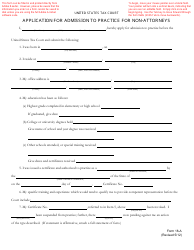

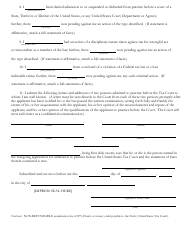

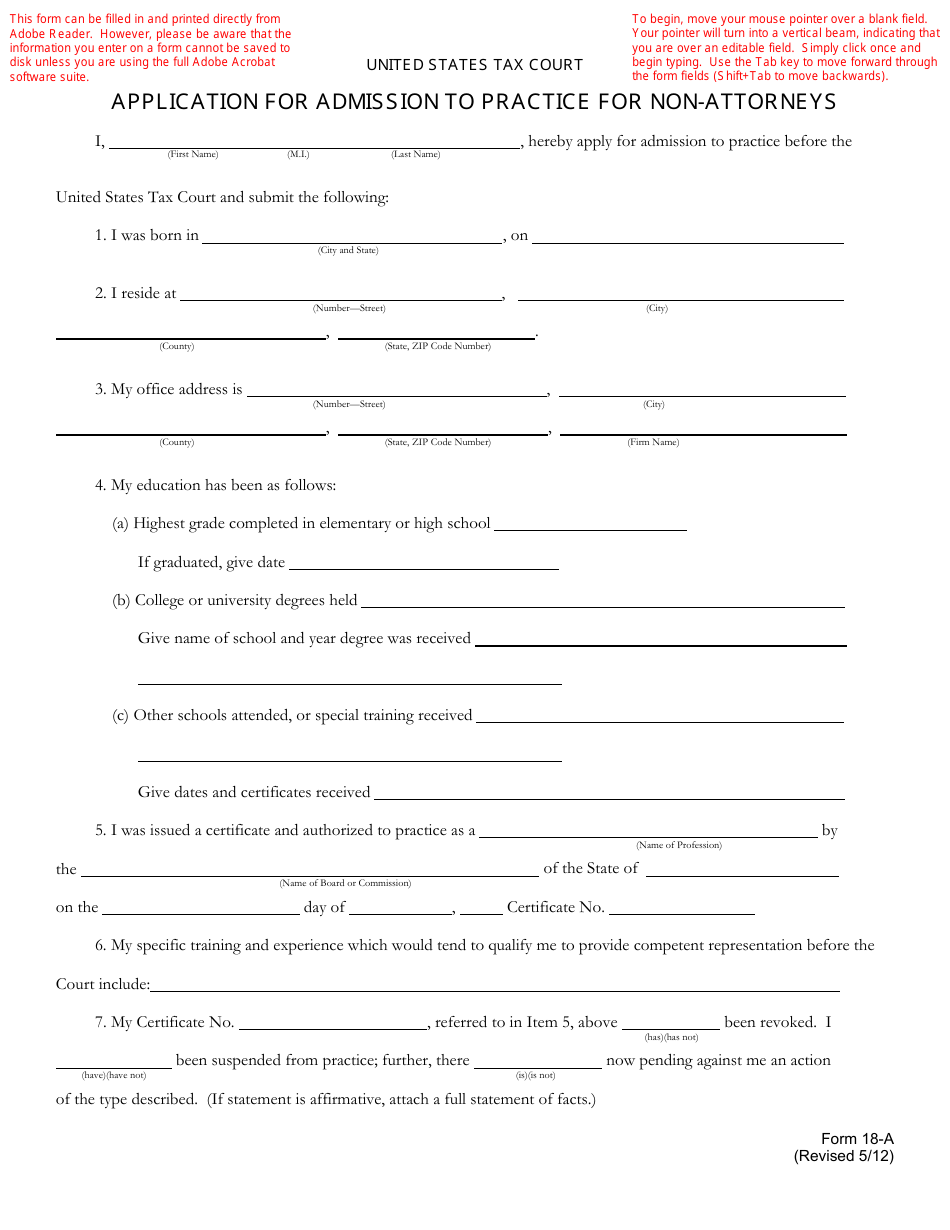

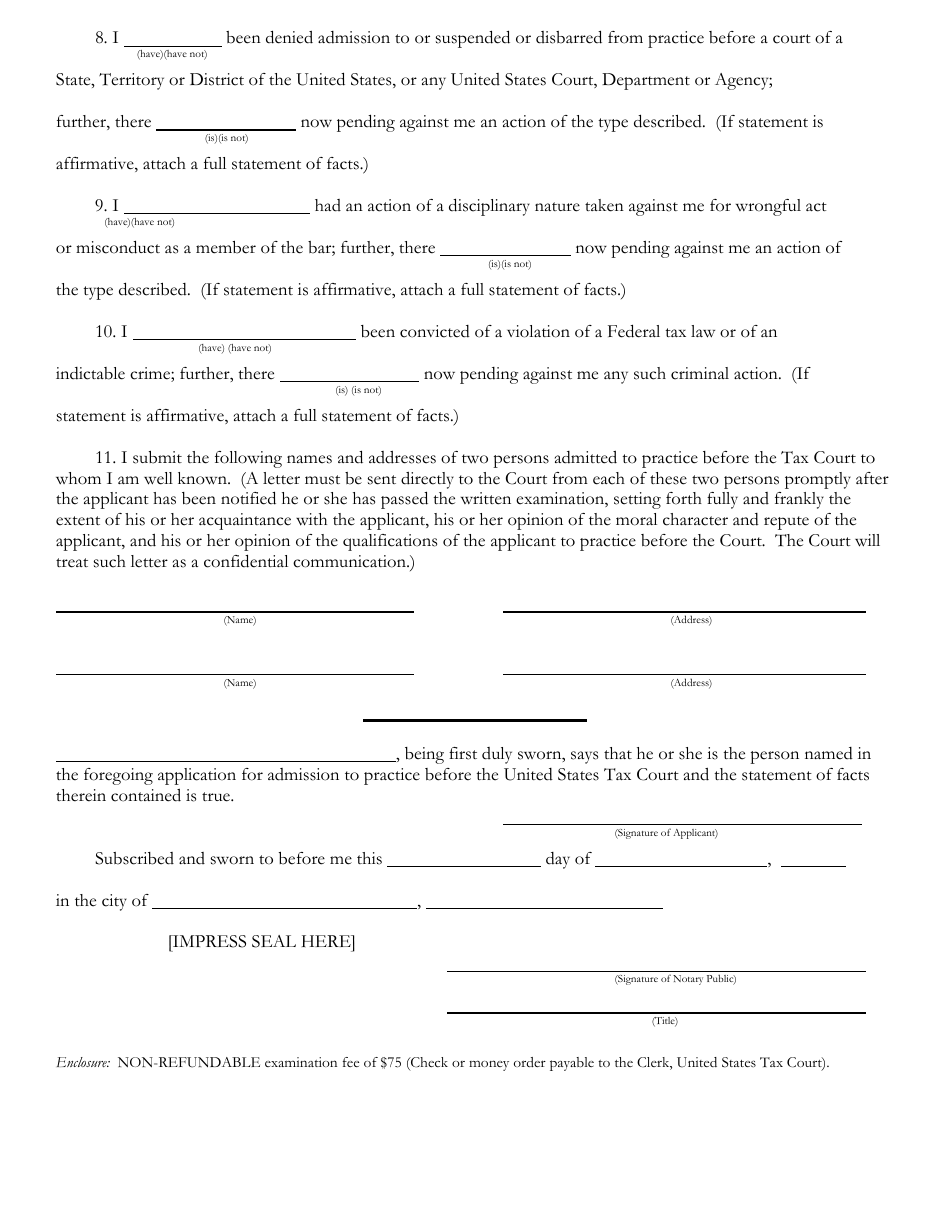

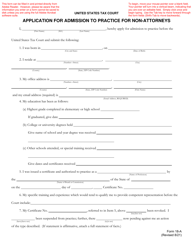

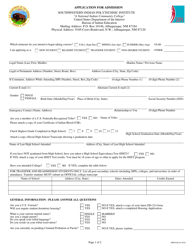

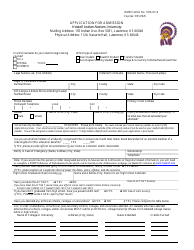

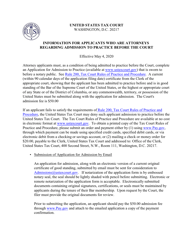

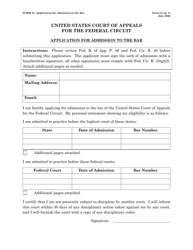

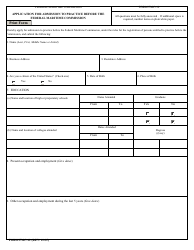

T.C. Form 18-A Application for Admission to Practice for Non-attorneys

What Is T.C. Form 18-A?

This is a legal form that was released by the United States Tax Court on May 1, 2012 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is T.C. Form 18-A?

A: T.C. Form 18-A is an application for admission to practice for non-attorneys.

Q: Who is eligible to use T.C. Form 18-A?

A: Non-attorneys who wish to be admitted to practice can use T.C. Form 18-A.

Q: What is the purpose of T.C. Form 18-A?

A: T.C. Form 18-A is used to apply for admission to practice for non-attorneys.

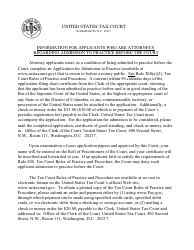

Q: Are there any fees associated with T.C. Form 18-A?

A: There may be fees associated with submitting T.C. Form 18-A. Please check with the relevant jurisdiction or court for more information.

Q: What documents are required to be submitted with T.C. Form 18-A?

A: The specific documents required may vary depending on the jurisdiction or court. Please refer to the instructions provided with T.C. Form 18-A or contact the relevant authority for the complete list of required documents.

Q: Is there a deadline for submitting T.C. Form 18-A?

A: The deadline for submitting T.C. Form 18-A may vary depending on the jurisdiction or court. Please refer to the instructions provided with the form or contact the relevant authority for more information.

Q: Can non-attorneys represent clients in court?

A: The rules regarding non-attorney representation vary by jurisdiction. It is important to consult the relevant jurisdiction's laws and regulations regarding non-attorney practice.

Q: What are the benefits of being admitted to practice as a non-attorney?

A: Being admitted to practice as a non-attorney can allow individuals to provide limited legal services and represent clients in certain matters, subject to applicable rules and regulations.

Form Details:

- Released on May 1, 2012;

- The latest available edition released by the United States Tax Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of T.C. Form 18-A by clicking the link below or browse more documents and templates provided by the United States Tax Court.