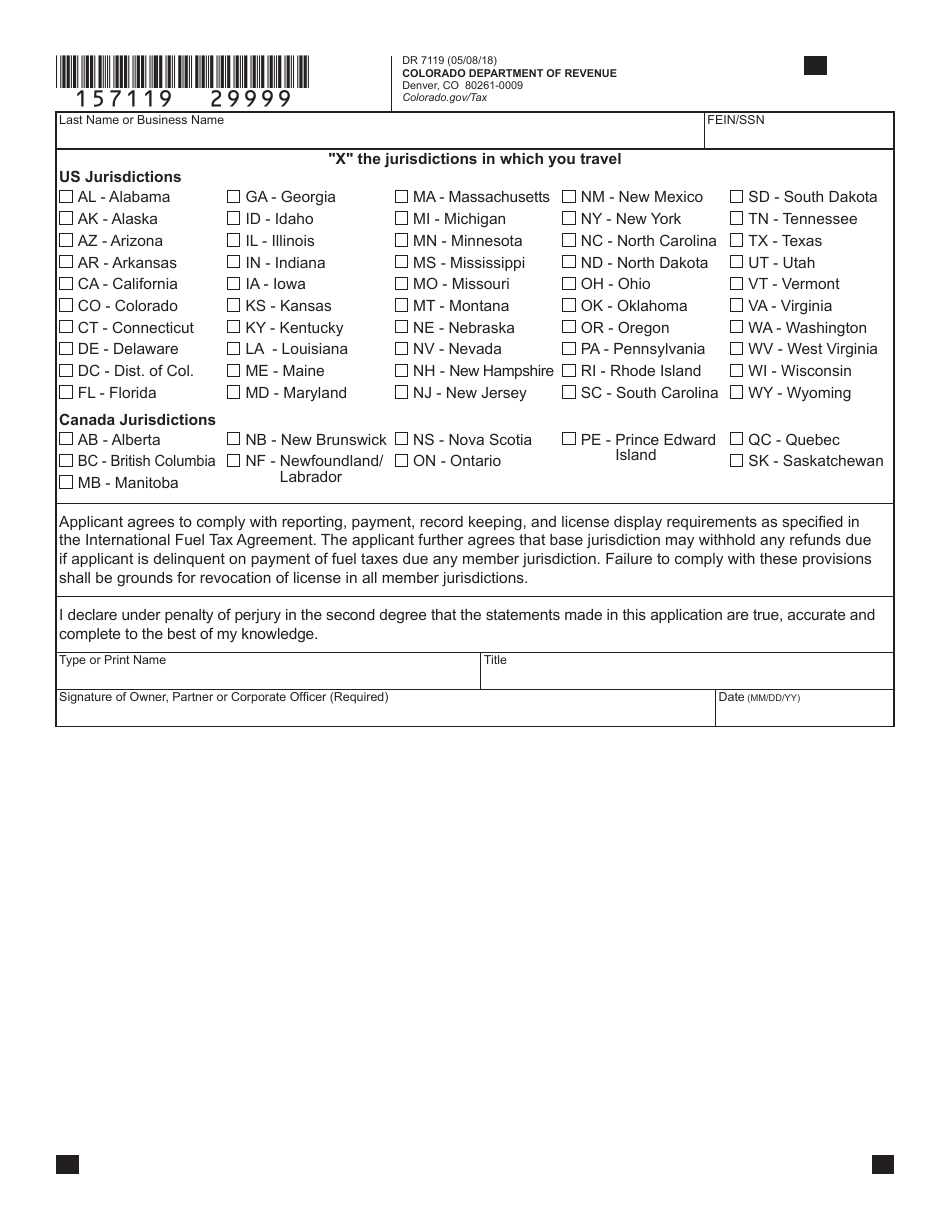

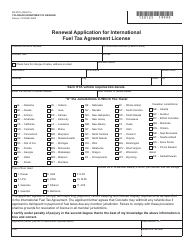

This version of the form is not currently in use and is provided for reference only. Download this version of

Form DR7119

for the current year.

