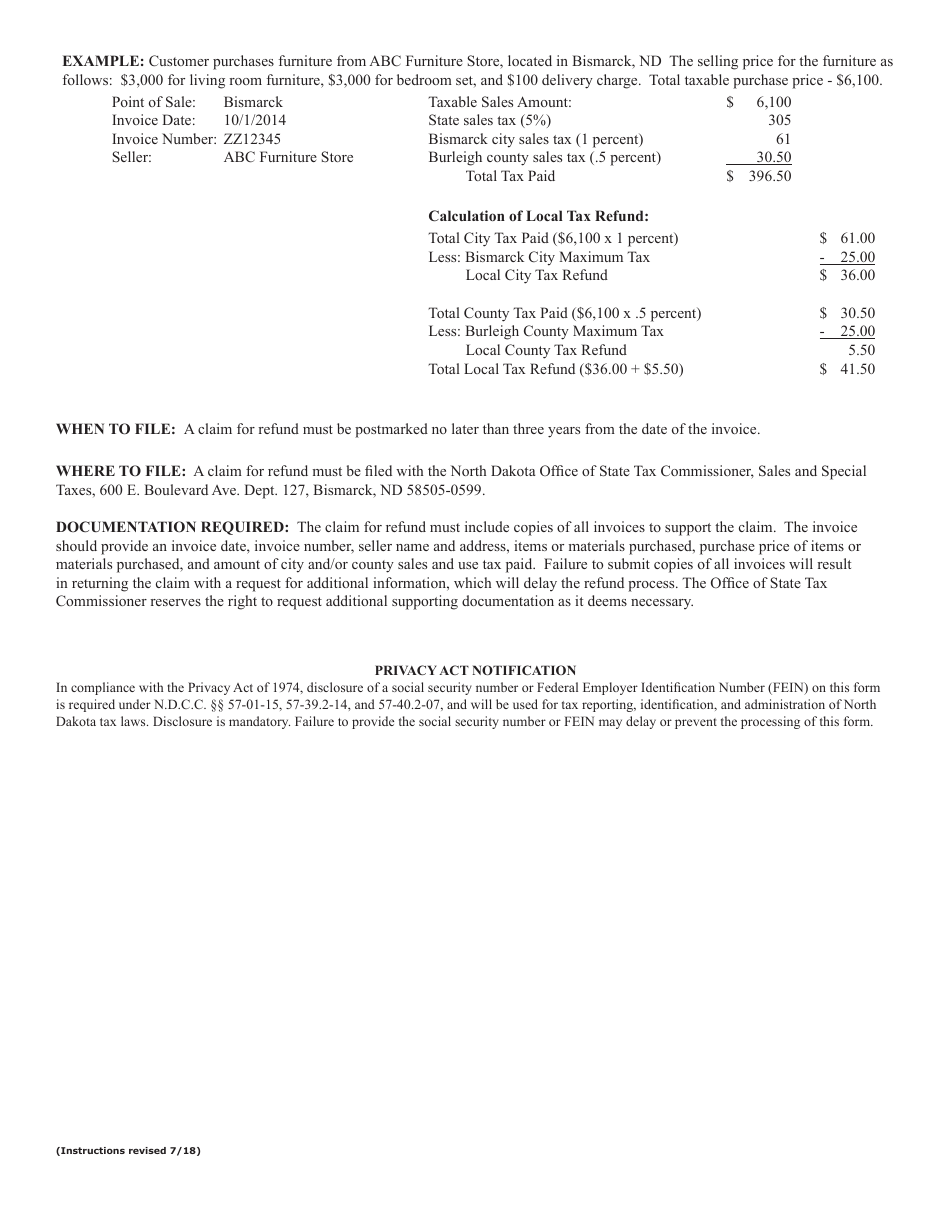

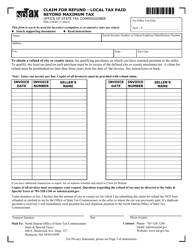

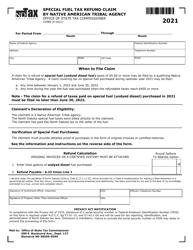

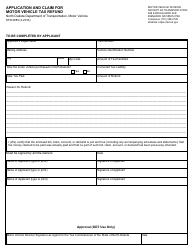

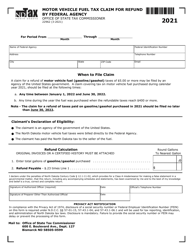

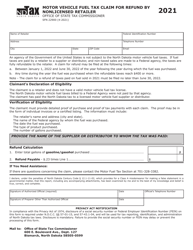

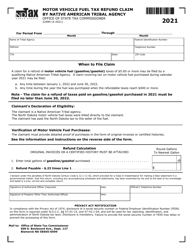

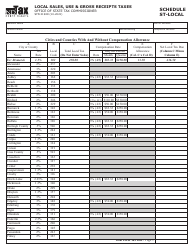

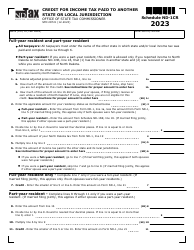

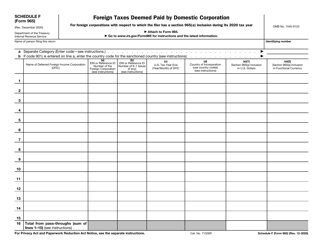

Form 21944 Claim for Refund - Local Sales Tax Paid Beyond Maximum Tax - North Dakota

What Is Form 21944?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 21944?

