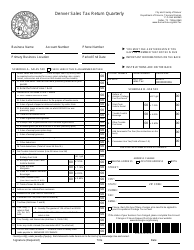

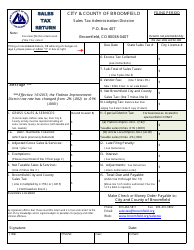

Form DR0100A Retail Sales Tax Return for Occasional Sales - Colorado

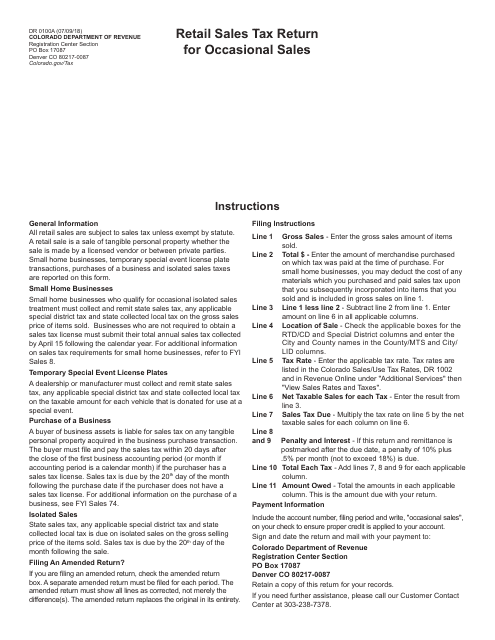

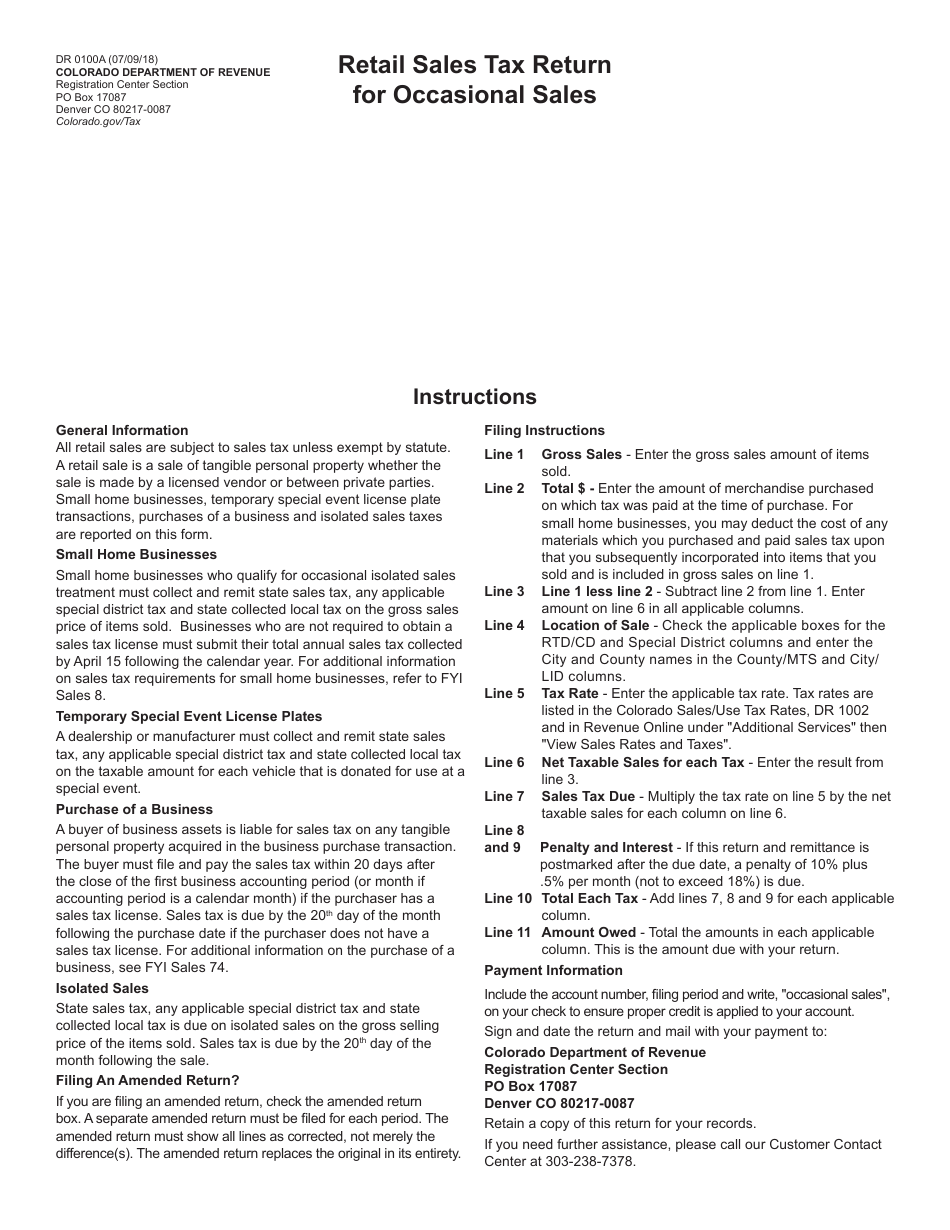

What Is Form DR0100A?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form DR0100A?