Form DR7119 International Fuel Tax Agreement (Ifta) Registration - Colorado

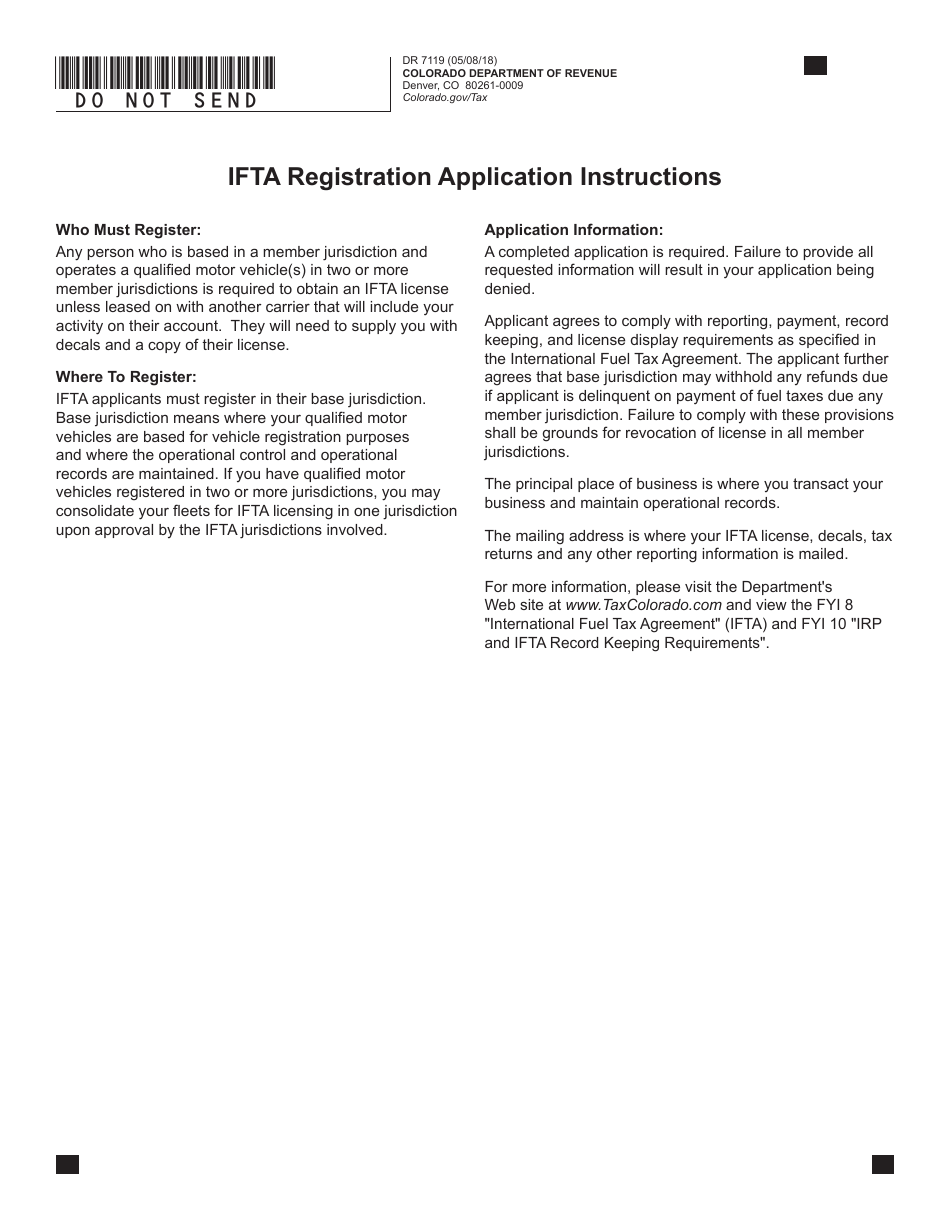

What Is Form DR7119?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

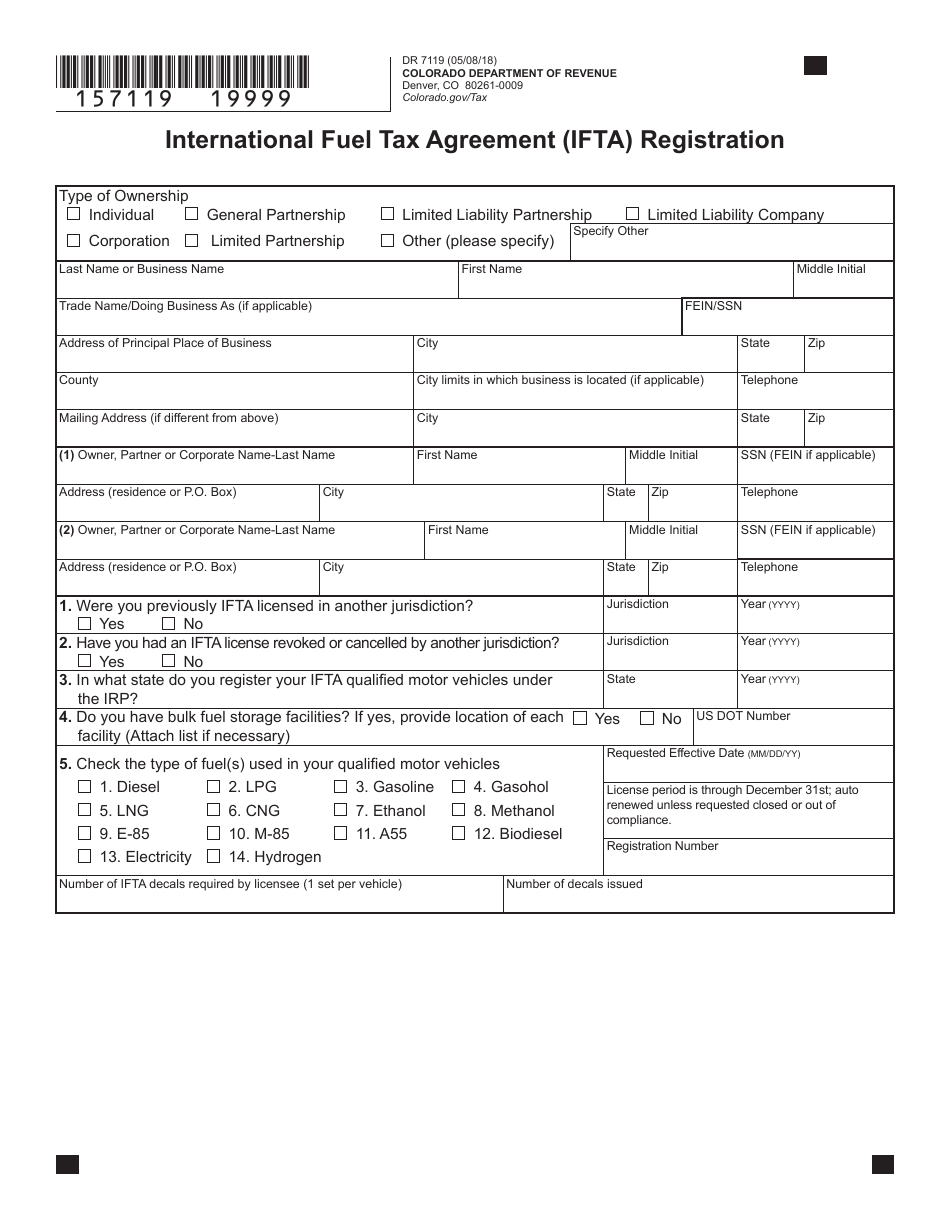

Q: What is Form DR7119?

A: Form DR7119 is the International Fuel Tax Agreement (IFTA) Registration form for the state of Colorado.

Q: What is the IFTA?

A: The International Fuel Tax Agreement (IFTA) is an agreement among the 48 contiguous United States and 10 Canadian provinces to simplify the reporting and payment of fuel taxes for the interstate operation of motor vehicles.

Q: Who needs to file Form DR7119?

A: Motor carriers based in Colorado who operate qualified motor vehicles in more than one jurisdiction and meet the IFTA requirements need to file Form DR7119.

Q: What information is required on Form DR7119?

A: Form DR7119 requires information such as the carrier's name, address, FEIN/SSN, vehicle identification numbers, and other details related to the operation of qualified vehicles.

Q: When should Form DR7119 be filed?

A: Form DR7119 should be filed before the beginning of the IFTA reporting period, which starts on January 1st and ends on December 31st of each year.

Q: Are there any fees associated with filing Form DR7119?

A: Yes, there is an initial fee of $35 for IFTA registration in Colorado.

Q: What happens if Form DR7119 is not filed?

A: Failure to file Form DR7119 or pay the required fuel taxes can result in penalties, fines, and the suspension or revocation of IFTA privileges.

Q: Are there any additional requirements for IFTA filing?

A: Yes, carriers must maintain detailed records of fuel purchases, miles traveled, and IFTA quarterly reports, which should be maintained for four years.

Form Details:

- Released on May 8, 2018;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR7119 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.