A: Form 21944 is a form used to claim a refund for local sales tax paid beyond the maximum tax limit.

Q: What is the purpose of Form 21944?

A: The purpose of Form 21944 is to request a refund for local sales tax paid beyond the maximum tax limit in North Dakota.

Q: What is local sales tax?

A: Local sales tax is a tax imposed by local jurisdictions, such as cities or counties, on the sale of goods and services.

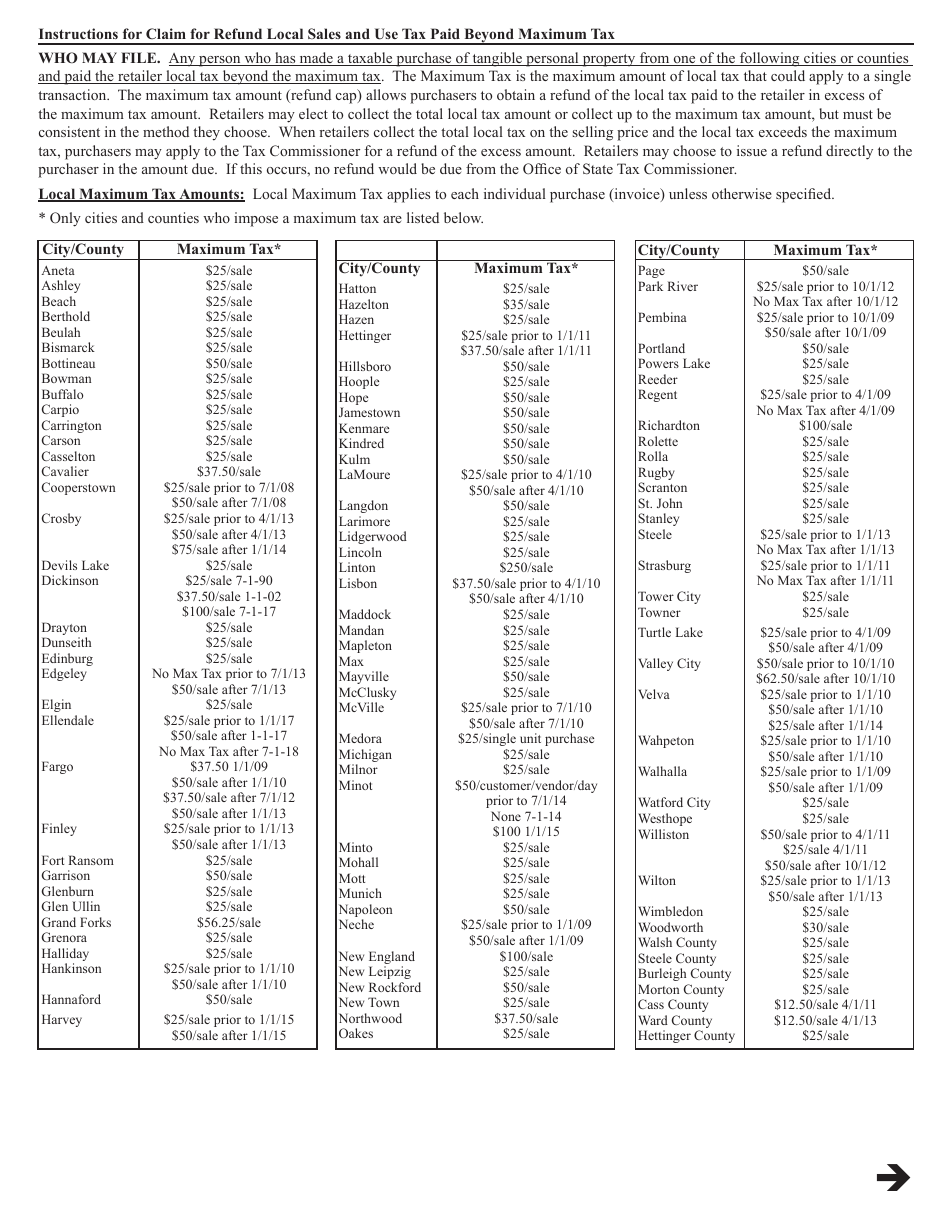

Q: What is the maximum tax limit for local sales tax in North Dakota?

A: The maximum tax limit for local sales tax in North Dakota is $25.

Q: Who can use Form 21944?

A: Any individual or business who paid local sales tax beyond the maximum tax limit in North Dakota can use Form 21944.

Q: Is there a deadline for filing Form 21944?

A: Yes, you must file Form 21944 within three years from the date you paid the local sales tax.

Q: How long does it take to receive a refund after filing Form 21944?

A: The processing time for a refund varies, but it typically takes several weeks to receive a refund after filing Form 21944.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 21944 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.