A: Form DR0100A is the Retail Sales Tax Return for Occasional Sales in Colorado.

Q: Who needs to file form DR0100A?

A: Individuals or businesses who engage in occasional sales in Colorado need to file form DR0100A.

Q: What is an occasional sale?

A: An occasional sale is a one-time or infrequent sale of tangible personal property.

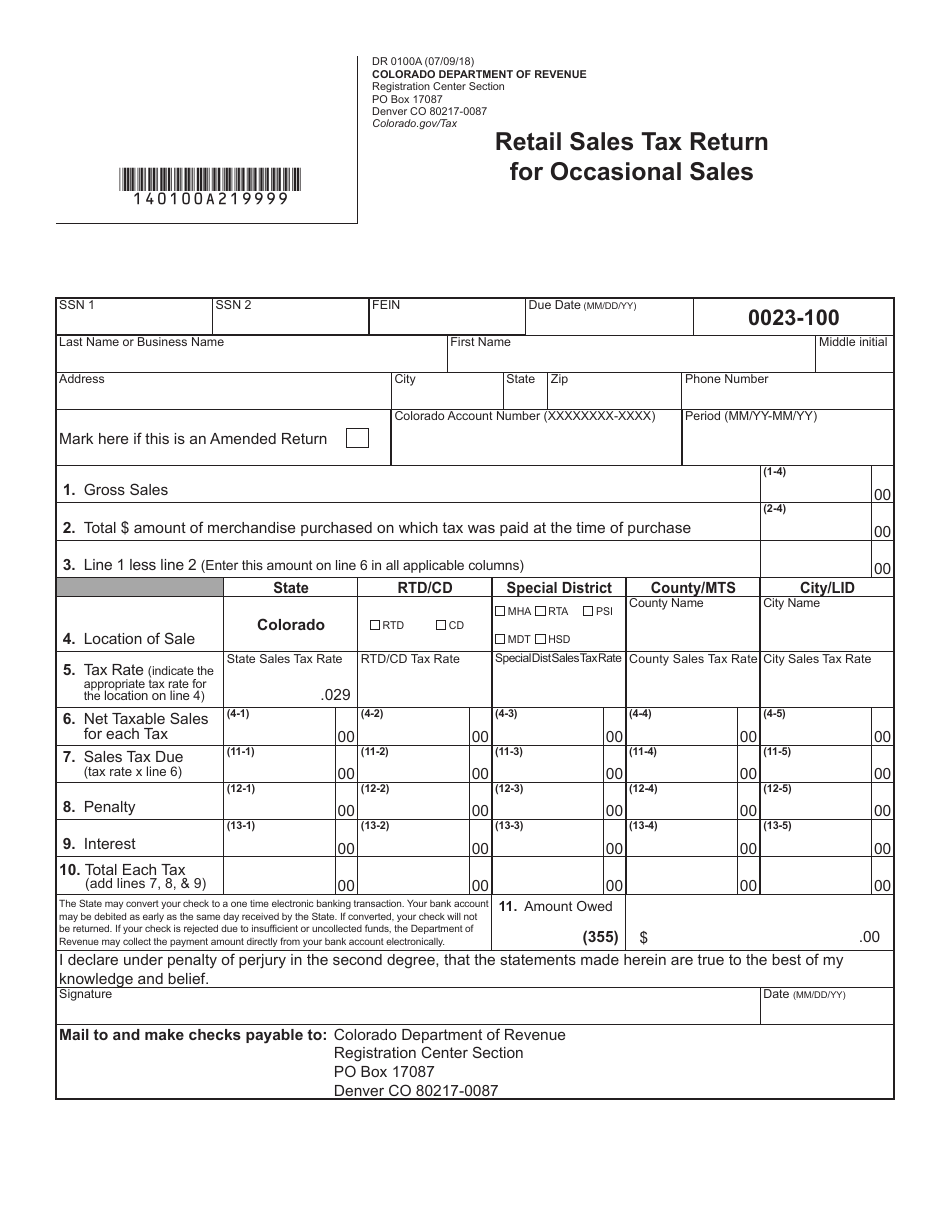

Q: What information is required on form DR0100A?

A: Form DR0100A requires you to provide details of the sales made, including the buyer's name, address, and purchase amount.

Q: When is form DR0100A due?

A: Form DR0100A is due on the 20th day of the month following the end of the reporting period.

Form Details:

- Released on July 9, 2018;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0100A by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.